|

市場調查報告書

商品編碼

1626298

拉丁美洲的溫度感測器:市場佔有率分析、行業趨勢、統計和成長預測(2025-2030)LA Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

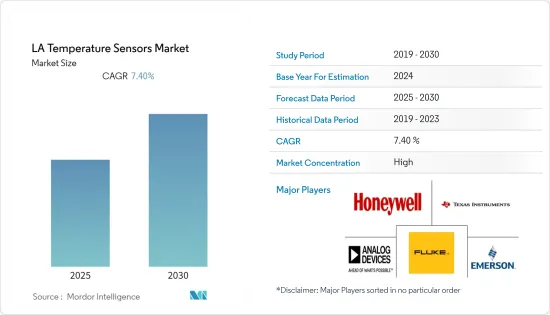

拉丁美洲溫度感測器市場預計在預測期內年複合成長率為 7.4%

主要亮點

- 拉丁美洲是消費電子、石油和天然氣、發電、航太和汽車等多個行業採用和推廣智慧技術的領先國家之一。

- 根據美國國家汽車製造商協會 (ANFAVEA) 的數據,截至 2020 年 2 月,有超過 7,500 輛混合動力汽車和電動車在流通。電動車大量使用溫度感測器,使汽車產業成為該國溫度感測器的主要用戶之一。

- 在該地區的其他國家中,墨西哥一直是主要的石油生產國,並且是世界新的石油前沿,據認為,未來十年全球產量有可能增加 300 萬桶/日。

- 溫度感測器很容易用於對抗 COVID-19。 2020年5月,巴西儒塞利諾·庫比契克機場宣布將為國內航班出發引入體溫感測器系統。此系統可同時測量30人的體溫,並區分正常體溫和其他熱源。

拉丁美洲溫度感測器市場趨勢

汽車工業呈現顯著成長

- 該地區的汽車工業是溫度感測器的重要用戶。專注於自動駕駛汽車領域的英特爾等公司正在墨西哥投資。儘管該國電動車銷量以兩位數的速度成長,但電動車的需求卻慢於混合動力汽車。

- 根據國家統計和地理研究所(INEGI)公佈的資料,2019年1月至2020年2月,墨西哥汽車經銷商銷售了353輛電動車。

- 此外,國家電力和能源局(ANEEL)表示,到 2030 年,電動車的數量預計將增加到 212,000 輛。電動車大量使用溫度感測器,使汽車產業成為全國溫度感測器的主要用戶之一。

- 然而,根據汽車製造協會(ADEFA)的資料,由於需求下降,阿根廷汽車產業的情況相當困難。由於需求減少,阿根廷汽車業的三家供應商已宣布關閉工廠(2020 年 7 月),並計劃遷往巴西。預計這將阻礙溫度感測器在阿根廷汽車產業的使用。

巴西市場佔有率最高

- 巴西是拉丁美洲最大的國家,也是在消費性電子、石油和天然氣、發電、航太和汽車等多個行業實施和傳播智慧技術的領先國家之一。

- 總部位於英國倫敦的石油和天然氣公司 BP PLC 估計,未來五年巴西石油產業可能吸引價值約 220 億美元的投資。因此,到 2025 年,產量預計將增加至約 370 萬桶/日。因此,也存在著透過新計劃進行擴張的可能性。這些統計數據突顯了該領域對溫度感測器不斷成長的需求。

- 該國是巴西航空工業公司最著名和最具代表性的公司之一的所在地,該公司目前是世界第三大民航機、軍用和公務飛機製造商。這使得該國的航太工業成為南半球最大的國家。 BCI Aerospace 預計,未來幾年航太業每年將有 5-6% 的成長機會。

- 巴西在發展智慧城市方面也取得了長足進展。例如,巴西推出了一個新的低成本智慧城市納塔爾,該城市將由 Planet Smart City 開發。該城市將佔地170公頃,居住約15萬人口。該城市將與 Habitux 合作開發。這些發展預計將增加感測器系統的使用,包括溫度感測器。

拉丁美洲溫度感測器產業概況

拉丁美洲溫度感測器市場競爭激烈,由多家大型企業組成。從市場佔有率來看,目前幾家大公司佔據市場主導地位。這些擁有顯著市場佔有率的領先公司致力於在全球擴大基本客群。這些公司利用策略合作措施來擴大市場佔有率並提高盈利。

- 2021 年 6 月 - Cold Chain Technologies, Inc. 已獲得 ISO 9001:2015 認證,作為一家擁有 50 多年保護溫度敏感產品完整性的智慧解決方案的全球供應商,Cold Chain Technologies, Inc. 宣布廣泛擴張至

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 工業 4.0 和高速工廠自動化的發展

- 消費性電子產品對穿戴式裝置的需求不斷成長

- 市場限制因素

- 原物料價格波動

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 有線

- 無線的

- 依技術

- 紅外線的

- 熱電偶

- 電阻溫度檢測器

- 熱敏電阻

- 溫度變送器

- 光纖

- 其他

- 按最終用戶產業

- 化學/石化

- 石油和天然氣

- 金屬/礦業

- 發電

- 飲食

- 車

- 醫療保健

- 航太/軍事

- 家電

- 其他最終用戶產業

- 按國家/地區

- 巴西

- 墨西哥

- 其他拉丁美洲

第6章 競爭狀況

- 公司簡介

- Siemens AG

- Panasonic Corporation

- Texas Instruments Incorporated

- Honeywell International Inc.

- ABB Ltd

- Analog Devices Inc.

- Fluke Process Instruments

- Emerson Electric Company

- STMicroelectronics

- Microchip Technology Incorporated

- NXP Semiconductors NV

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Gunther GmbH Temperaturmesstechnik

- TE Connectivity Ltd

- Denso Corporation

- Omron Corporatio

- FLIR Systems

- Thermometris

- Maxim Integrated Products

- Kongsberg Gruppen

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 47082

The LA Temperature Sensors Market is expected to register a CAGR of 7.4% during the forecast period.

Key Highlights

- Latin America is one of the leading adopters and promoters of smart technology in various industries, such as consumer electronics, oil, gas, power generation, aerospace, and automotive.

- According to the Associacao Nacional dos Fabricantes de Veiculos Automotores (ANFAVEA), As of February 2020, there are more than 7,500 hybrid and electric vehicles in circulation. Electric vehicles significantly utilize temperature sensors, making the automotive sector one of the country's prominent users of temperature sensors.

- Among other countries in the region, Mexico has traditionally been the dominant producer of oil and is being considered the world's new oil frontier with a potential to add three Million BPD to the global output during the next decade.

- Temperature sensors were readily used in combat against covid-19. In May 2020, the Juscelino Kubitschek Airport in Brazil announced the implementation of a body-heat sensor system for domestic departures. The system measures the temperature of 30 people at a time and can differentiate normal body temperatures from other sources of heat.

Latin America Temperature Sensors Market Trends

Automotive Industry to Show Significant Growth

- The automotive sector of the region is a significant user of temperature sensors. Companies such as Intel, which are focusing on the autonomous vehicle space, are investing in Mexico. The sales of electrified vehicles in the country have increased at a two-digit pace, although the demand for electric cars is growing slower than that of hybrid units.

- According to the data made available by the National Institute of Statistics and Geography (INEGI), auto dealers in Mexico sold 353 electrified vehicles between January 2019 and February 2020.

- Moreover, The National Agency of Electric Energy (ANEEL) suggests that the number of electric vehicles is expected to rise to 212,000 by 2030. Electric vehicles significantly utilize temperature sensors, making the automotive sector one of the country's prominent users of temperature sensors.

- However, the state of the automotive industry in Argentina has been quite challenging due to the decreasing demand, according to data from Asociacion de Fabricantes de Automotores (ADEFA). In response to the decline in demand, three supplier companies of the automotive industry in Argentina have announced the closure of factories (July 2020), with plans of migrating to Brazil. This is expected to hamper the usage of temperature sensors in the automotive sector of Argentina.

Brazil to Hold the Highest Market Share

- Brazil, the largest country in the Latin American region, is one of the leading countries involved in adopting and promoting smart technology in various industries, such as consumer electronics, oil, gas, power generation, aerospace, and automotive.

- BP PLC, an oil and gas firm based out of London, United Kingdom, estimates that Brazil could attract about USD 22 billion worth of investment in the oil sector in each of the next five years. Owing to this, the production is expected to increase to around 3.7 Million BPD by 2025. This has been providing the scope for expansion, possibly in new projects. Such statistics highlight the rising demand for temperature sensors in the sector.

- The country is home to the most prominent representative company named Embraer, a firm that is currently the third-major manufacturer of commercial, military, and executive aircraft in the world. This places the country's aerospace industry as the largest in the Southern Hemisphere. According to BCI Aerospace, the aerospace industry has potential opportunities for annual growth of 5-6% over the next few years.

- Brazil has also been witnessing significant development of smart cities. For instance, Brazil launched a new low-cost smart city, Natal, which is expected to be developed by Planet Smart City. The city is expected to be developed in 170 hectares and to house around 150,000 people. The city is to be developed in partnership with Habitax. Such developments are expected to increase the usage of sensor systems, including temperature sensors.

Latin America Temperature Sensors Industry Overview

The Latin America Temperature Sensor market is competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- June 2021 - Cold Chain Technologies, an ISO 9001:2015 certified global provider with more than 50 years of developing and delivering smart solutions that protect the integrity of temperature-sensitive products, announced an extensive expansion into Latin America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 & Rapid Factory Automation

- 4.3.2 Increasing Demand for Wearable in Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Fluctuation in Raw Material Prices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 By End-user Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Panasonic Corporation

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Honeywell International Inc.

- 6.1.5 ABB Ltd

- 6.1.6 Analog Devices Inc.

- 6.1.7 Fluke Process Instruments

- 6.1.8 Emerson Electric Company

- 6.1.9 STMicroelectronics

- 6.1.10 Microchip Technology Incorporated

- 6.1.11 NXP Semiconductors NV

- 6.1.12 GE Sensing & Inspection Technologies GmbH

- 6.1.13 Robert Bosch GmbH

- 6.1.14 Gunther GmbH Temperaturmesstechnik

- 6.1.15 TE Connectivity Ltd

- 6.1.16 Denso Corporation

- 6.1.17 Omron Corporatio

- 6.1.18 FLIR Systems

- 6.1.19 Thermometris

- 6.1.20 Maxim Integrated Products

- 6.1.21 Kongsberg Gruppen

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219