|

市場調查報告書

商品編碼

1690698

歐洲屋頂瓦:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Roofing Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

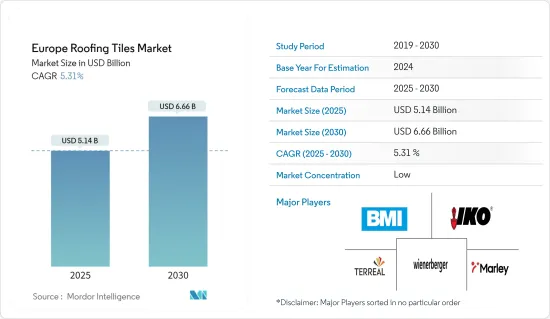

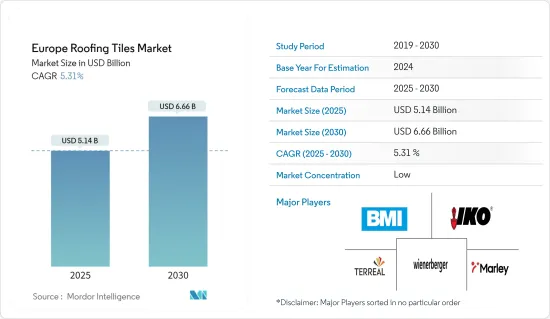

預計 2025 年歐洲屋頂瓦市場規模為 51.4 億美元,預計到 2030 年將達到 66.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.31%。

2020 年 COVID-19 疫情爆發,導致全國封鎖、製造活動和供應鏈中斷以及全球生產停頓,對歐洲屋頂瓦市場產生了負面影響。不過,預計市場將在 2021 年至 2022 年間復甦,並在預測期內保持成長軌跡。

主要亮點

- 推動市場發展的關鍵因素包括建設產業的需求不斷成長以及政府對綠建築的政策。

- 屋頂瓦片往往比其他一些選擇更貴,這可能會阻礙市場成長。此外,建設產業技術純熟勞工的短缺也有望阻礙市場擴張。

- 然而,太陽能屋頂瓦的發展預計將為市場成長提供各種有利可圖的機會。

- 在歐洲國家中,德國預計將憑藉其建築業的成長主導區域市場。

歐洲屋頂瓦市場的趨勢

住宅領域穩定成長

- 屋頂瓦片在住宅應用中擴大被使用,因為與瀝青瓦屋頂相比,它們可以將傳遞到閣樓的熱量減少近 70%。屋頂瓦片可用於各種住宅,包括獨棟住宅、連棟住宅、公寓和公寓。由於住宅瓷磚的使用壽命較長,安裝是最具成本效益的選擇之一。

- 歐洲國家的強勁需求使得住宅建築成為歐洲主要市場之一。英國政府表示,在撥出 100 億英鎊(127 億美元)用於增加住宅供應的投資的幫助下,英國政府有望實現本屆國會建造 100 萬套住宅的宣言承諾。

- 2024年2月,政府支持的貸款基金獲得30億英鎊(38億美元)注資,用於在英國各地建造2萬套新的經濟適用住宅,幫助更多人獲得住宅。

- 根據歐盟委員會聲明,法國政府宣布了「住宅優先」計畫(Le Logement D'abord)下的免稅政策。該預算為80%的法國家庭提供住宅稅的全面免除。對於剩餘20%的富人,稅率將從2021年起逐步降低,2023年住宅稅將完全取消。

- 根據西班牙國家統計局 (INE) 的數據,2019 年至 2025 年期間,淨住宅建設預計以平均每年約 135,000 套的速度成長。因此,預計住宅建設產業將在預測期的後半段顯著成長。

- 上述趨勢和事實表明,預測期內住宅領域對歐洲屋頂瓦片的需求強勁。

德國佔據市場主導地位

- 德國經濟是歐洲最大、世界五大經濟體之一。德國也是歐洲住宅存量最大的國家,這顯示德國在歐洲屋頂瓦需求方面佔據主導地位。

- 根據聯邦統計局(Destatis)的報告,2023年3月,德國批准建造24,500套住宅,與2022年3月相比減少了10,300份建築許可(約29.6%)。

- 由於建築價格大幅上漲,2022 年已完成建築工程的價值與 2021 年相比下降了 4.8%。

- 根據德國之聲報道,2023年至2025年間,德國新建住宅數量預計將下降32%。此外,預計2025年新建住宅將僅為20萬套,而2022年將為29.5萬套,可能導致住宅上漲。

- 德國住宅建設產業正在經歷新訂單大幅下滑、現有訂單頻繁取消的現象。例如,根據伊福經濟研究所的調查,約有22%的德國企業回應稱2023年10月的訂單已被取消,約有48.7%的企業將在2023年10月遭遇新訂單不足的困境,約有46.6%的企業將在2023年9月遭遇新訂單不足的困境。

- 考慮到上述事實和數據,儘管德國住宅建築業似乎正在萎縮,但預計德國在預測期內仍將保持其在歐洲屋頂瓦市場的主導地位。

歐洲屋瓦產業概況

歐洲屋頂瓦市場比較分散。受調查的市場中的主要企業(不分先後順序)包括 Wienerberger AG、BMI Group、TERREAL、IKO Industries Ltd 和 Marley。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 政府對綠建築的政策越來越有利

- 建設產業需求增加

- 限制因素

- 價格高於其他屋頂材料

- 建設產業技術純熟勞工短缺

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 類型

- 黏土

- 混凝土的

- 其他類型

- 最終用戶產業

- 住宅

- 商業的

- 基礎設施

- 業/設施

- 地區

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 俄羅斯

- 北歐的

- 土耳其

- 其他歐洲國家

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)分析**/市佔分析

- 主要企業策略

- 公司簡介

- BMI Group

- Crown Roof Tiles

- Fornace Laterizi Vardanega Isidoro SRL

- IKO Industries Ltd

- INDUSTRIE COTTO POSSAGNO SpA

- Marley

- TERREAL

- Vortex Hydra SRL Italy

- Wienerberger AG

第7章 市場機會與未來趨勢

- 太陽能屋頂瓦的開發

The Europe Roofing Tiles Market size is estimated at USD 5.14 billion in 2025, and is expected to reach USD 6.66 billion by 2030, at a CAGR of 5.31% during the forecast period (2025-2030).

In line with the COVID-19 outbreak in 2020, nationwide lockdowns around the globe, disruptions in manufacturing activities and supply chains, and production halts negatively impacted the European roof tiles market. However, the market recovered from 2021 to 2022 and is expected to continue its growth trajectory during the forecast period.

Key Highlights

- Besides, major factors driving the market studied include increasing demand from the construction industry and favorable government policies for green buildings.

- Roof tiles tend to be more expensive than a few other options, which is likely to hamper the market's growth. The lack of skilled workers in the construction industry is also anticipated to impede market expansion.

- Nevertheless, the development of solar roof tiles is expected to offer various lucrative opportunities for the market's growth.

- Among the European countries, Germany is expected to dominate the regional market due to the growth in its construction industry.

Europe Roofing Tiles Market Trends

Consistent Growth of the Residential Segment

- The usage of roofing tiles for residential applications is increasing because they can reduce the overall heat transfer into the attic by almost 70%, compared to an asphalt shingle roof. Roofing tiles are available for various residences, including single-family homes, townhomes, condominiums, and apartment buildings. The installation of roofing tiles in residential applications is one of the most cost-effective choices due to their long lifespan.

- Strong demand from various European countries makes residential construction one of the significant markets in Europe. According to the UK government, it is on track to meet its manifesto commitment to build 1 million homes in the current parliament with the support of the GBP 10 billion (USD 12.7 billion) investment allocated to boost housing supply.

- In February 2024, an increase of GBP 3 billion (USD 3.8 billion) was made in a government-backed loan fund to build 20,000 new affordable homes across the United Kingdom to help more people own a house.

- As per the European Commission, under its Housing First Plan (Le Logement D'abord), the French government announced tax waivers. Under the budget, the housing tax was entirely removed for 80% of French households. With regard to the remaining 20%, the country's wealthiest households, there was a gradual decrease in this tax rate from 2021, followed by a complete cessation of housing tax by 2023.

- According to Spain's National Statistics Institute (INE), the net household construction is anticipated to increase at an average pace of around 135,000 units every year from 2019 to 2025. Thus, the residential construction industry is expected to grow significantly over the latter period of the forecast period.

- The above-mentioned trends and facts indicate a strong demand for European roof tiles in the residential segment during the forecast period.

Germany to Dominate the Market

- The German economy is the largest in Europe and among the top five largest in the world. It also has the largest housing stock among European countries, which indicates its dominance over the demand for European roof tiles.

- According to the Federal Statistical Office (Destatis) report, in March 2023, the construction of 24,500 dwellings was permitted in Germany, a decrease of 10,300 (approx. 29.6%) in building permits compared with March 2022.

- The turnover in building completion work fell by 4.8% in 2022 compared to 2021 because of the substantial increase in construction prices.

- According to Deutsche Welle, Germany is expected to see a 32% drop in new housing construction between 2023 and 2025. Furthermore, it is estimated that only 200,000 homes will be completed in 2025 compared to 295,000 in 2022, which could lead to an increase in housing prices.

- Germany's residential construction industry has also witnessed new orders being considerably slower and existing orders being canceled much more frequently. For instance, according to the IFO Institute, around 22% of German companies witnessed orders getting canceled in October 2023, about 48.7% of companies also mentioned a lack of new orders in October 2023, and 46.6% mentioned the same in September 2023.

- Considering the above-mentioned facts and figures, even though the German housing construction industry seems to shrink, the country's dominance over the European roof tiles market is expected to be maintained during the forecast period.

Europe Roofing Tiles Industry Overview

The European roof tiles market is fragmented in nature. The major companies in the market studied (in no particular order) include Wienerberger AG, BMI Group, TERREAL, IKO Industries Ltd, and Marley.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Favorable Government Policies for Green Buildings

- 4.1.2 Increasing Demand from Construction Industry

- 4.2 Restraints

- 4.2.1 Higher Price Among Other Roofing Options

- 4.2.2 Lack of Skilled Workers in the Construction Sector

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Clay

- 5.1.2 Concrete

- 5.1.3 Other Types

- 5.2 End-user Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 NORDIC

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BMI Group

- 6.4.2 Crown Roof Tiles

- 6.4.3 Fornace Laterizi Vardanega Isidoro SRL

- 6.4.4 IKO Industries Ltd

- 6.4.5 INDUSTRIE COTTO POSSAGNO SpA

- 6.4.6 Marley

- 6.4.7 TERREAL

- 6.4.8 Vortex Hydra SRL Italy

- 6.4.9 Wienerberger AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Solar Roof Tiles