|

市場調查報告書

商品編碼

1630226

微晶蠟:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Microcrystalline Wax - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

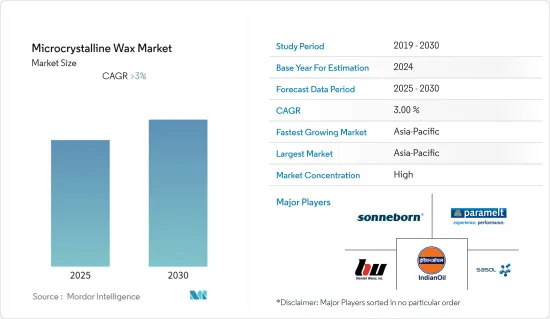

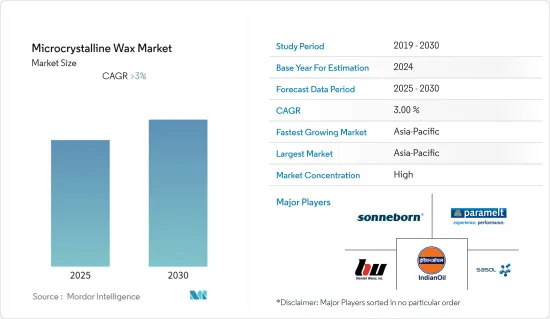

預計微晶蠟市場在預測期內複合年成長率將超過3%。

2020 年,由於產量低和供應鏈限制,COVID-19 對市場產生了影響。聚合物添加劑、黏合劑、油漆和被覆劑使用微晶蠟進行潤滑。封鎖導致施工停止,並減少了黏合劑和其他建築產品中微晶蠟的消耗。食品公司和電子商務公司需要更多用於紙包裝的微晶蠟。肥皂和其他個人保健產品使用微晶蠟作為消泡劑。由於衛生意識的提高,肥皂和其他個人保健產品的需求量很大,這可能會推動未來幾年對微晶蠟的需求。 2021年,由於建築、食品和電子商務領域的需求增加,市場將會復甦。

主要亮點

- 短期內,亞太地區個人護理行業的成長預計將推動市場成長。

- 同時,COVID-19對該產業的影響仍拖累市場。

- 冰球和滑雪板運動在北美地區的日益普及可能會在未來幾年創造市場機會。

- 在預測期內,化妝品和個人護理領域預計將佔據市場的最大佔有率。

- 預計未來五年亞太地區將擁有最大的市場佔有率和最高的複合年成長率。

微晶蠟市場趨勢

化妝品和個人護理行業的需求增加

- 化妝品和個人護理是微晶蠟的兩個主要用途。微晶蠟在化妝品和個人保健產品中用作黏度劑、黏合劑和潤膚劑,以增稠配方。

- 新美容產品的增加和對外表的興趣導致美容產品和化妝品市場顯著成長。根據歐萊雅預測,2021年全球化妝品市場規模將超過2,400億美元。新冠疫情嚴重影響了產業,2020年全球化妝品市場較2019年下降8%以上。但到了2021年,上升至8.2%,市場開始復甦。

- 亞太地區已成為微晶蠟最大的消費國和生產國。產量已達到較高水平,使該地區成為向美國等已開發國家出口化妝品和個人保健產品的重要基地。

- 化妝品市場的成長可能會導致韓國和印尼對個人保健產品的需求增加。

- 在歐洲市場,化妝品的需求正在穩定成長。特別是在歐洲,對高品質天然化妝品的需求強勁,使其成為世界上最大的化妝品市場之一。根據Cosmetics Europe統計,2021年歐洲化妝品及個人保健產品市場規模將超過850億美元,其中德國佔近17%的市場佔有率。

- 義大利的化妝品生意興旺是有原因的。義大利化妝品以其高品質的成分和優雅的外觀而受到世界各地的喜愛。根據Cosmetics Europe統計,2021年義大利化妝品及個人保健產品市場規模突破100億美元,佔歐洲市佔率超過13%。

- 因此,上述因素可能會對未來幾年的市場產生重大影響。

亞太地區主導市場

- 亞太地區主導全球微晶蠟市場,佔超過 45% 的佔有率。中國、印度、日本和韓國等國家不斷發展的包裝和個人化產業正在增加該地區微晶蠟的消費量。

- 在中國、印度和東南亞國家,人均收入的增加伴隨著支出的增加,這有望為該行業開闢新的途徑。為了改善整裝儀容,美容和化妝品的需求量很大。預計到2021年,亞太化妝品市場將佔全球化妝品市場的35%以上。

- 根據國家統計局預測,2021年中國將成為全球第二大化妝品零售市場,佔全球市佔率超過17%。

- 中國是世界第二大包裝製造國。由於食品業客製化包裝的興起以及對微波食品、零嘴零食和冷凍食品等包裝消費品的需求不斷增加,預計該國將在預測期內實現穩定成長。

- 印度的化妝品和其他整裝儀容產品市場正在迅速擴大,預計未來幾年將加速。印度對化妝品和其他個人護理用品的需求是由人均收入的成長以及對整裝儀容態度的改變所推動的。截至2021年,印度美容及個人護理行業銷售額預計將排名全球第四。

因此,預計上述因素將在未來幾年對市場產生重大影響。

微晶蠟產業概況

微晶蠟市場本質上是部分整合的。市場上的一些主要企業包括 Blended Waxes Inc.、Indian Oil Corporation Ltd.、Paramelt BV、Sasol 和 Sonneborn LLC。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區個人護理產業的成長

- 其他司機

- 抑制因素

- COVID-19 大流行的影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格分析

- 貿易分析

第5章市場區隔

- 按類型

- 靈活的

- 難的

- 按用途

- 化妝品和個人護理

- 蠟燭

- 膠水

- 包裝

- 橡皮

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析**/排名分析

- 主要企業策略

- 公司簡介

- Alfa Chemicals

- Alpha Wax

- Blended Waxes Inc.

- British Wax Ltd.

- Clarus Specialty Products LLC

- Frank B. Ross Co. Inc.

- Indian Oil Corporation Ltd.

- Industrial Raw Materials LLC

- Koster Keunen

- NIPPON SEIRO CO. LTD.

- Paramelt BV

- Sasol

- Sonneborn LLC

- Strahl & Pitsch Inc.

- The International Group Inc.

第7章 市場機會及未來趨勢

- 冰球和滑雪板運動在北美日益流行

The Microcrystalline Wax Market is expected to register a CAGR of greater than 3% during the forecast period.

In 2020, COVID-19 affected the market due to low production and supply chain constraints. Polymer additives, adhesives, paints, and coatings use microcrystalline wax for lubrication. The lockdown halted construction, reducing microcrystalline wax consumption in adhesives and other construction products. Food and e-commerce companies are demanding more microcrystalline wax for paper packaging. Soaps and other personal care products use microcrystalline wax as an antifoam. Soaps and other personal care products are in higher demand due to increased hygiene awareness, which will boost microcrystalline wax demand over the coming years. The market recovered in 2021 by virtue of increased demand from the construction, food, and e-commerce segments.

Key Highlights

- Over the short term, the growing personal care industry in the Asia-Pacific region is expected to drive the market's growth.

- On the other hand, COVID-19's effect on the industry was still the most important thing holding the market back.

- The growing popularity of ice hockey and snowboarding in the North American region is likely to create opportunities for the market in the coming years.

- During the forecast period, the cosmetics and personal care segment is expected to be the largest part of the market.

- The Asia-Pacific region is expected to have the biggest share of the market and the highest CAGR over the next five years.

Microcrystalline Wax Market Trends

Increasing Demand from the Cosmetics and Personal Care Industry

- Cosmetics and personal care are two of the major applications of microcrystalline wax. Microcrystalline wax is used in cosmetics and personal care products as a viscosity agent, binder, and emollient to thicken the formulations.

- The increasing number of new beauty products and the concern for good appearance have led to a significant rise in the market for beauty products and cosmetics. According to L'Oreal, in 2021, the global cosmetics market will be worth over USD 240 billion. The COVID pandemic has severely impacted the industry, and the global cosmetics market declined by more than 8% in 2020 as compared to 2019. However, the market began to pick up speed in 2021, rising to 8.2%.

- The Asia-Pacific region has become the largest consumer and producer of microcrystalline wax. The production has reached high levels, and the region has become a significant hub for exporting cosmetics and personal care products to developed nations such as the United States.

- The growth of the cosmetics market is likely to lead to a rise in demand for personal care products in South Korea and Indonesia.

- The European market has a robust and rising demand for cosmetics. The desire for high-quality, all-natural cosmetics is especially strong in Europe, making it one of the world's largest cosmetics marketplaces. According to Cosmetics Europe, the value of the European market for cosmetics and personal care products was above USD 85 billion in 2021, and Germany accounted for nearly 17% of the market.

- The Italian cosmetics business is flourishing, and for good reason: Italian beauty products are often regarded as some of the best in the world. Italian cosmetics are well-liked all around the world because of their high-quality ingredients and elegant presentation. According to Cosmetics Europe, the value of the Italian market for cosmetics and personal care products was above USD 10 billion in 2021 and accounted for more than 13% of the European market.

- Because of this, the above factors are likely to have a big effect on the market in the next few years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global microcrystalline wax market with a share of more than 45%. With growing packaging and personal industries in countries like China, India, Japan, and South Korea, the consumption of microcrystalline wax is increasing in the region.

- Growing per capita income followed by rising expenditure in China, India, and Southeast Asian countries is expected to open new avenues for the industry. Beauty and cosmetic products are in high demand for personal grooming. The Asia-Pacific cosmetics market will account for more than 35% of the global cosmetics market by 2021.

- According to the National Bureau of Statistics, China will be the world's second-largest retail market for cosmetics in 2021 and will account for more than 17% of the global market.

- China has the second-largest packaging industry in the world. The country is expected to witness consistent growth during the forecast period, owing to the rise of customized packaging and increased demand for packaged consumer goods in the food segment, like microwave food, snack foods, frozen foods, etc.

- The market for cosmetics and other items related to personal grooming is expanding rapidly in India, and this growth is forecast to accelerate in the years to come. The demand for cosmetics and other personal care items in India has been propelled by rising per capita income and shifting attitudes toward personal grooming and appearance. As of 2021, India's beauty and personal care industry is projected to have the fourth highest revenue worldwide.

Therefore, the aforementioned factors are expected to have a significant impact on the market in the coming years.

Microcrystalline Wax Industry Overview

The microcrystalline wax market is partially consolidated by nature. Some of the major players in the market include Blended Waxes Inc., Indian Oil Corporation Ltd., Paramelt BV, Sasol, and Sonneborn LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Personal Care Industry in the Asia-Pacific Region

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Impact of the COVID-19 Pandemic

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Trade Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flexible

- 5.1.2 Hard

- 5.2 Application

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Candles

- 5.2.3 Adhesives

- 5.2.4 Packaging

- 5.2.5 Rubber

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alfa Chemicals

- 6.4.2 Alpha Wax

- 6.4.3 Blended Waxes Inc.

- 6.4.4 British Wax Ltd.

- 6.4.5 Clarus Specialty Products LLC

- 6.4.6 Frank B. Ross Co. Inc.

- 6.4.7 Indian Oil Corporation Ltd.

- 6.4.8 Industrial Raw Materials LLC

- 6.4.9 Koster Keunen

- 6.4.10 NIPPON SEIRO CO. LTD.

- 6.4.11 Paramelt BV

- 6.4.12 Sasol

- 6.4.13 Sonneborn LLC

- 6.4.14 Strahl & Pitsch Inc.

- 6.4.15 The International Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Popularity of Ice Hockey and Snowboarding in the North American Region