|

市場調查報告書

商品編碼

1708120

金屬罐市場機會、成長動力、產業趨勢分析及2025-2034年預測Metal Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

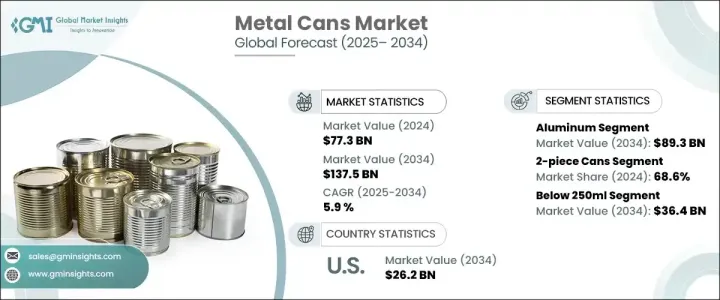

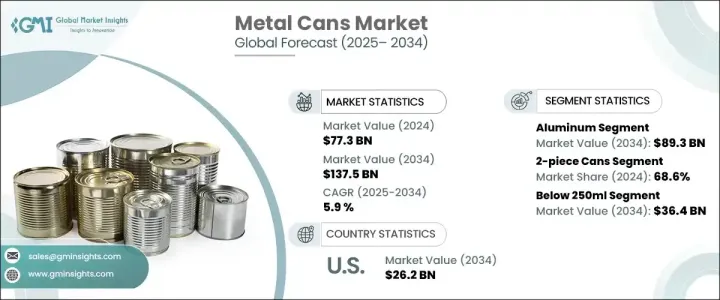

2024 年全球金屬罐市場規模達到 773 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.9%。金屬罐需求的不斷成長受到多種關鍵因素的推動,包括精釀啤酒的日益普及、電子商務的擴張以及消費者對永續包裝解決方案的日益傾向。各行各業的公司都在迅速轉向金屬罐,以滿足對環保、高效和耐用包裝日益成長的需求。隨著永續發展成為重中之重,企業正致力於減少塑膠垃圾,金屬罐因其可回收性、重量輕和增強的產品保存能力而成為一種有吸引力的替代品。

精釀啤酒產業在推動金屬罐需求方面發揮著至關重要的作用。許多獨立啤酒廠都採用鋁罐,因為它們能有效地維持產品的新鮮度和品質。鋁罐具有出色的防光和防氧性能,有助於保留風味並延長飲料的保存期限。隨著消費者偏好不斷轉向便利和永續的包裝,對金屬罐的需求正在加速成長,尤其是在飲料業。公司也利用金屬罐提供的品牌機會,實現高品質的印刷和生動的設計,增強貨架吸引力和消費者參與。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 773億美元 |

| 預測值 | 1375億美元 |

| 複合年成長率 | 5.9% |

市場主要分為兩種材料類型:鋁和鋼。預計到 2034 年,鋁罐的市值將達到 893 億美元,其主導地位歸功於其可回收性、重量輕以及對環境影響小。世界各國政府和環保組織正在實施更嚴格的法規來限制塑膠的使用,促使各行各業採用鋁罐作為永續的替代品。各大品牌也紛紛改用鋁包裝,以彰顯其永續發展的承諾,強化其具有環保意識的企業形象。隨著越來越多的人積極尋找具有環保包裝的產品,消費者偏好進一步支持了這種轉變。

從產品類型來看,金屬罐有兩片式和三片式兩種形式。 2024 年,兩件式產品佔了 68.6% 的市場佔有率,這主要歸功於其成本效益、耐用性和較低的材料消耗。兩片罐在食品和飲料行業中廣受歡迎,尤其是碳酸飲料和即食食品,因為包裝的完整性和易用性是關鍵因素。預計未來幾年對輕質和高度可回收包裝的需求將繼續推動兩片式金屬罐的採用。

2024 年,北美金屬罐市場佔有 25% 的佔有率,永續發展舉措推動該地區實現顯著成長。越來越多的飲料公司開始轉向使用鋁罐,以符合其企業永續發展目標並遵守不斷變化的監管標準。推動環保替代品發展的不僅是環境問題,也是消費者期望的結果。隨著政府推廣綠色包裝計畫以及領先品牌優先減少塑膠垃圾,北美金屬罐市場有望穩步擴張。隨著企業對創新包裝解決方案和回收計畫的投資,金屬罐將在塑造各行業永續包裝的未來方面發揮關鍵作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 提高回收效率和循環經濟整合

- 精釀啤酒銷量成長

- 攜帶式食品和飲料的需求不斷成長

- 電商平台的全球擴張

- 罐裝非酒精飲料的激增

- 產業陷阱與挑戰

- 金屬開採對環境的影響

- 加強金屬包裝的監管審查

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鋁

- 鋼

第6章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 兩片罐

- 三片罐

第7章:市場估計與預測:按關閉類型,2021 - 2034 年

- 主要趨勢

- 易開蓋(EOE)

- 剝離端(POE)

- 其他

第8章:市場估計與預測:按產能,2021 - 2034 年

- 主要趨勢

- 250毫升以下

- 250毫升-1升

- 1公升以上

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 食物

- 水果和蔬菜

- 簡便食品

- 寵物食品

- 肉類和海鮮

- 其他

- 飲料

- 酒精飲料

- 碳酸軟性飲料

- 運動和能量飲料

- 其他

- 化妝品和個人護理

- 製藥

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Ardagh Group

- Ball Corporation

- Canpack

- CCL Industries

- CPMC Holdings

- Crown Holdings

- DS Containers

- Envases Group

- Hindustan Tin Works

- Kian Joo Group

- Mauser Packaging

- P Wilkinson Containers

- Sapin

- Silgan Holdings

- Toyo Seikan

- Universal Can

- Visy

The Global Metal Cans Market reached USD 77.3 billion in 2024 and is projected to grow at a CAGR of 5.9% between 2025 and 2034. The increasing demand for metal cans is being fueled by several key factors, including the surging popularity of craft beer, the expansion of e-commerce, and a growing consumer inclination toward sustainable packaging solutions. Companies across industries are rapidly shifting to metal cans to meet the rising demand for eco-friendly, efficient, and durable packaging. With sustainability becoming a top priority, businesses are focusing on reducing plastic waste, making metal cans an attractive alternative due to their recyclability, lightweight nature, and enhanced product preservation capabilities.

The craft beer industry is playing a crucial role in boosting the demand for metal cans. Many independent breweries are embracing aluminum cans because they effectively maintain product freshness and quality. Aluminum cans offer superior protection against light and oxygen, which helps retain the flavor and extend the shelf life of beverages. As consumer preferences continue to shift toward convenient and sustainable packaging, the demand for metal cans is accelerating, particularly within the beverage sector. Companies are also capitalizing on the branding opportunities presented by metal cans, which allow for high-quality printing and vibrant designs, enhancing shelf appeal and consumer engagement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.3 Billion |

| Forecast Value | $137.5 Billion |

| CAGR | 5.9% |

The market is primarily segmented into two material types: aluminum and steel. Aluminum cans are expected to reach USD 89.3 billion by 2034, with their dominance attributed to their recyclability, lightweight properties, and low environmental impact. Governments and environmental organizations worldwide are enforcing stricter regulations to curb plastic usage, prompting industries to adopt aluminum cans as a sustainable alternative. Brands are also making concerted efforts to highlight their sustainability commitments by switching to aluminum packaging, reinforcing their image as eco-conscious enterprises. This shift is further supported by consumer preferences, as a growing number of individuals actively seek out products with environmentally friendly packaging.

In terms of product type, metal cans are available in two-piece and three-piece formats. The two-piece segment held a 68.6% market share in 2024, largely due to its cost-effectiveness, durability, and lower material consumption. Two-piece cans are widely preferred in the food and beverage industry, especially for carbonated drinks and ready-to-eat meals, where packaging integrity and ease of use are critical factors. The demand for lightweight and highly recyclable packaging is expected to continue driving the adoption of two-piece metal cans in the coming years.

North America Metal Cans Market held a 25% share in 2024, with sustainability initiatives driving significant growth in the region. Beverage companies are increasingly transitioning to aluminum cans to align with their corporate sustainability goals and comply with evolving regulatory standards. The push for eco-friendly alternatives is not only being driven by environmental concerns but also by consumer expectations. With government programs promoting green packaging and leading brands prioritizing the reduction of plastic waste, the metal cans market in North America is poised for steady expansion. As businesses invest in innovative packaging solutions and recycling initiatives, metal cans are set to play a pivotal role in shaping the future of sustainable packaging across various industries.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Enhanced recycling efficiency and circular economy integration

- 3.2.1.2 Increasing sales of craft beer

- 3.2.1.3 Rising demand for on-the-go food and beverages

- 3.2.1.4 Global expansion of e-commerce platforms

- 3.2.1.5 Proliferation of non-alcoholic beverages in cans

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental impact of mining for metal

- 3.2.2.2 Increased regulatory scrutiny on metal packaging

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Bn & Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Bn & Units)

- 6.1 Key trends

- 6.2 2-piece cans

- 6.3 3-piece cans

Chapter 7 Market Estimates and Forecast, By Closure Type, 2021 - 2034 (USD Bn & Units)

- 7.1 Key trends

- 7.2 Easy-open end (EOE)

- 7.3 Peel-off end (POE)

- 7.4 Others

Chapter 8 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Bn & Units)

- 8.1 Key trends

- 8.2 Below 250ml

- 8.3 250ml - 1 liter

- 8.4 Above 1 liter

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Bn & Units)

- 9.1 Key trends

- 9.2 Food

- 9.2.1 Fruits & vegetables

- 9.2.2 Convenience foods

- 9.2.3 Pet foods

- 9.2.4 Meat & seafood

- 9.2.5 Others

- 9.3 Beverages

- 9.3.1 Alcoholic beverages

- 9.3.2 Carbonated soft drinks

- 9.3.3 Sports & energy drinks

- 9.3.4 Others

- 9.5 Cosmetics and personal care

- 9.6 Pharmaceuticals

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Bn & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Ardagh Group

- 11.2 Ball Corporation

- 11.3 Canpack

- 11.4 CCL Industries

- 11.5 CPMC Holdings

- 11.6 Crown Holdings

- 11.7 DS Containers

- 11.8 Envases Group

- 11.9 Hindustan Tin Works

- 11.10 Kian Joo Group

- 11.11 Mauser Packaging

- 11.12 P Wilkinson Containers

- 11.13 Sapin

- 11.14 Silgan Holdings

- 11.15 Toyo Seikan

- 11.16 Universal Can

- 11.17 Visy