|

市場調查報告書

商品編碼

1627200

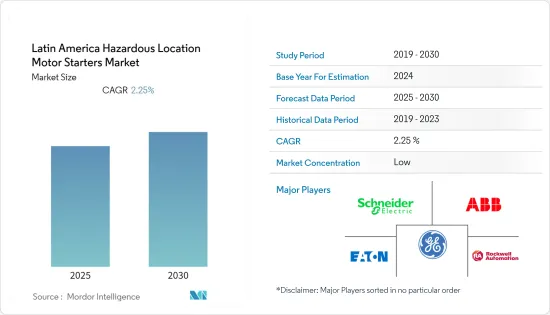

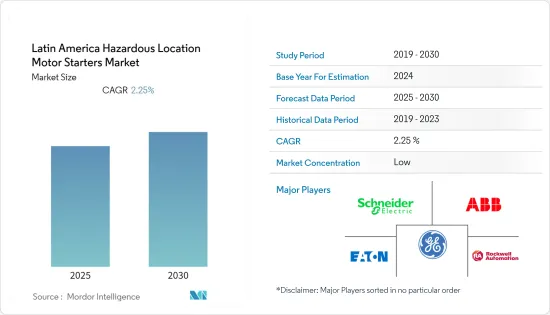

拉丁美洲危險區域馬達起動器:市場佔有率分析、產業趨勢和成長預測(2025-2030)Latin America Hazardous Location Motor Starters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

拉丁美洲危險場所馬達啟動器市場預計在預測期內複合年成長率為 2.25%

主要亮點

- 馬達啟動器控制大啟動電流並保護機器免受電壓波動的影響。對降低功耗和提高馬達效率的需求預計將推動危險場所馬達啟動器市場的成長。

- 主要海上石油和天然氣開發、新石油發現、對深海鑽探活動的日益關注以及用水和污水行業支出的增加是未來市場成長的關鍵機會。

- 採用自動化和機器人技術的防爆馬達在馬達啟動器市場佔據主導地位。由於石油和天然氣、化學、採礦、船舶和污水等各行業的使用量增加,對危險場所馬達起動器的需求不斷增加。

- COVID-19 大流行影響了拉丁美洲危險場所電機啟動器市場的供需。由於該地區原料供應/收集不足,製造商因封鎖限制而停止了馬達啟動器的生產。因此,市場成長出現下滑。

拉丁美洲危險區域馬達啟動器市場趨勢

巴西佔有很大佔有率

- 在拉丁美洲,巴西是石油和天然氣投資的首選目的地(中國也是重要的投資者)。因此,隨著拉丁美洲工業的快速發展,對電力的需求增加,最終帶動了馬達啟動器市場的成長。

- 磁力馬達啟動器可促進重型設備的短路和過載保護。因此,對低壓運轉保護磁電機啟動器的需求不斷成長,正在推動市場成長。

- Schneider Electric收購 DC Systems BV 以進一步創新配電領域。此次收購利用了Schneider Electric在提供永續能源基礎設施方面的專業知識和競爭優勢。

- 擁有大量石油和天然氣蘊藏量的拉丁美洲預計危險場所電機啟動器市場在預測期內將顯著成長,其中許多石油和天然氣計劃都在墨西哥開展。

煤炭和精製生產推動市場成長

- 巴西、墨西哥和委內瑞拉是該地區石油產能增加的主要原因,促進了電機起動機市場的過度成長。這些國家在生產方面取得了許多重要的發展。

- 在低壓和中壓下運作的低壓馬達和軟啟動器在發電、化學和石化、水泥、用水和污水、造紙和紙漿以及石油和天然氣等製程工業中擁有很大的市場佔有率。因此,除了石油和天然氣、水和用水和污水計劃的需求增加之外,對泵浦的需求增加預計也將推動馬達軟啟動器市場。

- 一家石化製造商正在使用物聯網技術連接重型機械馬達啟動器和智慧設備,以識別製造過程中的低效率,並在無法達到最佳生產水平的情況下自動監控機器,提供有關運行狀態的資訊。

- 危險場所馬達軟啟動器廣泛應用於發電、水和用水和污水、造紙和紙漿、化學和石化、水泥以及石油和天然氣等製程工業中使用的泵浦。對用水和污水計劃的投資以及對石油的需求不斷增加是泵浦應用的兩個重要最終用戶,預計將推動馬達軟啟動器市場的成長。

拉丁美洲危險場所電機啟動器產業概述

拉丁美洲危險場所馬達啟動器市場高度分散。該市場的主要企業包括施耐德電機、ABB、伊頓、通用電氣和羅克韋爾自動化公司。

- 2022 年 1 月,富蘭克林電氣收購了 Groundwater Distribution。此次收購提高了我們滿足拉丁美洲苛刻的用水需求的整體能力,還包括用於潛水馬達和泵浦的地下水抽水系統的解決方案,因為獲得清潔水為馬達啟動器市場的成長打開了大門。

- 2021 年 11 月 - 透過收購 GE 工業解決方案,ABB 的電氣化服務得到加強。 ABB 電氣化服務部門只有不到 30 名現場工程師負責低壓和中壓配電系統。 GE 提供廣泛的服務,並僱用了 250 多名現場工程師。在某些方面,此次收購擴大了兩家公司在低壓和中壓配電設備方面的創新規模。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭程度

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 危險場所技術的進步與研發投資推動市場

- 對熱過載保護設備的需求不斷成長推動市場發展

- 市場挑戰

- 缺乏正確安裝設備的意識阻礙了市場成長

- 危險場所馬達起動器必須經過堅固設計,以確保完全最佳化運行,從而保護人員和關鍵資產。

第6章 市場細分

- 按類型

- 低壓馬達啟動器

- 全電壓馬達啟動器

- 手動馬達啟動器

- 磁馬達啟動器

- 其他

- 按班級

- Ⅰ類

- 二級

- 三級

- 按部門分類

- 1級

- 2區

- 依危險地點分類

- 0區

- 1區

- 21區

- 2區

- 22區

- 按用途

- 油漆儲存區

- 精製煤廠

- 污水處理廠

- 精製

- 化學品儲存加工設施

- 穀物提昇機

- 石化設施/石油鑽井平台

- 其他

- 按國家/地區

- 巴西

- 墨西哥

- 哥倫比亞

- 阿根廷

- 其他

第7章 競爭格局

- 公司簡介

- Eaton

- Emerson Industrial Automation

- WEG Industries

- Rockwell Automation

- R. Stahl Inc.

- Heatrex

- Schneider Electric

- Siemens

- ABB Group

- GE Industrial Solutions

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 50787

The Latin America Hazardous Location Motor Starters Market is expected to register a CAGR of 2.25% during the forecast period.

Key Highlights

- The motor starters control the heavy starting currents, and also, this equipment protects the machines from voltages fluctuations. The requirement to reduce power consumption and increased motor efficiency is expected to propel the growth of the hazardous location motor starters market.

- Major offshore oil and gas developments, new oil discoveries, coupled with an increasing focus on deepwater drilling activities and rising expenditures in the water and wastewater industry, are the major opportunities for the market to grow in the future.

- Explosion-proof motors, which use automation and robotic technologies, are dominating the motors starters market. The demand for hazardous location motor starters is increasing due to their rising usage across different industries such as Oil & Gas, Chemicals, Mining, Marine, and Waste Water.

- The COVID-19 pandemic impacted Latin America's supply and demand of hazardous location motor starters market. With the improper supply/collection of the raw materials in the region, manufacturers halted the production of these motors starters due to restrictions in lockdown. As a result of these consequences, the market experienced a downfall in growth.

Latin America Hazardous Location Motor Starters Market Trends

Brazil to hold Significant Share

- In Latin America, Brazil is the preferred destination for oil and gas investments(with China being a significant investor). So, with the rapid evolution of industries in Latin America, there has been a rise in demand for electricity, which ultimately resulted in the growth of the motor starters market.

- Magnetic motor starters drive the short circuit and overload protection of heavy machinery. So, the increase in demand for magnetic motor starters that operate under low voltages for protection is boosting the market growth.

- Schneider Electric has acquired DC Systems B.V. to advance innovations in electrical distribution. This acquisition competences with Schneider Electric's expertise in providing sustainable energy infrastructures.

- Due to many oil & gas projects in Mexico, Latin America, which has a large pool of oil & gas reserves, is expected to show substantial growth during the mentioned forecast period for the hazardous location motor starters market.

Coal and Oil Refineries production to Drive the Market Growth

- Brazil, Mexico, and Venezuela are mainly responsible for the region's increase in oil production capacity and contributed to the overplus market growth for the motor starters market. They have many vital developments on the production side.

- Low voltage motor soft starter operating under low and medium voltage is witnessing a significant market share in process industries such as power generation, chemical & petrochemicals, cement, water & wastewater, paper & pulp, and oil & gas, among others. So, with rising demand for oil and gas, water, and wastewater projects and also the increasing demand for pumps is expected to drive the motor soft starter market.

- The petrochemical manufacturers are using the IoT technologies to connect the motor starters and smart devices in heavy machinery to identify the inefficiencies in the manufacturing process and provide information on the working condition of the machinery if they are encountered any failure to achieve the optimum production levels.

- The hazardous location motor soft starters are widely used in pumps that have applications in process industries such as power generation, water & wastewater, paper & pulp, chemical & petrochemicals, cement, oil & gas, among others. The increased investments in water & wastewater projects and demand for oil, the two significant end-users for pump applications, are expected to drive the growth of the motor soft starter market.

Latin America Hazardous Location Motor Starters Industry Overview

The Latin American hazardous location motor starters market is highly fragmented. The significant players in the market are Schneider Electric, ABB, Eaton, General Electric, and Rockwell Automation, Inc.

- January 2022- Franklin Electric acquired Groundwater Distribution company. The acquisition boosts the overall competency to meet the tough water demands of Latin America and also offers solutions of groundwater pumping systems for submersible motors and submersible water pumps, as the usage of clean water unlocks the doors for motor starters market growth.

- November 2021 - The acquisition of GE Industrial Solutions enhanced the ABB Electrification Services Offerings. Earlier, ABB'S Service had fewer than 30 field engineers present for low- and medium-voltage power distribution systems. GE's offering services are extensive, with more than 250 field engineers. In a way, this acquisition scaled both the companies in innovating the power delivery equipment operating under low and medium voltages with the advanced technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree Of Competition

- 4.2.5 Threat Of Substitute Products And Services

- 4.2.6 Intensity of Competitive Rivalry

- 4.3 Assessment of the COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in Technology and Investments in R&D in the Hazardous Locations to Drive the Market

- 5.1.2 Increasing Demand for Thermal Overload Protection Instruments to Boost the Market

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness of Proper Installation of Equipment Hampers the Market Growth

- 5.2.2 Hazardous Location Motor Starters must be Designed Robustly to Ensure Fully Optimized Operations to Protect Personnel and Critical Assets

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Low Voltage Motor Starter

- 6.1.2 Full voltage Motor Starter

- 6.1.3 Manual Motor Starter

- 6.1.4 Magnetic Motor Starter

- 6.1.5 Others

- 6.2 By Class

- 6.2.1 Class I

- 6.2.2 Class II

- 6.2.3 Class III

- 6.3 By Division

- 6.3.1 Division 1

- 6.3.2 Division 2

- 6.4 By Hazardous Zones

- 6.4.1 Zone 0

- 6.4.2 Zone 1

- 6.4.3 Zone 21

- 6.4.4 Zone 2

- 6.4.5 Zone 22

- 6.5 By Applications

- 6.5.1 Paint Storage Areas

- 6.5.2 Coal Preparation Plants

- 6.5.3 Sewage Treatment Plants

- 6.5.4 Oil Refineries

- 6.5.5 Chemical Storage and Handling Facilities

- 6.5.6 Grain Elevators

- 6.5.7 Petrochemical Facilities/Oil Rigs

- 6.5.8 Others

- 6.6 By Country

- 6.6.1 Brazil

- 6.6.2 Mexico

- 6.6.3 Colombia

- 6.6.4 Argentina

- 6.6.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Eaton

- 7.1.2 Emerson Industrial Automation

- 7.1.3 WEG Industries

- 7.1.4 Rockwell Automation

- 7.1.5 R. Stahl Inc.

- 7.1.6 Heatrex

- 7.1.7 Schneider Electric

- 7.1.8 Siemens

- 7.1.9 ABB Group

- 7.1.10 GE Industrial Solutions

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219