|

市場調查報告書

商品編碼

1642198

IT 服務 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

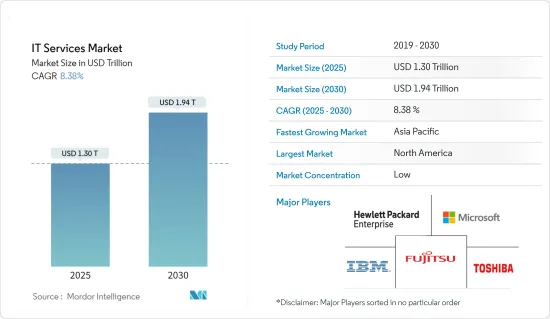

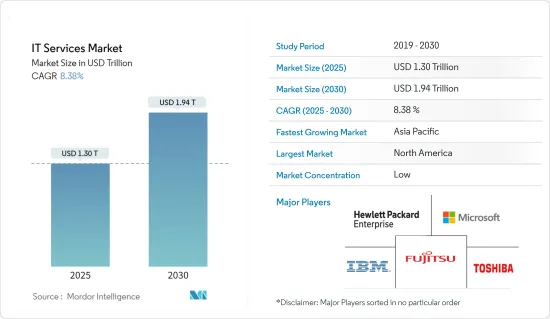

2025 年 IT 服務市場規模預估為 1.3 兆美元,預計到 2030 年將達到 1.94 兆美元,預測期內(2025-2030 年)的複合年成長率為 8.38%。

全球 IT 支出不斷增加,加上軟體即服務 (SaaS) 的採用日益廣泛以及雲端解決方案的成長,都證明了 IT 服務需求的激增。隨著IT基礎設施變得越來越強大,資料外洩的頻率不斷上升,這極大地推動了市場的成長機會。

關鍵亮點

- 由於幾個關鍵因素,IT 服務市場正在經歷強勁成長。第一個驅動力是數位轉型,企業採用數位技術來提高效率、改善客戶體驗並推動創新。此外,雲端運算的應用正在蓬勃發展,為企業提供可擴展且經濟高效的 IT 解決方案。巨量資料和分析的興起凸顯了對先進 IT 服務來管理資料和從中獲取見解的需求。

- 此外,5G、區塊鏈、AR 和 AI 等技術進步的興起可能會對 IT 服務的提供產生正面影響。 5G技術的出現將使企業能夠在自己的場所內建立網路。愛立信預計,到2029年終,全球5G用戶數預計將超過53億,佔所有行動用戶的58%。到2028年,5G將成為主導行動接取技術。值得注意的是,光是 2023 年第四季,5G 用戶數就激增 1.54 億,總合達到 15.7 億。

- 物聯網設備的普及,加上遠距辦公的激增,增加了對強大IT基礎設施和支援的需求。同時,隨著IT環境變得越來越複雜並且需要更多專業技能,企業擴大轉向外包IT服務,從而刺激市場擴張。

- 然而,諸如控制力減弱和關鍵目標不明確等業務挑戰不斷增加、資料外洩不斷增加以及產品客製化和資料遷移的成本問題等因素可能在整個預測期內仍然是重大問題。

IT服務市場的趨勢

隨著雲端基礎平台的出現,雲端服務佔據主導地位

- 在數位時代,企業正在透過採用新技術來尋求敏捷性,主要是透過轉向雲端基礎的環境。在雲端操作意味著嵌入式的連接性和智慧。這將有利於實現智慧營運的無縫整合,並為雲端連結數位服務奠定堅實的基礎。據 Flexera Software 稱,到 2024 年,49% 的受訪者將在 Amazon Web Services (AWS) 上運行關鍵工作負載。

- 雲端基礎的基礎設施提供了靈活的、按需的存取資源的能力,支撐著這些新的數位業務解決方案。隨著雲端基礎平台IT營運的進步,IT服務越來越資料主導、即時化,為企業創造更大的價值,特別是在最佳化營運效率、發掘商機、遠端存取等方面。

- 由於雲端解決方案提供了多種顯著的優勢,雲端運算近年來取得了長足的發展。未來幾年對雲端服務的需求預計會不斷成長,隨著不斷成長的企業部門對 IT 和通訊行業的巨大需求,來自這些最終用戶的IT基礎設施服務範圍預計將迅速擴大。

- 2024年4月,雲端軟體集團公司與微軟公司承諾透過廣泛的、為期八年的策略夥伴關係關係加強合作。此次合作旨在擴大 Citrix虛擬應用程式和桌面平台的市場佔有率。此外,它為透過統一的產品藍圖支援共同創造創新的雲端和人工智慧解決方案鋪平了道路。

- 為了提高生產力、管治和控制力,許多組織都希望在雲端部署核心系統。各類市場供應商都在增加投資,以加速數位轉型。例如,2024 年 5 月,Telefonica 和 Google Cloud 將擴大合作,向市場推出一流的雲端解決方案。兩家公司有一個共用的目標:加速企業的數位轉型。新的夥伴關係涉及透過 Telefonica Tech 擴展可用的 Google Cloud 服務,並且專門針對 B2B 領域量身定做。此次合作也強調了共同關注先進創新,特別是人工智慧(AI)和生成人工智慧(Gen AI)。

預計預測期內北美市場將顯著成長

- 技術的快速進步、雲端運算應用的激增以及對網路安全解決方案的需求不斷成長,正在推動北美 IT 服務市場的發展。企業正在加大數位轉型力度,以提高效率和競爭力。物聯網設備的廣泛使用和巨量資料分析的激增進一步推動了市場的發展。此外,由於新冠疫情的爆發,遠距辦公的轉變也凸顯了彈性IT基礎設施和託管服務的整體重要性。人工智慧和機器學習技術的興起進一步豐富了市場前景。

- 受銀行業成長加速和經濟基本面改善的推動,美國銀行和金融機構正在加快資訊科技服務的支出。該地區的許多企業已開始採用新方法和新流程來獲得競爭優勢,從而產生了人工智慧、物聯網、機器學習(ML)、區塊鏈、機器人、資料科學等新技術。增加。隨著商業和工業領域數位化和連網型設備的日益普及,該地區的物聯網應用和銷售正在激增。這項變更為該地區IT服務的擴張鋪平了道路。

- 市場正面臨參與企業企業和新興參與企業的激烈競爭。這些市場參與企業正在採用有機和無機策略相結合的策略來加強競爭,從而增強市場的成長前景。例如,2023 年 10 月,雲端商務市場 Pax8 與 CyberFOX 合作,為託管服務供應商(MSP) 提供專門從事特權存取管理 (PAM) 的身份存取管理 (IAM) 解決方案。 CyberFOX 擁有幫助超過 2,000 家 MSP 的成功經驗,並致力於幫助其主要中小型企業 (SMB) 客戶提高效率、提高生產力並創造新的收益來源。

- Cognizant 也於 2024 年 3 月與荷蘭企業集團 Pon Holdings 的子公司 Pon IT 續簽了長期夥伴關係關係。透過此次擴展,Cognizant 鞏固了其作為 Pon IT 多元化營業單位的雲端託管服務供應商的地位。隨著合作的進展,Cognizant 計劃推出進一步的增強功能,以使 Pon IT 能夠利用更靈活、直覺和整合的雲端基礎架構。

IT服務業概況

IT服務市場的特點是競爭激烈,主要由廣泛的參與企業推動。這些參與企業目前佔有相當大的市場佔有率,但這種情況正在改變。先進 IT 諮詢服務的興起為新參與企業提供了強大的力量,使他們能夠鞏固自己的地位,尤其是在新興經濟體中。

- 2024 年 5 月,CrowdStrike 與塔塔諮詢服務公司 (TCS) 建立策略夥伴關係關係,透過 AI 原生的 CrowdStrike Falcon XDR 平台增強 TCS 的擴展託管偵測和回應 (XMDR) 產品。此次夥伴關係將使 TCS 能夠利用 Falcon 平台的全面安全功能。這包括雲端安全和下一代 SIEM,促進 SOC 的 AI主導轉型,以更好地預防違規行為。

- 2023 年 7 月,IT 託管服務供應商Windstream Enterprise推出由 ATSG 提供的全新 IT 託管服務組合,為承包客戶提供控制和增強的虛擬整體空間、數位基礎架構和網路安全需求。服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 市場促進因素

- 越來越重視透過外包非核心活動來發揮核心競爭力

- 獲得更多人才和創新空間(相對於入職專業知識)

- 雲端基礎平台的出現使雲端服務成為人們關注的焦點

- 市場問題

- 營運挑戰(例如失去控制的感覺、確定關鍵目標等)

第5章 市場區隔

- 按服務類型

- 專業(系統整合及諮詢)

- 託管

- 按尺寸

- 中小企業

- 大型企業

- 按最終用戶產業

- BFSI

- 通訊

- 醫療

- 零售

- 製造業

- 政府

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 新加坡

- 印尼

- 馬來西亞

- 越南

- 泰國

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Citrix Systems Inc.

- Cisco Systems Inc.

- Dell EMC

- IBM Corporation

- Hewlett Packard Enterprise

- Microsoft Corporation

- TCS Limited

- Toshiba Corporation

- Verizon Communications Inc.

- Fujitsu Ltd

第7章 主要廠商定位

第8章 市場機會與未來趨勢

The IT Services Market size is estimated at USD 1.30 trillion in 2025, and is expected to reach USD 1.94 trillion by 2030, at a CAGR of 8.38% during the forecast period (2025-2030).

The rising IT expenditures throughout the world, alongside the growing embrace of software-as-a-service and expanding cloud solutions, underscore a surging demand for IT services. With an enhanced IT infrastructure, the frequency of data breaches is on the rise, driving the market growth opportunities significantly.

Key Highlights

- The IT Services market is witnessing robust growth, driven by several key factors. Primary among these is digital transformation, where businesses are leveraging digital technologies to boost efficiency, enhance customer experiences, and foster innovation. Moreover, the surge in the adoption of cloud computing is providing businesses with scalable and cost-efficient IT solutions. The rise in big data and analytics underscores the need for sophisticated IT services to manage and derive insights from data.

- Also, the rise in technological advancements like 5G, Blockchain, AR, and AI are likely to have a positive impact on the offerings of IT services. With 5G technology on its way, it is likely to ensure that companies may set up networks on their premises. According to Ericsson, by the end of 2029, global 5G subscriptions are projected to surpass 5.3 billion, representing 58% of all mobile subscriptions. 5G is set to take the lead as the primary mobile access technology by 2028. Notably, in Q4 2023 alone, 5G subscriptions surged by 154 million, reaching a total of 1.57 billion.

- The rise in IoT device adoption, coupled with the surge in remote work setups, is amplifying the demand for robust IT infrastructure and support. Simultaneously, as IT landscapes grow more intricate and demand specialized skills, organizations are increasingly turning to outsourcing for IT services, fuelling market expansion.

- However, factors like increasing operational challenges such as perceived loss of control and identification of key goals, as well as growing data breaches, cost concerns over product customization, and data migration, are some of the reasons that can act as a significant matter of concern, further restricting the market's growth throughout the forecast period.

IT Services Market Trends

Cloud Services is Gaining Traction Due to the Emergence of Cloud-based Platform

- Companies in this digital age are striving for agility through the adoption of new technologies, primarily by transitioning to cloud-based environments. Operating in the cloud involves establishing embedded connections and intelligence. This fosters the seamless integration of smart operations and lays a robust foundation for cloud-linked digital services. According to Flexera Software, in 2024, 49 percent of respondents are already running significant workloads on Amazon Web Services (AWS).

- Cloud-based infrastructure provides flexible, on-demand access to the resources underlying these new digital business solutions. Due to advancements in IT operation across the cloud-based platform, IT services have become more data-driven and real-time, creating greater value for the business, especially in operational efficiency, business opportunity discovery, and remote access optimization.

- There has been a significant breakthrough in cloud computing over the past few years, as cloud solutions offer various significant advantages. As the demand for cloud services is expected to grow over the next few years, with immense demand from the IT and telecommunication industry across the ever-growing corporate sector, the scope for IT infrastructure services from these end users is expected to grow rapidly.

- In April 2024, Cloud Software Group, Inc., and Microsoft Corp. declared that they are strengthening their collaboration plans through an extensive eight-year strategic partnership. This collaboration aims to bolster the market presence of Citrix's virtual application and desktop platform. Furthermore, it will pave the way for the joint creation of innovative cloud and AI solutions underpinned by a unified product roadmap.

- To increase productivity, governance, and control, many organizations aim to deploy their systems' core to the cloud. Various market vendors are driving their investments to accelerate digital transformation. For instance, in May 2024, Telefonica and Google Cloud broadened their collaboration, aiming to deliver top-tier cloud solutions to the market. Their shared goal is to empower businesses to expedite their digital evolution. This renewed partnership entails the expansion of Google Cloud services, available through Telefonica Tech, specifically tailored for the B2B sector. The collaboration also emphasizes a joint focus on advanced innovations, notably in artificial intelligence (AI) and generative AI (Gen AI).

North America is Expected to Register Significant Market Growth During the Forecast Period

- Rapid technological advancements, a surge in cloud computing adoption, and a rising demand for cybersecurity solutions propel North America's IT services market. Businesses are ramping up digita l transformation efforts to boost their efficiency and competitive edge. The market is further bolstered by the widespread adoption of IoT devices and the surge in big data analytics. Moreover, the shift to remote work, hastened by the COVID-19 pandemic, has emphasized the overall significance of resilient IT infrastructure and managed services. The ascent of AI and machine learning technologies further enriches the market's landscape.

- The banking and financial institutions in the United States are accelerating spending on information technology services, which is helped by higher growth in the banking sector and improving economic fundamentals. Many enterprises in the region have begun adhering to newer methods and processes to gain a competitive advantage, resulting in the increasing adoption of emerging technologies, like AI, IoT, machine learning (ML), Blockchain, robotics, and data science. The region is witnessing a surge in IoT applications and sales, propelled by the increasing digitalization and adoption of connected devices in business and industry. This shift is paving the way for the expansion of IT services in the region.

- The market witnessed intense competition, fuelled by both established and emerging players. These industry participants deploy a mix of organic and inorganic strategies to enhance their competitive edge, consequently amplifying market growth prospects. For instance, in October 2023, Pax8, a cloud commerce marketplace, teamed up with CyberFOX to offer managed service providers (MSPs) specialized identity access management (IAM) solutions, with a focus on privileged access management (PAM) via their exclusive product, AutoElevate. CyberFOX, with a track record of assisting more than 2000 MSPs, is dedicated to enhancing efficiencies, boosting productivity, and creating new revenue avenues for its clientele, primarily comprising small and medium-sized businesses (SMBs).

- Also, in March 2024, Cognizant renewed its enduring partnership with Pon IT, a subsidiary of the Dutch conglomerate Pon Holdings. This extension solidifies Cognizant's role as the provider of cloud-managed services for Pon IT's diverse operating entities. As the collaboration progresses, Cognizant is set to introduce additional enhancements, paving the way for Pon IT to leverage a more agile, intuitive, and integrated cloud infrastructure.

IT Services Industry Overview

The IT services market, characterized by intense competition, is primarily led by a wide range of market players. While these players currently hold significant market shares, the landscape is shifting. The rise of advanced IT consultancy services is empowering new entrants, enabling them to bolster their positions, particularly in emerging economies.

- May 2024: CrowdStrike and Tata Consultancy Services (TCS) signed a strategic partnership to power TCS' extended managed detection and response (XMDR) services with the AI-native CrowdStrike Falcon XDR platform. This partnership enables TCS to leverage the comprehensive security features of the Falcon platform. This includes cloud security and next-gen SIEM, facilitating an AI-driven transformation of their SOC to enhance breach prevention.

- July 2023: Windstream Enterprise, an IT-managed service provider, launched a new portfolio of IT Managed Services powered by ATSG, providing enterprise customers access to an entire range of turnkey services to control and power their virtual workspace, digital infrastructure, and cybersecurity needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the market

- 4.4 Market Drivers

- 4.4.1 Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 4.4.2 Greater Access to a Larger Pool of Talent and Scope for Innovation (As Opposed to Onboarding Expertise)

- 4.4.3 Cloud Services is Gaining Traction Due to the Emergence of Cloud-based Platform

- 4.5 Market Challenges

- 4.5.1 Operational Challenge (Such As Perceived Loss of Control and Identification of Key Goals)

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Professional (System Integration and Consulting)

- 5.1.2 Managed

- 5.2 By Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Telecommunication

- 5.3.3 Healthcare

- 5.3.4 Retail

- 5.3.5 Manufacturing

- 5.3.6 Government

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.3 Asia

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Singapore

- 5.4.3.5 Indonesia

- 5.4.3.6 Malaysia

- 5.4.3.7 Vietnam

- 5.4.3.8 Thailand

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Citrix Systems Inc.

- 6.1.2 Cisco Systems Inc.

- 6.1.3 Dell EMC

- 6.1.4 IBM Corporation

- 6.1.5 Hewlett Packard Enterprise

- 6.1.6 Microsoft Corporation

- 6.1.7 TCS Limited

- 6.1.8 Toshiba Corporation

- 6.1.9 Verizon Communications Inc.

- 6.1.10 Fujitsu Ltd