|

市場調查報告書

商品編碼

1521693

數位貨運匹配平台:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Digital Freight Matching Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

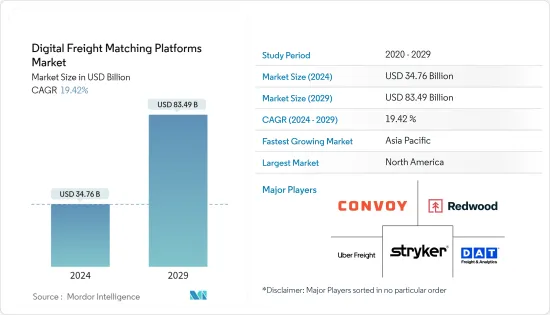

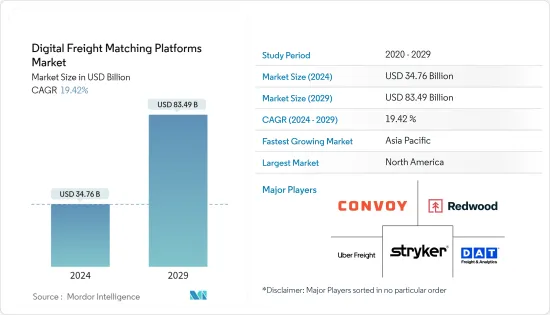

數位貨運匹配平台市場規模預計到2024年為347.6億美元,預計到2029年將達到834.9億美元,在預測期內(2024-2029年)複合年成長率為19.42%,預計將成長。

主要亮點

- 供應鏈對自動化和數位化的需求不斷成長正在推動市場成長。數位貨運匹配平台即時連接托運人和承運人以提供解決方案。這是透過應用程式和平台提供的相對較新的技術,允許托運人共用其貨運要求並協助承運人有效地查找和預訂貨運。

- 市場成長的主要驅動力之一是在線銷售的繁榮。網路購物的發展增加了對向消費者提供商品的運輸服務的需求。為了有效回應需求,DFM平台幫助電子商務公司利用運輸公司的能力。

- 由於國際貿易量的增加,對貨運服務的需求不斷增加。公司正在利用貨運使用量的增加,並透過技術創新提高效率。運輸和供應鏈的延誤可能會導致銷售損失,而當延誤蔓延到其他運輸服務時,可能會對公司造成巨大損失。為了提高效率並避免延誤,貨運匹配平台等各種貨運管理解決方案正在廣泛接受。

數位貨物匹配平台市場趨勢

基於行動的細分市場主導整個市場

大多數市場參與者在 Google Play 和 Apple Inc. 的 App Store 上提供行動應用程式。中國滿車聯盟(江蘇滿載軟體科技)透過雲端滿滿、貨運幫等行動應用程式提供票價匹配和附加價值服務。基於行動技術的平台比網路技術更快,並且應用程式可以離線運行。

這些應用程式提供貨運的即時可見性,使托運人和承運人能夠追蹤貨運、監控路線並及時接收更新。

2023 年 5 月,Transfix Inc. 宣布與 Highway 合作,這是一種營運商識別解決方案,旨在最大限度地減少詐欺並支援數位預訂。這種整合提高了營運商合規性和入職程序的透明度和效率。透過利用定位服務和物聯網整合,行動應用程式最佳化路線並確保貨物安全。

北美主導整個市場

北美擁有高度發展的科技基礎設施,網路和智慧型手機的普及率很高。因此,當地承運商和貨運公司可以使用數位貨物匹配平台。該地區的現代化連接使托運人和承運人能夠無縫存取數位貨運匹配系統。

北美地區可用性的提高將對 DFM 解決方案的整體採用和成功產生重大影響。發達的技術生態系統為該地區數位票價匹配市場的成長提供了有利的環境。

北美的物流業非常適合有效利用數位平台,因為許多人擁有高速網路和行動電話。更輕鬆地存取這些平台可以提高業務效率,加速決策流程,並刺激不斷發展和反應迅速的貨運生態系統。

2024 年 3 月,Bolt Express 宣布推出一流的數位貨運匹配系統。這個新的數位系統透過 API、EDI 或 XML 與大批量運輸帳戶無縫整合,簡化了貨運匹配。對於所有其他特殊客戶托運人,Bolt 利用先進人工智慧(AI) 的力量來讀取透過電子郵件、電話或簡訊發送的新請求並立即處理它們,確保您的托運簡化設定並確保及時解決您最困難和最緊急的問題運輸問題。

數位貨運匹配平台產業概況

數位貨物匹配平台市場需要變得更有凝聚力,因為參與者眾多,並且預計會有競爭。為了跟上競爭並確保效率、誠信和安全,市場上領先的服務提供者正在不斷升級其技術。這些參與者專注於合作夥伴關係、產品升級和協作,以獲得相對於競爭對手的競爭優勢並佔領重要的市場佔有率。 Uber Freight (Uber Technologies Inc.)、Redwood、Convoy Inc.、Stryker Corporation 和 DAT Solutions。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 承運人和托運人之間對可靠連接的需求日益成長

- 貨物即時可見性的需求

- 市場限制因素

- 物流行業細分

- 資料安全問題

- 市場機會

- 減少體力勞動的需求日益成長

- 價值鏈/供應鏈分析

- 全球數位票價匹配市場的主要成長策略

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 按服務前景

- 附加價值服務

- 貨物匹配服務

- 按平台前景

- 基於網路的

- 移動基地

- 按運輸方式

- 鐵路貨運

- 公路貨運

- 海運

- 空運貨物

- 按最終用戶

- 飲食

- 零售/電子商務

- 製造業

- 油和氣

- 車

- 衛生保健

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- Uber Freight(Uber Technologies, Inc.)

- Redwood

- CH Robinson Worldwide Inc.

- XPO Inc.

- Convoy Inc

- Stryker Corporation

- DAT Solutions

- Cargomatic Inc.

- Flexport

- Roper Technologies Inc.

- Loji Logistics

- Freight Technologies, Inc.

- 其他公司

第7章 市場機會及未來趨勢

第8章附錄

The Digital Freight Matching Platforms Market size is estimated at USD 34.76 billion in 2024, and is expected to reach USD 83.49 billion by 2029, growing at a CAGR of 19.42% during the forecast period (2024-2029).

Key Highlights

- An increasing need for automation and digitalization in supply chains drives the market's growth. Digital freight matching platforms provide solutions for shippers and carriers by connecting them in real time. It is a relatively new technology offered through an application or a platform that enables shippers to share their load requirements and assist carriers in finding and booking loads efficiently.

- One of the main drivers for market growth has been a boom in online sales. The development of online shopping has resulted in a growing demand for transport services to supply the consumer with products. To effectively meet demand, DFM platforms help e-commerce companies utilize carriers' capacity.

- The demand for freight services is increasing due to the growing volume of international trade. Companies are taking advantage of the increasing use of freight transport to improve their efficiency through technology innovation. Delays in the shipping and supply chain may lead to a loss of sales, which could amount to huge losses for firms when delays cascade into other transport services. Various freight management solutions, e.g., freight matching platforms, are becoming widely accepted to improve efficiency and avoid delays.

Digital Freight Matching Platforms Market Trends

The Mobile-Based Segment Dominates the Overall Market

Most market players provide mobile applications on Google Play and Apple Inc.'s App Store. China-based Full Truck Alliance (JiangSu ManYun Software Technology Co. Ltd) provides freight matching and value-added services through mobile apps such as Yunmanman and Huochebang. Platforms based on mobile technology are faster than web technologies, and apps can be run offline.

These apps provide real-time visibility of shipments, allowing shippers and carriers to track cargo, monitor routes, and receive timely updates.

In May 2023, Transfix Inc. unveiled a collaboration with Highway, a carrier identification solution engineered to minimize fraud and enhance digital bookings. This integration boosts transparency and efficiency in carrier compliance and onboarding procedures. By leveraging geolocation services and IoT integration, mobile apps optimize routes and ensure cargo safety, resulting in more reliable and efficient freight operations and boosting their adoption in the logistics industry.

North America Dominates the Overall Market

With a high penetration of the Internet and smartphones, North America has developed an advanced technology infrastructure. Therefore, local carriers and transporters may access digital freight matching platforms. The region's modern connectivity landscape provides seamless access to digital freight matching systems for shippers and carriers.

This increased availability in North America significantly impacts the overall adoption of DFM solutions and their success. A developed technological ecosystem provides the region with an environment conducive to the growth of the digital freight matching market.

The logistics sector in North America is well-placed to exploit digital platforms effectively, given the large number of people with high-speed Internet and mobile phones. The ease of access to these platforms will improve operational efficiency, speed up the decision-making process, and stimulate an evolving and responsive freight ecosystem.

In March 2024, Bolt Express announced the launch of its best-in-class digital freight matching system. This new digital system streamlines freight matching by seamlessly integrating via API, EDI, or XML with high-volume shipping accounts. For all other ad-hoc customer shippers, Bolt simplifies shipment set-up by using the power of advanced artificial intelligence (AI) to read and instantly process new requests submitted via email, phone, or text to ensure they receive a timely solution to their most challenging and urgent shipping problems.

Digital Freight Matching Platforms Industry Overview

Due to the presence of several players, the digital freight matching platform market needs to be more cohesive and expected to be subject to competition. To keep pace with competition and guarantee efficiency, integrity, and security, the leading service providers in the market are constantly upgrading their technology. These players focus on partnerships, product upgrades, and collaboration to gain a competitive edge over their competitors and capture a significant market share. Several players include Uber Freight (Uber Technologies Inc.), Redwood, Convoy Inc., Stryker Corporation, and DAT Solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Need for Reliable Connections between Carriers and Shippers

- 4.2.2 Demand for Real-time Visibility of Shipments

- 4.3 Market Restraints

- 4.3.1 High Fragmentation of the Logistics Industry

- 4.3.2 Data Security Concerns

- 4.4 Market Oppourtunities

- 4.4.1 Rising Need to Reduce the Manual Work

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Major Growth Strategy In The Global Digital Freight Matching Market

- 4.7 Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Service Outlook

- 5.1.1 Value-Added Services

- 5.1.2 Freight Matching Services

- 5.2 By Platform Outlook

- 5.2.1 Web-Based

- 5.2.2 Mobile-Based

- 5.3 By Transportation Mode

- 5.3.1 Rail Freight

- 5.3.2 Road Freight

- 5.3.3 Ocean Freight

- 5.3.4 Air Freight

- 5.4 By End User

- 5.4.1 Food & Beverages

- 5.4.2 Retail & E-Commerce

- 5.4.3 Manufacturing

- 5.4.4 Oil & Gas

- 5.4.5 Automotive

- 5.4.6 Healthcare

- 5.4.7 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Uber Freight (Uber Technologies, Inc.)

- 6.2.2 Redwood

- 6.2.3 C.H. Robinson Worldwide Inc.

- 6.2.4 XPO Inc.

- 6.2.5 Convoy Inc

- 6.2.6 Stryker Corporation

- 6.2.7 DAT Solutions

- 6.2.8 Cargomatic Inc.

- 6.2.9 Flexport

- 6.2.10 Roper Technologies Inc.

- 6.2.11 Loji Logistics

- 6.2.12 Freight Technologies, Inc.*

- 6.3 Other Companies