|

市場調查報告書

商品編碼

1699418

合規碳權市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Compliance Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

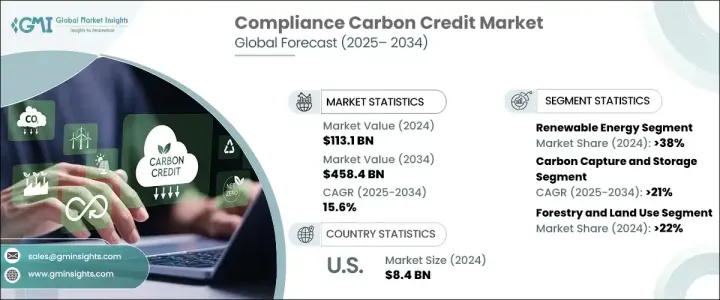

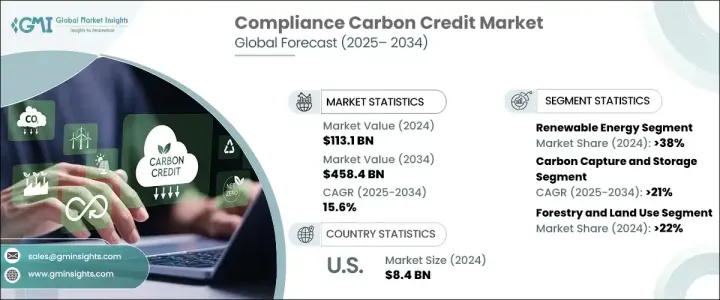

2024 年全球合規碳權市場規模達到 1,131 億美元,預計 2025 年至 2034 年期間的複合年成長率為 15.6%。在國際協議和企業永續發展承諾的推動下,氣候行動的緊迫性日益增強,這使得碳權成為尋求滿足環境法規和增強 ESG 形象的組織的重要工具。隨著越來越多的企業將碳權納入其長期策略,對經過驗證的高品質合規信用的需求持續激增。各行各業的公司都認知到參與碳權計畫的財務和聲譽優勢,從而增加了對減排計畫的投資。世界各地的監管機構也在收緊碳排放限制,進一步推動基於合規的信用交易的需求。企業淨零承諾的興起推動了碳權額的採用,成為彌合減排目標與營運可行性之間差距的必要機制。

標準化和驗證的進步促進了更大的市場參與,確保了信貸發行和交易的透明度和可信度。區塊鏈技術的整合顯著改善了碳權額的驗證和追蹤,消除了重複計算和詐欺帶來的風險。透過利用區塊鏈的分散式帳本系統,公司和監管機構可以維護安全且不可變的信用交易記錄,增強市場內的信任和責任。隨著區塊鏈的採用不斷成長,交易平台變得更加高效,允許企業無縫地購買、出售和註銷碳權額,同時確保遵守不斷變化的法規。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1131億美元 |

| 預測值 | 4584億美元 |

| 複合年成長率 | 15.6% |

在政府優惠政策和限額與交易制度實施的推動下,再生能源產業將在 2024 年合規碳權市場中佔據相當大的佔有率。這些框架允許能源公司在使用再生替代品取代化石燃料時產生可交易信用額,激勵清潔能源的生產。因此,對太陽能、風能和水力發電項目的投資持續增加,進一步加速向低碳能源的轉變。隨著世界各國政府承諾制定更嚴格的減碳目標,再生能源產業預計將繼續成為合規碳權市場成長的主要驅動力。

在監管要求和財政激勵措施不斷增加的支持下,碳捕獲和儲存 (CCS) 領域到 2034 年的複合年成長率預計將達到 21%。傳統上碳足跡較高的行業,如水泥、鋼鐵和發電,正在積極部署大規模 CCS 解決方案,以減少排放並遵守監管標準。合規市場透過可交易的碳權額獎勵這些行業,為繼續投資尖端 CCS 技術創造了財務激勵。隨著各國政府加大對碳封存計畫的資助,預計將有更多公司採用這些解決方案,為整體減排工作做出貢獻。

在聯邦碳定價政策和各州主導的限額與交易計畫的推動下,美國合規碳權市場在 2024 年創造了 84 億美元的收入。隨著越來越多的州參與受監管的碳權交易,多個行業對合規信用的需求激增,尤其是發電和製造業。更嚴格的排放限制和政策框架正在加速碳減排技術的採用,加強了合規信用在實現永續發展目標方面的作用。隨著監管環境和企業氣候承諾的不斷變化,美國市場將在未來幾年實現顯著成長。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 農業

- 碳捕獲與儲存

- 化學過程

- 能源效率

- 工業的

- 林業和土地利用

- 再生能源

- 運輸

- 廢棄物管理

- 其他

第6章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 丹麥

- 挪威

- 法國

- 瑞典

- 亞太地區

- 中國

- 日本

- 紐西蘭

- 中東和非洲

- 南非

- 拉丁美洲

- 阿根廷

- 智利

第7章:公司簡介

- 3Degrees

- ALLCOT

- Atmosfair

- CarbonClear

- ClimeCo

- Climate Impact Partners

- Ecosecurities

- Green Mountain Energy Company

- Shell

- South Pole

- Sterling Planet Inc.

- TerraPass

- The Carbon Collective Company

- The Carbon Trust

- VERRA

- WGL Holdings, Inc

The Global Compliance Carbon Credit Market reached USD 113.1 billion in 2024 and is projected to grow at a CAGR of 15.6% between 2025 and 2034. The growing urgency of climate action, driven by international agreements and corporate sustainability commitments, has positioned carbon credits as an essential tool for organizations looking to meet environmental regulations and enhance their ESG profiles. As more businesses integrate carbon credits into their long-term strategies, the demand for verified and high-quality compliance credits continues to surge. Companies across industries are recognizing the financial and reputational advantages of participating in carbon credit programs, leading to increased investment in emission reduction initiatives. Regulatory bodies worldwide are also tightening carbon emission limits, further driving the need for compliance-based credit trading. The rise of corporate net-zero pledges has propelled the adoption of carbon credits as a necessary mechanism to bridge the gap between emission reduction goals and operational feasibility.

Standardization and verification advancements have fueled greater market participation, ensuring transparency and credibility in credit issuance and trading. The integration of blockchain technology has significantly improved the verification and tracking of carbon credits, eliminating risks associated with double counting and fraud. By leveraging blockchain's distributed ledger system, companies and regulatory bodies can maintain a secure and immutable record of credit transactions, enhancing trust and accountability within the market. As blockchain adoption grows, trading platforms are becoming more efficient, allowing businesses to seamlessly buy, sell, and retire carbon credits while ensuring compliance with evolving regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $113.1 Billion |

| Forecast Value | $458.4 Billion |

| CAGR | 15.6% |

Renewable energy industries accounted for a significant share of the compliance carbon credit market in 2024, driven by favorable government policies and the implementation of cap-and-trade systems. These frameworks incentivize clean energy production by allowing energy companies to generate tradeable credits when replacing fossil fuels with renewable alternatives. As a result, investment in solar, wind, and hydropower projects continues to rise, further accelerating the transition toward low-carbon energy sources. With governments worldwide committing to more stringent carbon reduction targets, the renewable energy sector is expected to remain a key driver of compliance carbon credit market growth.

The carbon capture and storage (CCS) segment is set to expand at a CAGR of 21% through 2034, supported by increasing regulatory mandates and financial incentives. Industries with traditionally high carbon footprints, such as cement, steel, and power generation, are actively deploying large-scale CCS solutions to mitigate emissions and comply with regulatory standards. The compliance market rewards these industries with tradeable carbon credits, creating a financial incentive for continued investment in cutting-edge CCS technologies. As governments ramp up funding for carbon sequestration projects, more companies are expected to adopt these solutions, contributing to overall emission reduction efforts.

The U.S. Compliance Carbon Credit Market generated USD 8.4 billion in 2024, driven by the expansion of federal carbon pricing policies and state-led cap-and-trade programs. As more states participate in regulated carbon credit trading, demand for compliance credits has surged across multiple industries, particularly in power generation and manufacturing. Stricter emission limits and policy frameworks are accelerating the adoption of carbon reduction technologies, reinforcing the role of compliance credits in meeting sustainability goals. With evolving regulatory landscapes and corporate climate commitments, the U.S. market is poised for significant growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By End use, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Agriculture

- 5.3 Carbon Capture & Storage

- 5.4 Chemical process

- 5.5 Energy efficiency

- 5.6 Industrial

- 5.7 Forestry & Land use

- 5.8 Renewable energy

- 5.9 Transportation

- 5.10 Waste management

- 5.11 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Denmark

- 6.3.2 Norway

- 6.3.3 France

- 6.3.4 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 New Zealand

- 6.5 Middle East & Africa

- 6.5.1 South Africa

- 6.6 Latin America

- 6.6.1 Argentina

- 6.6.2 Chile

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 ALLCOT

- 7.3 Atmosfair

- 7.4 CarbonClear

- 7.5 ClimeCo

- 7.6 Climate Impact Partners

- 7.7 Ecosecurities

- 7.8 Green Mountain Energy Company

- 7.9 Shell

- 7.10 South Pole

- 7.11 Sterling Planet Inc.

- 7.12 TerraPass

- 7.13 The Carbon Collective Company

- 7.14 The Carbon Trust

- 7.15 VERRA

- 7.16 WGL Holdings, Inc