|

市場調查報告書

商品編碼

1628848

拉丁美洲金屬罐:市場佔有率分析、產業趨勢、成長預測(2025-2030)LA Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

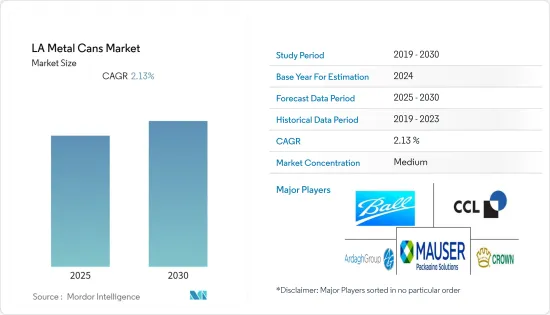

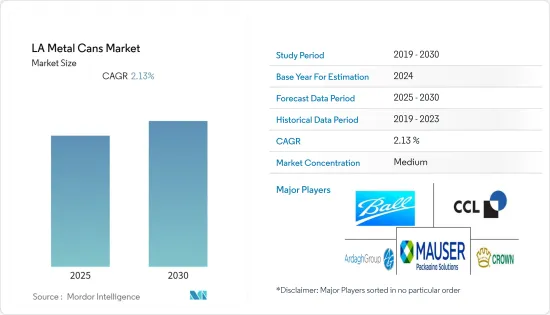

拉丁美洲金屬罐市場預計在預測期內複合年成長率為2.13%

主要亮點

- 在各種類型的金屬包裝中,包括罐、桶、瓶、蓋和封口,罐是最受歡迎的。上個世紀,易用性和可用性推動了金屬罐在多種包裝應用中的採用。此外,消費者趨勢,例如偏好較小尺寸和多包裝包裝形式,正在支持所研究市場中金屬罐市場的數量成長。

- 巴西和墨西哥等拉丁美洲市場對迷你罐的需求尤其明顯。這就是該地區大多數飲料公司提供迷你罐的原因。迷你罐通常含有較少量的產品,並且比傳統罐裝產品更便宜。

- 這一趨勢導致了單位消費量的增加。此外,隨著環境問題的增加,消費者正在尋求對環境影響較小的金屬罐。金屬罐的高回收性是一些地區的市場促進因素之一,而經濟狀況和罐頭食品的低廉價格是其他地區的市場促進因素。

- 由於 2021 年需求增加,Crown Holdings 等飲料罐供應商正計劃擴大其在巴西的罐頭工廠。該公司的目標是到2022年第二季末每年生產24億個各種尺寸的兩片鋁罐。

- 此外,隨著中等收入人口的成長、生活方式的改變和消費者偏好的變化,拉丁美洲國家的消費率正在穩步上升。根據世界銀行統計,拉丁美洲地區人均國民總收入為8,775.3美元。

拉丁美洲金屬罐市場趨勢

鋁罐佔據主要市場佔有率

- 鋁是罐頭包裝解決方案中最受歡迎的金屬之一。由於具有用於廣告印刷、快速冷卻、保護飲料風味、100% 可回收性以及對食品和飲料中的化學品和多種成分呈惰性等特性,成為飲料罐的首選。

- 由於其永續性和可回收性,鋁罐是汽水、啤酒和能量飲料的首選包裝。僅在過去十年中,用於多種包裝目的的鋁罐的重量就顯著減輕。

- 因此,大多數金屬罐製造商正在從鋼罐轉向鋁罐。貨物重量的顯著減輕,導致運輸成本降低和碳排放降低,推動了鋁罐的使用。

- 環保政策的加強和對回收的興趣不斷增加,對鋁罐的需求不斷增加,而企業對提高環保品牌形象的關注正在推動鋁罐市場的成長進一步擴大。製造技術的重大進步和消費者需求的變化預計將在預測期內為鋁市場創造新的機會。

- 鋁罐具有可回收且易於印刷的優點。此外,它重量輕,可作為出色的氣體屏障。由於這些因素,鋁罐在飲料行業比其他金屬罐更受歡迎。預計非酒精飲料行業的持續需求將在預測期內推動鋁罐市場的成長。

- 此外,由於該地區對鋁金屬罐的需求不斷增加,供應商正在投資擴大設備。例如,Ambevarso 於 2020 年在巴西完成了一家飲料罐工廠的建設,儘管由於 COVID-19 大流行而造成延誤。該公司投資1.75億美元,擴建每年生產15億個用於啤酒儲存的鋁罐。這導致了激烈的競爭,Ardagh、Ball 和 Canpack 等製造商競相將產能擴大到每年 400 億罐。

推動市場的食品和飲料

- 忙碌的生活方式和工作日程使包裝食品和簡便食品食品成為許多消費者的主食。結果,大型有組織的零售商開始儲備罐頭食品和飲料。如今,線下和線上零售商的商店上都備有各種品牌的包裝食品。

- 飲料公司針對金屬罐使用的正向行銷策略也影響著所研究的市場。罐裝飲料在年輕人中被認為是一種時尚,而即食罐裝和半加工罐裝食品在全球一些用戶中被認為是方便和經濟的,因此罐裝產品的受歡迎程度正在迅速增加。

- 拉丁美洲對能量飲料和罐裝冷咖啡的需求不斷成長預計也將推動市場成長。因此,拉丁美洲食品和飲料行業預計將為所研究的市場提供機會。例如,根據巴西食品工業協會的數據,食品和飲料產業是巴西製造業最重要的部門,2020 年銷售額為 7,892 億雷亞爾,而 2019 年為 6,999 億雷亞爾。

- 罐裝飲料在中北美洲及加勒比海冠軍聯賽、南美解放者杯、大聯盟世界職業棒球大賽等眾多體育賽事中的高消費量歸因於食品處理的日益便利,並增加了預計在預測期內調查的市場的需求。

- 在拉丁美洲市場,巴西擁有 889 家註冊釀酒廠,生產 16,968 種產品,為金屬罐的成長做出了貢獻。此外,有機飲料產業消費的增加也促進了所研究市場的成長。根據有機貿易協會的數據,2020 年巴西有機飲料消費淨收入為 4,420 萬美元,而 2019 年為 4,280 萬美元。

拉丁美洲金屬罐產業概況

拉丁美洲金屬罐市場較為分散,很少有公司佔據主導市場佔有率,也很少有新參與企業。公司不斷創新並結成策略夥伴關係以維持市場佔有率。

- 2020 年 8 月 - Ball Corporation 完成了對 Tubex Industria E Comercio de Embalagens Ltda 的收購,這是一家衝擊擠壓鋁氣霧劑包裝企業,包括位於巴西 Itupeva 的一家製造工廠。 Itupeva 工廠擁有 8 條擠壓鋁氣霧罐生產線,為全球和巴西本地客戶生產個人護理包裝。

- 2020 年 2 月 - Mouser Packaging Solutions 對設備進行重大投資,將田納西州孟菲斯工廠的誇脫和加侖 F 型金屬罐綜合產能提高一倍。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 對市場的影響

- 市場促進因素

- 金屬包裝回收率高

- 罐頭食品方便且價格低廉

- 市場限制因素

- 替代包裝解決方案的存在

第5章市場區隔

- 按材質

- 鋁

- 鋼

- 按最終用戶產業

- 食品

- 飲料

- 其他最終用戶產業

- 國家名稱

- 巴西

- 阿根廷

- 墨西哥

- 其他國家

第6章 競爭狀況

- 公司簡介

- Ball Corporation

- Ardagh Group

- Mauser Packaging Solutions

- Crown Holdings Inc.

- CCL Container, Mexico

- Can Pack SA

- Ambev SA

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 55717

The LA Metal Cans Market is expected to register a CAGR of 2.13% during the forecast period.

Key Highlights

- Of all the different kinds of metal packages, such as cans, drums, bottles, caps, and closures, can have been the most popular. Ease of use and availability aided in the adoption of metal cans in several packaging applications over the last century. Additionally, consumer trends, such as a preference for small-size and multi-pack packaging formats, are supporting the volume growth of the metal cans market in the studied market.

- Increasing demand for mini-cans has been observed, especially in the Latin American markets, such as Brazil and Mexico. Therefore, most beverage companies in the region are offering mini-cans, which generally contain smaller volumes of products and cost less than the traditional canned products.

- This trend is resulting in more substantial unit consumption. Furthermore, with the increasing environmental concerns, consumers are demanding metal cans, owing to their low environmental impact. The high recyclability of metal cans is one of the significant drivers for the market studied in some regions, while in other regions, economic conditions and low price of canned goods remain, key drivers for the market studied.

- Beverage Can Vendors like Crown holding planned to expand their can facility in Brazil amid the increased demand in 2021. The company has aims to produce two-piece aluminum cans at an annual capacity of 2.4 billion with all types of sizes by the end of the second quarter of 2022.

- Also, with the growing middle-income group population, changing lifestyle, and evolving consumer preferences, the consumption rates among the Latin American countries are also rising steadily. According to the World Bank, the gross national income per capita in the Latin American region accounts for USD 8775.3.

Latin America Metal Cans Market Trends

Aluminum Cans to Hold Major Market Share

- Aluminum is one of the most popular metals for can packaging solutions. Traits, such as the provision of metal canvas for ad printing, fast cooling, protection of flavors of beverages, 100% recyclability, and inertness to chemicals and several ingredients in the food and beverage products, make it the most preferred choice for beverage cans.

- Aluminum cans are the most preferred type of packaging for soda, brew beers, and energy drinks, owing to their sustainability and recycling properties. In the last decade alone, there has been a significant reduction in the weight of aluminum cans used for several packaging purposes.

- This has pushed most of the manufacturers of metal cans to shift from steel to aluminum cans. A considerable reduction in freight weight, resulting in low transportation costs and reduced carbon emission, is encouraging the use of aluminum cans.

- Increasing environmental policies and growing focus on recycling is augmenting the need for the material, while the focus of companies on improving the eco-friendly brand image is further expanding the growth of the aluminum segment of the market studied. Considerable advancements in manufacturing techniques and changing consumer needs are expected to open new opportunities to the aluminum segment of the market studied during the forecast period.

- Aluminum cans offer the advantages of recyclability and ease of printing. Additionally, they are lightweight and act as excellent barriers to gases. Such factors allow a higher penetration of aluminum variants in the beverages industry compared to other metal cans. Over the forecast period, sustained demand from the non-alcoholic beverage sector is expected to drive the growth of the aluminum cans market.

- Further, Vendors are investing in facility expansion with an increase in demands for aluminum metal cans in the region. For instance, Ambevalso completed the construction of a beverage can plant in Brazil in 2020 despite the delays caused by the spread of the COVID-19. The company invested USD 175 million and expanded the production to 1.5 billion aluminum cans every year for the storage of beer. This has increased competition among players as manufacturers like Ardagh, Ball, Canpack are competing to grow their respective production capacity to 40 billion cans a year.

Canned Food and Beverages to Drive the Market

- Packaged and convenience food has become a staple food for many consumers, owing to their hectic lifestyles and work schedules. Therefore, large organized retailers have started to stack huge amounts of canned food and beverages. Nowadays, offline and online retailers stock a wide range of brands of packaged food items in their stores.

- Aggressive marketing strategies of beverage companies toward the usage of metal cans have also had an impact on the studied market. As canned beverages are being considered trendy among the youth, and ready-to-eat or semi-processed canned foods are considered convenient and economical among several global users, the penetration of canned products is increasing rapidly.

- The rising demand for energy drinks and canned cold coffee in Latin America is also expected to boost market growth. Hence, the food and beverage industry in Latin America is expected to offer opportunities for the market studied. For instance, according to the Associacao Brasileira das Industrias da Alimentacao, the food and beverage industry is the most significant sector of Brazilian manufacturing, accounting for revenue of BRL 789.2 billion in 2020 compared to BRL 699.9 billion in 2019.

- High consumption of canned beverages in numerous sports tournaments, including CONCACAF Champions League, Copa Libertadores, and Big League World Series, among others, owing to the growing convenience in handling the food items, is expected to boost the demand in the market studied over the forecast period.

- In the Latin American market, Brazil contributes to the growth of metal cans through the presence of 889 registered breweries, with the country producing 16,968 products. Further, the increasing consumption of the organic beverage industry also contributes to the studied market's growth. According to Organic Trade Association, the net revenue on the consumption of organic beverages in Brazil accounted for USD 44.2 million in 2020 compared to USD 42.8 million in 2019.

Latin America Metal Cans Industry Overview

The Latin America Metal Cans Market is moderately fragmented, with few companies having a dominant market share and few new entrants in the market. The companies keep on innovating and entering into strategic partnerships to retain their market share.

- August 2020 - Ball Corporation completed the acquisition of Tubex Industria E Comercio de Embalagens Ltda, an impact extruded aluminum aerosol packaging business that includes a manufacturing plant in Itupeva, Brazil. The Itupeva plant includes eight extruded aluminum aerosol can lines and produces personal care packaging for global and local customers in Brazil.

- February 2020 - Mauser Packaging Solutions made significant investments in its facility on pieces of equipment to double the combined production capacity of quart and gallon-sized F- Style Metal Cans at its Memphis, Tennessee facility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 High Recyclability Rates of Metal Packaging

- 4.5.2 Convenience and Lower Price Offered by Canned Food

- 4.6 Market Restraints

- 4.6.1 Presence of Alternate Packaging Solutions

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Aluminum

- 5.1.2 Steel

- 5.2 End-User Industry

- 5.2.1 Food

- 5.2.2 Beverage

- 5.2.3 Other End-user Industries

- 5.3 Country

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Mexico

- 5.3.4 Other Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ball Corporation

- 6.1.2 Ardagh Group

- 6.1.3 Mauser Packaging Solutions

- 6.1.4 Crown Holdings Inc.

- 6.1.5 CCL Container, Mexico

- 6.1.6 Can Pack SA

- 6.1.7 Ambev SA

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219