|

市場調查報告書

商品編碼

1521766

日本半導體記憶體:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Japan Semiconductor Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

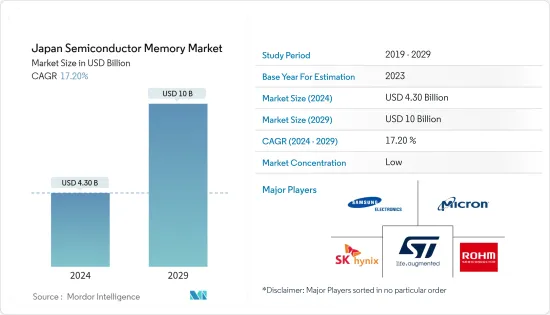

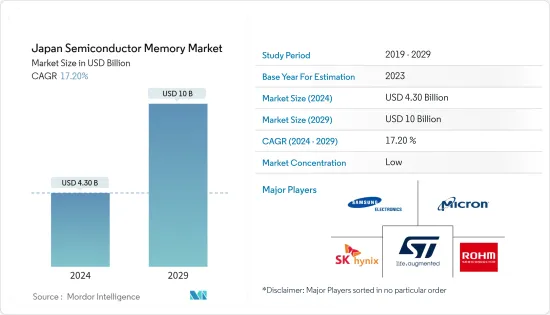

日本半導體記憶體市場規模預計到2024年將達到43億美元,並在2029年達到100億美元,在市場預測期間(2024-2029年)複合年成長率為17.20%。

*智慧型手機、平板電腦和其他消費性電子產品是半導體記憶體的最大消費者。隨著這些設備變得更加強大和功能豐富,它們需要更多的記憶體才能正常運作。對這些設備的需求增加正在推動日本對半導體記憶體的需求。

*一些汽車 ADAS 製造商已經在使用儲存設備。例如,Bosch 使用 Cypress Semiconductor 的汽車級串行 NOR 閃存,Infenion 生產基於視訊的 ADAS(高級駕駛員輔助系統)。這種用途預計能夠在高達 +125°C 的溫度下儲存系統啟動程式碼和演算法。

*在自然災害頻繁的日本,企業依靠資料中心來確保業務永續營運。日本還沒有產生雲端巨頭,因此中國和美國的企業都渴望向世界第三大經濟體的企業出售雲端服務。全球資料中心參與者正在日本新興市場建立雲端伺服器基地。這些因素預計將大大促進日本半導體記憶體的採用。

*此外,組織和當地大學的研究人員正在努力開發高速下一代內存,以支援人工智慧和物聯網設備中不斷成長的應用程式和資料量。例如,2023年5月,美光科技宣布,在日本政府的支持下,未來幾年將在日本投資高達5,000億日圓(36億美元)用於下一代記憶體晶片。

*疫情凸顯了半導體穩定供應的重要性。這導致包括日本在內的世界各地對半導體製造能力的投資增加。疫情也凸顯了對供應鏈彈性的關注。半導體製造商現在正在尋求供應鏈多元化,並減少對單一材料和組件供應商的依賴。

日本半導體記憶體市場趨勢

NAND快閃記憶體預計將大幅成長

*NAND解決方案針對emNAND快閃記憶體,該快閃記憶體由智慧型手機驅動,在預測期內將繼續使用,並以其結構簡單、高容量和低成本而聞名。其典型特徵為連續式讀出、架構和高密度。 NAND 快閃記憶體越來越流行用作 SSD(固態硬碟),也稱為快閃記憶體和 USB 記憶體。

* 由於在家工作對電腦和智慧型手機的需求增加,NAND快閃記憶體的消費量急劇增加,其中很大一部分是由於智慧型手機平均容量的增加。智慧型手機擴大採用 NAND 快閃記憶體。

*在智慧型手機中,使用NAND快閃記憶體來改善多晶片封裝(MCP)、疊層封裝(POP)、高密度嵌入式儲存以及行動裝置中的MCP/POP和卡片插槽等領域的資料儲存正在擴大。

*此外, NAND快閃記憶體廣泛應用於汽車領域,用於存儲為車載資訊娛樂系統提供支援的軟體和資料,例如導航地圖、音樂和視訊檔案。此外,這些記憶體還用於儲存車道偏離警告、防撞和主動式車距維持定速系統等 ADAS 功能的軟體和資料。

*因此,汽車銷售量的成長也對市場成長產生正面影響。例如,根據日本工業協會的數據,日本乘用車新註冊量將從2022年的345萬輛增加到2023年的399萬輛。乘用車銷售量的增加和對先進車輛的需求不斷成長預計將推動未來幾年的市場需求。

智慧型手機/平板電腦市場預計將錄得顯著成長

*內存已成為智慧型手機的基本要素。需求呈指數級成長,主要是由智慧型手機的平均容量所推動的。智慧型手機中的NAND快閃記憶體記憶體可以顯著提高網頁瀏覽、閱讀電子郵件、遊戲甚至 Facebook 等社群網站的效能。隨著智慧型手機變得越來越流行,該公司正在添加額外的功能和應用程式,以將其產品與其他製造商區分開來。例如,製造商正在整合手勢控制、指紋掃描器和 GPS 功能。這推動了對快閃記憶體的需求,快閃記憶體被用作智慧型手機中的代碼儲存媒體。

*此外,主要智慧型手機供應商每年都會發布旗艦機型,每種機型的記憶體容量都在增加。此外,各大智慧型手機廠商每年都會發表旗艦機型,記憶體容量也會隨著每次發布而增加。

*此外,每天用智慧型手機相機拍攝的照片和影片的數量也在增加。隨著像素數量的增加,智慧型手機照片的尺寸呈指數級成長。此外,包括手機遊戲在內的大容量智慧型手機應用程式的增加也推動了更大的儲存容量。隨著 5G 的推出,這種趨勢可能會持續下去,因為大容量儲存對於支援高速通訊、AR/VR、AI 技術和高清/4K 內容至關重要。

*據SK海力士稱,隨著蘋果、華為、小米等主要智慧型手機製造商發布新的高規格產品,對大容量儲存設備的需求正在迅速成長。為此,SK海力士在疫情到來之前推出了全球首款128層4D NAND快閃記憶體並開始量產。

*隨著5G無線通訊的快速普及,智慧型手機的數量預計將增加一倍,並且需要不斷升級最新型號。電子情報技術產業協會(JEITA)的數據顯示,2023年12月國內智慧型手機出貨量從上月的約33萬台增加至約49萬台。

日本半導體記憶體產業概況

日本半導體記憶體市場的特點是高度分散,主要參與者包括三星電子、美光科技、SK海力士和意法半導體等。市場參與企業正在策略性地利用聯盟和收購來加強產品系列併建立永續的競爭優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 擴大 5G 和物聯網設備的滲透率

- 資料中心記憶體需求不斷增加

- 消費性電子和汽車產業的需求增加

- 市場限制因素

- 疫情與美國貿易戰帶來的短期供應鏈挑戰

第6章 市場細分

- 類型

- DRAM

- SRAM

- 或非快閃記憶體

- NAND快閃記憶體

- ROM和EPROM

- 其他

- 目的

- 消費性產品

- 個人電腦/筆記型電腦

- 智慧型手機/平板電腦

- 資料中心

- 車

- 其他用途

第7章 競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- SK Hynix Inc.

- ROHM Co. Ltd.

- STMicroelectronics NV

- Maxim Integrated Products Inc.

- IBM Corporation

- Cypress Semiconductor Corporation

- Intel Corporation

- Nvidia Corporation

- Kioxia Corporation

第8章投資分析

第9章市場的未來

The Japan Semiconductor Memory Market size is estimated at USD 4.30 billion in 2024, and is expected to reach USD 10 billion by 2029, growing at a CAGR of 17.20% during the forecast period (2024-2029).

* Smartphones, tablets, and other consumer electronics are among the largest consumers of semiconductor memory. As these devices become more powerful and feature-rich, they require more memory to function properly. The increasing demand for these devices drives the demand for semiconductor memory in Japan.

* Some of the automotive ADAS manufacturers have already been using memory devices. For Example, Bosch uses the automotive-grade Serial NOR Flash memories from Cypress Semiconductor Corporation, which Infenion now acquires to manufacture its video-based Advanced Driver Assistance Systems (ADAS). The usage is expected to boost the storage of system boot code and algorithms at temperatures up to +125°C.

* As Japan is prone to natural disasters, companies in the region use data centers to secure their business continuity. Japan has not produced a cloud giant, so Chinese and American companies are rushing to sell cloud services to businesses in the world's third-largest economy. The global data center players are building homes for all those cloud servers in Japan's emerging markets. Such factors are expected to significantly boost the country's adoption of semiconductor memory.

* Moreover, researchers from organizations and regional universities are trying to develop high-speed next-generation memory to cater to the increasing applications of AI and IoT devices and their growing amount of data. For instance, in May 2023, Micron Technology announced it would invest up to JPY 500 billion (USD 3.6 billion) in Japan for the next few years, with support from the Japanese government, for next-generation memory chips.

* The pandemic highlighted the importance of having a secure supply of semiconductors. This has led to increased investment in semiconductor manufacturing capacity worldwide, including in Japan. The pandemic also increased the focus on supply chain resilience. Semiconductor manufacturers are now looking to diversify their supply chains and reduce their reliance on a single source of materials or components.

Japan Semiconductor Memory Market Trends

NAND Flash Memory is Expected to Have a Significant Growth

* NAND solution continues to be used over the forecast period, driven by smartphones, targeting emNAND flash memories that are known for their uncomplicated structure, high capacity, and low cost. Their typical features are sequential reading, architecture, and high density. NAND flash memories are becoming more popular due to their usage as Solid-State Drives (SSDs) and USB flash drives, which are called flash storage devices.

* With the rise in demand for PCs and smartphones owing to work from home, NAND flash consumption has dramatically increased, much of which is attributed to the growth of the average capacity of smartphones. This is expected to drive the demand for NAND flash, thus influencing the demand for memory packaging.

* Within smartphones, the use of NAND flash for improved data storage has grown in areas such as multi-chip packages (MCP) and package-on-package (POP), high-density embedded storage, and MCPs/POPs and card slots in handsets.

* Moreover, NAND Flash memory is widely used in the automotive segment to store the software and data that power in-vehicle infotainment systems, such as navigation maps, music, and video files. Additionally, these memories are used to store the software and data that powers ADAS features, such as lane departure warning, collision avoidance, and adaptive cruise control.

* As such, the increasing vehicle sales are also positively impacting the market growth. For instance, according to JAMA, new passenger car registrations in Japan increased from 3.45 million in 2022 to 3.99 million in 2023. The increasing sales of passenger cars and the rising demand for advanced vehicles are expected to drive the market demand in the coming years.

Smartphone/Tablet Segment Is Expected to Register a Significant Growth

* Memory storage has become an essential component in smartphones. The demand has been growing exponentially, primarily driven by the average capacity of smartphones. NAND flash memory in smartphones can significantly enhance the performance of web browsing, email loading, games, and even social network sites, such as Facebook. With the increasing adoption of smartphones, companies are adding extra features and applications to differentiate their products from other manufacturers. For instance, manufacturers are integrating gesture control, fingerprint scanners, and GPS features. This boosts the demand for flash memory, which is used as smartphone code storage media.

* Further, major smartphone vendors are launching their flagship models every year, and the memory capacity keeps increasing with each launch. By improving the scaling limits year after year, smartphone manufacturers sell smartphones at a premium by upgrading the memory capacity to boost performance.

* Additionally, the number of photos and videos users take daily through their smartphone cameras is increasing. The size of smartphone photos has grown exponentially as the number of pixels has increased. The growth in high-capacity smartphone applications, including mobile games, is another reason driving higher storage capacity. This trend would continue with the launch of 5G as high-capacity storage is essential to support high-speed communication, AR/VR, AI technology, and high-definition/4K content.

* According to Sk Hynix, the demand for high-capacity storage devices is booming due to the launch of new high-spec products by major smartphone manufacturers, such as Apple, Huawei, and Xiaomi. Hence, SK Hynix introduced the world's first '128-layer 4D NAND Flash' and put it into mass production before the pandemic arrived.

* With 5G wireless communication rapidly increasing, smartphones are expected to increase multifold, increasing the need for the latest models to raise the bar continuously. According to the Japan Electronics and Information Technology Industries Association (JEITA), the monthly domestic shipment volume of smartphones in Japan amounted to about 490 thousand units in December 2023, increasing from 330 thousand units in the previous month.

Japan Semiconductor Memory Industry Overview

The Japan semiconductor memory market is characterized by a high degree of fragmentation, featuring key players like Samsung Electronics Co. Ltd, Micron Technology Inc., SK Hynix Inc., and STMicroelectronics NV. Market participants strategically leverage partnerships and acquisitions to bolster their product portfolios and establish a sustainable competitive edge.

- In May 2023, Samsung Electronics announced to build a development facility in Yokohama in an initiative to spur collaboration between the chip industries of Japan and South Korea. The new facility will cost over JPY 30 billion (USD 222 million), and operations are expected to begin by 2025.

- In May 2023, SK Hynix Inc. announced that it had started the mass production of its 238-layer 4D NAND Flash memory. SK Hynix has developed solution products for smartphones and client SSDs, which are used as PC storage devices, adopting the 238-layer NAND technology, and has moved into mass production now. The 238-layer product - the smallest NAND in size - has a 34% higher manufacturing efficiency than the previous generation of 176-layer, significantly improving cost competitiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of 5G and IoT Devices

- 5.1.2 Growing Memory Requirement in Data Centers

- 5.1.3 Rising Demand from Consumer Electronics and Automotive Sectors

- 5.2 Market Restraints

- 5.2.1 Short term supply chain challenges due to the pandemic scenario and the US-China Trade war scenario

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 DRAM

- 6.1.2 SRAM

- 6.1.3 NOR Flash

- 6.1.4 NAND Flash

- 6.1.5 ROM & EPROM

- 6.1.6 Others

- 6.2 Application

- 6.2.1 Consumer Products

- 6.2.2 PC/Laptop

- 6.2.3 Smartphone/Tablet

- 6.2.4 Data Center

- 6.2.5 Automotive

- 6.2.6 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Micron Technology Inc.

- 7.1.3 SK Hynix Inc.

- 7.1.4 ROHM Co. Ltd.

- 7.1.5 STMicroelectronics NV

- 7.1.6 Maxim Integrated Products Inc.

- 7.1.7 IBM Corporation

- 7.1.8 Cypress Semiconductor Corporation

- 7.1.9 Intel Corporation

- 7.1.10 Nvidia Corporation

- 7.1.11 Kioxia Corporation