|

市場調查報告書

商品編碼

1537719

半導體鍵合設備:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Semiconductor Bonding Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

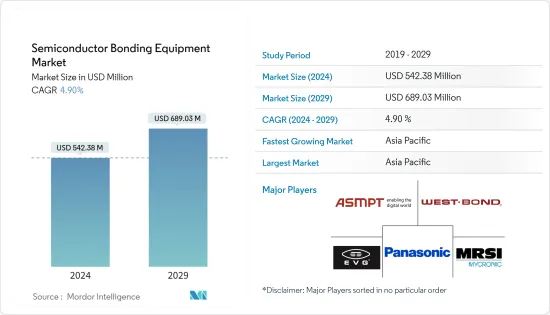

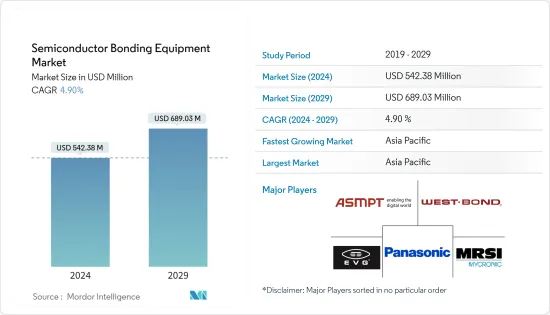

預計 2024 年半導體鍵合設備市場規模為 5.4238 億美元,預計 2029 年將達到 6.8903 億美元,在預測期內(2024-2029 年)複合年成長率為 4.90%。

由於對具有更高效率、吞吐量和更小占地面積的半導體晶片的需求不斷成長,半導體鍵合設備將變得更加通用,這將在預測期內推動市場需求。

主要亮點

- 隨著數位化影響的加大,半導體市場正在蓬勃發展。值得注意的是,這導致政府推出了進一步的計劃來支援 5G 部署。例如,歐盟委員會很早就認知到5G網路的重要性,並為5G技術的開發和研究建立了官民合作關係。

- 隨著未來十年晶片需求的飆升,全球半導體產業預計到 2030 年將成為價值 1 兆美元的產業。這種成長是由公司和國家向半導體製造、材料和研究投入大量資金推動的,以確保晶片和技術的穩定供應,以支持越來越以資料為中心的廣泛行業的成長。

- 製造關鍵技術組件的半導體行業由於需求激增而成為頭條新聞。根據《華爾街日報》最近的一份報告,半導體被列為繼原油、精製油和汽車之後全球第四大貿易商品(進口和出口總合)。這是因為半導體對於各種行業的高運算應用至關重要,包括電子和製造、農業、醫療保健、基礎設施、娛樂、交通、通訊、軍事系統、能源管理和太空。

- 當產品需要黏合兩個晶粒或晶圓時,可以使用多種方法。除了選擇鍵合方法本身的類型之外,還必須決定要鍵合的材料是晶圓還是晶粒的形式。所選的鍵合製程是鍵合擁有成本的主要因素。對於給定製程來說,三個最重要的因素是上游工程、鍵結製程的週期時間以及鍵合製程的產量比率。

- 全球新冠疫情的爆發和遏制COVID-19傳播的限制措施嚴重擾亂了半導體鍵合設備產業的全球供應鏈,影響了企業的產能。儘管感染 COVID-19 的患者數量大幅減少,但這些組件的材料供應和需求方面的重大問題仍需要解決,這對市場成長構成了挑戰。

半導體鍵合設備市場趨勢

功率IC和功率分離式元件應用領域佔據主要市場佔有率

- 功率半導體裝置有助於在各種應用中實現高效的電源管理、轉換和控制。人們對節能和電力消耗日益成長的興趣正在增加功率半導體裝置的重要性。該市場的促進因素包括更低的損耗、更好的控制、更高的耐用性以及在標準和故障條件下的可靠性能。隨著功率半導體的需求不斷增加,功率IC和鍵結技術的市場也有望擴大。

- 該領域的成長是由行業的快速數位化和互聯設備的增加所推動的。這些設備需要高效率的電源管理和高效能功率半導體裝置。透過利用這些裝置,可以實現最佳功率轉換,減少能量損失並提高電子系統的整體能源效率。

- 由於對高能源效率設備的需求不斷成長,該細分市場正在經歷成長。無線和可攜式電子產品的激增、汽車行業向電氣化的轉變以及這些設備的使用不斷增加進一步推動了這一需求。

- 該行業越來越傾向於電源模組和整合解決方案。功率半導體製造商正在轉向緊湊、高度整合的模組,這些模組整合了開關、二極體和輔助器等各種功率元件,以簡化系統設計、減少元件數量並提高整體系統效率。為了保持競爭力,功率半導體公司可以在產品設計過程的早期了解障礙和市場趨勢,從而受益。供應商增加投資以增加功率半導體的產量預計將影響市場擴張。

- 電源 IC 和分立元件的顯著進步提高了電源管理效率。系統結構的最新進展減少了 AC-DC 電源適配器的尺寸和組件數量,從而創造了更有效率的 AC-DC 電源適配器。新 PoE(乙太網路供電)標準的推出實現了更高的電力傳輸能力,並促進了連網型照明等創新設備類別的創建。電子製造商越來越重視最大限度地降低電力消耗,而家用電子電器的需求不斷增加,是推動電源 IC 需求的主要因素。這些因素可能會增加對黏合設備的需求。

- 智慧型手機的通訊速度顯著提高,需要電池模組才能滿足處理要求。電源轉接器現在配備了離散半導體,由於電池供電設備銷量的增加,預計需求將激增。物聯網應用的成長預計將進一步推動對離散半導體的需求。

- 例如,根據愛立信的數據,全球蜂巢式物聯網連接預計到 2022 年將達到 19 億,到 2027 年將達到 55 億。隨著 5G 的發展,智慧型手機的普及率不斷提高,預計將推動市場成長。

- 同樣,旨在為全球消費者提供技術增強和協作設備的物聯網應用的重大技術進步預計也將對市場成長產生積極影響。物聯網應用的擴展導致智慧型設備和小型半導體的激增,從而導致對先進半導體鍵合設備的需求增加。

- 愛立信表示,2022 年至 2028 年間,全球連網設備數量將幾乎翻倍,這主要是由於短距離物聯網設備的增加。預計到 2028 年,此類設備的數量將約為 287.2 億台。隨著這些物聯網連接設備的需求不斷成長,對電源IC的需求也預計會增加,從而推動鍵合設備市場的成長。

亞太地區可望成為快速成長的市場

- 半導體產業已成為亞洲經濟成長的重要推手。其快速擴張和技術進步使其成為全球供應鏈的重要組成部分。

- 由於三星電子和台積電等知名公司的存在,亞太地區佔據了全球半導體晶圓代工廠的主要佔有率。韓國、台灣、日本和中國在該地區佔有很大佔有率。台灣在全球晶圓代工廠中佔有顯著佔有率,是半導體價值鏈的重要地區。增加對該地區半導體製造能力的投資預計將顯著促進市場成長。

- 2023年9月,中國推出了400億美元的基金以促進半導體產業發展。中國計劃建立一個國家支持的投資基金,以縮小與全球競爭對手尤其是美國的差距。該計劃可望發展成為中國積體電路產業投資基金(俗稱「大基金」)管理的三支基金中最重要的一支。中國國家主席習近平強調了實現半導體自給自足的重要性,主要是為了回應美國的出口管制措施。該基金已獲得中國當局核准,財政部將出資 600 億元人民幣(83 億美元)。

- 基於不斷成長的國內晶片需求,中國預計將超越美國,成為全球最大的半導體產業強國。根據半導體產業協會預測,到2030年,半導體市場規模預計將加倍,達到1兆美元以上,其中中國將佔這一增量的60%以上。如此快速的成長預計將增加對半導體鍵合設備的需求。

- 新的半導體工廠將生產用於顯示和輔助器、電源管理IC、微控制器和高效能運算邏輯等應用的晶片,並將服務於運算和資料儲存、汽車、無線通訊和人工智慧等市場。增加。該廠月產能為5萬片晶圓,預定年終出貨第一顆晶片。

半導體鍵結設備產業概況

半導體鍵合設備市場高度分散,主要參與者包括 EV Group、ASMPT Semiconductor Solutions、MRSI Systems (Myronic AB)、WestBond Inc. 和 Panasonic Holding Corporation。市場參與企業正在參與聯盟和收購,以獲得永續的競爭優勢並加強其產品組合。

- 2023 年 11 月 - EV 集團 (EVG) 宣布 EVG 總部擴建下一階段的施工工作已完成。 「Manufacturing V」工廠將作為 EVG 的設備組件製造部門,並將顯著擴大其生產車間和倉庫空間。 EVG 受益於對 EVG混合鍵合解決方案以及其他製程解決方案和製程開發服務的持續高需求,以支援快速成長的先進封裝和3D/異質整合市場,Manufacturing V 工廠的開幕標誌著EVG 的最新擴張階段和投資。

- 2023 年 9 月 - MRSI Systems (Mycronic AB) 宣布推出 MRSI 7001HF,這是流行的 MRSI-7001 平台的新版本。 7001HF 具有加熱鍵合頭,可在鍵合過程中施加高達 500N 的力。此加熱鍵合頭也可從頂部加熱至 400°C。這使得 7001HF 成為高負載晶片鍵合的理想工具,適用於IC封裝的功率半導體燒結和IC封裝的熱壓鍵合等應用。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場吸引力 - 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈/供應鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 半導體廠商加大投資擴大產能

- 各種應用對半導體晶片的需求增加

- 市場限制因素

- 高擁有成本

- 由於電路的小型化而增加了複雜性

第6章 市場細分

- 按類型

- 永久黏接設備

- 臨時黏接設備

- 混合鍵合設備

- 按用途

- 先進封裝

- 電源 IC 和功率分離式元件

- 光子裝置

- MEMS 感測器和致動器

- 工程師基板

- 射頻裝置

- CMOS影像感測器(CIS)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- EV Group

- ASMPT Semiconductor Solutions

- MRSI Systems.(Myronic AB)

- WestBond Inc.

- Panasonic Holding Corporation

- Palomar Technologies

- Dr. Tresky AG

- BE Semiconductor Industries NV

- Fasford Technology Co.Ltd(Fuji Group)

- Kulicke and Soffa Industries Inc.

- DIAS Automation(HK)Ltd

- Shibaura Mechatronics Corporation

- SUSS MicroTec SE

- Tokyo Electron Limited

第8章投資分析

第9章市場的未來

The Semiconductor Bonding Equipment Market size is estimated at USD 542.38 million in 2024, and is expected to reach USD 689.03 million by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Semiconductor bonding equipment finds application owing to the rising demand for semiconductor chips with higher efficiency, processing power, and smaller footprint, thereby driving the demand for the market during the forecast period.

Key Highlights

- As the impact of digitalization has increased, semiconductor markets have boomed. Notably, this has further resulted in government programs to support the 5G deployment. For instance, the European Commission recognized the importance of the 5G network early and established a public-private partnership to develop and research 5G technology.

- With chip demand set to surge over the coming decade, the global semiconductor industry is expected to become a trillion-dollar industry by 2030. This growth is favored by companies and countries funneling vast sums of money into semiconductor manufacturing, materials, and research to guarantee a constant supply of chips and know-how to support growth across a broad swath of increasingly data-centric industries.

- The semiconductor industry, which makes crucial technological components, has been hitting the headlines due to a rampant demand increase. A recent Wall Street Journal report shows that semiconductors rank as the world's fourth-largest traded product (imports and exports, counted), after crude oil, refined oil, and cars. This is because semiconductors are critical for high-computing applications in various industries, including electronics and manufacturing industries, agriculture, healthcare, infrastructure, entertainment, transportation, telecommunications, military systems, energy management, and space, to name just a few.

- Several methods might be used when a product needs the bonding of two dies or wafers. Not only does the type of bonding method itself have to be selected, but it must also be decided whether the items being bonded will be in wafer or die form. The selected bonding process is the primary driver for the cost of ownership of bonding. For a given process, the three most important factors are the cost of the upstream process needed for bonding, the cycle time of the bonding process, and the yield of the bonding process.

- With the global outbreak of the pandemic and restrictive measures taken to control the spread of COVID-19, the global supply chain of the semiconductor bonding equipment industry was significantly disrupted, impacting the production capabilities of various companies. Although the number of COVID-19-infected patients decreased considerably, salient issues with materials supply and demand for these components still need to be addressed, challenging the market's growth.

Semiconductor Bonding Equipment Market Trends

Power IC and Power Discrete Application Segment Holds Significant Market Share

- Power semiconductor devices facilitate efficient power management, conversion, and control across various applications. The increasing focus on energy conservation and power consumption is increasing the significance of power semiconductor devices. The market is supported by reduced losses, enhanced controllability, greater durability, and reliable performance in standard and fault conditions. As the demand for power semiconductors continues to rise, there is also an expected increase in the market for power ICs and bonding technology.

- The segment's growth is driven by the rapid digitization of industries and the increasing number of connected devices. These devices necessitate efficient power management and high-performance power semiconductor devices. By utilizing these devices, optimal power conversion is achieved, energy losses are reduced, and the overall energy efficiency of electronic systems is enhanced.

- The segment is experiencing growth due to the rising demand for high-energy and power-efficient devices. This demand is further fueled by the prevalence of wireless and portable electronic products, the automotive industry's shift toward electrification, and the increased use of these devices.

- The industry has a rising inclination toward power modules and integrated solutions. Manufacturers of power semiconductors are creating compact, highly integrated modules that merge various power components like switches, diodes, and drivers to streamline system design, lower component quantity, and improve overall system efficiency. Power semiconductor firms stand to gain by understanding the obstacles and market trends early in the product design process to remain competitive. The increasing investments by vendors to boost power semiconductor production are anticipated to affect the market's expansion.

- A significant development in power IC and discrete components enhances power management efficiency. Recent advancements in system architectures have led to more efficient AC-DC power adapters with reduced size and component numbers. Introducing new Power-over-Ethernet (PoE) standards has enabled higher power transfer capabilities, facilitating the creation of innovative device categories like connected lighting. The growing emphasis on minimizing electricity consumption by electronics manufacturers and the increasing demand from consumer electronics are the primary drivers behind the necessity for Power ICs. These factors could potentially boost the demand for bonding equipment.

- There is a significant rise in smartphone transmission speeds, necessitating battery modules to accommodate the processing requirements. Power adapters are now incorporating discrete semiconductors, leading to an anticipated surge in demand driven by the increasing sales of battery-powered devices. The growth of IoT applications is projected to propel the demand for discrete semiconductors further.

- For example, according to Ericsson, global cellular IoT connections reached 1.9 billion in 2022 and are estimated to reach 5.5 billion by 2027. The increasing penetration of smartphones with the evolution of 5G is expected to drive the market's growth.

- Similarly, the market's growth is expected to be positively influenced by the significant technological advancements in IoT applications, which aim to provide technologically enhanced linked devices to consumers worldwide. The expansion of IoT applications has increased the prevalence of smart devices and small semiconductors, consequently driving the demand for advanced semiconductor bonding equipment.

- Ericsson stated that the number of connected devices globally will nearly double from 2022 to 2028, primarily due to the rise in short-range IoT devices. It is expected that there will be approximately 28.72 billion such devices by 2028. With the growing demand for these IoT-connected devices, the demand for power ICs is expected to rise, thereby enhancing the growth of the bonding equipment market.

Asia-Pacific is Expected to be the Fastest Growing Market

- The semiconductor industry has emerged as a critical driver of economic growth in Asia. Its rapid expansion and technological advancements have become an important component of the global supply chain.

- Asia-Pacific holds a major share of semiconductor foundries globally, with the region having the presence of prominent companies like Samsung Electronics, TSMC, etc. South Korea, Taiwan, Japan, and China have significant market shares in the region. Taiwan holds a prominent share of the foundries in the world and is a vital region in the semiconductor value chain. The increasing investments in the expansion of semiconductor manufacturing capacities in the region are expected to aid the market's growth significantly.

- In September 2023, China launched a USD 40 billion fund to boost the semiconductor industry. China plans to establish a state-backed investment fund to narrow the gap with global rivals, especially the United States. This initiative is poised to evolve as the most significant of the trio of funds managed by the China Integrated Circuit Industry Investment Fund, generally known as the Big Fund. President Xi Jinping of China stressed the critical importance of achieving semiconductor self-sufficiency, primarily in response to export control measures imposed by the United States. The latest fund obtained approval from Chinese authorities, with the finance ministry committing CNY 60 billion (USD 8.30 billion).

- Based on its expanding domestic chip demand, China is estimated to overtake the United States as the world's top powerhouse in the semiconductor industry. By 2030, the semiconductor market is expected to double in size to reach more than USD 1 trillion, with China contributing over 60% of that increase, according to the Semiconductor Industry Association. Such exponential growth is anticipated to increase demand for semiconductor bonding equipment.

- The new semiconductor fab would fabricate chips for applications like display drivers, power management IC, microcontrollers, and high-performance computing logic, addressing the growing demand in markets like computing and data storage, automotive, wireless communication, and artificial intelligence. This fab claims to have a manufacturing capacity of up to 50,000 wafers per month, and the first chip will come out of the facility before the end of 2026.

Semiconductor Bonding Equipment Industry Overview

The semiconductor bonding equipment market is highly fragmented, with major players like EV Group, ASMPT Semiconductor Solutions, MRSI Systems (Myronic AB), WestBond Inc., and Panasonic Holding Corporation. Market players participate in partnerships and acquisitions to gain sustainable competitive advantage and enhance their product offerings.

- November 2023 - The EV Group (EVG) announced the completion of construction works for the next phase of the expansion of EVG corporate headquarters. The "Manufacturing V" facility serves as EVG's manufacturing department for equipment components and offers a significant expansion of production floor and warehouse space. The opening of the Manufacturing V facility marks the latest expansion phase and investment of EVG, which continues to benefit from the continuing high demand for EVG's hybrid bonding solutions and other process solutions, as well as process development services, to support the fast-growing advanced packaging market and 3D / heterogeneous integration market.

- September 2023 - MRSI Systems (Mycronic AB) announced the launch of the new variant of the well-established MRSI-7001 platform, the MRSI 7001HF. The 7001HF features a heated bond head capable of applying up to 500N forces during bonding. The heated bond head also provides heating from the top at a temperature of 400°C. This makes the 7001HF the perfect tool for high-force die bonders for applications such as power semiconductor sintering for IC packaging or thermocompression bonders for IC packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Driver

- 5.1.1 Increasing Investment by Semiconductor Manufacturers to Expand their Manufacturing Capacity

- 5.1.2 Rising Demand for Semiconductor Chips across Various Application

- 5.2 Market Restraints

- 5.2.1 High Cost of Ownership

- 5.2.2 Increased Complexity Owing to Miniaturization of Circuits

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Permanent Bonding Equipment

- 6.1.2 Temporary Bonding Equipment

- 6.1.3 Hybrid Bonding Equipment

- 6.2 By Application

- 6.2.1 Advanced Packaging

- 6.2.2 Power IC and Power Discrete

- 6.2.3 Photonic Devices

- 6.2.4 MEMS Sensors and Actuators

- 6.2.5 Engineered Substrates

- 6.2.6 RF Devices

- 6.2.7 CMOS Image Sensors (CIS)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 EV Group

- 7.1.2 ASMPT Semiconductor Solutions

- 7.1.3 MRSI Systems. (Myronic AB)

- 7.1.4 WestBond Inc.

- 7.1.5 Panasonic Holding Corporation

- 7.1.6 Palomar Technologies

- 7.1.7 Dr. Tresky AG

- 7.1.8 BE Semiconductor Industries NV

- 7.1.9 Fasford Technology Co.Ltd (Fuji Group)

- 7.1.10 Kulicke and Soffa Industries Inc.

- 7.1.11 DIAS Automation (HK) Ltd

- 7.1.12 Shibaura Mechatronics Corporation

- 7.1.13 SUSS MicroTec SE

- 7.1.14 Tokyo Electron Limited