|

市場調查報告書

商品編碼

1636217

馬達起動機:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Motor Starter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

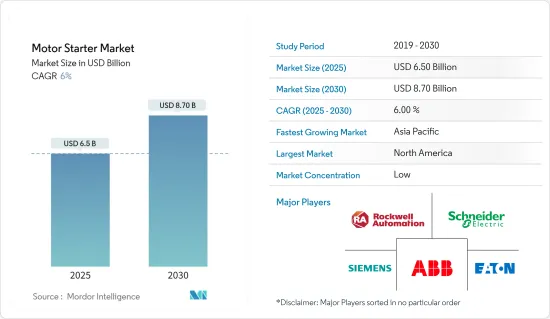

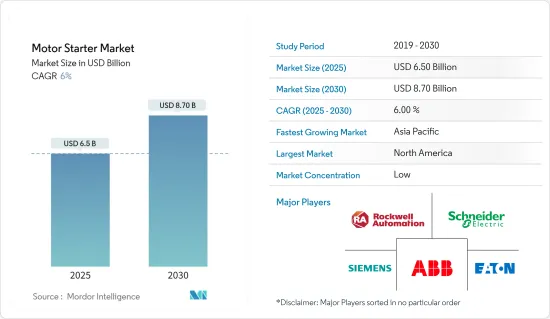

馬達啟動器市場規模預計到 2025 年將達到 65 億美元,預計到 2030 年將達到 87 億美元,預測期內(2025-2030 年)複合年成長率為 6%。

主要亮點

- 由於對環境問題的日益關注,業界擴大採用節能馬達啟動器,例如緩衝啟動器,以降低能耗並延長馬達壽命。同時,物聯網 (IoT) 的興起正在刺激智慧馬達啟動器的誕生,實現遠端監控和控制,並不斷發展市場。

- 全球向電動車 (EV) 的轉變正在推動汽車應用中對先進馬達控制解決方案(包括馬達啟動器)的需求。在電動車中,馬達啟動器與電池管理系統配合使用,以最佳化性能並確保安全。隨著世界各國將重點從內燃機轉向電動車,對馬達啟動器的需求預計將迅速增加。

- 馬達啟動器市場的最新創新推出了具有過載保護、溫度監控和可程式設計設定等先進功能的產品,以提高可靠性和性能。製造商正在擴展其馬達啟動器產品線,以適應不同的電壓等級、額定功率和特定產業需求。

- 馬達啟動器市場競爭激烈,眾多製造商爭奪市場佔有率。這種激烈的競爭往往會帶來定價壓力和產品差異化挑戰。

- 宏觀經濟趨勢,特別是新興市場強勁的經濟成長,正在推動製造業和建設業對馬達啟動器的需求。此外,有關能源效率和環境永續性的法規不斷增加正在影響市場動態。然而,市場預計將繼續成長。

馬達啟動器市場趨勢

製造業可望推動市場成長

- 向工業 4.0 的過渡正在加速自動化技術在製造業的傳播。工廠配備了先進的機器人和自動化系統,需要高效率的馬達控制。這種發展推動了對複雜馬達啟動器的需求,這些啟動器可以管理不同的負載並提高整體性能。

- 在製造業中引入物聯網和智慧技術正在徹底改變設施營運。具有即時監控、診斷和遠端控制功能的智慧馬達啟動器越來越受歡迎。這些進步提高了營運效率和預測性維護,推動市場向前發展。

- 製造商擴大尋找適合其應用和操作條件的客製化馬達起動器。這種需求正在推動馬達起動器製造商和最終用戶之間的合作,以創建滿足其獨特性能標準的解決方案。

- 隨著製造商對其設備進行現代化改造,包括馬達啟動器在內的自動化設備的資本支出大幅增加。 FRED資料凸顯了這一趨勢。美國新製造設施的建設總投資從 2022 年的 1,243 億美元飆升至 2023 年創紀錄的 1,930 億美元。

- 《減少通貨膨脹法案》(IRA)、《兩黨基礎設施法案》(BIL)、《晶片與科學法案》(CHIPS Act)等立法措施將支持美國國內製造業,包括半導體、電動車(EV )電池和我們正在推動風力發電機的投資。這種投資動能不僅限於美國;新興國家的工業化也在迅速進展,導致對馬達啟動器的需求激增。

亞太地區預計將維持高成長率

- 中國和印度等國家的快速工業化和城市擴張正在推動多個行業對馬達啟動器的需求。隨著這些產業不斷擴大以滿足都市區的需求,高效能馬達控制系統的重要性變得越來越明顯。

- 亞太地區是世界製造地,特別是在電子、汽車和機械領域。該地區與印度、中國、日本和東南亞國家等主要企業的成長正在推動對馬達啟動器的需求,這對於在製造過程中控制馬達至關重要。

- 印度製造業投資大幅成長,正處於該國經濟發展的關鍵時期。根據高力國際的報告,印度製造業市場規模預計在 2025-26 年間突破 1 兆美元大關。古吉拉突邦正在成為領跑者,並將自己打造成印度的製造業強國。

- 汽車產業正在蓬勃發展,尤其是在中國和日本,印度也取得了長足的進步,刺激了對電動車馬達馬達的需求。此外,隨著都市化和人口成長,水處理設施的需求不斷增加,從而增加了泵浦和控制系統中對可靠馬達啟動器的需求。

- 根據中國國家發展和改革委員會預測,到2025年,中國污泥量將達到9,000萬噸。專家預測,2021年至2025年,中國將投資約80億美元新建污泥處理設施。隨著污染水準不斷上升,預計印度也會跟進。由於這些趨勢,該地區的馬達啟動器市場預計將顯著成長。

馬達啟動器產業概況

市場競爭激烈,既有大型跨國公司,也有區域企業。這一格局的特點是技術快速進步、策略聯盟以及企業迫切需要透過客製化產品、提高能源效率和整合智慧技術來脫穎而出。

該領域的知名企業包括Schneider Electric、西門子、ABB 和伊頓。這些公司投資於研發,重點是開拓和改進馬達啟動器技術。過載保護、熱感監控、智慧連接和即時診斷等功能正在成為這個競爭激烈的市場中的關鍵差異化因素。

隨著工業 4.0 的發展勢頭,那些將物聯網功能、即時監控和預測性維護無縫融入其產品的公司將吸引渴望自動化數位解決方案的客戶。此外,我們還可以透過提供滿足特定行業特定要求的客製化馬達啟動器來加深與客戶的關係。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19大流行和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 工業自動化的成長

- 能源效率法規

- 市場限制因素

- 與變頻驅動器 (VFD) 的競爭

第6章 市場細分

- 按類型

- 直接在線啟動

- 定子電阻啟動器

- 滑環啟動器

- 自耦變壓器啟動器

- 星Delta起動機

- 緩衝啟動器

- 按額定功率

- 小於5千瓦

- 5-50 kW

- 50千瓦以上

- 按行業分類

- 製造業

- 石油和天然氣

- 礦業

- 用水和污水處理

- 車

- 飲食

- 建築/施工

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Seimens AG

- ABB Group

- Eaton Corporation

- Rockwell Automation

- Mitsubishi Electric Corporation

- Fuji Electric FA Components & Systems Co. Ltd

- Toshiba Corporation

- Larsen & Toubro Limited

- WEG SA

- WW Grainger Inc.

- Danfoss

第8章投資分析

第9章 市場的未來

The Motor Starter Market size is estimated at USD 6.50 billion in 2025, and is expected to reach USD 8.70 billion by 2030, at a CAGR of 6% during the forecast period (2025-2030).

Key Highlights

- In response to growing environmental concerns, industries are increasingly adopting energy-efficient motor starters, like soft starters, to reduce energy consumption and extend motor lifespan. Concurrently, the rise of the Internet of Things (IoT) has spurred the creation of intelligent motor starters, enabling remote monitoring and control, thus evolving the market.

- The global shift toward electric vehicles (EVs) has heightened the demand for sophisticated motor control solutions, including motor starters in automotive applications. In EVs, motor starters collaborate with battery management systems to optimize performance and ensure safety. As countries pivot from internal combustion engines to EVs across the world, the demand for motor starters is projected to surge.

- Recent innovations in the motor starter market have introduced products with advanced features like overload protection, thermal monitoring, and programmable settings, boosting reliability and performance. Manufacturers are broadening their product lines to encompass motor starters tailored to various voltage levels, power ratings, and industry-specific needs.

- The motor starter market is fiercely competitive, with many manufacturers competing for a market share. This intense competition often results in pricing pressures and challenges in product differentiation.

- Macroeconomic trends, particularly robust economic growth in emerging markets, fuel the demand for motor starters in the manufacturing and construction sectors. Additionally, tightening regulations on energy efficiency and environmental sustainability are influencing market dynamics. Nevertheless, the market is poised for continued growth.

Motor Starter Market Trends

The Manufacturing Sector is Expected to Drive the Market's Growth

- The transition to Industry 4.0 has spurred the widespread adoption of automation technologies in manufacturing. Factories are deploying advanced robotics and automated systems, necessitating efficient motor control. This evolution fuels the demand for sophisticated motor starters capable of managing diverse loads and enhancing overall performance.

- The infusion of IoT and smart technologies into manufacturing is revolutionizing facility operations. Smart motor starters, equipped with real-time monitoring, diagnostics, and remote control features, are gaining traction. These advancements bolster operational efficiency and predictive maintenance, propelling the market.

- Manufacturers are increasingly seeking customized motor starters specifically designed for distinct applications and operating conditions. This demand has fostered collaborative initiatives between motor starter producers and end users, aiming to craft solutions that align with unique performance standards.

- With manufacturers modernizing their facilities, there has been a notable uptick in capital expenditure on automation equipment, including motor starters. Data from FRED highlights this trend: total construction investment in new manufacturing facilities in the United States soared to a record USD 193 billion in 2023, a significant leap from USD 124.3 billion in 2022.

- Legislative measures like the Inflation Reduction Act (IRA), Bipartisan Infrastructure Law (BIL), and CHIPS and Science Act (CHIPS Act) are catalyzing investments in domestic manufacturing sectors, notably semiconductors, electric vehicle (EV) batteries, and wind turbines in the United States. This investment momentum is not confined to the United States, with emerging economies witnessing rapid industrialization, contributing to the surging demand for motor starters.

Asia-Pacific is Expected to Witness a High Growth Rate

- Countries like China and India are witnessing rapid industrialization and urban expansion, leading to a heightened demand for motor starters across multiple sectors. As these industries scale operations to cater to urban needs, the importance of efficient motor control systems becomes increasingly evident.

- Asia-Pacific is a global manufacturing hub, especially in the electronics, automotive, and machinery sectors. With key players like India, China, Japan, and several Southeast Asian nations, the region's growth propels the demand for motor starters, which are vital for controlling electric motors during manufacturing processes.

- The Indian manufacturing sector is witnessing a significant surge in investments, marking a pivotal moment in the country's economic journey. A report by Colliers highlights that the Indian manufacturing market is on track to hit the USD 1 trillion mark by 2025-26. Gujarat is emerging as the frontrunner, establishing itself as India's manufacturing powerhouse, closely trailed by Maharashtra and Tamil Nadu, which are expected to make substantial contributions to the market.

- The automotive industry, particularly booming in China and Japan, with India making significant strides, is fueling the demand for motor starters in electric vehicles. Furthermore, as urbanization and population grow, there is a rising need for water treatment facilities, underscoring the demand for dependable motor starters in pumps and control systems.

- According to the PRC's National Development and Reform Commission, China's sludge volume could hit 90 million tons by 2025. Experts project an investment of around USD 8 billion in new sludge processing facilities in China from 2021 to 2025. Given the escalating pollution levels, India is anticipated to follow suit. With such trends, the motor starter market in the region is poised for significant growth.

Motor Starter Industry Overview

The market is fiercely competitive, featuring a blend of large multinational corporations and regional players. This landscape is marked by rapid technological advancements, strategic collaborations, and a pressing need for companies to stand out through product customization, enhanced energy efficiency, and the integration of smart technologies.

Prominent players in the arena include Schneider Electric, Siemens AG, ABB Ltd, and Eaton Corporation. These companies are channeling investments into R&D, focusing on pioneering and refining motor starter technologies. Features like overload protection, thermal monitoring, smart connectivity, and real-time diagnostics have emerged as pivotal differentiators in this competitive market.

As Industry 4.0 gains momentum, companies that seamlessly weave in IoT capabilities, real-time monitoring, and predictive maintenance into their offerings are poised to attract a clientele eager for automated and digital solutions. Furthermore, companies can foster deeper relationships with their clients by providing tailored motor starters that address the distinct requirements of specific industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the Aftereffects of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Industrial Automation

- 5.1.2 Energy Efficiency Regulation

- 5.2 Market Restraints

- 5.2.1 Competition From Variable Frequency Drives (VFDs)

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Direct-on-Line Starter

- 6.1.2 Stator Resistance Starter

- 6.1.3 Slip Ring Starter

- 6.1.4 Auto Transformer Starter

- 6.1.5 Star Delta Starter

- 6.1.6 Soft Starter

- 6.2 By Power Rating

- 6.2.1 Up to 5 kW

- 6.2.2 5 - 50 kW

- 6.2.3 Above 50 kW

- 6.3 By End-user Vertical

- 6.3.1 Manufacturing

- 6.3.2 Oil and Gas

- 6.3.3 Mining

- 6.3.4 Water and Wastewater Treatment

- 6.3.5 Automotive

- 6.3.6 Food and Beverage

- 6.3.7 Building and Construction

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Seimens AG

- 7.1.3 ABB Group

- 7.1.4 Eaton Corporation

- 7.1.5 Rockwell Automation

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Fuji Electric FA Components & Systems Co. Ltd

- 7.1.8 Toshiba Corporation

- 7.1.9 Larsen & Toubro Limited

- 7.1.10 WEG SA

- 7.1.11 W.W. Grainger Inc.

- 7.1.12 Danfoss