|

市場調查報告書

商品編碼

1666692

運輸生物燃料市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Transportation Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球運輸生物燃料市場價值為 1019 億美元,預計 2025 年至 2034 年的複合年成長率為 10.7%。生物燃料生產技術的進步,特別是第二代和第三代生物燃料,正在提高效率並實現使用多種原料。這些創新透過利用非糧食來源解決了糧食安全和資源分配問題。

該行業正在向原料多樣化轉變,包括農業殘留物、廢油和其他副產品。這種方法促進了循環經濟並提高了生物燃料生產的永續性。此外,生物燃料與目前燃料基礎設施的兼容性正在促進其融入能源結構。將生物燃料與傳統燃料混合正在成為減少溫室氣體排放的實用解決方案,且不需要對現有汽車引擎進行重大改造。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1019億美元 |

| 預測值 | 2805億美元 |

| 複合年成長率 | 10.7% |

由於乙醇在混合燃料中的使用不斷增加,預計到 2034 年乙醇市場規模將超過 1,910 億美元。政府推行的低排放政策和對環境永續性的日益重視正在鼓勵人們增加乙醇消費。乙醇正成為減少交通運輸溫室氣體排放策略的重要組成部分。它在新興燃料技術中的作用進一步鞏固了其在市場上的地位。

粗糧原料部分包括用於生物燃料生產的各種穀物,預計到 2034 年將以超過 10.5% 的複合年成長率成長。這些發展推動了再生燃料混合物的廣泛採用,從而促進了更廣泛的市場擴張。

在美國,運輸生物燃料市場規模預計到 2034 年將超過 980 億美元。隨著產業向更永續的能源解決方案邁進,對先進生物燃料技術的投資正在加速。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模與預測:按燃料,2021 – 2034 年

- 主要趨勢

- 生質柴油

- 乙醇

- 其他

第6章:市場規模與預測:依原料,2021 – 2034 年

- 主要趨勢

- 粗粒

- 糖料作物

- 植物油

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 西班牙

- 英國

- 義大利

- 亞太地區

- 中國

- 印度

- 印尼

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ADM

- Borregaard

- BTG Bioliquids

- Cargill

- Chevron

- Clariant

- COFCO

- CropEnergies

- FutureFuel

- Munzer Bioindustrie

- My Eco Energy

- Neste

- POET

- Praj Industries

- The Andersons

- TotalEnergies

- UPM

- Verbio

- Wilmar International

- Zilor

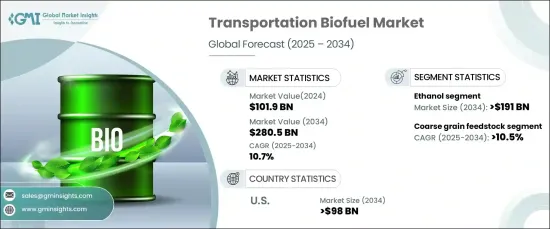

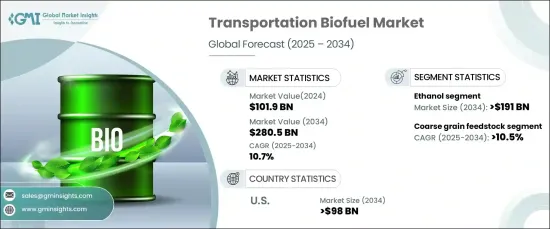

The Global Transportation Biofuel Market was valued at USD 101.9 billion in 2024 and is projected to grow at a CAGR of 10.7% from 2025 to 2034. The market is gaining momentum due to the rising need for sustainable energy alternatives and heightened efforts to reduce carbon emissions in the transportation industry. Advancements in biofuel production technologies, particularly second and third-generation biofuels, are improving efficiency and enabling the use of diverse feedstocks. These innovations address concerns over food security and resource allocation by utilizing non-food sources.

The industry is seeing a shift toward feedstock diversification, incorporating agricultural residues, waste oils, and other byproducts. This approach promotes a circular economy and enhances the sustainability of biofuel production. Additionally, the compatibility of biofuels with current fuel infrastructure is fostering their integration into the energy mix. Blending biofuels with conventional fuels is becoming a practical solution for reducing greenhouse gas emissions without requiring significant changes to existing vehicle engines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $101.9 Billion |

| Forecast Value | $280.5 Billion |

| CAGR | 10.7% |

The ethanol market is expected to surpass USD 191 billion by 2034, driven by its increasing use in blended fuels. Government policies promoting lower emissions and the growing emphasis on environmental sustainability are encouraging higher ethanol consumption. Ethanol is becoming a critical component of strategies aimed at reducing greenhouse gas emissions in transportation. Its role in emerging fuel technologies is further solidifying its position in the market.

The coarse grain feedstock segment, which includes various grains used for biofuel production, is forecasted to grow at a CAGR of over 10.5% through 2034. Efforts to enhance crop yields and improve agricultural efficiency are supporting the growth of this segment, making biofuel production more cost-effective and scalable. These developments are driving increased adoption of renewable fuel blends, contributing to the broader market expansion.

In the U.S., the transportation biofuel market is expected to exceed USD 98 billion by 2034. Federal mandates and supportive regulatory frameworks are fueling the adoption of biofuels, with an increasing focus on achieving net-zero emissions in the transportation sector. Investments in advanced biofuel technologies are accelerating as the industry moves toward more sustainable energy solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 – 2034 (MToe, USD Billion)

- 5.1 Key trends

- 5.2 Biodiesel

- 5.3 Ethanol

- 5.4 Others

Chapter 6 Market Size and Forecast, By Feedstock, 2021 – 2034 (MToe, USD Billion)

- 6.1 Key trends

- 6.2 Coarse grain

- 6.3 Sugar crop

- 6.4 Vegetable oil

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (MToe, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Indonesia

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ADM

- 8.2 Borregaard

- 8.3 BTG Bioliquids

- 8.4 Cargill

- 8.5 Chevron

- 8.6 Clariant

- 8.7 COFCO

- 8.8 CropEnergies

- 8.9 FutureFuel

- 8.10 Munzer Bioindustrie

- 8.11 My Eco Energy

- 8.12 Neste

- 8.13 POET

- 8.14 Praj Industries

- 8.15 The Andersons

- 8.16 TotalEnergies

- 8.17 UPM

- 8.18 Verbio

- 8.19 Wilmar International

- 8.20 Zilor