|

市場調查報告書

商品編碼

1685084

馬達起動器市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Motor Starter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

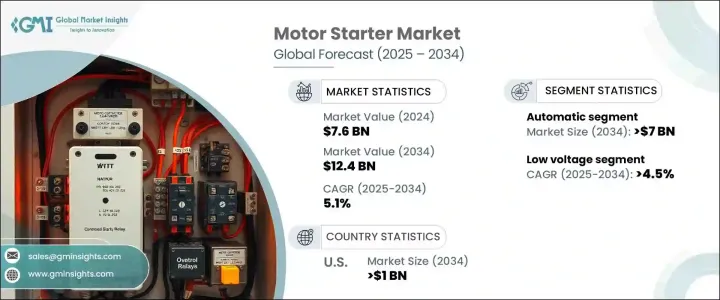

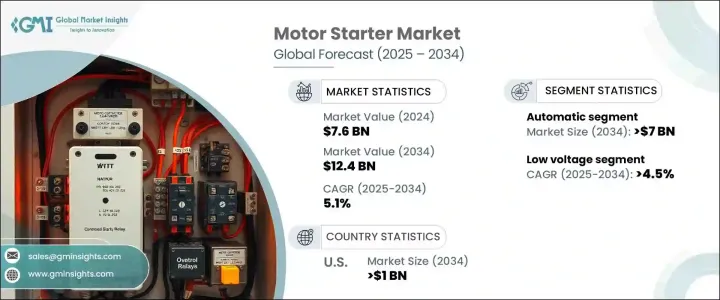

2024 年全球電動馬達起動器市場價值為 76 億美元,預計將穩定成長,2025 年至 2034 年的複合年成長率預計為 5.1%。這一成長可歸因於工業自動化的快速應用,這導致了對更高效的電機控制和保護解決方案的需求。隨著各行各業越來越關注能源效率和永續性,對先進馬達起動器的需求激增。主要的市場促進因素包括人們對具有遠端監控、診斷和智慧控制功能的智慧型馬達起動器的日益青睞,所有這些都大大提高了營運效率。

此外,將物聯網 (IoT) 技術整合到電動馬達起動器中的轉變透過提高功能性、適應性和節能性徹底改變了市場。基於微處理器的控制、數位介面和即時監控功能等技術創新也在重塑該產業的未來。工業自動化加上環保意識預計將在未來幾年推動對這些系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 76億美元 |

| 預測值 | 124億美元 |

| 複合年成長率 | 5.1% |

預計到 2034 年,自動電動馬達起動器市場將創造 70 億美元的收入。這一成長主要得益於小型工業和商業領域日益成長的需求,在這些領域,電動馬達起動器對於高效和安全的電動馬達運作至關重要。基於微處理器的技術和電子控制的結合增強了它們的吸引力,使企業能夠最大限度地節省能源並降低營運成本。基礎設施的不斷擴張,加上全球製造活動的不斷增加,將推動對這些高效且經濟的解決方案的需求。

同時,預計到 2034 年低壓電動馬達起動器市場的複合年成長率將達到 4.5%。對節能降耗的電動馬達起動器的需求不斷成長是推動該產業發展的關鍵因素。低壓啟動器對於尋求實現永續發展目標同時最大限度減少能源浪費的行業尤其有價值。先進通訊協定、物聯網連接和更環保的設計元素的整合使這一領域實現了強勁成長。人們對再生能源和永續實踐的日益重視為低壓起動器在從綠色建築項目到智慧電網等多個行業中發揮重要作用提供了機會。

到 2034 年,美國電動馬達起動器市場規模預計將達到 10 億美元。製造技術的進步、自動化的廣泛採用以及基礎設施的現代化是這一成長的重要推動因素。此外,再生能源系統的整合和更嚴格的能源效率法規的實施,正在推動美國對先進馬達控制解決方案的需求。隨著各行各業尋求滿足高能源標準和提高營運效率,電機起動器市場有望蓬勃發展,滿足現代製造業和基礎設施發展的需求。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模與預測:依技術,2021 – 2034 年

- 主要趨勢

- 手動的

- 自動的

第 6 章:市場規模與預測:按電壓,2021 – 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 7 章:市場規模及預測:依階段,2021 – 2034 年

- 主要趨勢

- 單相

- 三相

第 8 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第 9 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 荷蘭

- 奧地利

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- ABB

- C&S Electric

- CG Power & Industrial Solutions

- CHINT Group

- CORDYNE

- Danfoss

- Eaton

- Emerson Electric

- Fuji Electric

- General Electric

- Havells India

- Kalp Controls

- L&T Electrical & Automation

- LOVATO ELECTRIC

- Mitsubishi Electric

- Rockwell Automation

- Schneider Electric

- Siemens

- SKN-BENTEX GROUP

- WEG

The Global Motor Starter Market, valued at USD 7.6 billion in 2024, is expected to experience steady growth, with a projected CAGR of 5.1% from 2025 to 2034. This growth can be attributed to the rapid adoption of industrial automation, which has created a demand for more efficient motor control and protection solutions. As industries increasingly focus on energy efficiency and sustainability, the need for advanced motor starters has surged. Key market drivers include the growing preference for intelligent motor starters that offer remote monitoring, diagnostics, and smart controls, all of which significantly enhance operational efficiency.

Moreover, the shift towards integrating Internet of Things (IoT)-)-enabled technologies into motor starters have revolutionized the market by improving functionality, adaptability, and energy savings. Technological innovations like microprocessor-based controls, digital interfaces, and real-time monitoring features are also reshaping the industry's future. Industrial automation, coupled with environmental consciousness, is expected to propel demand for these systems in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.4 Billion |

| CAGR | 5.1% |

The automatic motor starter segment is anticipated to generate USD 7 billion in revenue through 2034. This growth is largely driven by the increasing demand from small-scale industries and the commercial sector, where motor starters are crucial for efficient and safe motor operations. The incorporation of microprocessor-based technologies and electronic controls enhances their appeal, allowing businesses to maximize energy savings and reduce operational costs. The ongoing expansion of infrastructure, coupled with rising manufacturing activities globally, will fuel the demand for these efficient and cost-effective solutions.

Meanwhile, the low-voltage motor starter segment is forecast to grow at a CAGR of 4.5% through 2034. The growing demand for energy-efficient motor starters with reduced power consumption is a key factor propelling this sector. Low-voltage starters are particularly valued in industries looking to meet sustainability goals while minimizing energy waste. The integration of advanced communication protocols, IoT connectivity, and more eco-conscious design elements positions this segment for strong growth. The increasing emphasis on renewable energy sources and sustainable practices presents an opportunity for low-voltage starters to play a significant role across multiple industries, from green building projects to smart grids.

The U.S. motor starter market is set to generate USD 1 billion by 2034. Advances in manufacturing technologies, the widespread adoption of automation, and the modernization of infrastructure are significant contributors to this growth. Additionally, the integration of renewable energy systems and the enforcement of stricter energy efficiency regulations are driving the demand for advanced motor control solutions in the U.S. As industries seek to meet high energy standards and improve operational efficiency, the market for motor starters is well-positioned to thrive, meeting the needs of modern manufacturing and infrastructure development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Automatic

Chapter 6 Market Size and Forecast, By Voltage, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Phase, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.3.8 Austria

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.4.6 New Zealand

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.5.6 Nigeria

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 C&S Electric

- 10.3 CG Power & Industrial Solutions

- 10.4 CHINT Group

- 10.5 CORDYNE

- 10.6 Danfoss

- 10.7 Eaton

- 10.8 Emerson Electric

- 10.9 Fuji Electric

- 10.10 General Electric

- 10.11 Havells India

- 10.12 Kalp Controls

- 10.13 L&T Electrical & Automation

- 10.14 LOVATO ELECTRIC

- 10.15 Mitsubishi Electric

- 10.16 Rockwell Automation

- 10.17 Schneider Electric

- 10.18 Siemens

- 10.19 SKN-BENTEX GROUP

- 10.20 WEG