|

市場調查報告書

商品編碼

1644776

小訊號二極體:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Small Signal Diode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

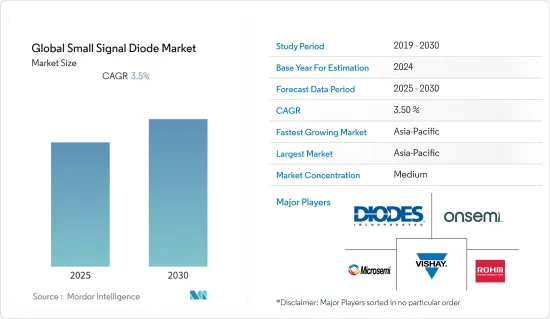

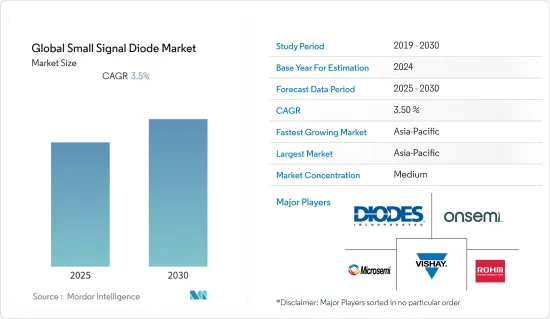

預計預測期內全球小訊號二極體市場的複合年成長率將達到 3.5%。

主要亮點

- 小訊號二極體具有快速的開關速度和快速的恢復時間。許多電子系統使用小訊號二極體。小訊號二極體傳輸幅度為幾伏特、毫伏特甚至微伏特的交流(連續變化)訊號或脈衝。家庭、工業設備、汽車、航空和音樂系統中都存在無線電、音訊、視訊和數位訊號。

- 此外,小訊號二極體還有線端和表面黏著技術(SMT) 類型。小訊號二極體與整流二極體的不同之處在於,它們的結面積較小,這使它們具有無結電容,並且使其在高頻下更有用。高速小訊號二極體通常被稱為開關二極體。它們比專用電源整流器更小,並且最大反向電壓規格更低。

- 與其他功能相比,小訊號二極體通常具有較低的電流承載能力和功率損耗。小訊號二極體可以由矽或鍺型半導體材料製造,但二極體的特性會根據所使用的摻雜材料而變化。

- 隨著病毒在全球蔓延,全球供應鏈陷入混亂,隔離期仍不清楚。世界各地許多製造工廠已經關閉。例如,安森美半導體公司在馬來西亞、中國、馬來西亞和菲律賓等國的大部分製造工廠均根據政府命令關閉,影響了供給能力,並造成了供需缺口。

- 設計小訊號二極體的複雜性可能會阻礙市場的成長。預計製造成本和功能可靠性問題等因素將在未來幾年阻礙小訊號二極體市場的成長。

小訊號二極體市場趨勢

鍺訊號二極體有望佔據較大的市場佔有率

- 鍺二極體在電路中用於僅在一個方向上傳導導電訊號。鍺二極體比矽二極體有幾個優點。與矽二極體相比,鍺二極體在電流通過時損失的能量較少。這使其成為中等電流訊號的理想選擇,因為高能量損失可能導致訊號被切斷。

- 在低訊號環境(偵測從音頻到 FM 頻率的訊號)和低階邏輯電路中,鍺的低壓降非常重要。因此鍺二極體在低階數位電路的應用越來越多。隨著人們對鍺二極體的興趣日益濃厚,了解這種材料的基本特性變得至關重要。

- 儘管鍺二極體能夠破壞電路,但是它的一個很大的優點就是其閾值電壓低,因此電壓降也低。閾值電壓是二極體必須允許電流從陽極流到陰極的電壓。這被稱為正向電流。除非達到閾值電壓,否則二極體就無法通過電流。

- 現代鍺二極體是點接觸二極體,其線觸點是在鍺晶片上製作的。額定電流往往以毫安培為單位,大則反向電壓低,小則反向電壓高。由於這個限制,它們被用作檢測目的的小訊號二極體。

亞太地區可望佔據主要市場佔有率

- 亞太地區由於其蓬勃發展的半導體製造業務而佔據了主要的市場佔有率。在該地區營運的半導體製造商正在提高生產能力,以滿足無晶圓廠供應商日益成長的需求。

- 泰國政府於 2016 年推出了電動車行動計劃,以鼓勵生產純電動車和插電式混合動力車,目標是到 2036 年道路上擁有 120 萬輛純電動車和插電式混合動力車。結果,13家公司享受了電動車稅收優惠政策。泰國於 2020 年 3 月發布了其電動車藍圖,宣布計劃在 2025 年生產 25 萬輛電動車並建立東協電動車中心。

- 5G 網路的快速推出,加上設備中物聯網 (IoT) 應用的不斷增多,例如駕駛輔助和智慧交通的車對車 (V2X)通訊,預計將增加對小訊號二極體的需求。

- 此外,2022 年 6 月,東芝電子擴大了與 Farnell 的合作,Farnell 是一家全球電氣元件分銷商,在亞太地區以 element14 的名義進行交易。此次合作將使 Farnell 能夠更好地儲備更多東芝產品並更好地支持東芝的客戶供應鏈。 Farnell 的產品組合將包括更多東芝設備,到 2023 年總合1,000 種。東芝的小訊號二極體和電晶體很受關注。

- 日本政府的目標是到 2050 年,日本銷售的所有新車都是電動或混合動力汽車。日本政府的目標是到2050年,國內銷售的所有新車均為電動或混合動力汽車汽車,併計劃向私營企業提供補貼,以加速電動車電池和馬達的開發。在日本,政府為電動車購買者提供補貼,導致電動車充電站數量增加,從而支持了越來越多的電動車。預計這將推動汽車產業對小訊號二極體的需求。

小訊號二極體產業概況

全球小訊號二極體市場競爭適中,有許多地區和全球參與者。主要參與者包括 Vishay Intertechnology, Inc、On Semiconductor Corporation、Diodes Incorporated、Microsemi Corporation 和 ROHM。

- 2022 年 2 月 - 智慧電源和感測器解決方案供應商安森美半導體 (ON Semiconductor) 正在採用晶圓廠升級 (fab-liter) 製造方法,透過提高毛利率來實現長期財務成功。

- 2021 年 10 月 - Vishay Intertechnology, Inc. 宣布推出採用超小型 DFN1006-2A 塑膠封裝且具有可潤濕側面的新型表面黏著技術超小訊號二極體。 40 V BAS40L 蕭特基二極體和 100 V BAS16L 開關二極體符合 AEC-Q101核准,旨在在汽車和工業應用中節省空間並提高熱性能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 汽車技術中小訊號二極體的採用日益增多

- 小訊號二極體在家用電子電器應用的使用日益增多

- 市場挑戰

- 製造過程的複雜性

第6章 市場細分

- 依產品類型

- 鍺訊號二極體

- 矽訊號二極體

- 其他

- 按最終用戶產業

- 車

- 家電

- 產業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Diodes Incorporated

- On Semiconductor Corporation

- Microsemi Corporation

- Vishay Intertechnology, Inc

- ROHM Co., Ltd.

- Taiwan Semiconductor

- TT Electronics Plc

- STMicroelectronics

- Infineon Technologies AG

- Diotec Semiconductor AG

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 91068

The Global Small Signal Diode Market is expected to register a CAGR of 3.5% during the forecast period.

Key Highlights

- The small-signal diode has a high switching speed with a fast recovery time. Many electronic systems use small signal diodes, which are AC (continuously changing) signals or pulses with amplitudes of a few volts, millivolts, or even microvolts. Radio, audio, video, and digital signals are employed in the household, industrial equipment, automobile, aeronautic, and musical systems.

- Further, small signal diodes are available in wire-ended and surface mount (SMT) configurations. They differ from rectifier diodes and have smaller junction areas, resulting in junction-less capacitance, making them more useful at higher frequencies. Small signal diodes with high speeds are often known as switching diodes. They are smaller and have lower maximum reverse voltage specifications than dedicated power rectifiers.

- Signal diodes often have a low current carrying capacity and power dissipation compared to their other capabilities. The Small Signal Diode can be manufactured using Silicon or Germanium type semiconductor material, although the diode's characteristics vary based on the doping material used.

- The global supply chains are disrupted as the virus spreads worldwide, and there is still uncertainty over quarantine durations. Many manufacturing factories were shut down across the world. For instance, most of the company's manufacturing facilities, On semi, were shut down due to government mandates in countries like Malaysia, China, Malaysia, and the Philippines, which impacted its ability to supply products to its clients and created a gap in demand and supply.

- The complexity associated with the design of small signal diodes can hinder the market's growth. Factors such as the manufacturing cost and functional reliability issues are expected to hinder the market's growth for the small signal diode in the coming years.

Small Signal Diode Market Trends

Germanium Signal Diodes Expected to Witness Significant Market Share

- Germanium diodes are used in electrical circuits and conduct electrical signals in only one direction. A germanium diode has some advantages over a silicone diode. Compared to a silicone diode, a germanium diode loses less energy as the current travels through. This makes it an ideal alternative for signals created by modest currents where a considerable energy loss could cause the signal to be disrupted.

- In low signal environments (signal detection from audio to FM frequencies) and low-level logic circuits, germanium's smaller voltage drop becomes crucial. As a result, low-level digital circuits are increasingly using germanium diodes. With the rising interest in germanium diodes, it became essential to understand the basic features of the material.

- One significant benefit of germanium diodes, which could be a disruptive force for a circuit, is that they have lower threshold voltages and, as a result, fewer voltage drops. The threshold voltage is the voltage at which the diode must conduct current from anode to cathode. This is referred to as forwarding current. The diode cannot conduct current unless the threshold voltage is met.

- Modern germanium diodes are point contact diodes with a wire contact made of a germanium wafer. The current rating is often in the milliamp range, with a low inverse and high reverse voltage. They are used as small-signal diodes for detection because of this limitation.

Asia-Pacific Expected to Witness Significant Market Share

- Asia-Pacific holds a prominent market share due to a significant number of regional semiconductor manufacturing operations. The pure-play manufacturers operating in the region are increasing their production capacity to cater to the growing demand from fabless vendors.

- The Thai government launched an EV action plan in 2016 to encourage the production of BEVs and PHEVs to have 1.2 million such vehicles on the road by 2036. As a result, 13 companies have benefited from preferential tax treatment for electric vehicles. Thailand announced an EV roadmap in March 2020 to produce 250,000 EVs by 2025 and establish an ASEAN EV hub, which will drive market growth.

- The rapid deployment of 5G networks, coupled with the increasing Internet of Things (IoT) applications for devices, such as assisted driving and vehicle-to-everything (V2X) communication for smart transport, is expected to increase the demand for small signal diodes.

- Further, in June 2022, Toshiba Electronics extended its collaboration with Farnell, a global distributor of electrical components traded as element14 in the Asia Pacific. Farnell will stock more Toshiba products in larger numbers due to this partnership, enhancing support of Toshiba's client supply chain. Farnell's portfolio contains more of Toshiba's devices, totaling 1,000 by 2023. Toshiba's compact signal diodes and transistors will be highlighted.

- The Japanese government aims to ensure that all new cars sold in Japan be electric or hybrid vehicles by 2050. The country plans to subsidize the private sector to accelerate the development of batteries and motors for electricity-powered vehicles. Japan witnessed an increase in EV charging stations to support the rising number of EVs because of the introduction of government subsidies for EV buyers. This is expected to drive the small signal diode demand in the automotive industry.

Small Signal Diode Industry Overview

The Global Small Signal Diode Market is moderately competitive, with many regional and global players. Key players include Vishay Intertechnology, Inc, On Semiconductor Corporation, Diodes Incorporated, Microsemi Corporation, and ROHM CO., LTD.

- February 2022 - Onsemi, a provider of intelligent power and sensor solutions, adopted a fab-liter manufacturing approach to achieve long-term financial success by increasing gross margins.

- October 2021 - Vishay Intertechnology, Inc. announced the availability of new surface-mount tiny signal diodes in the ultra-compact DFN1006-2A plastic package with wettable flanks. The 40 V BAS40L Schottky and 100 V BAS16L switching diodes are AEC-Q101 approved and designed to conserve space and improve thermal performance in automotive and industrial applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Small Signal Diodes in Vehicle Technologies

- 5.1.2 Rising Usage of Small Signal Diodes in Consumer Electronics Applications

- 5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Germanium Signal Diodes

- 6.1.2 Silicon Signal Diodes

- 6.1.3 Other

- 6.2 By End-User Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Industrial

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Diodes Incorporated

- 7.1.2 On Semiconductor Corporation

- 7.1.3 Microsemi Corporation

- 7.1.4 Vishay Intertechnology, Inc

- 7.1.5 ROHM Co., Ltd.

- 7.1.6 Taiwan Semiconductor

- 7.1.7 TT Electronics Plc

- 7.1.8 STMicroelectronics

- 7.1.9 Infineon Technologies AG

- 7.1.10 Diotec Semiconductor AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219