|

市場調查報告書

商品編碼

1635369

發電領域無損檢測:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)NDT in Power Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

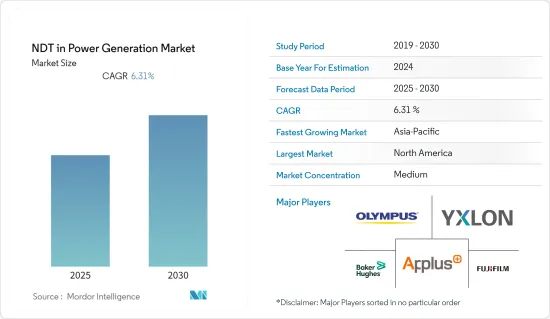

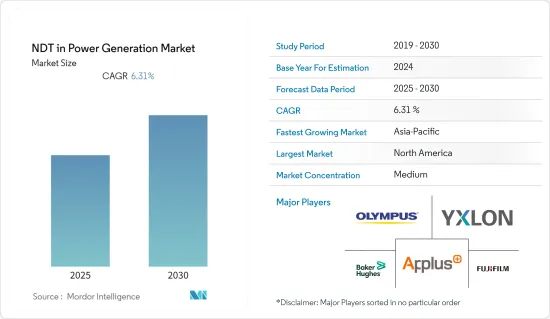

預計發電無損檢測市場在預測期間的複合年成長率為 6.31%。

主要亮點

- 發電行業正在經歷許多變化,包括整體效率的提高和所用材料品質的提高。暴露於操作或環境條件下可能會導致意外損壞。 NDT 可協助您檢查此類缺陷並在它們成為更大問題之前解決它們。

- 無損檢測在電力行業的主要應用範圍是幫助確保工廠設備的安全性、完整性和可靠性,例如壓力容器、鍋爐、熱交換器、管道和管道。水泥建築物的檢查是工廠壽命評估的一部分,因為這些材料通常構成工廠設備建造的一個組成部分。

- 北美是發電領域無損檢測設備市場的旗手,並且繼續擁有先進無損檢測應用的機會。近年來,亞太地區尤其是中國、印度、日本和韓國的電力需求快速成長。這項變化為發電無損檢測市場提供設備和服務的公司創造了巨大的市場機會。隨著環保天然氣發電廠的出現,亞太地區對非破壞性檢測設備的需求預計將增加。

- 此外,數位成像技術日益提高的可用性和適應性也有望提高發電行業無損檢測設備方法的成本效益。新的無損檢測儀器技術還可以實現連續資料收集、儲存、線上檢測、高級即時資料模擬以及資訊解釋。這些技術正在為市場創造重大機會。

- 此外,各種法規要求發電廠進行壽命評估程序作為安全措施。除此之外,還需要進行檢查,檢查設備是否有損壞,並採取必要的措施進行控制。這種情況可望擴大核能發電領域的商機。

- 美國機械工程師協會 (ASME) 和國際標準化組織 (ISO) 等多個政府機構和地區機構已製定嚴格的措施,以確保設備安全,同時監督工程服務測試過程。這對於獲得相關機構的批准和證書至關重要,這將對無損檢測市場產生積極影響。

發電無損檢測的市場趨勢

目視檢查預計將顯著成長

- 目視檢查設備包括內視鏡、高速攝影機、紅外線攝影機和顯微鏡,用於檢測檢體表面的洩漏和裂縫。它們也用於發電行業的品質保證、維護和修理。目視檢查在大量生產或最終檢查過程中進行。

- 此外,目視檢查設備包括用於兩種類型檢查的設備:直接檢查和間接檢查。直接檢驗設備是由一名檢驗員或檢驗員直接對材料進行檢驗和評估。

- 可使用管道鏡、纖維內視鏡和高清光學元件等工具進行直接目視檢查。它們用於難以到達的區域,例如機器內部和鎖後面。在間接目視檢查中,用相機對要檢查的區域進行拍照,顯示在監視器上,並由大量人員進行檢查。

- 由於技術進步和發電行業的數位化,公司正在創新自動視覺檢測設備。例如,RNA 製造的電腦影像檢查系統可以滿足 100% 檢測的高速品管要求。它可用於各行業的所有類型的自動化和機器人應用,包括系統整合、分類、生產、製造和發電產業。

- 此外,研究市場上的許多公司都提供遠端視覺檢測設備。例如,貝克休斯提供耐用的遠端視覺檢測設備,可以更輕鬆、更準確地收集和分析資料。該公司使用保證測量精度的Real3D和提供出色影像品質的TrueSight等技術。該公司的視覺檢測設備旨在滿足發電行業對安全、效率和準確性的現代需求。

亞太地區預計將出現顯著成長

- 目前,中國是世界上最大的電力生產國。該國的能源需求預計將增加,從而推動能源生產的成長。無損檢測在石化燃料領域的應用佔據市場主導地位。該國的電力產業基礎設施老化程度也不斷增加,因此必須使用無損檢測設備來識別並確保這些結構的完整性。因此,預計該國的無損檢測服務在預測期內將快速成長。

- 2021年2月,中國運作燃煤發電量38.4吉瓦(GW)。中國也支持2020年新增煤電裝置容量36.9GW,是2019年的三倍。目前,正在開發的燃煤發電容量為247吉瓦,足以供應整個德國。無損檢測設備市場預計將從這些規劃的發電廠中獲得重大商機。

- 印度發電能力位居世界第五。發電量也高居世界第三。截至2021年3月,印度國家電網裝置容量為382.15GW。這顯示目前對無損檢測設備的需求以石化燃料產業為主,核能無損檢測設備正逐漸獲得發展動能。

- 此外,截至年終,韓國有超過84座煤電廠(CPP)、27座燃氣電廠(GPP)和23座核能發電廠(NPP)在運作。多項研究顯示,韓國電力需求與前一年同期比較%,有4座核能發電廠、8座CPP在建,並宣布再建設6座CPP,增加了該地區無損檢測機組的數量。 。

- 據日本核能工業論壇稱,6個地點的12座核子反應爐已核准運作,兩座新發電廠正在建設中,預計將在預測期內運作,發電領域的無損檢測也已獲得批准。 。

發電無損檢測產業概況

發電領域的無損檢測 (NDT) 市場競爭激烈,由幾個主要企業組成。越來越多的法規要求各種組織進行壽命評估程序作為安全措施,再加上檢查設備損壞情況所需的定期檢查,正在塑造發電領域的無損檢測市場。該市場的主要企業正在推出創新的新產品並建立夥伴關係和協作,以獲得競爭優勢。

- 2021 年 2 月 - Controle Mesure Systemes 開發了名為 Probus 的軟體。它收集NDT設備提供的資訊、顯示訊號、分析訊號、做出篩選決策並產生檢查報告。 Probus是無損偵測線的決策中心。所有感測器資料都可以集中管理,並且可以控制測試台致動器。 Probus 軟體的主要目的是產生單一產品或批次的檢驗報告,以確保可追溯性。它可以列出檢測到的缺陷及其位置,並提供控制證明。

- 2021 年 1 月 -Olympus Corporation推出創新的 DP 系列相機,該系列相機共用智慧功能和精確的色彩精度,可簡化工業顯微鏡的成像。 DP28相機提供4K解析度的高解析度影像。同時,DP23 相機的全高清解析度與有用的功能相平衡,使其對幾乎所有工業影像處理應用(包括發電行業)具有出色的價值。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 嚴格的法規強制執行安全標準

- 缺陷檢測的需求增加以降低維修成本

- 基礎設施老化和維護需求增加

- 市場限制因素

- 熟練勞力短缺及培訓規定

第6章 市場細分

- 按類型

- 服務

- 裝置

- 透過檢測技術

- 射線照相檢查

- 超音波探傷檢驗

- 目視檢查

- 渦流探傷

- 其他測試技術

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Olympus Corporation

- Fujifilm Corporation

- Baker Hughes Company

- Yxlon International Gmbh(Comet Holding AG)

- Applus+Services Technologies, SL

- Mistras Group, Inc.

- SGS Group

- Bureau Veritas SA

- Zetec, Inc.

- Eddyfi

- Intertek Group Plc.

- Team Inc.

第8章投資分析

第9章 市場的未來

The NDT in Power Generation Market is expected to register a CAGR of 6.31% during the forecast period.

Key Highlights

- The power generation industry has undergone various changes, including enhanced overall efficiency and quality of the materials used. Exposure to operating and environmental conditions can cause damages to unforeseen. NDT serves that purpose to check any such flaws and help solve the problem before it elevates.

- The main scope of NDT applications in the power industry is to help ensure plant equipment's safety, integrity, and reliability, such as pressure vessels, boilers, heat exchangers, pipework, and pipelines. The inspection of concrete structures is a part of plant life assessment, as these materials often form an essential part of constructing such plant equipment.

- North America has been the flag bearer for the NDT equipment market in the power generation sector and still has opportunities for advanced NDT applications. Recently, Asia-Pacific has experienced an enormous boom in power demand, mainly from China, India, Japan, and South Korea. This shift has created significant market opportunities for companies providing equipment and services in the NDT market for electricity generation. Due to emerging eco-friendly natural gas power plants, the demand for NDT equipment is expected to be higher in the APAC region.

- Further, the increasing utilization and adaptability of digital imaging technology are also expected to increase the cost-effectiveness of the NDT equipment methods in the power generation industry. Continuous data collection, storage, online inspection, advanced simulation of data in real-time, and interpretation of the information are also possible with new NDT equipment techniques. These techniques are creating greater opportunities in the market.

- Moreover, various regulations make it mandatory for power plants to undergo a life assessment procedure as a safety measure. Apart from this, inspection is also required to check for any damages to the equipment and take necessary countermeasures to control them. This situation is expected to create increased opportunities in the nuclear power sector.

- Several governmental agencies and regional bodies, like the American Society of Mechanical Engineers (ASME) and the International Organization for Standardization (ISO), have been instructed to formulate stringent measures for assuring the safety of instruments, while overseeing the process of engineering services testing. This is crucial for gaining clearances and certificates from the concerned authorities thereby creating a positive impact on the NDT market.

Non-Destructive Testing In Power Generation Market Trends

Visual Inspection Testing is Expected to Witness a Significant Growth

- Visual inspection equipment comprises a wide range of endoscopes, high-speed cameras, thermal imagers, and microscopes, which are used to detect leaks or cracks on the surface of the specimen. These are also used for quality assurance or maintenance and repair in the power generation industry. Visual inspections are carried out during series production or in the final inspection step.

- Also, visual inspection equipment comprises devices used for two different types of inspection, direct and indirect inspections. Direct equipment is employed to test and assess the material directly by one inspector or tester.

- Direct visual inspection can be carried out with tools such as borescopes, fiberscopes, and HD optics. These are used in difficult-to-reach places, such as the insides of machines, locks, etc. In indirect visual inspection, the area to be inspected is captured by a camera and displayed on a monitor by many people.

- Due to the advancement in technology and digitalization of the power generation sector, companies are innovating automated visual inspection equipment. For instance, RNA has manufactured a computerized vision inspection system to meet high-speed quality control requirements for 100% inspection. It can be used for system integrators, sorting, production, manufacturing, and all types of automation and robotic applications in various industries, including the power generation sector.

- Further, many companies offer remote visual inspection equipment in the studied market. For instance, Baker Hughes offers a range of durable remote visual inspection equipment that enable easier and more accurate data collection and analysis. The company uses technologies such as Real3D to ensure measurement accuracy, and TrueSight, for superior image quality. Its visual inspection equipment is built to meet the modern demands for safety, efficiency, and precision in the power generation industries.

Asia Pacific is Expected to Witness Significant Growth

- Currently, China is the world's largest producer of electricity. The country's energy demand is expected to increase, thereby provoking the growth in energy production. NDT application in the fossil fuel segment for power generation dominates the market. Also, there has been an increased count of aging infrastructure in the power industry in the country, making it essential to use NDT equipment to identify and secure the integrity of these structures. As a result, the NDT service in the country is expected to grow rapidly over the forecast period.

- In February 2021, China put a new 38.4 gigawatts (GW) of new coal-fired power capacity into operation. Also, China supported the construction of a further 36.9 GW of coal-fired capacity in 2020, three times more than in 2019. It now has 247 GW of coal power under development, enough to supply the whole of Germany. The NDT equipment market is expected to have tremendous opportunities with these planned power plants.

- India has the fifth-largest power generation capacity globally. Also, the country ranks third globally in terms of electricity production. The Indian national electric grid has an installed capacity of 382.15 GW as of March 2021. This implies that the current demand for NDT equipment is dominated by the fossil fuel sector, with nuclear energy-based NDT equipment slowly gaining momentum.

- Further, South Korea had more than 84 coal power plants (CPP), 27 gas power plants (GPP), and 23 nuclear power plants (NPP) operational at the end of 2016. According to several studies, the electricity demand increased approximately 0.7% Y-o-Y in the country, leading to 4 NPP, 8 CPP under construction, and 6 more CPP announced for the future, creating several opportunities for the NDT equipment market in the region.

- According to the Japan Atomic Industrial Forum, twelve other reactors at six sites have been approved for the restart, and two new powerplants are under construction, which is expected to be operational in the forecast period, increasing the need for NDT services in the power generation sector.

Non-Destructive Testing In Power Generation Industry Overview

Non-Destructive Testing (NDT) in Power Generation Market is competitive in nature and consists of several key players. The increasing regulations, which make it mandatory for different organizations to undergo a life assessment procedure as a safety measure, coupled with the regular inspection required to check for any damage in the equipment, create a market for NDT in the power generation industry. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

- February 2021 - Controle Mesure Systemes developed software called Probus. It collects information provided by NDT equipment to display signals, analyzes them, makes a sorting decision, and creates inspection reports. Probus is the decision-making center of the Non-destructive Testing line. It centralizes all the sensor data and can control the test bench's actuators. The main purpose of the Probus software is to ensure traceability by creating either an individual product or a batch inspection report. They can list the detected defects and their locations and provide proof of control.

- January 2021 - Olympus Corporation launched the innovative DP series cameras that share a suite of smart features and precise color accuracy to simplify industrial microscopy imaging. The DP28 camera offers 4K resolution to provide high-resolution images. In contrast, the DP23 camera's full HD resolution is balanced with convenient features, offering outstanding value for almost any industrial imaging application, including the power generation industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Regulations Mandating Safety Standards

- 5.1.2 Increase in Demand for Flaw Detection to Reduce Repair Cost

- 5.1.3 Aging Infrastructure and Increasing Need for Maintenance

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Workforce and Training Regulations

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Services

- 6.1.2 Equipment

- 6.2 Testing Technology

- 6.2.1 Radiography Testing

- 6.2.2 Ultrasonic Testing

- 6.2.3 Visual Inspection Testing

- 6.2.4 Eddy Current Testing

- 6.2.5 Other Testing Technologies

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Olympus Corporation

- 7.1.2 Fujifilm Corporation

- 7.1.3 Baker Hughes Company

- 7.1.4 Yxlon International Gmbh (Comet Holding AG)

- 7.1.5 Applus+ Services Technologies, S.L

- 7.1.6 Mistras Group, Inc.

- 7.1.7 SGS Group

- 7.1.8 Bureau Veritas S.A.

- 7.1.9 Zetec, Inc.

- 7.1.10 Eddyfi

- 7.1.11 Intertek Group Plc.

- 7.1.12 Team Inc.