|

市場調查報告書

商品編碼

1698584

蜂蠟市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Beeswax Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

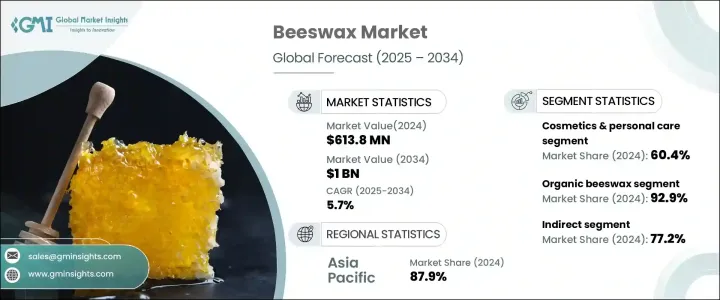

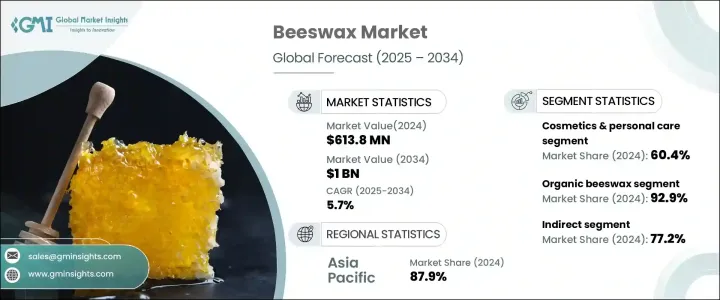

2024 年全球蜂蠟市場價值為 6.138 億美元,預計 2025 年至 2034 年的複合年成長率為 5.7%。推動市場成長的主要因素是對天然和永續產品的需求不斷成長,尤其是在美容、醫療保健和食品領域。隨著消費者越來越意識到其對環境的影響,他們擴大轉向有機和無化學替代品,尤其是在美容和個人護理產品方面。蜂蠟因其保濕和保護特性在個人護理中發揮著至關重要的作用,使其成為潤唇膏、乳液和乳霜等產品中的關鍵成分。此外,它的抗菌和抗炎特性使其成為醫用藥膏和傷口護理產品中備受追捧的成分。

市場主要分為兩種:有機蜂蠟和傳統蜂蠟。有機蜂蠟處於領先地位,到 2024 年將佔據近 93% 的市場佔有率,這得益於其在化妝品和個人護理產品中的廣泛應用。由於其保濕和保護皮膚的特性,它被認為是護膚產品配方中必不可少的成分,而且由於消費者對天然、無農藥產品的偏好日益增加,它的受歡迎程度也越來越高。隨著越來越多的人不再使用塑膠替代品,蜂蠟在蜂蠟包裝等環保食品包裝中的作用日益增強,也促進了其需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.138億美元 |

| 預測值 | 10億美元 |

| 複合年成長率 | 5.7% |

在市場應用方面,美容和個人護理領域佔有最大佔有率,佔2024年整個市場的60%以上。蜂蠟因其保持水分和提供皮膚保護的能力而被廣泛用於潤唇膏和保濕霜等產品中。然而,由於價格波動和素食替代品的競爭,市場面臨挑戰。儘管存在這些障礙,對天然配方的需求仍在持續成長,特別是隨著消費者的環保意識增強並傾向於有機成分。

在分銷方面,間接通路佔據最大的市場佔有率,佔總佔有率的77%以上。其中包括批發商和分銷商,他們在推動化妝品、食品包裝和蠟燭等各個領域的產品供應方面發揮著重要作用。亞太地區對蜂蠟的需求尤其高,佔全球收入的近 88%。這種激增歸因於可支配收入增加、城市化進程加快以及對永續產品的偏好日益成長等因素。此外,受提倡使用天然成分和永續實踐的政策推動,北美也出現了類似的趨勢。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

- 初步研究和驗證

- 主要來源

- 資料探勘來源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對天然和永續產品的需求不斷增加

- 化妝品和個人護理行業

- 健康和醫療應用

- 產業陷阱與挑戰

- 環境問題和蜜蜂數量下降

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 有機蜂蠟

- 常規蜂蠟

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 化妝品和個人護理

- 製藥

- 食品和飲料

- 工業和製造業

- 其他

第7章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Bacofoil

- Charlotte Tilbury Source

- Koster Keunen LLC

- Strahl and Pitsch

- Hilltop

- British Wax Refining Company

- New Zealand Beeswax Ltd.

- Gustav Heess GmbH

The Global Beeswax Market was valued at USD 613.8 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. The primary factor driving the market's growth is the increasing demand for natural and sustainable products, particularly in the beauty, healthcare, and food sectors. With consumers becoming more conscious of their environmental impact, there's a growing shift toward organic and chemical-free alternatives, especially in beauty and personal care products. Beeswax plays a vital role in personal care due to its moisturizing and protective properties, making it a key ingredient in items like lip balms, lotions, and creams. Furthermore, its antibacterial and anti-inflammatory benefits have made it a sought-after element in medical ointments and wound care products.

The market is categorized into two main types: organic beeswax and conventional beeswax. Organic beeswax is leading, making up nearly 93% of the market share in 2024, driven by its widespread use in cosmetics and personal care products. It's considered essential in the formulation of skincare products due to its moisturizing and skin-protecting properties, and its popularity is fueled by a rising consumer preference for natural, pesticide-free products. Beeswax's increasing role in eco-friendly food packaging, like beeswax wraps, has also contributed to its demand, as more people move away from plastic alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $613.8 Million |

| Forecast Value | $1 Billion |

| CAGR | 5.7% |

In terms of market applications, the beauty and personal care sector holds the largest share, accounting for over 60% of the total market in 2024. Beeswax is widely used in products such as lip balms and moisturizers because of its ability to retain moisture and provide skin protection. However, the market faces challenges due to price fluctuations and the competition from vegan substitutes. Despite these hurdles, the demand for natural formulations continues to grow, especially as consumers become more eco-conscious and inclined toward organic ingredients.

In terms of distribution, indirect channels account for the largest portion of the market, making up over 77% of the total share. These include wholesalers and distributors who play a significant role in driving product availability in various sectors, including cosmetics, food packaging, and candles. The demand for beeswax is especially high in the Asia Pacific region, which represents nearly 88% of the global revenue. This surge is attributed to factors like rising disposable income, increased urbanization, and a growing preference for sustainable products. Additionally, North America is seeing similar trends, driven by policies that promote the use of natural ingredients and sustainable practices.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for natural and sustainable products

- 3.6.1.2 Cosmetics and personal care industry

- 3.6.1.3 Health and medicinal applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental concerns and bee population decline

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Organic beeswax

- 5.3 Conventional beeswax

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cosmetics and personal care

- 6.3 Pharmaceuticals

- 6.4 Food and beverages

- 6.5 Industrial and manufacturing

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bacofoil

- 9.2 Charlotte Tilbury Source

- 9.3 Koster Keunen LLC

- 9.4 Strahl and Pitsch

- 9.5 Hilltop

- 9.6 British Wax Refining Company

- 9.7 New Zealand Beeswax Ltd.

- 9.8 Gustav Heess GmbH