|

市場調查報告書

商品編碼

1485967

中國生物基及生物降解塑膠產業Bio-based and Biodegradable Plastics Industries in China |

||||||

過去二十年來,中國在 5G、再生能源和電動車等戰略技術領域已成為國際領導者。這一優勢可能會給歐洲企業留下深刻印象,引發對競爭的擔憂,並激起他們對中國在這些領域取得突破的好奇心。

為 2060 年實現淨零化學工業鋪路,利用再生生物質生產生物基化學品是全球化學工業最有前途的轉型解決方案之一。在中國和歐洲努力走這條道路的過程中,歐洲化學工業可能也有類似的問題:中國生物基工業的現況如何?中歐能否找到合作互利的方式來發展這個產業?

本報告分析了中國生物基和生物降解塑膠市場和產業,包括市場的基本結構、近期趨勢、相關市場結構和趨勢、相關政府政策以及我們正在調查的主要公司概況。

目錄

第 1 章執行摘要

第二章生物基塑膠市場

- 中國塑膠工業

- 全球市場規模與成長率

- 中國市場規模及成長率

- 出口/進口量

- 報廢管理

- 發展碳中和的未來

- 中國生物基塑膠產業

- 行業分類與識別

- 生物基塑膠市場規模及成長率

- PA(聚醯胺)市場

- PA 市場概覽(包括化石燃料衍生的 PA)

- 生物基PA市場

- 進入者分析:凱賽生物

- PHA(聚羥基鏈烷酸)市場

- PHA 功能

- 合成生物學

- 政策趨勢

- 中國PHA產業進展

第三章政策/法律/治理

- 整體政策版圖

- "雙碳目標"

- 中國石化產業轉型策略

- 影響生物基產業發展的關鍵政策

- 第一個國家生物經濟戰略

- 非食品生物基材料行動計劃

- 地方政府的獎勵政策

- 生物基產業主管機關

- 國家發展與改革委員會 (NDRC)

- 工業與資訊化部 (MIIT)

- 農業農村部 (MoA)

- 中國石油化學工業聯合會 (CPCIF)

第四章生物降解塑膠市場

- 政策驅動的結構性產能過剩

- 市場區隔與潛在規模預測(2025 年)

- 快遞包裝

- 食品外帶包裝

- 一次性購物袋

- 農用地膜

- PBAT市場

- PLA市場

- 治理與標準

- 整體狀況

- 可生物降解塑膠標示的新標準

- 修訂有關可降解塑膠定義的標準

- 政策框架的問題與必要的調整

- 不平衡:有效性與社會成本

- 專家意見

- 政策框架的調整

第五章公司面試

- 總體分析結果

- 公司簡介

- Polynovo Biotechnology Co

- Zhongke Baiyijin

- Kingfa Technology

- Zhongke Guosheng (Hangzhou) Technology (ZKGS)

- Ningbo Sugar Energy

- Ningbo TianAn Biopolymer

- Pliith Biotechnology Co., Ltd

- PHAbuilder

附錄

China has emerged as a global leader in strategic technologies such as 5G, renewable energy, and electric vehicles in the past two decades. This dominance may leave European companies impressed and concerned about competition while also sparking curiosity about China's leapfrogging advancement in these areas.

SAMPLE VIEW

Paving the way to a net-zero chemical industry in 2060, using renewable biomass to produce bio-based chemicals has been one of the promising transitional solutions for the global chemical industry. As China and Europe strive to follow this path, a similar question may exist within the European chemical industry: What is the status of the bio-based industry in China? Can China and Europe find a cooperative and win-win way to develop this industry?

Table of Contents

1. Executive Summary

2. The Bio-Based Plastics Market

- 2.1. Plastics Industry in China

- 2.1.1. Global Market Size and Growth

- 2.1.2. Domestic Market Size and Growth

- 2.1.3. Import & Export

- 2.1.4. End-of-Life Management

- 2.1.5. Navigating the Path to a Carbon-Neutral Future

- 2.2. Bio-based Plastics Industry in China

- 2.2.1. Industry Classification and Identification

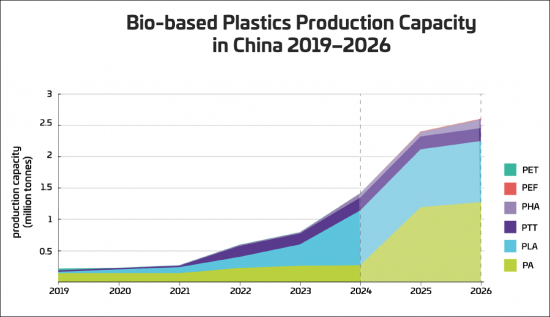

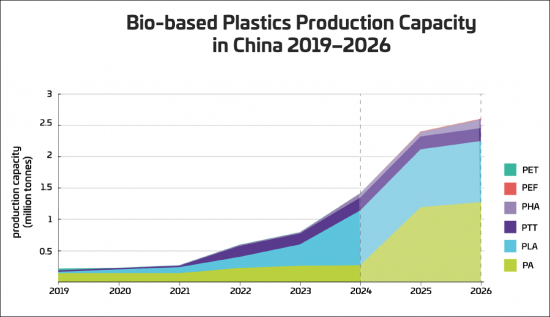

- 2.2.2. Size and Growth of the Bio-Based Plastics Market

- 2.3. PA (Polyamide) Market

- 2.3.1. PA Market Overview (Including Fossil-based PA)

- 2.3.2. Bio-based PA Market

- 2.3.3. Market Player Analysis: Cathay Biotech

- 2.4. PHAs (Polyhydroxyalkanoates) Market

- 2.4.1. PHAs Feature

- 2.4.2. The Synthetic Biology

- 2.4.3. Policy Trend

- 2.4.4. Advancements in the PHAs Industry in China

3. Policies, Legislations, and Governance

- 3.1. Overall Policy Landscape

- 3.1.1. The "Dual Carbon Goals"

- 3.1.2. Transformation Strategy for the Chinese Petrochemical Industry

- 3.2. Key Policies Influencing Bio-Based Industry Development

- 3.2.1. The First National Bioeconomy Strategy

- 3.2.2. The Action Plan of Non-food Bio-Based Materials

- 3.2.3. Incentive Policies from Local Governments

- 3.3. Competent Authorities of the Bio-based Industry

- 3.3.1. The National Development and Reform Commission (NDRC)

- 3.3.2. Ministry of Industry and Information Technology (MIIT)

- 3.3.3. The Ministry of Agriculture and Rural Affairs (MoA)

- 3.3.4. China Petroleum and Chemical Industry Federation (CPCIF)

4. The Biodegradable Plastics Market

- 4.1. Policy-driven Structural Overcapacity

- 4.2. Market Segmentation and Potential Size Forecast for 2025

- 4.2.1. Express Delivery Packaging

- 4.2.2. Food Takeaway Packaging

- 4.2.3. Disposable Shopping Bag

- 4.2.4. Agricultural Mulch Film

- 4.3. PBAT Market

- 4.4. PLA Market

- 4.5. Governance and Standards

- 4.5.1. Overall Status

- 4.5.2. New Standards for Labelling Biodegradable Plastics

- 4.5.3. Revising Standard for Defining Degradable Plastics

- 4.6. Policy Framework Challenges and Required Adjustments

- 4.6.1. Unbalance: Effectiveness Versus Social Cost

- 4.6.2. Experts' Opinions

- 4.6.3. Policy Framework Adjustments

5. Company Interviews

- 5.1. Overall Findings

- 5.2. Company Profiles

- Polynovo Biotechnology Co

- Zhongke Baiyijin

- Kingfa Technology

- Zhongke Guosheng (Hangzhou) Technology (ZKGS)

- Ningbo Sugar Energy

- Ningbo TianAn Biopolymer

- Pliith Biotechnology Co., Ltd

- PHAbuilder

Appendix

List of Figures

- Figure 1: Bio-based Plastics Production Capacity in China in Tonnes, 2019-2026E

- Figure 2: Biodegradable Plastics (PLA and PBAT): Production Capacity by 2025

- Figure 3: Plastic Production by Regions (Source: Plastic Europe)

- Figure 4: Global Production Capacities of Bio-based Plastics per Region 2022

- Figure 5: Plastic Production Capacity in China (1950-2020)

- Figure 6: Plastic Application Market in China (2021)

- Figure 7: 2019-2026E Bio-based Plastics Production Capacity in China

- Figure 8: China Bio-based PA Manufacturers and Capacity in 2023

- Figure 9: Bio-based PA Production Capacity Forecast in China (2024-2028)

- Figure 10: PHA Production Capacity Forecast in China (2024-2028)

- Figure 11: Combined Annual Production Capacity of PLA and PBAT by 2025

- Figure 12: One-pot Process of the Bio-based MEG vs. the Fossil-based MEG (Source: Zhongke Baiyijin provided)

- Figure 13: PHBV Production Process (Source: Provided by TianAn Biopolymer)

List of Tables

- Table 1: The Milestones of "Carbon Peak and Carbon Neutrality" in the Chinese Plastics Industry

- Table 2: Cathay Biotech Production Capacity in 2023

- Table 3: Chinese PHAs Producer's Capacity in 2023

- Table 4: China's National Determined Contributions(NDC) and Current Progress

- Table 5: The Key Developed Bio-based Chemicals

- Table 7: List of the Competent Authorities

- Table 8: PBAT 2022-2023 Production Capacity

- Table 9: PBAT Production Capacity in 2023 and Forecast in 2024 (in Tonnes)

- Table 10: PLA 2022-2023 Production Capacity

- Table 11: PLA Production Capacity 2023-2024e (Unit: kg)

- Table 12: Main GB Standards in Biodegradable Plastics

- Table 13: Comparison of Current and Revised Standards in Biodegradable Plastics Definition

- Table 14: List of Interviewed Companies