|

市場調查報告書

商品編碼

1698532

GaN LED 晶片市場機會、成長動力、產業趨勢分析及 2025-2034 年預測GaN LED Chips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

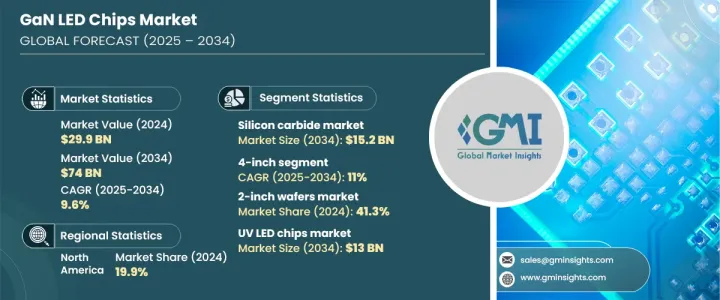

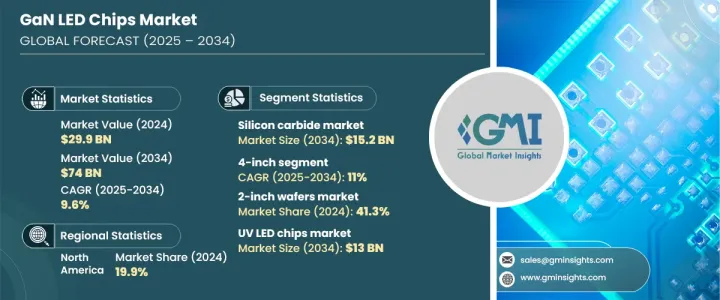

2024 年全球 GaN LED 晶片市值為 299 億美元,預計 2025 年至 2034 年的複合年成長率為 9.6%。消費性電子、汽車和航太等各領域對微型 LED 顯示器的需求不斷成長,推動了市場成長。 GaN LED 晶片具有卓越的亮度、能源效率和耐用性,使其成為微型 LED 技術不可或缺的一部分。預計到 2027 年全球微型 LED 顯示器市場規模將達到 718 億美元,凸顯了對 GaN 基 LED 的依賴日益增加。這些晶片因其高解析度、低功耗和增強的色彩性能而被廣泛應用於智慧手錶、高階電視、AR/VR設備和商業顯示器。它們的熱穩定性和高光輸出使其成為微型 LED 製造的首選材料,從而推動了持續的需求。此外,體育場、機場和零售場所的大面積顯示器正在整合微型 LED 技術,進一步推動 GaN LED 晶片市場的發展。

製造商優先考慮用於電子產品和大型顯示器的高性能微型 LED 解決方案。增強的亮度、色彩精度和能源效率是推動智慧型手機、電視和其他顯示應用程式採用的關鍵因素。市場按晶圓尺寸細分為2吋、4吋、6吋和8吋。 2024年,2吋晶圓市場佔有41.3%的佔有率,受惠於成熟、經濟高效的生產流程。預計到 2034 年,在高亮度應用的推動下,4 吋市場的複合年成長率將達到 11.1%。預計到 2034 年,6 吋晶圓市場規模將達到 123 億美元,而 8 吋晶圓市場將佔據 2024 年 8.9% 的市場佔有率,因其在高需求應用中的效率而獲得關注。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 299億美元 |

| 預測值 | 740億美元 |

| 複合年成長率 | 9.6% |

根據基板類型,市場分為碳化矽 (SiC)、藍寶石、矽 (Si)、氮化鎵 (GaN) 等。藍寶石憑藉其高溫穩定性、透明度和耐化學性,在 2024 年佔據 61.4% 的佔有率,成為高品質 LED 生產的理想選擇。預計到 2034 年,SiC 的市值將達到 152 億美元,因其優異的導熱性而受到青睞。矽基 LED 的複合年成長率為 8.5%,而受微型 LED 和 UV LED 需求推動的 GaN 基板的年成長率預計將超過 13%。

產品細分包括藍色、綠色和紫外線 LED 晶片。受背光和通用照明應用的推動,藍色 LED 晶片將在 2024 年佔據 40.3% 的市場佔有率。由於綠色 LED 晶片在 AR/VR 和高解析度顯示器中的應用,其複合年成長率預計將達到 10.7%。預計到2034年,紫外線LED晶片市場規模將達130億美元,在殺菌和醫療消毒領域的應用將日益增加。

按技術分類的市場包括標準、薄膜、垂直和覆晶 GaN LED。由於發光效率的提高,標準 GaN LED 將在 2024 年佔據 32.8% 的市場佔有率。預計到 2034 年薄膜 GaN LED 的市場規模將達到 226 億美元,在高性能照明領域越來越受歡迎。受微型 LED 顯示器進步的推動,垂直 GaN LED 的複合年成長率為 13.4%。預計到 2034 年,覆晶 GaN LED 的市場規模將達到 167 億美元,受益於熱阻的提高和亮度的提高。

最終用途產業包括汽車、消費性電子、國防、工業和資訊通訊技術。由於 GaN LED 為新一代顯示器提供卓越的亮度和效率,預計到 2034 年消費性電子產品的複合年成長率將達到 11.4%。汽車產業在 2024 年佔據 30.3% 的市場佔有率,並且擴大採用基於 GaN 的照明解決方案。國防部門佔18.7%,受益於GaN LED在極端條件下的可靠性。在倉庫和工廠節能照明的推動下,工業應用預計到 2034 年將達到 83 億美元。受資料中心和網路基礎設施照明需求不斷成長的推動,ICT 的複合年成長率預計將達到 6.9%。

從應用角度來看,在向節能解決方案轉型的支持下,通用照明將在 2024 年佔據 34% 的市場佔有率。受電視和顯示器中 mini-LED 的採用推動,背光市場正以 8.6% 的複合年成長率擴張。隨著電動車擴大整合基於 GaN 的解決方案以提高能源效率,汽車照明佔據了 16.6% 的佔有率。預計到 2034 年,顯示和標牌應用將達到 106 億美元,而包括醫療和園藝用途在內的特種照明預計將以 11.4% 的複合年成長率成長。

從地區來看,北美在 2024 年佔據 19.9% 的市場佔有率,對智慧照明和消費性電子產品的需求強勁。受汽車和國防應用領域採用率提高的推動,美國市場規模預計到 2034 年將達到 107 億美元。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 汽車和智慧型設備領域的新興應用

- 電動車(EV)市場的擴張

- 轉向永續和綠色技術

- GaN LED 在消費性電子產品的應用日益廣泛

- 微型LED顯示器市場不斷成長

- 產業陷阱與挑戰

- 製造成本高、生產流程複雜

- 與現有顯示基礎設施整合的挑戰

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 藍色LED晶片

- 綠色LED晶片

- 紫外線 LED 晶片

- 其他

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 標準GaN LED

- 薄膜GaN LED

- 垂直GaN LED

- 覆晶GaN LED

- 其他

第7章:市場預估與預測:依晶圓尺寸,2021 – 2034

- 主要趨勢

- 2英吋

- 4吋

- 6吋

- 8吋

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 汽車

- 消費性電子產品

- 國防與航太

- 工業和電力

- 資訊與通訊技術

- 其他

第9章:市場估計與預測:依基材類型,2021 年至 2034 年

- 主要趨勢

- 藍寶石

- 碳化矽(SiC)

- 矽(Si)

- 氮化鎵(GaN)

- 其他

第 10 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 普通照明

- 住宅照明

- 商業照明

- 工業照明

- 戶外照明

- 背光

- 電視背光

- 智慧型手機和平板電腦顯示幕

- 筆記型電腦和顯示器顯示器

- 汽車照明

- 頭燈

- 尾燈

- 室內照明

- 日間行車燈(DRL)

- 指示燈

- 展示和標牌

- 數位廣告看板

- 室內數位看板

- 戶外顯示器

- 交通號誌

- 特種照明

- 園藝照明

- 紫外線(UV)固化

- 醫療器材及設備

- 舞台和演播室燈光

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Aixtron

- Aledia

- Allegro Microsystems

- Bridgelux

- Cree

- Efficient Power Conversion

- Epileds Technologies

- Epistar

- Fujitsu

- Ganpower International

- Infineon Technologies

- Lumileds Holding

- Navitas Semiconductor

- Qorvo

- SemiLEDs

- Sumitomo Electric Industries

- Veeco Instruments

The Global GaN LED Chips Market was valued at USD 29.9 billion in 2024 and is projected to expand at a CAGR of 9.6% from 2025 to 2034. Rising demand for micro-LED displays across various sectors, including consumer electronics, automotive, and aerospace, is fueling market growth. GaN LED chips offer superior brightness, energy efficiency, and durability, making them indispensable for micro-LED technology. The global micro-LED display market is expected to reach USD 71.8 billion by 2027, underscoring the increasing reliance on GaN-based LEDs. These chips are widely used in smartwatches, premium TVs, AR/VR devices, and commercial displays due to their high resolution, low power consumption, and enhanced color performance. Their thermal stability and high light output make them the preferred material for micro-LED fabrication, driving consistent demand. Additionally, large-area displays in stadiums, airports, and retail settings are integrating micro-LED technology, further propelling the GaN LED chips market.

Manufacturers are prioritizing high-performance micro-LED solutions for electronics and large-scale displays. Enhanced brightness, color accuracy, and energy efficiency are key factors driving adoption in smartphones, TVs, and other display applications. The market is segmented by wafer size into 2-inch, 4-inch, 6-inch, and 8-inch. In 2024, the 2-inch wafer segment held a 41.3% market share, benefiting from an established, cost-effective production process. The 4-inch segment is forecast to grow at an 11.1% CAGR by 2034, driven by high-brightness applications. The 6-inch wafer market is expected to reach USD 12.3 billion by 2034, while the 8-inch segment, accounting for 8.9% market share in 2024, is gaining traction due to its efficiency in high-demand applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.9 Billion |

| Forecast Value | $74 Billion |

| CAGR | 9.6% |

By substrate type, the market is categorized into silicon carbide (SiC), sapphire, silicon (Si), gallium nitride (GaN), and others. Sapphire dominated with a 61.4% share in 2024 due to its high-temperature stability, transparency, and chemical resistance, making it ideal for high-quality LED production. SiC is projected to reach USD 15.2 billion by 2034, favored for its superior thermal conductivity. Silicon-based LEDs are expanding at an 8.5% CAGR, while GaN substrates, driven by demand for micro-LEDs and UV LEDs, are set to grow at over 13% annually.

The product segmentation includes blue, green, and UV LED chips. Blue LED chips captured 40.3% of the market in 2024, driven by applications in backlighting and general lighting. Green LED chips are set to grow at a 10.7% CAGR due to their use in AR/VR and high-resolution displays. UV LED chips are projected to reach USD 13 billion by 2034, with increasing applications in sterilization and medical disinfection.

Market segmentation by technology includes standard, thin-film, vertical, and flip-chip GaN LEDs. Standard GaN LEDs led with a 32.8% market share in 2024, supported by advancements in luminous efficacy. Thin-film GaN LEDs are projected to reach USD 22.6 billion by 2034, gaining popularity in high-performance lighting. Vertical GaN LEDs are growing at a 13.4% CAGR, driven by micro-LED display advancements. Flip-chip GaN LEDs are expected to hit USD 16.7 billion by 2034, benefiting from improved thermal resistance and higher brightness.

End-use industries include automotive, consumer electronics, defense, industrial, and ICT. Consumer electronics are projected to expand at an 11.4% CAGR by 2034, as GaN LEDs offer superior brightness and efficiency for next-generation displays. The automotive sector held a 30.3% market share in 2024, with increasing adoption of GaN-based lighting solutions. The defense sector accounted for 18.7%, benefiting from GaN LEDs' reliability in extreme conditions. Industrial applications are expected to reach USD 8.3 billion by 2034, driven by energy-efficient lighting in warehouses and factories. ICT is set to grow at a 6.9% CAGR, fueled by rising demand for data centers and network infrastructure lighting.

Application-wise, general lighting dominated with a 34% market share in 2024, supported by the transition to energy-efficient solutions. Backlighting is expanding at an 8.6% CAGR, driven by mini-LED adoption in TVs and monitors. Automotive lighting held a 16.6% share as electric vehicles increasingly integrate GaN-based solutions for energy efficiency. Display and signage applications are expected to reach USD 10.6 billion by 2034, while specialty lighting, including medical and horticultural uses, is projected to grow at an 11.4% CAGR.

Regionally, North America accounted for a 19.9% market share in 2024, with strong demand in smart lighting and consumer electronics. The U.S. market is expected to reach USD 10.7 billion by 2034, driven by increased adoption in automotive and defense applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising applications in automotive and smart devices

- 3.2.1.2 Expansion of electric vehicle (EV) market

- 3.2.1.3 Shift towards sustainable and green technologies

- 3.2.1.4 Increasing use of GaN LEDs in consumer electronics

- 3.2.1.5 Growing market for micro-LED displays

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs and complex production process

- 3.2.2.2 Challenges in integration with existing display infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Bn & Units)

- 5.1 Key trends

- 5.2 Blue LED chips

- 5.3 Green LED chips

- 5.4 UV LED chips

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 (USD Bn & Units)

- 6.1 Key trends

- 6.2 Standard GaN LEDs

- 6.3 Thin-Film GaN LEDs

- 6.4 Vertical GaN LEDs

- 6.5 Flip-Chip GaN LEDs

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Wafer Size, 2021 – 2034 (USD Bn & Units)

- 7.1 Key trends

- 7.2 2-inch

- 7.3 4-inch

- 7.4 6-inch

- 7.5 8-inch

Chapter 8 Market Estimates and Forecast, By End-Use, 2021 – 2034 (USD Bn & Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Defense & aerospace

- 8.5 Industrial & power

- 8.6 Information & communication technology

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Substrate Type, 2021 – 2034 (USD Bn & Units)

- 9.1 Key trends

- 9.2 Sapphire

- 9.3 Silicon Carbide (SiC)

- 9.4 Silicon (Si)

- 9.5 Gallium Nitride (GaN)

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn & Units)

- 10.1 Key trends

- 10.2 General lighting

- 10.2.1 Residential lighting

- 10.2.2 Commercial lighting

- 10.2.3 Industrial lighting

- 10.2.4 Outdoor lighting

- 10.3 Backlighting

- 10.3.1 Tv backlighting

- 10.3.2 Smartphone and tablet displays

- 10.3.3 Laptop and monitor displays

- 10.4 Automotive lighting

- 10.4.1 Headlights

- 10.4.2 Taillights

- 10.4.3 Interior lighting

- 10.4.4 Daytime running lights (drls)

- 10.4.5 Indicator lights

- 10.5 Display & signage

- 10.5.1 Digital billboards

- 10.5.2 Indoor digital signage

- 10.5.3 Outdoor displays

- 10.5.4 Traffic signals

- 10.6 Specialty lighting

- 10.6.1 Horticultural lighting

- 10.6.2 Ultraviolet (uv) curing

- 10.6.3 Medical devices and equipment

- 10.6.4 Stage and studio lighting

- 10.7 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Aixtron

- 12.2 Aledia

- 12.3 Allegro Microsystems

- 12.4 Bridgelux

- 12.5 Cree

- 12.6 Efficient Power Conversion

- 12.7 Epileds Technologies

- 12.8 Epistar

- 12.9 Fujitsu

- 12.10 Ganpower International

- 12.11 Infineon Technologies

- 12.12 Lumileds Holding

- 12.13 Navitas Semiconductor

- 12.14 Qorvo

- 12.15 SemiLEDs

- 12.16 Sumitomo Electric Industries

- 12.17 Veeco Instruments