|

市場調查報告書

商品編碼

1639412

中東和非洲危險場所的馬達起動器:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)MEA Hazardous Location Motor Starters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

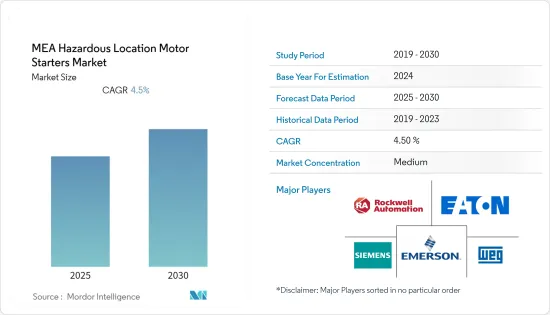

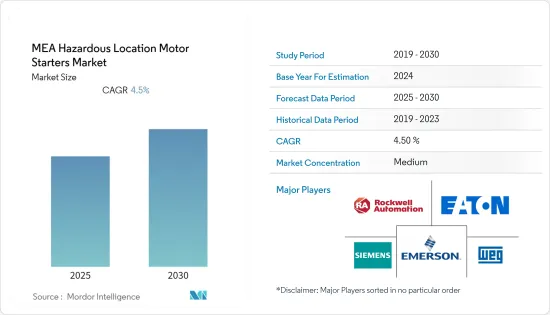

中東和非洲危險場所馬達啟動器市場在預測期內的複合年成長率預計為 4.5%。

危險區域馬達旨在透過抑制馬達內的爆炸來提高職場的安全性。採用不同的馬達來滿足不同配置和應用的需要。 I 類馬達用於影響氣體、蒸氣或液體的環境。 Ⅱ類馬達用於含有灰塵、可燃棉絨、纖維和鋸末等纖維的區域。

對熱過載保護設備不斷成長的需求正在推動市場的發展,因為瞬時過流通常是故障情況的結果。雙金屬片過載繼電器和時間過電流繼電器是高壓地區使用的馬達保護繼電器,具有短路保護、轉子堵轉保護等多種功能。

區域性併購正在推動危險地區的大量鑽探和探勘活動,進一步推動該地區對馬達和馬達啟動器的需求。例如,去年12月,阿布達比國家石油公司ADNOC旗下子公司ADNOC鑽井公司簽署協議,總合總計2億美元收購兩座海上鑽井鑽機。此次收購是該公司機隊擴張和成長策略的一部分。此次購買鑽機是該公司去年簽署的 9 台鑽機合約和 2021 年購買的 4 台鑽機合約的補充。該公司希望在 2024 年總合持有122 台內部鑽機。

此外,去年5月,ADNOC宣布發現了三項石油發現,包括阿布達比最大的陸上油田Bu Hasa的原油產能為65萬桶/日。

根據美國能源資訊署(2021)的數據,沙烏地阿拉伯持有全球已探明原油蘊藏量的15%。它是世界上最大的原油出口國。它的原油產能約為每天1200萬桶,其中包括與科威特共用的中立區的產能。沙烏地阿拉伯是僅次於美國的歐佩克最大原油生產國和全球第二大石油液化生產國。

沙烏地阿拉伯不斷發現新的油氣井,同時對現有和未開發的油井進行升級改造。例如,政府所有的阿布達比國家石油公司最近宣布了一項重要的鑽機隊發展計劃,希望在 2025 年增加數十台鑽機。阿拉伯石油投資公司去年1月發布的報告預測,隨著石油收入的增加,能源出口國增加支出,未來五年中東和非洲的能源投資將成長9%,達到8,790億美元。

COVID-19大流行為市場帶來了多項挑戰,包括供應鏈中斷和原料價格上漲。由於該地區石油和天然氣等許多行業的成長,預計該市場將在預測期內成長。

中東和非洲危險地區馬達啟動器市場趨勢

精製煤廠佔據主要市場佔有率

- 煤礦富含甲烷,接觸明火時,會在密閉的洞穴內引起爆炸。甲烷爆炸非常嚴重,通常最初的爆炸會導致煤塵雲的燃燒,從而引發更強烈的粉塵爆炸。

- 對煤炭生產的日益依賴正在推動該地區多家燃煤電廠的成長並推動市場。封閉煤炭儲存區域和結構內的所有機械和電氣設備均已核准用於危險場所,以消除潛在的點火源並提供合適的設備。這些電機配有防火花或防爆電機,並指定了溫度代碼(T 代碼)。

- 據沙烏地阿拉伯統計總局稱,2022年煤炭開採收入預計將達到創紀錄的44萬美元,2023年將達到55萬美元。防塵引燃馬達的開發是為了消除有害物質並防止粉塵爆炸。 ABB 提供各種防塵點火電機,有助於防止選煤過程中的粉塵爆炸傳播。

- 阿拉伯聯合大公國計劃在2050年成為第一個利用煤炭開發電力並維持淨零碳排放的海灣國家。此外,杜拜正在興建耗資34億美元的哈西安燃煤電廠,今年將把發電量從600兆瓦增加到2,400兆瓦。根據 ACWA 的聲明,作為與沙烏地阿拉伯 Akwa Power 長期協議的一部分,日本 Jera 將供應煤炭並建造該工廠。

- 該地區煤礦工廠的擴張可能會為危險場所馬達啟動器帶來更大的需求。

沙烏地阿拉伯實現顯著的市場成長

- 精製主導危險場所電機啟動器市場。對石油產品的日益依賴引發了一些精製的成長。該地區石油工業的需求量很大。精製通常是大型、龐大的工業,擁有廣泛的管道,在大型化學加工裝置之間輸送流體以供即時蒸餾塔使用。

- 中東國家在全球採購和出口大量原油。該地區對各種應用中使用的工業感測器有很高的需求。例如,根據貝克休斯公司的數據,中東地區的石油和天然氣鑽井平台數量最近達到275個,包括海上和陸上,位居世界第二。

- 此外,常規電動機在涉及石油、天然氣和液體等易燃成分時容易發生爆炸。其影響範圍從輕微的生產中斷到嚴重的傷害和死亡。

- 此外,去年一月,國際技術參與企業霍尼韋爾宣佈在沙烏地阿拉伯王國建造一個新的石油和天然氣展覽設施。該工廠是 Elster Instromet 沙烏地阿拉伯公司和 Gas阿拉伯服務公司合資 (JV) 合作夥伴關係的一部分,擁有用於生產和組裝天然氣和液體燃料解決方案的最先進的基礎設施。這些地區的石油和天然氣投資預計將顯著推動馬達啟動器市場的發展。

- 阿拉伯地區人口的增加可能會進一步推動精製的成長,並為危險場所電機啟動器市場創造巨大的需求。例如,根據 OPEC 的數據,沙烏地阿拉伯的人口約為 3,550 萬人,其中超過 700 萬人居住在利雅德。沙烏地阿拉伯持有世界已探明石油蘊藏量的約17%。該國最近出口了 1,344 份(1,000 桶/天)石油產品。

- 因此,該地區正在迅速使用不同類型的危險場所電機,這些電機旨在確保電機外殼溫度在存在易燃氣體、蒸氣或液體的環境中不超過允許的溫度。

中東和非洲危險場所電機啟動器產業概述

中東和非洲危險場所電機起動器市場適度整合,許多市場參與企業所佔的市場佔有率極小。區域市場的發展和本地參與企業在外國直接投資中所佔佔有率的增加是推動市場區隔的關鍵因素。

- 2022 年 2 月 - ABB 推出 NMK 630L4A 5,000 KW 11,000V ABB 高壓感應馬達 1,492 RPM 50HZ。 ABB 的低壓變速驅動馬達功率高達 2240 kW。模組化滑環馬達是 NMK 的一種,可用於高負載慣性應用。滑環馬達是需要高啟動扭力和低啟動電流的應用的理想解決方案。滑環馬達是需要高啟動扭力和低啟動電流的應用的完美解決方案。特別適合高負載慣性應用,例如磨機驅動器和弱網路條件。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間敵對關係的強度

- 替代品的威脅

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 增加安全措施

- 節能馬達的需求不斷增加

- 市場限制因素

- 監理與合規

- 與非防爆馬達相比,材料和人事費用的安裝成本更高

第6章 市場細分

- 按類型

- 低壓馬達啟動器

- 全電壓馬達啟動器

- 手動馬達啟動器

- 磁電機啟動器

- 其他

- 按班級

- Ⅰ類

- 二級

- 三級

- 按部門分類

- 1級

- 2區

- 按區域

- 0區

- 1區

- 21區

- 2區

- 22區

- 按用途

- 油漆儲存區

- 精製煤廠

- 污水處理廠

- 精製

- 化學品儲存加工設施

- 穀物提昇機

- 石化設施/石油鑽井平台

- 其他

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 卡達

- 其他國家

第7章 競爭格局

- 公司簡介

- Eaton

- Emerson Industrial Automation

- WEG Industries

- Rockwell Automation

- Siemens

- Heatrex

- Schneider Electric

- R. Stahl Inc.

- ABB Group

- GE Industrial Solutions

第8章投資分析

第9章市場的未來

The MEA Hazardous Location Motor Starters Market is expected to register a CAGR of 4.5% during the forecast period.

Hazardous location motors are intended to enhance workplace safety by containing explosions within the motor. Different motors are used to meet the needs of various settings and applications. Class I motors are used for settings affecting gases, vapors, or liquids. Class II motors are intended for areas containing dust, flammable lint, or fibers, such as textiles and sawdust.

Growing demand for instruments for protection against thermal overload drives the market, as instantaneous over-current is usually the result of fault conditions. Bimetallic overload relays and time overcurrent relays are the motor protection relay used in high voltage areas and provide various features, such as short circuit protection, locked rotor protection, and many more.

Regional mergers and acquisitions have led to enormous drilling and exploration activities in hazardous locations, further boosting the region's demand for motors and motor starters. For instance, in December last year, ADNOC Drilling Co., a subsidiary of Abu Dhabi's national oil company ADNOC, signed a deal to acquire two offshore drilling rigs for a combined cost of USD 200 million. The acquisition is part of the company's fleet expansion and growth strategy. This rig purchase adds to the company's earlier deals for nine rigs signed last year and four rigs acquired in 2021. The company wants to operate a total fleet of 122 owned rigs by 2024.

In addition, in May last year, ADNOC announced three oil discoveries, including one at Bu Hasa, Abu Dhabi's most extensive onshore field, with a crude oil production capacity of 650,000 barrels per day (bpd).

According to the US Energy Information Administration 2021, Saudi Arabia holds 15% of the world's proven crude oil reserves. It is the world's largest crude oil exporter. It has about 12 million barrels per day of crude oil production capacity, including capacity from the Neutral Zone, which it shares with Kuwait. After the United States, Saudi Arabia is OPEC's largest crude oil producer and the world's second-largest producer of total petroleum liquids.

The region constantly discovers fresh oil and gas wells while existing and underutilized ones renew. For instance, the government-owned Abu Dhabi National Oil Co. recently announced a significant rig fleet evolution program that desired to add dozens of rigs by 2025. In January last year's report by Arab Petroleum Investments Corporation, energy investments in the Middle East and Africa are anticipated to increase by 9% over the next five years to more than USD 879 billion as energy exporters raise spending amid higher oil revenue.

The COVID-19 pandemic posed several challenges to the market, like supply chain disruptions and increased raw material prices. The market is expected to grow during the forecast period with the growth of many industries across the region, such as oil and gas.

MEA Hazardous Location Motor Starters Market Trends

Coal Preparation Plants Hold Significant Market Share

- Coal mines are rich in methane, and an explosion occurs in the confined cavern when exposed to open fire. Methane explosion is severe, as it often consists of an initial explosion leading to the burning of a coal dust cloud, which produces a more violent dust explosion.

- Growing dependency on coal production is triggering the growth of several coal plants in the region, driving the market. All machinery and electrical equipment inside the enclosed coal storage area or structure are approved for use in hazardous locations to eliminate potential ignition sources and provide appropriate equipment. These are supplied with spark- or explosion-proof motors, which are assigned a temperature code (T code).

- According to the General Authority for Statistics (Saudi Arabia), coal mining revenue was recorded at 0.44 million in 2022 and is projected to amount to USD 0.55 million in 2023. A dust ignition-proof motor is developed to exclude hazardous materials and prevent dust explosions. ABB delivers a wide range of dust ignition-proof motors, which helps prevent any explosion transmission of dust in the coal preparation.

- The United Arab Emirates plans to evolve as the first Gulf country to develop electricity from coal and maintain net-zero carbon emissions by 2050. Further, Dubai is constructing a USD 3.4 billion Hassyan coal plant, which will increase capacity from 600 MW to 2,400 MW by this year. According to ACWA's statement, Jera Co. of Japan will supply coal as part of a long-term agreement with Acwa Power of Saudi Arabia to build the plant.

- Such expansion in coal mining plants in the region may further create significant demand for hazardous location motor starters.

Saudi Arabia to Experience Significant Market Growth

- Oil refineries are dominating the hazardous location motor starters market. Increasing dependency on oil products is triggering the growth of several oil refining plants. The region has witnessed a massive demand from the petroleum industry. The oil refineries are typically large, sprawling industrial complexes with extensive piping running all over, carrying streams of fluids between extensive chemical processing units for instant distillation columns.

- Countries in the Middle East furnish and export a significant amount of crude oil globally. The area commands considerable demand for industrial sensors used for various applications. For instance, according to Baker Hughes, the number of oil and gas rigs in the Middle East recently stood at 275, including offshore and land, the second-highest in the world.

- In addition, regular electric motors are prone to explosions containing flammable elements such as oil and gas fumes or liquids. The implications could vary from modest production interruptions to serious injury and death.

- Further, in January last year, Honeywell, an international technology player, announced the new oil and gas exhibit facility in the Kingdom of Saudi Arabia. The facility was created as part of a joint venture (JV) partnership between Elster Instromet Saudi Arabia and Gas Arabian Services to provide a cutting-edge infrastructure for the manufacturing and assembly of natural gas and liquid fuel solutions. Such regional oil and gas investments will significantly drive the Motor Starter market.

- The increased number of populations across the country may further drive the growth of oil refineries, thereby creating significant demand for hazardous location motor starters in the market. For instance, according to OPEC, Saudi Arabia has a population of around 35.5 million, more than seven million of whom live in Riyadh. Saudi Arabia possesses about 17% of the world's proven petroleum reserves. The country has exported 1,344 (1,000 b/d) of petroleum products recently.

- As a result, the region is rapidly using various types of hazardous site motors, which are engineered such that their motor case temperatures do not exceed permissible temperatures for settings with flammable gases, vapors, or liquids.

MEA Hazardous Location Motor Starters Industry Overview

The Middle East and African hazardous location motor starters market are moderately consolidated, with many market players cornering a minimal market share. The development of regional markets and increasing shares of local players in foreign direct investments are the major factors promoting the fragmented nature of the market.

- February 2022- ABB launched NMK 630L4A 5000 KW 11000V ABB high voltage induction motor 1492 RPM 50HZ. ABB's engineered motors for low-voltage variable speed drive range of up to 2240 kW. Modular slip-ring motors, a type of NMK available for heavy load inertia applications slip-ring motors, are an ideal solution for applications that require high starting torque and low starting current. They are especially suitable for rich load inertia applications like mill drives or weak network conditions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness: Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyer

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Safety Measures

- 5.1.2 Increasing Demand for Energy Efficient Motors

- 5.2 Market Restraints

- 5.2.1 Regulations and Compliance

- 5.2.2 High Installation Cost for Material and Labor Compared to Non-explosion Proof Motors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Low Voltage Motor Starter

- 6.1.2 Full Voltage Motor Starter

- 6.1.3 Manual Motor Starter

- 6.1.4 Magnetic Motor Starter

- 6.1.5 Other Types

- 6.2 By Class

- 6.2.1 Class I

- 6.2.2 Class II

- 6.2.3 Class III

- 6.3 By Division

- 6.3.1 Division 1

- 6.3.2 Division 2

- 6.4 By Zone

- 6.4.1 Zone 0

- 6.4.2 Zone 1

- 6.4.3 Zone 21

- 6.4.4 Zone 2

- 6.4.5 Zone 22

- 6.5 By Applications

- 6.5.1 Paint Storage Areas

- 6.5.2 Coal Preparation Plants

- 6.5.3 Sewage Treatment Plants

- 6.5.4 Oil Refineries

- 6.5.5 Chemical Storage and Handling Facilities

- 6.5.6 Grain Elevators

- 6.5.7 Petrochemical Facilities/Oil Rigs

- 6.5.8 Other Applications

- 6.6 By Country

- 6.6.1 United Arab Emirates

- 6.6.2 Saudi Arabia

- 6.6.3 South Africa

- 6.6.4 Qatar

- 6.6.5 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Eaton

- 7.1.2 Emerson Industrial Automation

- 7.1.3 WEG Industries

- 7.1.4 Rockwell Automation

- 7.1.5 Siemens

- 7.1.6 Heatrex

- 7.1.7 Schneider Electric

- 7.1.8 R. Stahl Inc.

- 7.1.9 ABB Group

- 7.1.10 GE Industrial Solutions