|

市場調查報告書

商品編碼

1666579

生物燃料市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

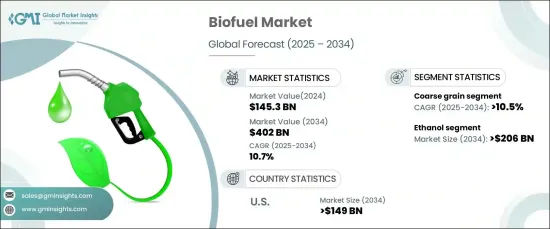

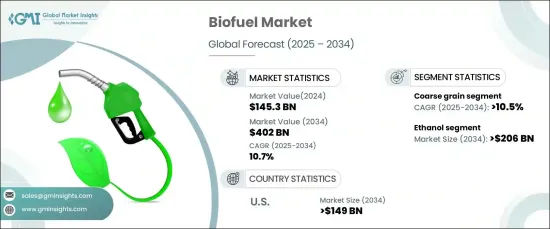

2024 年全球生物燃料市場價值為 1,453 億美元,預計將出現顯著成長,2025 年至 2034 年期間的複合年成長率為 10.7%。生物燃料被視為全球向再生能源轉型的關鍵參與者,越來越多地融入交通運輸、發電和工業活動等各個領域。在世界各國尋求應對氣候變遷的當兒,生物燃料在幫助各國和企業在不破壞現有基礎設施的情況下實現永續發展目標方面發揮關鍵作用。隨著企業和政府加大努力實現長期環境目標,這個充滿活力的產業將大幅成長。

企業持續採取永續發展措施以及運輸業對生物燃料的使用日益增多是市場擴張的主要驅動力。越來越多的公司開始使用生質燃料來幫助實現碳減排目標。生物燃料與傳統燃料系統的無縫整合使其成為有吸引力的選擇。這些燃料可以輕鬆地與傳統燃料混合,使產業能夠在維護現有基礎設施的同時減少對環境的影響。因此,生物燃料為那些注重永續性且不需要大量資本投資的企業提供了一種經濟有效的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1453億美元 |

| 預測值 | 4020億美元 |

| 複合年成長率 | 10.7% |

乙醇是主要的生物燃料產品,預計到 2034 年其產值將達到 2,060 億美元。持續發展的纖維素乙醇(源自農業殘留物等非食品來源)預計將進一步刺激需求。隨著永續性繼續成為全球議程的中心議題,纖維素乙醇的生產和使用與減少燃料生產對環境影響的努力完美契合,使得乙醇成為更具吸引力的選擇。

粗糧原料市場,尤其是玉米,預計到 2034 年將以 10.5% 的複合年成長率成長。農業實踐的進步提高了農作物產量並降低了生產成本,使得以玉米為基礎的乙醇更具經濟可行性。此外,乙醇生產過程中產生的副產品,如酒糟,可以作為寶貴的動物飼料,有助於乙醇產業的整體經濟永續發展。

在聯邦政府授權和州級推廣再生燃料計畫的推動下,美國生質燃料市場預計到 2034 年將創收 1,490 億美元。乙醇主要來自玉米,透過在 E10 和 E15 等燃料混合物中的使用引領市場。此外,在加州低碳燃料標準(LCFS)等措施的支持下,再生柴油產量的不斷成長也增強了這一勢頭。作為實現交通運輸領域淨零排放策略的一部分,美國也大力投資包括纖維素乙醇在內的先進生物燃料,使美國成為生物燃料創新的全球領導者。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模與預測:按燃料,2021 – 2034 年

- 主要趨勢

- 生質柴油

- 乙醇

- 其他

第6章:市場規模與預測:依原料,2021 – 2034 年

- 主要趨勢

- 粗粒

- 糖料作物

- 植物油

- 其他

第 7 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 運輸

- 航空

- 其他

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 西班牙

- 英國

- 義大利

- 亞太地區

- 中國

- 印度

- 印尼

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ADM

- Borregaard

- BTG Bioliquids

- Cargill

- Chevron

- Clariant

- COFCO

- CropEnergies

- FutureFuel

- Munzer Bioindustrie

- My Eco Energy

- Neste

- POET

- Praj Industries

- The Andersons

- TotalEnergies

- UPM

- Verbio

- Wilmar International

- Zilor

The Global Biofuel Market, valued at USD 145.3 billion in 2024, is projected to witness significant growth, expanding at a CAGR of 10.7% between 2025 and 2034. This rapid growth is being fueled by rising environmental awareness, the increasing push for sustainable energy solutions, and supportive government policies aimed at reducing carbon emissions. Biofuels, seen as a key player in the global transition to renewable energy, are increasingly integrated across various sectors, including transportation, power generation, and industrial activities. As the world seeks to address climate change, biofuels are playing a pivotal role in helping countries and corporations meet their sustainability targets without disrupting current infrastructure. This dynamic sector is positioned for substantial growth as businesses and governments intensify their efforts to achieve long-term environmental goals.

The continued adoption of sustainability initiatives by corporations and the growing use of biofuels in the transportation industry are major drivers of market expansion. Companies are increasingly turning to biofuels to help meet their carbon reduction targets. The seamless integration of biofuels with conventional fuel systems is making them an appealing option. These fuels can be easily blended with traditional fuels, allowing industries to reduce their environmental impact while maintaining existing infrastructure. Biofuels, therefore, present a cost-effective solution for businesses aiming to prioritize sustainability without needing significant capital investments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $145.3 Billion |

| Forecast Value | $402 Billion |

| CAGR | 10.7% |

Ethanol, a major biofuel product, is expected to generate USD 206 billion by 2034. This growth is driven by its widespread use in fuel blends, thanks to its effectiveness in reducing greenhouse gas emissions. The ongoing development of cellulosic ethanol, derived from non-food sources like agricultural residues, is expected to further fuel demand. As sustainability continues to take center stage in the global agenda, the production and use of cellulosic ethanol align perfectly with efforts to reduce the environmental impact of fuel production, making ethanol an even more attractive option.

The coarse grain feedstock market, particularly corn, is expected to grow at a CAGR of 10.5% through 2034. Corn remains the dominant feedstock for ethanol production due to favorable biofuel mandates that promote renewable fuel blends. Advances in agricultural practices have improved crop yields and reduced production costs, making corn-based ethanol even more economically viable. Additionally, the byproducts of ethanol production, such as distillers' grains, serve as valuable animal feed, contributing to the overall economic sustainability of the ethanol industry.

The U.S. biofuel market is projected to generate USD 149 billion by 2034, driven by federal mandates and state-level programs designed to promote renewable fuels. Ethanol, primarily sourced from corn, leads the market through its use in fuel blends like E10 and E15. Furthermore, the growing production of renewable diesel, backed by initiatives like California's Low Carbon Fuel Standard (LCFS), adds to the momentum. The U.S. is also significantly investing in advanced biofuels, including cellulosic ethanol, as part of its strategy to achieve net-zero emissions in the transportation sector, positioning the nation as a global leader in biofuel innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 – 2034 (MToe, USD Billion)

- 5.1 Key trends

- 5.2 Biodiesel

- 5.3 Ethanol

- 5.4 Others

Chapter 6 Market Size and Forecast, By Feedstock, 2021 – 2034 (MToe, USD Billion)

- 6.1 Key trends

- 6.2 Coarse grain

- 6.3 Sugar crop

- 6.4 Vegetable oil

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (MToe, USD Billion)

- 7.1 Key trends

- 7.2 Transportation

- 7.3 Aviation

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (MToe, USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Spain

- 8.3.4 UK

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Indonesia

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ADM

- 9.2 Borregaard

- 9.3 BTG Bioliquids

- 9.4 Cargill

- 9.5 Chevron

- 9.6 Clariant

- 9.7 COFCO

- 9.8 CropEnergies

- 9.9 FutureFuel

- 9.10 Munzer Bioindustrie

- 9.11 My Eco Energy

- 9.12 Neste

- 9.13 POET

- 9.14 Praj Industries

- 9.15 The Andersons

- 9.16 TotalEnergies

- 9.17 UPM

- 9.18 Verbio

- 9.19 Wilmar International

- 9.20 Zilor