|

市場調查報告書

商品編碼

1624579

北美分散式發電:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)North America Distributed Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

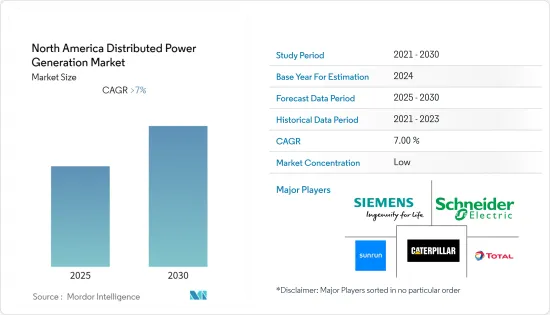

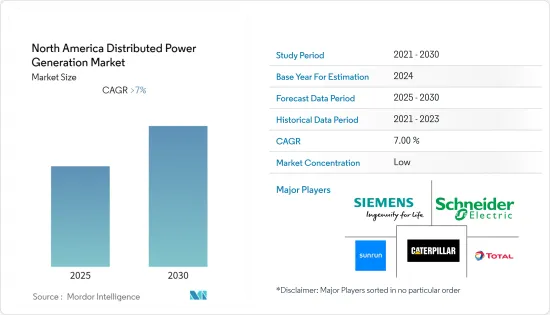

預計北美分散式發電市場在預測期內年複合成長率將超過 7%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從長遠來看,人們對環境問題的認知不斷提高,政府對太陽能板安裝的激勵和稅收優惠政策不斷增加,以及電網擴建高成本,預計將顯著推動市場發展。

- 然而,從 2022 年開始,美國太陽能發電稅額扣抵的減少預計將略微阻礙預測期內的市場成長。

- 由於其多種經濟效益,商業和工業部門對分散式太陽能發電越來越感興趣。分散式太陽能還可作為恆定能源來源,消除傳統電網因電壓波動造成的停機和設備損壞。這些因素預計將在該地區的分散式發電市場創造重大商機。

- 由於日益成長的環境問題和國內分散式發電的經濟效益,預計美國將主導市場。

北美分散式發電市場趨勢

太陽能發電領域正在經歷顯著的成長。

- 預計太陽能產業在預測期內將出現顯著成長。相對較低的安裝成本、不斷下降的太陽能電池板製造價格以及不斷增加的政府補貼使其成為最受歡迎的分散式發電形式。

- 對清潔能源的需求不斷成長是該地區分散式太陽能發電市場的主要驅動力之一。 2021年美國小型太陽能裝置容量增加5.4吉瓦,比2020年的水準(4.4吉瓦)增加23%。 2021年新增的小型太陽能發電容量大部分安裝在住宅中。 2021 年住宅安裝量超過 3.9GW,而 2020 年為 2.9GW。

- 屋頂太陽能為無法用電的家庭提供現代電力服務的好處,減少島嶼和其他依賴燃油發電的偏遠地區的電費,並為居民、中小企業提供發電。

- 商業和工業系統仍然是最大的成長部分,因為它們通常較便宜且具有相對穩定的日間負載曲線。

- 根據太陽能產業協會 (SEIA) 2022 年 9 月進行的一項研究,美國太陽能市場預計在未來五年內將成長約兩倍。最近,美國總統拜登還簽署了該國最大的氣候變遷法案,這可能進一步推動該國太陽能市場的成長。

- 因此,這些因素預計將在預測期內推動北美分散式發電市場的發展。

預計美國將主導市場

- 2021年,北美分散式發電市場由美國主導。預計該國將在未來幾年保持其主導地位。美國在擴展分散式能源系統(DES)方面具有巨大潛力,特別是離網和住宅太陽能發電。電網基礎設施效率低、供不應求以及分散技術的擴充性正在為該國的部署鋪平道路。

- 加州在分散式太陽能發電方面處於全國領先地位,2021 年住宅太陽能安裝量將超過 1,000 兆瓦。該州住宅太陽能發電容量總合超過5,000MW。

- 可再生能源目標因州而異。例如,夏威夷設定了2045年實現100%可再生能源的目標,亞利桑那州設定了2030年實現45%可再生能源的目標,到2045年實現100%清潔能源的目標。這些具體目標預計將有助於進一步振興國內分散式太陽能發電市場。

- 2021年,美國太陽能新增裝置容量達到約23.6GW。太陽能佔該國新增發電能力的最大佔有率。

- 2021年11月,Orsted和Eversource選擇西門子能源為美國一座924兆瓦離岸風力發電提供輸電服務。該發電廠將位於紐約蒙托克角以東 30 多英里處,將產生清潔能源,為紐約州約 60 萬戶家庭供電。預計於 2025 年開始營運。

- 2022年5月,Green Lantern Solar在佛蒙特州韋瑟斯菲爾德開發了500kW太陽能發電工程。該計劃將為佛蒙特州當地的退休社區提供清潔能源。該太陽能發電工程預計每年向承購商分配約 15 萬美元的信貸。

- 由於這些發展,預計美國將在預測期內主導北美分散式發電市場。

北美分散式發電產業概況

北美分散式發電市場較為分散。主要企業(排名不分先後)包括 Caterpillar Inc.、Total SA、Seimens AG、Schneider Electric SE 和 Sunrun Inc.。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027 年之前的市場規模與需求預測

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 技術領域

- 太陽能

- 風力

- 熱電聯產 (CHP)

- 其他技術

- 地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Total SA

- Caterpillar Inc.

- Ballard Power Systems Inc.

- Total SA

- Seimens AG

- Toshiba Fuel Cell Power Systems Corporation

- Sunrun Inc.

- Capstone Turbine Corporation

- Cummins Inc.

- Schneider Electric SE

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 46344

The North America Distributed Power Generation Market is expected to register a CAGR of greater than 7% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, rising environmental concerns, increasing government policies for incentives and tax benefits for solar panel installation, and the high cost of grid expansion are expected to significantly drive the market.

- However, a reduced tax credit for solar power generation in the United States from 2022 is expected to slightly hamper the growth of the market during the forecast period.

- Commercial and industrial sectors are showing a growing interest in distributed solar power generation due to various economic benefits. Distributed solar power also acts as a constant source of energy to eliminate downtimes and equipment damage due to voltage fluctuations in conventional power grids. This factor is expected to create a huge opportunity for distributed power generation market in the region.

- The United States is expected to dominate the market over rising environmental concerns and economic benefits of domestic distributed power generation.

North America Distributed Power Generation Market Trends

Solar PV Sector to Witness Significant Growth

- The solar PV sector is expected to witness significant growth during the forecast period. It is the most popular form of distributed power generation due to its relatively low setup cost, declining prices of solar panel manufacturing, and increasing government subsidies.

- Increasing demand for clean energy is one of the primary drivers for the region's distributed solar power generation market. The small-scale solar capacity installations in the United States increased by 5.4 GW in 2021, up by 23% from the 2020 level (4.4 GW). Most of the small-scale solar capacity added in 2021 was installed on homes. Residential installations totaled more than 3.9 GW in 2021, compared to 2.9 GW in 2020.

- Rooftop solar offers the benefits of modern electricity services to households with no access to electricity, thus reducing electricity costs on islands and in other remote locations that are dependent on oil-fired generation and enabling residents and small businesses to generate their electricity.

- Commercial and industrial systems remain the largest growth segment as they are usually more inexpensive and have a relatively stable load profile during the day, which can enable larger savings on electricity bills, depending on the policy scheme in place.

- According to the survey by the Solar Energy Industries Association (SEIA),conducted in September 2022, the US solar market is expected to nearly triple over the next five years. Recently, the US President Joe Biden also signed the largest climate bill in the country, which may further boost the growth of the country's solar energy market.

- Therefore, such factors are expected to drive the North American distributed power generation market during the forecast period.

United States is Expected to Dominate the Market

- The United States dominated the North American distributed power generation market in 2021. The country is expected to continue its dominance in the coming years as well. The United States holds vast potential for the expansion of distributed energy systems (DES), notably in the form of off-grid and residential solar. Inefficiencies in the power grid infrastructure, power supply shortages, and the scalability of decentralized technology pave the way for the deployment in the country.

- California leads the distributed solar PV sector in the country, with more than 1,000 MW residential solar PV installations in 2021. The state has a total residential installed capacity of over 5,000 MW.

- Different states have set different goals to increase their individual renewable energy targets. For example, Hawaii has set a 100% renewable target by 2045, while Arizona has set a 45% renewable by 2030 and 100% clean energy by 2045. These individual targets are expected to help further boost the country's distributed solar power generation market.

- In 2021, the new solar photovoltaic capacity installations in the United States reached approximately 23.6 gigawatts. Solar had the largest share of new electricity-generating capacity in the country.

- In November 2021, Orsted and Eversource selected Siemens Energy to supply transmission system for a 924-MW Offshore Wind Farm in the United States. The plant is located more than 30 miles east of Montauk Point, New York, and will generate clean energy to power nearly 600,000 homes in New York. It is expected to be operational in 2025.

- In May 2022, Green Lantern Solar developed a 500-kW solar project in Weathersfield, Vermont. The project will supply clean energy to a local retirement community in Vermont. The solar project is estimated to generate approximately USD 150,000 annually in credits divided among the off-takers.

- Hence, due to such developments, the United States is expected to dominate the North American distributed power generation market during the forecast period.

North America Distributed Power Generation Industry Overview

North America's distributed power generation market is fragmented. Some of the major companies (in no particular order) include Caterpillar Inc., Total SA, Seimens AG, Schneider Electric SE, and Sunrun Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar PV

- 5.1.2 Wind

- 5.1.3 Combined Heat and Power (CHP)

- 5.1.4 Other Technologies

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Total SA

- 6.3.2 Caterpillar Inc.

- 6.3.3 Ballard Power Systems Inc.

- 6.3.4 Total SA

- 6.3.5 Seimens AG

- 6.3.6 Toshiba Fuel Cell Power Systems Corporation

- 6.3.7 Sunrun Inc.

- 6.3.8 Capstone Turbine Corporation

- 6.3.9 Cummins Inc.

- 6.3.10 Schneider Electric SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219