|

市場調查報告書

商品編碼

1537607

正極材料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Cathode Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

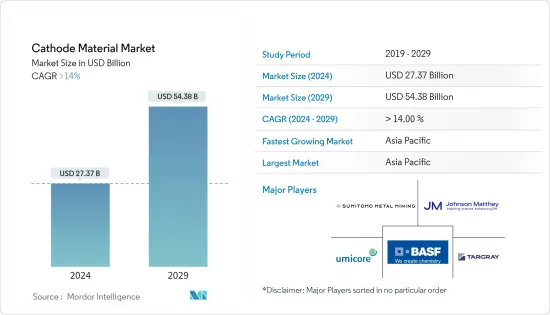

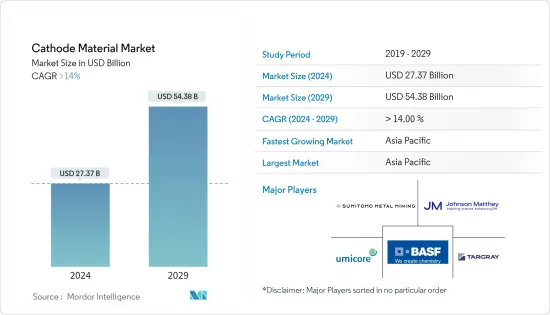

預計2024年正極材料市場規模為273.7億美元,預計2029年將達到543.8億美元,在預測期內(2024-2029年)複合年成長率將超過14%。

COVID-19大流行對全球正極材料市場產生了各種影響。儘管作為正極材料主要消費者的製造業和汽車產業暫時放緩,但電動車(EV)和可再生能源產業的成長依然強勁。儘管如此,2021年產業出現復甦跡象,市場需求再次增加。

主要亮點

- 從中期來看,電動車製造商的需求增加和消費性電子產品的需求增加是推動所研究市場成長的一些因素。

- 另一方面,有關電池儲存和運輸的嚴格安全法規正在限制市場成長。

- 然而,陰極材料和高效電解質的持續研究和進步可能會為市場成長提供機會。

- 亞太地區由於正極材料在汽車產業的應用不斷擴大,從而增加了對正極材料的需求,從而佔據了市場主導地位。

正極材料市場趨勢

汽車產業主導市場

- 由於汽車電池正極材料的大量消耗,汽車工業佔據市場主導地位。燃料需求的增加和鋰離子電池價格的下降正在促使汽車製造商投資電動車。

- 由於世界各國政府加強對電動車和充電站開發的投資等因素,全球對電動車的需求不斷成長。

- 此外,人們對環境問題的日益關注進一步推動了對電動車的需求。電動車電池的大規模生產導致電池成本降低,刺激了人們對電動車的需求。電動汽車電池是電動車的關鍵部件之一。因此,電動車需求的激增預計將有利於電池用正極材料的生產。

- 根據國際能源總署(IEA)的數據,電動車(包括純電動車和混合動力電動車)市場經歷了快速成長,2022年全球銷量將超過1,000萬輛。 2022 年銷售的新車中,電動車總合14%。

- 此外,IEA預測,到2023年終,電動車銷量將達到1,400總合,與前一年同期比較35%。

- 由於電動車需求增加,汽車鋰離子(Li-ion)電池的需求也將成長約65%,從2021年的約330 GWh達到2022年的550 GWh。

- 因此,鑑於上述幾點,汽車(電動車)產業可能會大幅成長,從而預計會增加所研究市場的需求。

亞太地區主導市場

- 亞太地區包括中國、印度和日本等國家,它們是電動車和電子產品最大、成長最快的市場之一。

- 2022年,中國將成為全球電動車市場的領跑者,約佔全球電動車銷量的60%。全球超過50%的電動車是中國製造的。

- 2022年,印度、泰國、印尼的電動車銷量將大幅成長,這些國家的電動車總銷量總合約8萬輛,較2021年成長200%以上。

- 在印度,價值約 32 億美元的政府獎勵計畫吸引了 83 億美元的總投資,電動車和零件製造勢頭強勁。

- 此外,泰國和印尼政府也在加強政策支持體系,以促進電動車的普及。

- 全球最大的電子產品生產基地是中國。成長最快的電子產業是行動電話、電視和電腦等電氣產品。

- 根據國家統計局數據,2022年中國電子市場成長13%,而2021年為10%。 2023年預計成長率為7%。中國市場是世界上最大的市場,甚至比工業國家市場的總合還要大。

- 因此,由於所有此類應用和強勁的需求,預計亞太地區將成為預測期內最大的市場。

正極材料行業概況

正極材料市場存在部分分散的特點,大量企業進入該市場。市場上的主要企業包括(排名不分先後)住友金屬礦業、莊信萬豐、BASF、塔格雷和優美科。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車產業的需求不斷增加

- 電子產品產量增加

- 其他司機

- 抑制因素

- 運輸、儲存的安全問題

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 依電池類型

- 鉛酸電池

- 鋰離子

- 其他電池種類(鹼性電池、鎳鎘電池等)

- 按材質

- 磷酸鋰鐵

- 鈷酸鋰

- 鋰、鎳、錳、鈷

- 錳酸鋰

- 鎳鈷鋁酸鋰

- 二氧化鉛

- 其他材料(磷酸鐵鈉、氫氧化物、石墨)

- 按用途

- 車

- 家電

- 電動工具

- 能源儲存

- 其他應用(醫療設備、航太零件等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- 3M

- BASF SE

- Hitachi Ltd

- Johnson Matthey

- LG Chem

- Mitsubishi Chemical Corporation

- MITSUI MINING & SMELTING CO. LTD

- POSCO FUTURE M

- PROTERIAL, Ltd.

- Sumitomo Metal Mining Co. Ltd

- Targray

- Umicore

第7章 市場機會及未來趨勢

- 正極材料和高效電解的進展

- 其他機會

The Cathode Material Market size is estimated at USD 27.37 billion in 2024, and is expected to reach USD 54.38 billion by 2029, growing at a CAGR of greater than 14% during the forecast period (2024-2029).

The COVID-19 pandemic had a mixed impact on the global cathode materials market. While there was a temporary slowdown in the manufacturing and automotive sectors, which are major consumers of cathode materials, the growth in electric vehicles (EVs) and renewable energy sectors remained strong. Nevertheless, in 2021, the industry showed signs of recovery and consequently increased its market demand again.

Key Highlights

- Over the medium term, increasing demand from electric vehicle manufacturers and increasing demand from consumer electronics are some of the factors driving the growth of the market studied.

- On the flip side, the stringent safety regulations for batteries through storage and transportation are restraints for the market's growth.

- However, the ongoing research and advancement in cathode material and efficient electrolytes may offer opportunities for market growth.

- Asia-Pacific dominates the market, owing to the growing application of cathode material in the automotive industry, which augments the demand for cathode material.

Cathode Material Market Trends

Automotive Industry to Dominate the Market

- The automotive sector dominates due to the extensive consumption of cathode material in vehicle batteries. Increasing fuel demand and reduced Li-ion battery prices have encouraged automobile manufacturers to invest more in electric vehicles.

- The global demand for electric vehicles is rising on account of factors such as increasing investments by governments across the world toward the development of electric vehicles and charging stations.

- Additionally, rising environmental concerns have further benefited the demand for electric vehicles. The large-scale production of EV batteries has resulted in lowering the cost of the batteries, which has fueled the demand for electronic vehicles among the people. The EV battery is one of the significant components of the electric vehicle. Thus, surging demand for electric vehicles is anticipated to benefit the production of cathode materials used in the batteries.

- According to the International Energy Agency (IEA), electric car (including both battery electric vehicles and hybrid electric vehicles) markets observed exponential growth in 2022 as sales globally exceeded 10 million. A total of 14% of all new cars sold in 2022 were electric.

- Furthermore, as per IEA estimates, by the end of 2023, a total of 14 million electric vehicles were sold, representing a 35% Y-o-Y increase.

- Owing to the increased demand for electric vehicles, automotive lithium-ion (Li-ion) battery demand also observed an increase of about 65% and was valued at 550 GWh in 2022 compared to about 330 GWh in 2021.

- Thus, due to the abovementioned point, the automotive (electric vehicle) industry is likely to grow significantly, which, in turn, is expected to enhance the demand in the market studied.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is home to countries like China, India, and Japan, which are among the largest and fastest-growing markets for electric vehicles and electronics products.

- In the year 2022, China was the frontrunner in the global electric vehicles market, accounting for around 60% of global electric car sales. More than 50% of the world's electric cars are made in China.

- In 2022, electric car sales in India, Thailand, and Indonesia observed significant growth, and collectively, sales of electric cars in these countries were around 80,000 units, which was an increase of more than 200% compared to 2021.

- In India, EV and component manufacturing are gaining significant momentum due to a supportive government incentive program of about USD 3.2 billion that has attracted investments totaling USD 8.3 billion.

- Furthermore, to increase the adoption of EVs, the government of Thailand and Indonesia are also strengthening their policy support schemes.

- The world's largest electronics production base is in China. The fastest growth in the electronics sector has been recorded for electrical products, such as mobile phones, televisions, and computers.

- According to the National Bureau of Statistics, the Chinese electronics market grew by 13% in 2022 compared to 10% growth in 2021. The estimated growth rate for 2023 was 7%. The Chinese market is the largest in the world, even more significant than the combined markets of all industrialized countries.

- Hence, with all such applications and robust demand in the region, Asia-Pacific is expected to be the largest market during the forecast period.

Cathode Material Industry Overview

The cathode material market is partially fragmented in nature, with a number of players operating in the market. Some of the major companies in the market (not in any particular order) are Sumitomo Metal Mining Co. Ltd, Johnson Matthey, BASF SE, Targray, and Umicore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing demand from Automotive Industry

- 4.1.2 Increasing Production of Electronics Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Safety Issues with Transportation and Storage

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Battery Type

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Battery Types (Alkaline Battery, Nickel Cadmium Battery, etc)

- 5.2 By Material

- 5.2.1 Lithium Iron Phosphate

- 5.2.2 Lithium Cobalt Oxide

- 5.2.3 Lithium-Nickel Manganese Cobalt

- 5.2.4 Lithium Manganese Oxide

- 5.2.5 Lithium Nickel Cobalt Aluminium Oxide

- 5.2.6 Lead Dioxide

- 5.2.7 Other Materials (Sodium Iron Phosphate, Oxyhydroxide, and Graphite)

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Consumer Electronics

- 5.3.3 Power Tools

- 5.3.4 Energy Storage

- 5.3.5 Other Applications (Medical Devices, Aerospace Components, etc)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middl East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 BASF SE

- 6.4.3 Hitachi Ltd

- 6.4.4 Johnson Matthey

- 6.4.5 LG Chem

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 MITSUI MINING & SMELTING CO. LTD

- 6.4.8 POSCO FUTURE M

- 6.4.9 PROTERIAL, Ltd.

- 6.4.10 Sumitomo Metal Mining Co. Ltd

- 6.4.11 Targray

- 6.4.12 Umicore

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Cathode Material and Efficient Electrolyte

- 7.2 Other Opportunities