|

市場調查報告書

商品編碼

1692096

歐洲電子書:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe E-Book - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

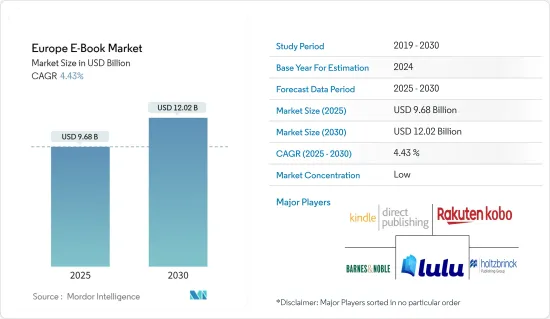

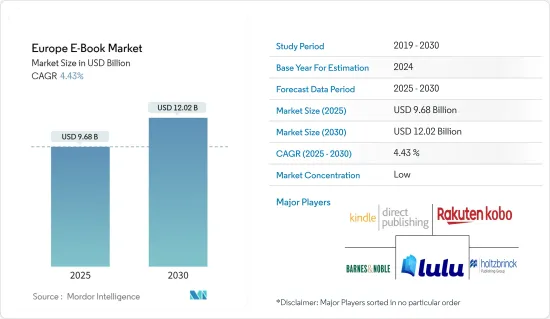

預計 2025 年歐洲電子書市場規模為 96.8 億美元,到 2030 年將達到 120.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.43%。

數位媒體設備的激增和網際網路的廣泛普及使得消費者能夠存取他們想要的媒體內容。這種從線下到線上的轉變正在推動歐洲電子書市場的發展。

主要亮點

- 電子書的廣泛普及和日益流行正在改變出版業,但電子書的性質和變化的程度在不同公司和不同類型之間差異很大。透過互動式動畫電子書,電子出版業務使得許多出版商和作家能夠更快、更精緻地將其作品推向市場。

- 能夠提供數位媒體的設備的激增和網際網路普及率的上升使得消費者無論身在何處都能訪問自己喜愛的媒體內容,無論是資訊、娛樂還是社交活動。

- 透過應用程式和線上服務輕鬆存取大量電子書庫,推動了網路消費的成長,並提供了傳統交付方式的低成本替代方案。電子借閱等電子書相關服務也促進了電子書在全部區域的接受。

- 印刷版教科書通常比電子書更貴。銷售教科書的成本包括製作和出版印刷書籍的成本。高等教育書籍也很昂貴。這最終促使消費者從昂貴的書籍轉向電子書,因為電子書使用方便,而且對於預算有限的人來說價格實惠。

- 新冠疫情導致網路內容消費量大幅增加,並維持在現有水準。由於封鎖期間圖書館關閉,讀者已轉向閱讀電子書。歐洲研究理事會(ERC)加入線上圖書館和出版平台。 ERC 的目標是促進研究人員主導的、以良好科學為基礎的各個學科的前沿研究,並透過資金競賽促進歐洲最好的研究。 OAPEN 鼓勵出版商代表其作者將書籍存放在 OAPEN 圖書館。

歐洲電子書市場的趨勢

網路普及率的提高和行動裝置上內容消費的增加正在推動成長

- 行動裝置已經發展成為獨立的銷售點,讓使用者可以無限制地存取書籍和內容,從新出版的書籍到舊書和早已絕版的書籍。

- 數位化擴展了閱讀和學習體驗,為出版商提供了新的管道,也為作家和插畫家提供了新的管道。例如,阿歇特書店(Hachette Lible)處於圖書產業技術發展和創新的前沿。阿歇特肝臟對新的閱讀風格和消費行為的發展做出了回應。同時,阿歇特圖書作為作家經濟利益的守護者,熱衷於保證每本書的真實價值。

- 智慧型手機、平板電腦和筆記型電腦等行動裝置在市場上的日益普及預計將推動電子書市場的成長。根據愛立信預測,到 2027 年,西歐的行動/行動電話用戶數量將達到 7,800 萬,中歐和東歐的行動/手機用戶數量將達到 6,900 萬。預計這些數字還會成長,從而推動對數位閱讀訂閱的需求增加。

- 各種各樣的功能正在推動行動裝置在這個市場上的普及。例如,當在具有LCD螢幕的行動裝置上閱讀電子書時,使用者可以降低亮度。為了獲得更好的閱讀體驗,使用者可以更改文字和背景顏色。此外,大多數電子閱讀器和應用程式允許使用者閱讀 PDF、EPUB 和 Mobi 文件,並協助將它們傳輸到使用者的裝置上,然後它們就會出現在使用者的書庫中。

英國佔市場主導地位

- 各種各樣的設備都可用於閱讀電子書,包括電子閱讀器、智慧型手機和平板電腦。這是跨市場和跨行業更廣泛的數位化趨勢的一部分。

- 儘管許多消費者仍然喜歡購買和閱讀實體書,但在可以存取和儲存的設備上閱讀電子書更適合現代的移動和旅行模式、日常日程安排以及在旅途中獲取文學作品。

- 此外,隨著近年來智慧型手機、平板電腦和電子閱讀器的大量普及,預計電子書市場將以顯著的速度成長。

- 由於學術圖書館關閉,圖書館使用者被迫依賴電子書而非傳統文學,COVID-19 疫情顯著增加了該國電子書的採用率。

- 義大利著名的電子書供應商包括 Amazon、Ibs.it、LA Feltrinelli、Google Play Store、Mondadori Store、Apple iBooks、Rakuten Kobo、Ebooksitalia、Hoepli.it、BookRepublic、Libreria Rizzoli、Scuolabook 和 Street Lib。

歐洲電子書產業概況

由於獨立作者和出版商眾多,電子書市場變得分散。然而,市場主要由 Kindle Direct Publishing(Amazon.com)、Barnes & Noble Inc. 和 Georg von Holtzbrinck GmbH & Co. KG 等公司主導。為了在激烈的競爭中生存,這些公司的主要成長策略包括基於訂閱的計劃、大量投資於研發、合作和收購。

2023 年 6 月,培生宣布其 K-12 線上學校計畫 Connections Academy 將擴大針對初中和高中學生的大學和職業準備舉措。該舉措與全球線上學習平台 Coursera 和 Acadeum 建立了合作夥伴關係。

2022 年 7 月,KITABOO 將與 Amazon Polly 合作,為兒童打造互動式電子書。透過此次合作,可以實現對英語和歐洲語言的100%自動支援。 KITABOO 是一個尖端的數位出版平台,可協助您建立適合行動裝置的互動式電子書。

2022年7月,教育委員會與ESR(歐洲放射學會)本科教育小組委員會共同開發了放射學本科教育電子書計劃。這本電子書將幫助歐洲各地的醫學生和住院醫師了解放射學,並在培訓的第一年將其作為一門學科進行教學。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 歐洲電子書市場概況

- 產業相關人員分析

- 出版監理與定價分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 網路普及率提高,行動裝置內容消費量增加

- 消費者生活方式的改變導致非物質方式消費增加

- 市場挑戰

- 電子書盜版現象增多,有聲書接受度不斷提高,等等。

- 電子書生態系統

- 監管狀態

第6章 市場細分

- 按內容

- 專業的

- 教育

- 一般的

- 依設備類型

- 智慧型手機

- 藥片

- 按地區

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 義大利

- 荷蘭

- 波蘭

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Kindle Direct Publishing(amazon.com)

- Rakuten Kobo Inc.

- Barnes & Noble Inc.

- Lulu Press Inc.

- Georg Von Holtzbrinck Gmbh & Co. Kg

- Hachette Livre

- Harpercollins Publishers LLC

- Usborne Publishing

- Pearson Publishing

- Penguin Random House LLC

第8章 投資分析及市場展望

- 投資分析

- 市場展望

The Europe E-Book Market size is estimated at USD 9.68 billion in 2025, and is expected to reach USD 12.02 billion by 2030, at a CAGR of 4.43% during the forecast period (2025-2030).

The growing number of devices capable of providing digital media and the increasing internet penetration have allowed consumers to access the media content of their choice. This transformation from offline to online is driving the European e-books market.

Key Highlights

- The widespread availability and rising popularity of e-books are transforming the publishing industry, while the nature and scope of e-books changes differ significantly from company to company and genre to genre. With interactive e-books, and animated e-books, e-publishing businesses have enabled many publishers and authors to get their works to market faster and more advanced.

- Consumers were given the possibility to access media content of their own choice, with regards to information, entertainment or Social Activities, wherever they may be due to an increase in devices that are able to provide digital media and a rise in Internet penetration.

- Easy access to a wide selection of e-book libraries via applications or online services is growing internet consumption, resulting in low-cost alternatives to traditional delivery methods. e-book-related services, such as e-lending, have also aided in the acceptance of e-books throughout the region.

- Printed textbooks typically cost more than e-books. The selling costs of the textbooks include the expense of producing and publishing printed books. Books for higher education are likewise costly. This finally prompted customers to switch from expensive books to their digital counterparts, which are easier to use and affordable for users on a tight budget.

- COVID-19 triggered a massive increase in online content consumption, and the current levels were maintained. While libraries were shut down due to lockdowns, readers switched to e-books. European Research Council joined the Online library and publication platform. The ERC aimed to promote investigator-driven, frontier research in all domains based on superior science while promoting the best caliber research in Europe through financing competitions.OAPEN encouraged publishers to deposit books into the OAPEN Library on behalf of authors.

Europe E-Book Market Trends

Increasing Internet Penetration Levels And Content Consumption Through Mobile Devices to Witness the Growth

- Mobile devices have evolved into individual points of sale, allowing users to browse an unlimited selection of books and content, ranging from new releases to backlist titles to long-out-of-print titles.

- Digital is expanding the reading and learning experience, offering publishers new ground for talent scouting and providing authors and illustrators with new avenues for expression. For instance, Hachette Livre has been at the forefront of the book industry's response to technical developments and innovations. It has adapted to new kinds of reading and developing consumer behavior. On the other hand, Hachette Livre is keen to guarantee that each book's genuine value is recognized as the custodian of its authors' financial interests.

- The proliferation of mobile devices, such as smartphones, tablets, and laptops in the market is expected to drive the growth of e-books in the market. According to Ericsson, in 2027 number of estimated mobile/cellular subscriptions will account for 78 million in Western Europe and 69 million in Central and Eastern Europe. These numbers are expected to increase, which will create increased demand for digital reading subscriptions.

- Various features help drive mobile devices adoption in the market. For instance, users can reduce the brightness when reading e-books on a mobile device with an LCD screen. For a better reading experience, users can change the text and background colors. Further, most e-book readers and apps allow the user to read PDF, EPUB, and Mobi files and help transfer them to the user's device, and they will appear in the books library.

United Kingdom Dominates the Market

- For e-book consumption, various devices are adopted, comprising e-book readers, smartphones, and tablets. This is part of an expansive trend of digitalization across markets and industries.

- While many consumers still prefer to buy and read physical books, e-book consumption on devices that allow for access and storage is more in keeping up with modern mobility and travel patterns, daily schedules, and accessing literature on the go.

- Moreover, With smartphones, tablets, and e-readers reaching mass adoption over the past few years, the market for e-books is analyzed to grow at a significant rate.

- The outbreak of COVID-19 significantly increased the adoption of e-books in the country as Academic libraries have been shut down, forcing library customers to rely on e-books rather than traditional literature.

- Some of the prominent providers of e-books in Italy include Amazon, Ibs.it, LA Feltrinelli, Google Play Store, Mondadori Store, Apple iBooks, RakutenKobo, Ebooksitalia, Hoepli.it, BookRepublic, Libreria Rizzoli, Scuolabook, Street Lib, etc.

Europe E-Book Industry Overview

The e-book market is fragmented due to many independent authors and publishers. However, the market is dominated by players such as Kindle Direct Publishing (Amazon.com), Barnes & Noble Inc., and Georg von Holtzbrinck GmbH & Co. KG, to name a few. These businesses' primary growth tactics to survive the fierce competition include subscription-based programs, substantial investment in research and development, collaborations, and acquisitions.

In June 2023 - Pearson announced that connections connections academy its K-12 online school program will expand its slate of college and career readiness initiatives for middle and high school students. The initiatives feature partnerships with, coursera the global online learning platform, acadeum

In July 2022, KITABOO partnered with Amazon Polly to create interactive eBooks for children. The collaboration will facilitate 100% automated support for English and European languages. KITABOO is a cutting-edge digital publishing platform that helps create mobile-ready interactive e-books.

In July 2022, the Education Committee and the Undergraduate Education Subcommittee of the ESR (Europen Society of Radiology) jointly developed the eBook for Undergraduate Education in Radiology project. The e-book will help medical students and residents in their first year of training and academic lecturers across Europe to understand and teach radiology as a single discipline.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Europe E-book Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Publishing Regulations and Pricing Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Internet Penetration Levels And Content Consumption Through Mobile Devices

- 5.1.2 Recent Changes in Consumer Lifestyles has Lead to Increased Consumption through Nonphysical Means

- 5.2 Market Challenges

- 5.2.1 Increasing Piracy of e-books, Increasing Acceptance of Audible Content, etc.

- 5.3 E-books Ecosystem

- 5.4 Regulatory Landscape

6 MARKET SEGMENTATION

- 6.1 By Content

- 6.1.1 Professional

- 6.1.2 Educational

- 6.1.3 General

- 6.2 By device type

- 6.2.1 Smartphone

- 6.2.2 Tablet

- 6.3 Geography

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Russia

- 6.3.6 Italy

- 6.3.7 Netherlands

- 6.3.8 Poland

- 6.3.9 Rest of the Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kindle Direct Publishing (amazon.com)

- 7.1.2 Rakuten Kobo Inc.

- 7.1.3 Barnes & Noble Inc.

- 7.1.4 Lulu Press Inc.

- 7.1.5 Georg Von Holtzbrinck Gmbh & Co. Kg

- 7.1.6 Hachette Livre

- 7.1.7 Harpercollins Publishers LLC

- 7.1.8 Usborne Publishing

- 7.1.9 Pearson Publishing

- 7.1.10 Penguin Random House LLC

8 INVESTMENT ANALYSIS AND MARKET OUTLOOK

- 8.1 Investment Analysis

- 8.2 Market Outlook