|

市場調查報告書

商品編碼

1575711

虛擬電控系統 (vECU) 的檢驗·原型製作·XiL解決方案Validation, Prototyping & XiL Solutions for Virtual ECUs |

||||||

汽車產業正在經歷一場前所未有的向軟體定義車輛 (SDV) 概念的轉變,從根本上改變了車輛在整個生命週期中的設計、驗證、生產和支援方式。

本報告研究了虛擬電子控制單元 (vECU) 和開發工具市場,並透過深入了解最新趨勢、技術趨勢和供應商策略來量化和研究市場動態。該報告還包括 VDC 工程師之聲調查的最終用戶見解。

信息圖形

研究問題:

- 全球汽車驗證、原型設計和 XiL 解決方案收入規模的趨勢和預測(2023-2028 年):預計將以兩位數複合年增長率成長

- 硬體虛擬化,包括 ECU 和晶片(vMCU、vGPU、vSoC):供應商將如何應對?

- 阻礙 vECU 推廣的挑戰是什麼?

- vECU 開發成長最快的領域是什麼?

- 誰是業界領先的供應商?

- vECU 開發有何地區差異?

本報告中介紹的組織

|

|

目錄

本報告的內容

將涵蓋哪些問題?

誰該閱讀本報告?

本報告中介紹的組織

摘要整理

- 主要調查結果

全球市場概要

- 近期市場趨勢

- 虛擬 ECU 在向 SDV 的過渡中將扮演什麼角色?

- 虛擬 ECU 如何支援向 SDV 的過渡?

- 虛擬ECU抽象層

- 汽車軟體工廠和虛擬ECU

- 虛擬 ECU 與 SBOM 管理

- 引入 vECU 的障礙

- 標準和法規

比較預測:各地區

- 南北美洲

- 歐洲·中東·非洲

- 亞太地區

業者情勢

- 汽車工具供應商成為虛擬ECU解決方案實現的鑰匙

業者簡介

- EDA/模擬供應商

- 汽車工具供應商

- 矽供應商

最終使用者見解

- 選擇虛擬原型解決方案的重要決定特徵

- 使用 E/E 系統軟體任務進行虛擬原型設計

- 縮短上市時間推動虛擬 ECU 的採用

- 遷移到 SDV 首先考慮虛擬 ECU

關於作者

VDC 關於Research

Inside this Report:

The automotive industry is undergoing an unprecedented shift toward the software-defined vehicle (SDV) concept that is fundamentally changing the design, validation, production, and support of the vehicle through its lifecycle. This report defines and examines the market for virtual electronic control units (vECUs), and development tools, quantifying, and qualifying market dynamics through an in-depth discussion of recent events, engineering trends, and vendor strategies. As part of VDC's continued efforts to engage with the technology markets we research, this report includes end user insights from VDC's "Voice of the Engineer" survey.

INFOGRAPHICS

What Questions are Addressed?

- Global revenue for automotive validation, prototyping, & XiL solutions will grow with a double-digit CAGR from 2023 through 2028.

- How will vendors adapt to the virtualization of hardware, including ECUs and silicon (vMCU, vGPU and vSoC)?

- What barriers are challenging more widespread use of vECUs?

- Which areas of vECU development will experience the most growth?

- Who are the leading suppliers in the industry, and what initiatives are they taking to ensure their future as the industry pivots to the software-defined vehicle?

- What are the regional differences in vECU development?

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

- Recent Market Developments

- Where do Virtual ECUs Fit in the Transition to the SDV?

- How can a Virtual ECU Help Navigate the Transition to the SDV?

- Virtual ECU Abstraction Layers

- Automotive Software Factory and Virtual ECUs

- Virtual ECUs and SBOM Management

- Hurdles to vECU Adoption

- Standards and Regulations

Comparative Forecasts by Region

- Americas

- Government Initiatives Drive Domestic Semiconductor, Software, and Hardware Development

- Europe, Middle East, Africa (EMEA)

- Automaker Direct Sourcing of Semiconductors Fuels Growth

- Asia-Pacific (APAC)

- Chinese OEMs Rapid Vehicle Development Timelines Spur Demand

Vendor Landscape

- Automotive Tool Vendors are Key to Enabling Virtual ECU Solutions

Vendor Profiles

- EDA/Simulation Vendors

- Automotive Tool Suppliers

- Silicon Providers

End User Insights

- Key Decision Characteristics for Selecting Virtual Prototyping Solutions

- Virtual Prototyping Driven by E/E System Software Tasks

- Reducing Time to Market Drives Virtual ECU Adoption

- The Transition to SDVs is Building Virtual ECU Consideration

About the Authors

About VDC Research

List of Exhibits

- Exhibit 1: Global Revenue of Automotive Validation, Prototyping, & XiL Solutions Exhibit 2: Consideration of Key Trends: Software-defined Functionality

- Exhibit 3: Biggest Obstacle to the Development and Growth of the Connected/Software-Defined Vehicle Industry Exhibit 4: Global Revenue by Level of ECU Virtualization

- Exhibit 5: Global Revenue of Validation, Prototyping, & XiL Solutions by Geographic Region 2023 to 2028 Exhibit 6: Revenue of Automotive Validation, Prototyping, & XiL Solutions, Americas

- Exhibit 7: Revenue of Automotive Validation, Prototyping, & XiL Solutions, EMEA Exhibit 8: Revenue of Automotive Validation, Prototyping, & XiL Solutions, APAC

- Exhibit 9: Validation, Prototyping, & XiL Solution Market, Segmented by Leading Vendor Exhibit 10 Global Revenue of Validation, Prototyping, & XiL Solutions by Vendor Type

- Exhibit 11: Community/Tool Type Perceived to be the Most Successful in Enabling/Facilitating Virtual ECU Solutions Exhibit 12: Most Important Characteristics When Selecting Virtual Prototyping Solution

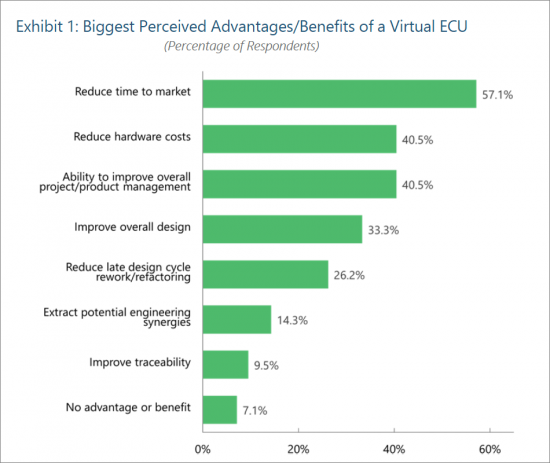

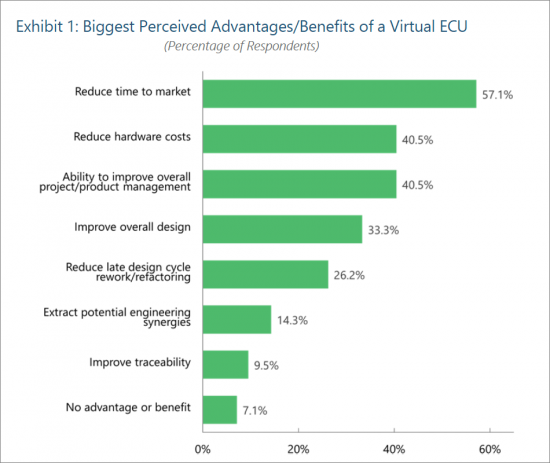

- Exhibit 13: Type of Tasks in Which Virtual Prototyping Solutions are Used Exhibit 14: Biggest Perceived Advantages/Benefits of a Virtual ECU

- Exhibit 15: Current Use or Consideration of Virtual ECUs