|

市場調查報告書

商品編碼

1628849

亞太地區金屬罐:市場佔有率分析、產業趨勢、成長預測(2025-2030)Asia Pacific Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

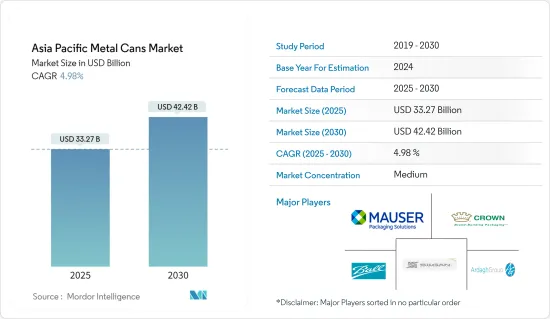

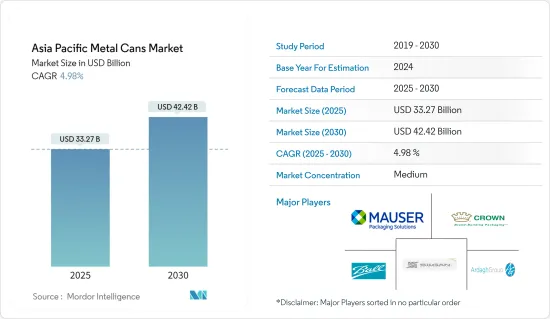

亞太地區金屬罐市場規模預估至2025年為332.7億美元,預估至2030年將達424.2億美元,預測期間內(2025-2030年)複合年成長率為4.98%。

主要亮點

- 在技術創新和對永續性的嚴格追求的推動下,模式轉移。為了跟上世界對環保包裝解決方案的推動,製造商正在採用尖端材料和環保方法。

- 罐頭是消費者的理想選擇,因為它們易於運輸且重量輕。此外,使用罐子可以最大限度地減少溢出或破裂的風險,這使得它們在戶外活動和活動中特別受歡迎。消費者對罐裝飲料的偏好不斷增加、機能飲料和運動飲料的日益普及以及對永續包裝材料的需求不斷成長是市場的一些關鍵驅動力。

- 亞太國家對塑膠廢棄物的擔憂預計將成為預測期內金屬包裝的成長要素之一。製造商和消費者現在優先考慮其他考慮因素,例如低成本和便利性。然而,政府加強監管和減少包裝廢棄物的措施可能會促進金屬包裝未來的擴張。

- 在整個亞洲,食品包裝行業越來越依賴金屬罐,透過其理想的防腐性能和結構完整性來延長保存期限。隨著消費者兼顧忙碌的生活方式和工作日程,包裝簡便食品已成為人們的主食。

- 對較小的合裝包裝形式的偏好等趨勢正在推動金屬罐市場的成長。印度、中國和日本等亞太市場對迷你罐的需求正在增加。為此,許多地區飲料製造商正在推出迷你罐,與傳統罐相比,體積更小,成本更低。

- 亞洲的趨勢與東南亞的成長交織在一起。中國和日本製造商正在增加在該地區的業務。例如,昭和鋁罐透過其計劃,策略性地瞄準東南亞以實現中期業務成長。

- 製造流程的創新、各種形狀和尺寸以及智慧包裝的進步使金屬罐製造商能夠跟上市場趨勢。與多步驟列印和標籤相容的清潔表面正在推動重要的行銷創新。

- 例如,印度的 Hindustan Tin Works Ltd 生產的普通罐頭可以提供出色的氧氣、濕氣和細菌屏障,阻止囓齒動物和害蟲,並確保產品在消費前的安全。

- 金屬罐,尤其是鋁罐,在回收方面處於領先地位。它能夠在生命週期結束時進行回收而不損失質量,這使其成為品牌的首選包裝選擇,超越了塑膠和紙張等替代品。新罐在 60 天內退回貨架的速度凸顯了鋁在食品、飲料和氣霧劑行業的吸引力。

- 然而,金屬罐面臨來自替代包裝解決方案的激烈競爭。塑膠包裝,尤其是瓶子和桶形式的塑膠包裝,是一個主要的競爭對手。此外,聚合物替代品的出現和原料價格的波動對該地區的金屬罐市場構成了挑戰。

亞太金屬罐市場趨勢

罐頭食品提供的便利性和低廉的價格推動了市場的成長

- 由於對不含化學物質的選擇的需求不斷成長,罐頭食品市場的創新包裝不斷增加。許多罐頭食品品牌已開始使用無BPA 的容器提供食品。

- 人們迫切需要密封、防篡改的鋼製容器食品來保護食品免受有害細菌的侵害。此外,由於消費者忙碌的生活方式,罐頭食品預計將變得越來越重要。

- 寵物食品包裝可防止潮濕和其他可能導致污染和腐敗的環境條件,從而極大地影響食品品質和安全。寵物食品包裝通常由金屬(通常是錫或鋁)製成,並進行密封以防止食物、氣味和洩漏逸出。

- 有限的設計彈性和打開罐頭的不便一直是金屬寵物食品罐的顯著缺點。該細分市場旨在透過強調鋼罐的安全性以及由於其可回收性和使用再生材料而對環境友好的方式來競爭。金屬罐包裝的寵物食品比塑膠替代品更受青睞,因為金屬罐密封性佳且防拆封。

- 其他優點包括低成本、保存期限長、耐用性以及與濕食品的兼容性。此外,開放的便利性預計將帶來持續的商機。金屬食品罐更快的填充速度和生產線效率也阻礙了製造商將生產轉向塑膠替代品,因為塑膠替代品的製造時間更長且製造成本更高。

印度正在經歷顯著的成長

- 近年來,印度飲料業的果汁包裝發生了重大變化。這種演變不僅僅是一種趨勢:它反映了消費者偏好的變化和對環境問題意識的增強。考慮到這一點,製造商優先考慮在印度推出永續產品。

- 2024 年,波爾公司與創新和永續鋁包裝領域的全球領導者德爾蒙特食品公司 (Del Monte Foods) 合作。兩家公司都致力於永續性,符合印度政府的雄心勃勃的目標,即到 2070 年實現淨零排放,並在 2030 年將碳強度降低 45%。在鮑爾的幫助下,德爾蒙特食品公司從傳統的三片馬口鐵罐轉變為可無限回收的兩片鋁製飲料罐。

- 此外,最近關於一次性塑膠禁令的規定預計將促進塑膠包裝的成長,並將在與所有相關人員的討論完成後實施。印度食品安全和標準局正在審查一次性塑膠材料的禁令,以適應環保的替代品。

- 隨著酒精和非酒精飲料市場的成長,預計該國對金屬罐包裝的需求將大幅增加。例如,根據印度精釀啤酒協會的數據,過去五年裡,印度精釀啤酒廠的數量從 20 家躍升至 120 家。

- 印度鋁製飲料罐協會 (ABCAI) 聯盟正在推動從塑膠和玻璃包裝轉向鋁製包裝。 ABCAI 的目標是到 2030 年將這一數字增加到約 25%。

- 此外,根據礦業部的資料,鋁的初級產量將從2022-2023會計年度的407.3萬噸增加到2023-2024會計年度的41.59噸,成長率為2.1%。鋁產量的增加表明對金屬罐的需求正在激增。由於金屬罐生產嚴重依賴鋁,產量的增加表明製造商正在提高金屬罐產量以滿足強勁的消費者需求。

- 此外,國內新興企業擴大啤酒市場也推動了印度金屬罐產業的發展。 Ball公司還提供符合飲料產品要求的金屬罐,在印度的年生產能力為13億罐。鮑爾表示,印度的人均消費量不到一罐,這為金屬包裝供應商進入新興市場創造了巨大的機會。

- 飲料製造商和印度罐頭製造商之間的合作關係也支持了金屬罐市場的成長。例如,2024年,喜力子公司印度聯合啤酒廠與CANPACK合作推出了一款以女性氣質為主題的限量版啤酒。新的優質拉格啤酒被命名為“Queenfisher”,旨在補充該公司的旗艦品牌“Kingfisher”。

亞太金屬罐產業概況

亞太金屬罐市場是細分的,由 Ball Corporation、Crown Holdings、Ardagh Group SA、Silgan Holdings Inc. 和 Mauser Packaging Solution 等不同的主要企業組成。這些公司正積極致力於透過創新、合作和併購來擴大其在金屬罐市場的業務。

2024 年 5 月,Ball Corporation 與乳製品行業先驅 CavinKare 合作,邁出了永續包裝的重大一步。此次合作旨在透過推出 CavinKare 著名的兩片式蒸餾鋁製蒸煮罐來改變乳製品包裝。

據該公司預測,乳製品和乳製品替代品細分市場在印度極為重要,預計到2028年將以4.1%的年成長率擴張。該公司專注於即飲細分市場,並預計透過提供多種口味實現更快成長。 Ball India 正在提高專門為滿足乳製品行業需求而設計的蒸餾鋁罐的製造能力。這項產品組合的擴展凸顯了我們對產品創新和永續性的承諾,使在鋁罐中包裝各種口味的乳製品變得更加容易。

2023年7月,皇冠控股宣布將參加10月30日至11月1日在泰國曼谷舉行的Asia CanTech 2023的演講者行程。該計畫將討論泰國、越南和柬埔寨等國家鋁製飲料罐回收率的調查結果。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 金屬包裝回收率高

- 罐裝帶來的便利性和低廉的價格

- 市場限制因素

- 替代包裝解決方案的存在

- 地區原物料價格波動

第6章 市場細分

- 材料類型

- 鋁

- 鋼

- 產品類型

- 2 件

- 3 件

- 可以打字

- 食品罐

- 蔬菜

- 水果

- 寵物食品

- 湯

- 咖啡

- 其他食品罐

- 飲料罐

- 酒精飲料

- 非酒精性

- 氣霧罐

- 化妝品/個人護理

- 家庭使用

- 油漆/清漆

- 醫藥/獸醫用途

- 汽車/工業

- 其他氣霧罐

- 其他罐型

- 食品罐

- 國家名稱

- 印度

- 中國

- 韓國

- 日本

- 澳洲和紐西蘭

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Ball Corporation

- Mauser Packaging Solutions

- Crown Holdings Inc.

- CANPACK SA

- Toyo Seikan Group Holdings Ltd

- Showa Denko KK

- Hindustan Tin Works Ltd

- AJ Packaging Limited

- Nanchang Ever Bright Industrial Trade Co. Ltd(EBI)

- Shanghai Jima Industrial Co. Ltd

第8章投資分析

第9章 市場機會及未來趨勢

The Asia Pacific Metal Cans Market size is estimated at USD 33.27 billion in 2025, and is expected to reach USD 42.42 billion by 2030, at a CAGR of 4.98% during the forecast period (2025-2030).

Key Highlights

- The metal cans market is witnessing a paradigm shift fueled by a severe search for innovation and sustainability. Manufacturers increasingly adopt cutting-edge materials and eco-friendly practices, aligning with the global push for environmentally responsible packaging solutions.

- Cans are easy to carry and light in weight, making them ideal for consumers. Additionally, using cans helps minimize the risk of spills or breakage, making them especially popular for outdoor activities and events. The increasing consumer preference for canned drinks, the rising popularity of energy and sports drinks, and the growing demand for sustainable packaging materials are some of the critical drivers of the market.

- Concerns about plastic waste in various Asia-Pacific countries will likely be one of the growth factors for metal packaging during the forecast period. Manufacturers and consumers now prioritize other considerations, such as low cost and convenience. However, the future expansion of metal packaging may be aided by increased government initiatives to regulate and decrease packaging waste.

- Across Asia, the food packaging industry increasingly relies on metal cans due to their ideal preservative properties and structural integrity, which extend shelf life. Packaged and convenient foods have become dietary staples as consumers juggle hectic lifestyles and work schedules.

- Trends like a preference for smaller and multi-pack formats are driving the growth of the metal cans market. There is a rising demand for mini-cans in the Asia-Pacific markets, including India, China, and Japan. In response, many regional beverage companies are introducing mini-cans, which offer smaller volumes at a lower cost than traditional cans.

- Asian trends are intertwined with the growth of Southeast Asia. Manufacturers from China and Japan are broadening their presence in the region. For instance, Showa Aluminum Can Corporation, through its project, is strategically targeting Southeast Asia for medium-term business growth.

- Innovations in manufacturing processes, diverse shapes and sizes, and advancements in smart packaging are enabling metal can manufacturers to stay aligned with market trends. Clean surfaces that accommodate multi-stage printing and labeling are drawing significant marketing innovations.

- As an illustration, Hindustan Tin Works Ltd from India produces general line cans that offer superior barriers against oxygen, moisture, and bacteria and deter rodents and pests, ensuring product safety until consumption.

- Metal cans, especially aluminum, lead the way in recycling. Their ability to be recycled without any loss of quality at the end of their life cycle makes them the preferred choice for packaging for brands, surpassing alternatives such as plastic and paper. This swift return to shelves as new cans in 60 days underscores aluminum's appeal in the food, beverage, and aerosol industries.

- However, metal cans grapple with stiff competition from alternative packaging solutions. Plastic packaging, especially in forms like bottles and pails, stands as the primary competitor. Additionally, the emergence of polymer-based substitutes and fluctuating raw material prices pose challenges for the metal cans market in the region.

Asia Pacific Metal Cans Market Trends

Convenience and Lower Price Offered by Canned Food to Drive the Market Growth

- The canned food market is seeing a rise in innovative packaging due to the growing demand for chemical-free options. Many brands of canned food products have started offering food in BPA-free containers.

- The demand for sealed and tamper-proof steel container food is high, as they protect food from harmful bacteria. Also, due to consumers' busy lifestyles, canned food is expected to gain more importance.

- Pet food packaging can significantly influence the quality and safety of the food product by providing barriers to moisture and other environmental conditions that may result in contamination and spoilage. Metal is commonly used in pet food packaging, typically tin or aluminum, and is tightly sealed to prevent any food, odors, or leaks from escaping.

- Limited design flexibility and inconvenience in opening the cans have been the significant disadvantages of metal pet food cans. This segment is trying to increase its competitiveness by emphasizing steel cans' safety and environmental friendliness, owing to their recyclability and use of recycled content. Pet food packaged in metal cans is preferred over plastic alternatives due to cans' tight seal and tamper evidence.

- Other advantages include its low cost, long shelf life, durability, and amenability to wet food products. Additionally, easy opening ends are expected to support continued opportunities. Fast-filling speeds and line efficiencies of metal food cans also make manufacturers reluctant to shift production to plastic alternatives, which are slower to manufacture and involve added production costs.

India to Witness Significant Growth

- In recent years, the Indian beverage industry has seen a significant shift in juice packaging. This evolution goes beyond merely following trends; it reflects changing consumer preferences and a growing awareness of environmental issues. In light of this, manufacturers are prioritizing sustainable product launches in India.

- In 2024, Ball Corporation partnered with Del Monte Foods, a global leader in innovative, sustainable aluminum packaging. Both companies are committed to sustainability, aligning with the Indian government's ambitious goals of achieving net-zero emissions by 2070 and cutting carbon intensity by 45% by 2030. With Ball's backing, Del Monte Foods moved from traditional three-piece tin cans to infinitely recyclable two-piece aluminum beverage cans.

- Additionally, the recent regulation on the ban on single-use plastics is expected to grow plastic packaging growth, which is scheduled to be enforced once the discussion with all the stakeholders is concluded. The Food Safety and Standards Authority of India is reviewing the ban on using single-use plastic materials to accommodate eco-friendly alternatives.

- With the growth of the alcoholic and non-alcoholic beverage market, the demand for metal can packages is expected to increase significantly in the country. For instance, according to the Craft Brewers Association of India, the number of microbreweries in India galloped from 20 to 120 in the past five years.

- The Aluminum Beverage Can Association of India (ABCAI) consortium is pushing for a shift from plastic and glass packaging to aluminum. Aluminum cans hold a mere 5% share of the country's packaging landscape, but ABCAI aims to elevate this figure to approximately 25% by 2030.

- Also, the Ministry of Mines data reveals that primary aluminum production rose from 40.73 lakh tons (LT) in FY 2022-2023 to 41.59 LT in FY 2023-2024, marking a growth rate of 2.1%. This increase in aluminum production signals a burgeoning demand for metal cans. Given that producing metal cans heavily relies on aluminum, the increased production volume indicates that manufacturers are ramping up metal can production to cater to this surging consumer appetite.

- Moreover, the proliferation in the beer market by newer companies in the country is helping the Indian metal can segment. Ball Corporations also provide metal cans that meet the requirement of beverage products, with an annual capacity of 1.3 billion cans in India. According to the Ball Corporation, the consumption in India is less than one can per capita, which presents a massive opportunity for metal packaging providers to tap into the emerging market.

- Also, collaborations between beverage companies and can manufacturers in India fuel the growth of the metal cans market. For example, in 2024, United Breweries of India, a subsidiary of HEINEKEN, partnered with CANPACK to unveil a limited-edition beer prominently featuring a feminine theme. This new premium lager, dubbed 'Queenfisher', is designed to complement the company's flagship 'Kingfisher' brand.

Asia Pacific Metal Cans Industry Overview

The Asia-Pacific metal cans market is fragmented and consists of a diverse array of key players, including Ball Corporation, Crown Holdings, Ardagh Group SA, Silgan Holdings Inc., and Mauser Packaging Solution. These companies actively focus on business expansion in the metal cans market through innovations, collaborations, and mergers and acquisitions.

May 2024: As a major move toward sustainable packaging, Ball Corporation teamed up with CavinKare, a trailblazer in the dairy industry. The collaboration aims to transform dairy packaging by rolling out retort two-piece aluminum cans for CavinKare's renowned milkshakes.

The dairy and dairy alternatives segment is pivotal in India and is projected to expand at an annual growth rate of 4.1% by 2028, as per company projections. The company concentrates on the ready-to-drink segment, anticipating quicker growth by diverse flavor offerings. Ball India has bolstered its capabilities to manufacture retort aluminum cans specifically designed for the dairy sector's needs. This portfolio expansion emphasizes the commitment to product innovation and sustainability and facilitates the packaging a diverse range of flavored dairy products in aluminum cans.

July 2023: Crown Holdings announced it would join the schedule of speakers at Asia CanTech 2023, which will be held in Bangkok, Thailand, from October 30 to November 1. The business will discuss the study's findings on the recycling rates of aluminum beverage cans, including Thailand, Vietnam, and Cambodia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Metal Packaging

- 5.1.2 Convenience and Lower Price Offered by Canned Food

- 5.2 Market Restraints

- 5.2.1 Presence of Alternate Packaging Solutions

- 5.2.2 Fluctuating Raw Material Prices in the Region

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Aluminium

- 6.1.2 Steel

- 6.2 Product Type

- 6.2.1 2-piece

- 6.2.2 3-piece

- 6.3 Can Type

- 6.3.1 Food Cans**

- 6.3.1.1 Vegetables

- 6.3.1.2 Fruits

- 6.3.1.3 Pet Food

- 6.3.1.4 Soups

- 6.3.1.5 Coffee

- 6.3.1.6 Other Food Cans

- 6.3.2 Beverages Cans

- 6.3.2.1 Alcoholic

- 6.3.2.2 Non-alcoholic

- 6.3.3 Aerosol Cans**

- 6.3.3.1 Cosmetics and Personal Care

- 6.3.3.2 Household

- 6.3.3.3 Paints and Varnishes

- 6.3.3.4 Pharmaceutical/Veterinary

- 6.3.3.5 Automotive/Industrial

- 6.3.3.6 Other Aerosol Cans

- 6.3.4 Other Cans Types

- 6.3.1 Food Cans**

- 6.4 Country

- 6.4.1 India

- 6.4.2 China

- 6.4.3 South Korea

- 6.4.4 Japan

- 6.4.5 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Ball Corporation

- 7.1.3 Mauser Packaging Solutions

- 7.1.4 Crown Holdings Inc.

- 7.1.5 CANPACK SA

- 7.1.6 Toyo Seikan Group Holdings Ltd

- 7.1.7 Showa Denko K.K.

- 7.1.8 Hindustan Tin Works Ltd

- 7.1.9 AJ Packaging Limited

- 7.1.10 Nanchang Ever Bright Industrial Trade Co. Ltd (EBI)

- 7.1.11 Shanghai Jima Industrial Co. Ltd