|

市場調查報告書

商品編碼

1632054

獨立記憶體:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Standalone Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

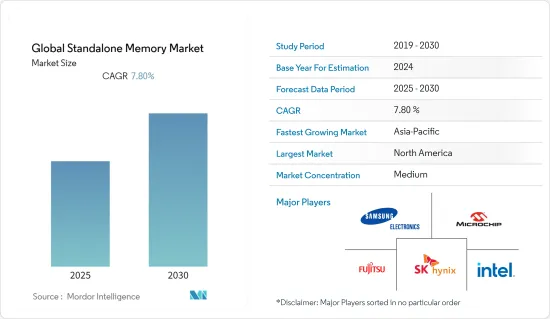

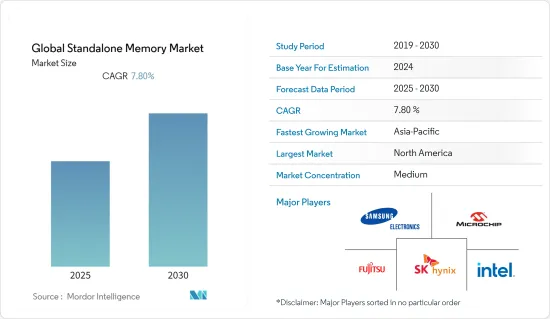

預計全球獨立記憶體市場在預測期內的複合年成長率為 7.8%。

主要亮點

- 物聯網設備的使用增加以及穿戴式設備和人工智慧設備等感測器技術的採用正在推動對高速資料傳輸和高儲存密度的需求,為全球獨立記憶體市場的成長創造巨大的機會和潛力。應用材料公司表示,物聯網、邊緣設備和網路用戶產生的大量資料將成為加速這些記憶體商業化的催化劑。人工智慧和資料分析應用極大地推動了對這些資料的需求。

- 產生的資料呈指數級成長,沒有任何放緩的跡象。在 COVID-19 爆發期間,在家工作的趨勢導致視訊會議等應用程式產生了大量資料成長。預計人工智慧和 AR/VR 等新應用將在預測期內變得普遍,導致資料進一步繁榮。由於資料成長,記憶體技術正在被推向新的標準。為了滿足這種需求,DRAM和NAND的規模不斷擴大。

- 另一方面,必須開發新的儲存技術來應對資料的增加。 2021年9月,韓國SK海力士表示,三項新技術——STT-MRAM、鐵電記憶體和ReRAM——可以在處理更大量的資料方面發揮作用。

- 由於物聯網的採用,處理資料激增的需求日益成長,這進一步推動了市場的發展。物聯網設備的採用正在快速發展。世界各地的各種政府措施(例如智慧城市)正在推動這些設備的更快採用。

獨立記憶體市場趨勢

汽車預計將獲得顯著的市場佔有率

- 隨著自動駕駛汽車、ADAS 整合等的興起,獨立記憶體的應用正在擴展到汽車領域。汽車行業的進步正在推動高性能記憶體的採用並支持市場成長。

- 自動駕駛汽車的核心是具有多個感測器 (AV) 的高級駕駛員輔助系統 (ADAS)。車輛將擴大被設計為在本地收集、分析和儲存資料,並在最佳時間有選擇地上傳資料。這需要在車輛中安裝資料儲存和計算設備。自動駕駛汽車的核心是具有多個感測器 (AV) 的 ADAS(高級駕駛輔助系統)。車輛將擴大被設計為在本地收集、分析和儲存資料,並在最佳時間有選擇地上傳資料。

- 分析汽車產業的顯著成長以及儲存設備的整合和需求,以提高預測期內的市場成長率。例如,2021年7月,富士通開始量產可在125度C下運作的汽車級4Mbit FRAM。這款FRAM產品符合「汽車級」零件的AEC-Q100 1級認證標準,適用於需要高可靠性電子元件的汽車應用,例如工業機器人和ADAS(高級駕駛輔助系統)。

- 此外,2021年12月,三星開始大量生產用於下一代自動駕駛電動車的全面車載記憶體解決方案。三星電子為下一代自動駕駛汽車發布了一系列先進的車載記憶體解決方案。 256 GB PCIe Gen3 NVMe 球柵陣列 (BGA) SSD、2GB GDDR6 DRAM、2GB DDR4 DRAM、2GB GDDR6 DRAM、128GB 通用快閃記憶體 (UFS),用於自動駕駛系統的高性能資訊娛樂系統新陣容到。

- 市場主要集中在汽車 DRAM,我們看到了該領域的各種創新。例如,2021年2月,美光科技公司發布了一款汽車低功耗DDR5 DRAM,經過硬體測試,達到了最嚴格的汽車安全完整性等級(ASIL)ASIL D,並宣布發布LPDDR5)記憶體。美光基於國際標準化組織 (ISO) 26262 標準的全新記憶體和儲存產品組合旨在實現車輛功能安全。

亞太地區預計將獲得主要市場佔有率

- 亞太地區的半導體製造市場是推動消費性電子市場的最重要市場。根據分析,中國、印度、日本和韓國等國家的消費性電子、汽車等各個製造業的存在和需求增強了該地區對獨立記憶體的需求。

- eMemory 在中國進行了長期投資,並與晶圓代工廠合作夥伴合作,使用一次性可編程 (OTP) 和多次可編程 (MTP) 解決方案提供從成熟節點到高級節點的各種嵌入式應用。個平台上的易失性記憶體(eNVM)。 eMemory 於 2021 年第三季宣布其首款採用 UMC 40nm ULP(超低功耗)製程的 ReRAM IP,目前正在研究 22nm 版本。

- 根據印度品牌股權基金會(IBEF)統計,2021年該國電子硬體產值為633.9億美元。此外,根據印度蜂窩與電子協會 (ICEA) 的數據,到 2025 年,印度筆記型電腦和平板電腦製造業的價值可能達到 1,000 億美元。分析這一點是為了增加對儲存設備的需求,並為預測期內的市場成長率做出貢獻。

- 據國家投資促進和便利化機構Invest in India稱,印度汽車工業價值超過1000億美元,占出口總額的8%,佔GDP的2.3%,預計到2025年將實現成長。 2021年12月,現代汽車宣布將在印度投資5.3025億美元研發,並於2028年推出六種電動車。 2021年10月,塔塔汽車宣布私募股權公司TPG和阿布達比ADQ同意向其電動車領域投資10億美元。這些因素共同影響了預測期內的市場成長率。

離散記憶體產業概述

全球獨立記憶體市場競爭溫和,有許多地區和全球參與者。創新產品正在推動市場,每個供應商都在技術創新上進行投資。主要參與者包括三星電子、SK 海力士公司、Microchip Technology Inc.、富士通半導體記憶體解決方案公司和英特爾公司。

- 2022 年 5 月,知名 DRAM 製造商 SK Hynix參展Intel Vision 大會,展示了其用於伺服器應用的最新內存,包括 DDR5 DIMM、Processing in Memory (PiM) 和 Compute Express Link (CXL) 等下一代技術。方案。

- 2021 年 3 月 - 三星電子在其 DDR5 DRAM 記憶體產品組合中添加了基於 HKMG(高 K 金屬閘極)製造技術的 512GB DDR5 模組。這款全新 DDR5 能夠組織超級運算、人工智慧 (AI)、機器學習 (ML) 和資料分析應用中運算最密集的高頻寬工作負載,最高可達 7,200 兆位元/秒 (Mbps) ),是DDR4 的兩倍多。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 雲端運算、物聯網、人工智慧和行動性等大趨勢的持續發展預計將創造未來需求

- 自動化機器人應用需求快速成長

- 市場挑戰/限制

- 技術應用的複雜性

第6章 市場細分

- 依產品類型

- DRAM

- NAND

- NOR

- (NV)SRAM/FRAM

- 其他產品類型

- 按最終用戶產業

- 車

- 消費性電子產品

- 公司

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Microchip Technology Inc.

- SK Hynix Inc.

- Fujitsu Semiconductor Memory Solution

- Nanya Technology Corporation

- Powerchip Technology Corporation

- Avalanche Technology

- Intel Corporation

- Infineon Technologies AG

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 90942

The Global Standalone Memory Market is expected to register a CAGR of 7.8% during the forecast period.

Key Highlights

- The increasing use of internet of things devices and adoption of sensor technology such as wearable and AI-enabled devices have boosted demand for fast data transfers and high storage density, providing a tremendous chance or possibility for the growth of the standalone memory market globally. According to Applied Materials, the exponential volumes of data generated via IoT and edge devices and by internet users act as a catalyst to drive the commercialization of such memory. Artificial intelligence and data analytics applications are largely driving the demand for this data.

- The exponential growth of data generated shows no indications of abating. During the COVID-19 pandemic, the work-from-home trend resulted in a massive data increase through applications such as video conferencing. New applications, such as AI and AR/VR, are projected to become commonplace in the forecast period, resulting in a further data boom. As a result of the increase in data, memory technology is being pushed to new standards. To fulfill these demands, DRAM and NAND have scaled up.

- Additional memory technologies, on the other side, must be developed to keep up with the data growth. In September 2021, SK Hynix, a South Korean firm, stated that three new technologies, STT-MRAM, Ferroelectric Memory, and ReRAM, could play a role in processing larger quantities of data.

- The rising need to handle the proliferation of data due to the adoption of IoT further drives the market. The adoption of IoT devices is taking place at a rapid pace. Various government initiatives worldwide, like smart cities, are supporting the deployment of these devices at a much faster pace.

Standalone Memory Market Trends

Automotive Expected to Witness Significant Market Share

- The applications of standalone memory are spanning in the automotive sector due to the rise of self-driving cars and ADAS integration, among others. The advancement in the automotive sector has driven the adoption of high-performance memory, which supports the market's growth.

- The core of autonomous vehicles will be advanced driver assistance systems (ADAS) with multiple sensors (AVs). Vehicles will increasingly be designed to collect, analyze, and store data locally and selectively upload data at the optimal period. This will necessitate the vehicle's installation of data storage and computing equipment. The core of autonomous vehicles will be advanced driver assistance systems (ADAS) with multiple sensors (AVs). Vehicles will increasingly be designed to collect, analyze, and store data locally and selectively upload data at the optimal period.

- The significant growth in the automotive sector alongside the integration and demand for memory devices is analyzed to boost the market growth rate during the forecast period. For instance, In July 2021, Fujitsu began mass production of 4Mbit FRAM that can operate at 125°C and is automotive grade. This FRAM product meets the AEC-Q100 Grade 1 qualification criteria for "automotive grade" components, suitable for industrial robots and automotive applications such as advanced driver-assistance systems (ADAS) that demand high-reliability electronic components.

- Also, In December 2021, Samsung began mass production of comprehensive automotive memory solutions for next-generation autonomous electric vehicles. Samsung Electronics has released a broad range of advanced automotive memory solutions for next-generation self-driving cars. For high-performance infotainment systems, the new lineup includes a 256-gigabyte (GB) PCIe Gen3 NVMe ball grid array (BGA) SSD, 2GB GDDR6 DRAM, 2GB DDR4 DRAM, 2GB GDDR6 DRAM, and 128GB Universal Flash Storage (UFS) for autonomous driving systems.

- The market focuses on automotive DRAMs, and various innovations are witnessed in the segment. For instance, in February 2021, Micron Technology, Inc. announced the launch of the automotive low-power DDR5 DRAM (LPDDR5) memory that has been hardware-tested to achieve the most stringent Automotive Safety Integrity Level (ASIL), ASIL D. Micron's new portfolio of memory and storage products based on the International Organization for Standardization (ISO) 26262 standard is aimed at functional vehicle safety.

Asia Pacific Expected to Witness Significant Market Share

- The semiconductor manufacturing market in Asia Pacific is the most significant in the region, driving the consumer electronics market. The presence and demand from various manufacturing sectors such as consumer electronics, automotive, and so on in the countries such as China, India, Japan, and South Korea are analyzed to bolster the demand for standalone memory in the region.

- eMemory has made a long-term investment in China and partnered with foundry partners to implement various embedded non-volatile memory (eNVM) on multiple platforms, ranging from mature to advanced nodes, using one-time programmable (OTP) and multiple-times programmable (MTP) solutions. In Q3/2021, eMemory launched its initial ReRAM IP on UMC's 40nm ULP (ultra-low power) process, and it is currently researching a 22nm version.

- India Brand Equity Foundation (IBEF) stated that the country's electronics hardware production stood at USD 63.39 billion in 2021. Moreover, according to India Cellular & Electronics Association (ICEA), India has the potential to achieve a value of USD 100 billion in manufacturing of laptops and tablets by 2025. It is analyzed to boost the demand for memory devices, contributing to the market growth rate during the forecast period.

- According to Invest in India, a National Investment Promotion and Facilitation Agency, India's automotive industry is valued at more than USD100 billion, produces 8% of total exports, accounts for 2.3% of GDP, and is on pace to become the global third-largest by 2025. In December 2021, Hyundai announced an investment of USD 530.25 million in R&D in India to launch six EVs by 2028. In October 2021, Tata Motors stated that private equity firm TPG and Abu Dhabi's ADQ had agreed to spend USD 1 billion in its electric vehicle sector. These factors collectively contribute to the market growth rate during the forecast period.

Standalone Memory Industry Overview

The Global Standalone Memory Market is moderately competitive, with many regional and global players. Innovation drives the market in the product offerings, and each vendor invests in innovation. Key players include Samsung Electronics Co. Ltd, SK Hynix Inc., Microchip Technology Inc., Fujitsu Semiconductor Memory Solution, and Intel Corporation.

- May 2022 - SK Hynix, a prominent DRAM manufacturer, displayed at the Intel Vision conference, showcasing the latest memory solutions for server applications, including DDR5 DIMM and next-generation technologies like Processing in Memory (PiM) and Compute Express Link (CXL).

- March 2021- Samsung Electronics has added the 512GB DDR5 module based on the High-K Metal Gate (HKMG) manufacturing technology to its DDR5 DRAM memory portfolio. The new DDR5 will be capable of organizing the most extreme computationally intensive, high-bandwidth workloads in supercomputing, artificial intelligence (AI), and machine learning (ML), as well as data analytics applications, with performance more than twice that of DDR4 at up to 7,200 megabits per second (Mbps).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Evolution of Mega Trends, such as Cloud Computing, IoT, AI, and Mobility, is Expected to Create Demand in the Future

- 5.1.2 Surging Demand for Application of Automation Robots

- 5.2 Market Challenge/Restraint

- 5.2.1 Complexity in Technological Applications

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 DRAM

- 6.1.2 NAND

- 6.1.3 NOR

- 6.1.4 (NV)SRAM /FRAM

- 6.1.5 Other Product Types

- 6.2 By End-User Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Enterprise

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Micron Technology Inc.

- 7.1.3 Microchip Technology Inc.

- 7.1.4 SK Hynix Inc.

- 7.1.5 Fujitsu Semiconductor Memory Solution

- 7.1.6 Nanya Technology Corporation

- 7.1.7 Powerchip Technology Corporation

- 7.1.8 Avalanche Technology

- 7.1.9 Intel Corporation

- 7.1.10 Infineon Technologies AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219