|

市場調查報告書

商品編碼

1665333

模組化健身家具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Modular Fitness Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

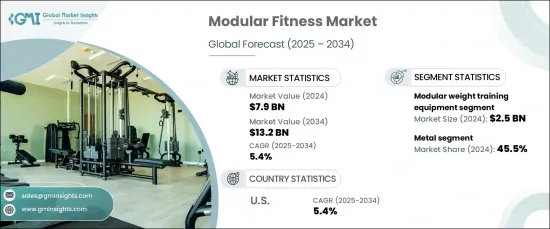

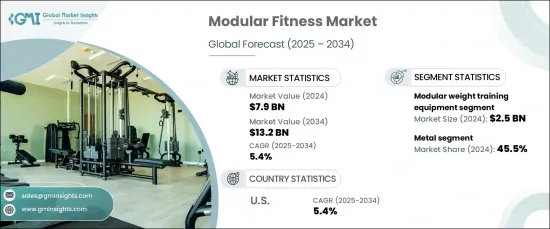

2024 年全球模組化健身家具市場價值為 79 億美元,預計 2025 年至 2034 年的複合年成長率為 5.4%。隨著越來越多的人開始在家鍛煉,對支持各種健身活動的多功能家具的需求也不斷增加。

材料和設計的創新增強了模組化健身家具的吸引力。環保材料和可自訂功能的日益使用引起了那些重視家居裝飾的永續性和適應性的消費者的共鳴。這一趨勢反映了全球範圍內更廣泛的轉變,人們開始追求個性化、環保的生活空間,將功能性和風格完美地融合在一起。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 79億美元 |

| 預測值 | 132億美元 |

| 複合年成長率 | 5.4% |

市場按類型分類,包括模組化重量訓練設備、可變形有氧運動家具、適應性家庭健身站、多功能健身平台、緊湊型運動家具等。 2024 年,模組化重量訓練設備將佔據市場主導地位,貢獻 25 億美元,預計在預測期內的複合年成長率為 5.1%。這一領域的領先地位源於其多功能性,因為許多消費者更喜歡緊湊、可調節的設計來進行家庭力量訓練。家庭健身房日益普及以及對節省空間、靈活的肌力訓練設備的需求是推動這一類別成長的關鍵因素。

根據材料,市場分為金屬、木材、塑膠和複合材料。 2024 年,金屬佔據了 45.5% 的市場佔有率,預計到 2034 年將以 5.7% 的複合年成長率成長。它的可靠性和與模組化設計的兼容性使其成為尋求實用且節省空間的解決方案的消費者的首選材料。

2024 年,北美模組化健身家具市場規模為 28 億美元,預計 2025 年至 2034 年的複合年成長率為 5.4%。家庭健身房的興起和對節省空間產品日益成長的興趣推動了該市場的成長。透過不斷創新,美國在推動模組化健身家具的普及和滿足注重健康、節省空間的消費者需求方面仍然發揮著關鍵作用。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 都市化進程加快,居住空間有限。

- 健身意識和居家運動趨勢不斷增強。

- 環保材料和設計的進步。

- 電子商務銷售額成長。

- 產業陷阱與挑戰

- 初始成本高。

- 對新興市場的認知有限

- 成長動力

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 偏好價格範圍

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 模組化重量訓練器材

- 可適應的居家健身站

- 可變形有氧健身家具

- 多用途健身平台

- 緊湊型健身家具

- 其他

第6章:市場估計與預測:按材料,2021 – 2034 年

- 主要趨勢

- 木頭

- 金屬

- 塑膠

- 複合材料

第 7 章:市場估計與預測:按價格,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業(健身房、健身工作室、辦公室)

第 9 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- BodyCraft

- Core Health & Fitness

- Ecore Athletic

- Eleiko

- Escape Fitness

- Hammer Strength

- Herman Miller

- Kimball International

- Life Fitness

- Matrix Fitness

- Nautilus

- Peloton

- Power Lift

- Precor

- Rogue Fitness

- Technogym

- YR Fitness

The Global Modular Fitness Furniture Market was valued at USD 7.9 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2034. This growth is driven by increasing urbanization and shrinking living spaces, which are fueling the demand for multifunctional, space-saving fitness furniture. As more individuals embrace home workout routines, the need for versatile furniture that supports a variety of fitness activities continues to rise.

Innovations in materials and design are enhancing the appeal of modular fitness furniture. The growing use of eco-friendly materials and customizable features is resonating with consumers who prioritize sustainability and adaptability in their home furnishings. This trend reflects a broader global shift toward personalized, environmentally conscious living spaces that seamlessly blend functionality and style.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $13.2 Billion |

| CAGR | 5.4% |

The market is categorized by type, including modular weight training equipment, transformable cardio furniture, adaptable home gym stations, multi-purpose fitness platforms, compact exercise furniture, and others. In 2024, modular weight training equipment dominated the market, contributing USD 2.5 billion, and is expected to grow at a CAGR of 5.1% over the forecast period. This segment's leadership is driven by its versatility, as many consumers prefer compact, adjustable designs for home-based strength training. The rising popularity of home gyms and the demand for space-efficient, flexible equipment for strength exercises are key factors propelling growth in this category.

By material, the market is segmented into metal, wood, plastic, and composite materials. In 2024, the metal segment captured 45.5% of the market share and is forecasted to grow at a CAGR of 5.7% through 2034. Metal remains the top choice for modular fitness furniture due to its superior durability and strength, which ensure stability and longevity, especially for heavy-duty applications. Its reliability and compatibility with modular designs make it the preferred material for consumers seeking practical and space-conscious solutions.

North America modular fitness furniture market accounted for USD 2.8 billion in 2024 and is projected to grow at a CAGR of 5.4% from 2025 to 2034. The United States leads the region, driven by strong fitness awareness and growing consumer demand for premium, multifunctional furniture solutions. The rise of home gyms and increasing interest in space-saving products are fueling growth in this market. With continuous innovation, the U.S. remains a pivotal player in advancing modular fitness furniture adoption and meeting the needs of health-conscious, space-savvy consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising urbanization and limited living spaces.

- 3.6.1.2 Increasing fitness awareness and at-home exercise trends.

- 3.6.1.3 Advancements in eco-friendly materials and design.

- 3.6.1.4 Growth in e-commerce sales.

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs.

- 3.6.2.2 Limited awareness in emerging markets

- 3.6.1 Growth drivers

- 3.7 Consumer buying behavior analysis

- 3.7.1 Demographic trends

- 3.7.2 Factors affecting buying decision

- 3.7.3 Consumer product adoption

- 3.7.4 Preferred distribution channel

- 3.7.5 Preferred price range

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Thousand units)

- 5.1 Key trends

- 5.2 Modular weight training equipment

- 5.3 Adaptable home gym stations

- 5.4 Transformable cardio furniture

- 5.5 Multi-purpose fitness platforms

- 5.6 Compact exercise furniture

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion) (Thousand units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Metal

- 6.4 Plastic

- 6.5 Composite materials

Chapter 7 Market Estimates and Forecast, By Price, 2021 – 2034 (USD Billion) (Thousand units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Thousand units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial (gyms, fitness studios, offices)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 BodyCraft

- 11.2 Core Health & Fitness

- 11.3 Ecore Athletic

- 11.4 Eleiko

- 11.5 Escape Fitness

- 11.6 Hammer Strength

- 11.7 Herman Miller

- 11.8 Kimball International

- 11.9 Life Fitness

- 11.10 Matrix Fitness

- 11.11 Nautilus

- 11.12 Peloton

- 11.13 Power Lift

- 11.14 Precor

- 11.15 Rogue Fitness

- 11.16 Technogym

- 11.17 YR Fitness