|

市場調查報告書

商品編碼

1651027

中東和非洲溫度感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)MEA Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

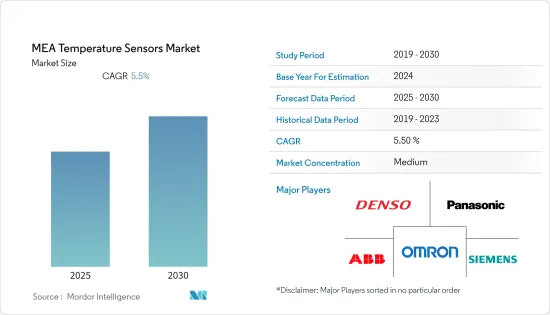

預測期內中東和非洲溫度感測器市場預計複合年成長率為 5.5%

關鍵亮點

- 該地區擁有該地區成長最快的製造業之一。由於政府的支柱計劃、低稅率和商業友好法規,預計領先的溫度感測器製造商將在該國投資。

- 由於進口關稅低、燃料成本低等因素,阿拉伯聯合大公國是海灣合作理事會中汽車產業實力最強的國家之一。預計到 2030 年,杜拜將投入數百萬迪拉姆作為獎勵,讓 42,000 輛電動車上路。通用汽車希望透過推出雪佛蘭電動車來提高該地區的銷量。杜拜警察局也經營一支小型 Bolt EV 車隊。

- 此外,沙烏地阿拉伯正尋求將經濟從石油轉向其他來源,並正在與約旦和埃及就建設價值 5,000 億美元的可再生能源工業區進行談判。該區域名為 NEOM,將專注於能源、水、生物技術、食品和先進製造等行業,以推動對自動化的需求並鼓勵工業相關人員在該地區投資。

- COVID-19 疫情已對全球供應鏈和多種產品的需求造成嚴重干擾,預計到 2020年終無線溫度感測器的採用將受到影響。然而,醫療應用需求的不斷成長正在推動市場成長。各公司正在投資和合作以滿足這一需求。

中東和非洲的溫度感測器市場趨勢

汽車產業正在呈現顯著成長

- 由於進口關稅低、燃料成本低廉等因素,阿拉伯聯合大公國是海灣合作理事會中汽車工業實力最強的國家之一。預計到 2030 年,杜拜將投入數百萬迪拉姆作為獎勵,實現電動車保有量達到 42,000 輛。通用汽車希望透過推出雪佛蘭電動車來提高該地區的銷量。此外,杜拜警察局還營運著一支小型 Bolt EV 車隊。

- 杜拜政府宣布,2025年將向該國新興工業製造業投資750億美元,目標到2025年使製造業對該國GDP的貢獻率達到25%。通用汽車計劃在2023年全球推出20款新電動車,並打算在阿拉伯聯合大公國銷售該產品線。阿拉伯聯合大公國政府的目標是到2020年減少二氧化碳排放15%,並實現電動車普及率達20%。

- 此外,汽車產業正在遊說政府在南非創建電動車市場。日產和寶馬正在遊說南非政府降低電動車的進口關稅,以降低電動車的價格。 2019 年 9 月,南非最大的公共電動車充電站安裝商之一 GridCars 完成了國家電動車高速公路的鋪設,連接了南非最繁忙高速公路沿線的主要城市。 2019 年 11 月,南非機場公司 (ACSA) 宣布與寶馬公司合作,在全國三個 ACSA 機場安裝電動車充電站。這些發展可能會使汽車產業成為溫度感測器的重要終端用戶。

石油和天然氣佔市場佔有率最高

- 該地區不斷發現新的油氣井,同時舊的、未充分利用的油井正在重新煥發活力。例如,2019 年 11 月,國有阿布達比國家石油公司 (ADNOC) 宣布了一項重大鑽井平台擴建計劃,預計到 2025 年將增加數十座鑽機。該公司還表示,該地區發現傳統天然氣礦床,使其天然氣蘊藏量增加至約 273 兆立方英尺 (TCF)。這種活性化發展正推動對溫度感測器的需求。

- 同時,沙烏地阿拉伯是世界主要石油液體產品生產國和出口國之一,目前是僅次於俄羅斯的世界第二大原油生產國。沙烏地阿拉伯經濟嚴重依賴石油和石油相關產業,包括石化和精製,使得石油和天然氣產業成為該國溫度感測器的主要用戶之一。

- 此外,科威特還與哈里伯頓簽署了一份價值 6 億美元的海上探勘契約,將在未來兩到三年內鑽探六口高壓高溫 (HP/HT)探勘井。此次與哈里伯頓合作的新的海上探勘計劃未來可能每天額外貢獻10萬桶石油。海上探勘工作預計將於 2020 年中期開始,第一座鑽機預計將於 2020 年 7 月部署,第二座鑽機預計將於 2021 年 1 月部署。預計這些發展將積極推動市場成長。

- 阿曼發現了新的探勘活動,預計將對市場產生積極影響。例如,BP和埃尼集團已簽署了77個區塊的探勘與生產合約。預計將導致鑽井活動增加8.0%。 2020 年 12 月,阿曼成立了一家名為阿曼能源開發公司(EDO)的新上游石油和天然氣公司,該公司將收購該國更成熟的能源公司阿曼石油開發公司(PDO)的股份並開發計劃。

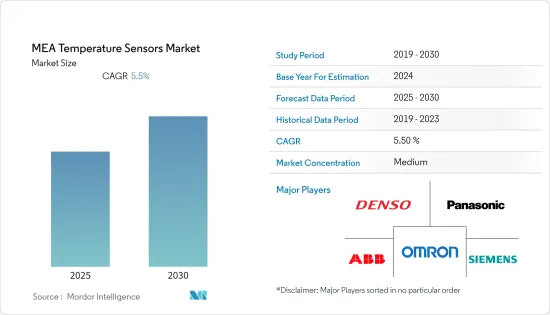

中東和非洲溫度感測器產業概況

中東和非洲溫度感測器市場競爭適中,由少數幾家大公司組成。就市場佔有率而言,目前少數幾家參與企業佔據主導地位。然而,隨著電子元件測量和評估技術的進步,新參與企業正在增加其在市場上的佔有率,從而擴大其在新興經濟體的業務範圍。

- 2021 年 8 月——杜拜一所學校的五名學生發明了一種方便的設備和消毒材料,可用於機構的門把,以幫助防止肆虐的 COVID-19 蔓延,並進一步加強同齡人的公共衛生安全。學生們利用了門上有一個可以產生動能的裝置這一事實。他們還添加了基於 Arduino 的溫度感測器和 LED 螢幕,旨在監控每個進門人的體溫。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- COVID-19 工業影響評估

- 市場促進因素

- 工業 4.0 的發展和快速的工廠自動化

- 消費性電子產品中穿戴式裝置的需求不斷增加

- 市場限制

- 原物料價格波動

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 有線

- 無線的

- 依技術分類

- 紅外線的

- 熱電偶

- 電阻溫度檢測器

- 熱敏電阻器

- 溫度變送器

- 光纖

- 其他

- 按最終用戶產業

- 化工和石化

- 石油和天然氣

- 金屬與礦業

- 發電

- 飲食

- 車

- 醫療

- 航太和軍事

- 家用電子電器

- 其他

- 按國家

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

第6章 競爭格局

- 公司簡介

- Siemens AG

- Panasonic Corporation

- Texas Instruments Incorporated

- Honeywell International Inc.

- ABB Ltd

- Analog Devices Inc.

- Fluke Process Instruments

- Emerson Electric Company

- STMicroelectronics

- Microchip Technology Incorporated

- NXP Semiconductors NV

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Gunther GmbH Temperaturmesstechnik

- TE Connectivity Ltd

- Denso Corporation

- Omron Corporatio

- FLIR Systems

- Thermometris

- Maxim Integrated Products

- Kongsberg Gruppen

第7章投資分析

第 8 章:市場的未來

簡介目錄

Product Code: 50289

The MEA Temperature Sensors Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- The region is one of the fastest-growing manufacturing industries in the region. Due to the government's anchor projects, low taxes, and business-friendly regulations, significant manufacturers of temperature sensors are expected to invest in the country.

- The United Arab Emirates has one of the robust automotive sectors in the GCC due to factors such as low import tariffs and low fuel costs. Dubai is expected to spend Millions of Dirhams on incentives to have 42,000 EVs on its streets by 2030. General Motors expects to see increased sales in the region with the launch of its Chevrolet electric vehicle. Besides, Dubai Police also operates a small fleet of Bolt EVs.

- Moreover, Saudi Arabia aims to shift from its oil-based economy and is in talks with Jordan and Egypt for a USD 500 billion industrial zone powered by renewable energy. Known as NEOM, the zone will focus on industries, including energy and water, biotechnology, food, and advanced manufacturing, propelling the demand for automation and encouraging the industry players to invest in the region.

- Due to the outbreak of COVID-19, the global supply chain and demand for multiple products have majorly been disrupted, due to which wireless temperature sensors adoption is anticipated to be influenced until the end of the year 2020. However, the growing demand for medical applications is driving the market growth. Various players are investing and collaborating to cater to the requirements.

MEA Temperature Sensors Market Trends

Automotive industry to Show Significant Growth

- The United Arab Emirates has one of the robust automotive sectors in the GCC due to factors such as low import tariffs and low fuel costs. Dubai is expected to spend Millions of Dirhams on incentives to have 42,000 EVs on its streets by 2030. General Motors expects to see increased sales in the region with the launch of its Chevrolet electric vehicle. Besides, Dubai Police also operates a small fleet of Bolt EVs.

- The government has announced that it aims to invest USD 75 billion by 2025 in the country's new industrial manufacturing sector and that the manufacturing sector would contribute 25% toward the country's GDP by 2025. General Motors is planning to launch 20 new electric vehicle models globally by 2023 and intends to market the UAE product line. The UAE government targets up to a 15% reduction in carbon emissions by 2020 and a 20% adoption of EVs within its fleet, making the automotive sector one of the prominent users of temperature sensors in the region.

- Moreover, The automotive industry has pushed the government to create a market for electric vehicles in South Africa. Nissan and BMW have been pushing the South African government to reduce the import duty on electric vehicles to make them more affordable. In September 2019, GridCars, one of the largest installers of public electric vehicle charging stations in South Africa, completed its national EV highway rollout that connects significant cities along some of South Africa's busiest highways. In November 2019, Airports Company South Africa (ACSA), in partnership with BMW SA, announced EV charging stations across three ACSA's airports in the country. Such developments will make the automotive sector a significant end-user of temperature sensors.

Oil and Gas to Hold the Highest Market Share

- The region is witnessing the continuous discovery of new oil and gas wells while the old and underutilized ones are rejuvenated. For instance, in November 2019, the government-owned company, Abu Dhabi National Oil Co. (ADNOC), announced a significant rig fleet expansion program, which is expected to add dozens of rigs by 2025. The company also claims to have increased its gas reserves to about 273 trillion cubic feet (TCF), owing to the discovery of unconventional gas deposits in the region. Such increasing developments are driving the demand for temperature sensors.

- On the other hand, Saudi Arabia is one of the world's largest producers and exporters of petroleum liquids, which is currently the world's second-largest crude oil producer, right after Russia. The Saudi Arabian economy remains heavily dependent on oil- and petroleum-related industries, including petrochemicals and petroleum refining, making the oil and gas sector one of the prominent users of temperature sensors in the country.

- Moreover, Kuwait signed a USD 600 Million offshore exploration contract with Halliburton to drill six high-pressure, high-temperature (HP/HT) exploration wells in the next two to three years. This new offshore exploration project with Halliburton could help add around 100,000 barrels of oil per day in the future. The offshore exploration work was anticipated to start in mid-2020, with the first rig anticipated to come by July 2020 and the second rig by January 2021. Such developments are expected to drive the market's growth positively.

- New exploration activities are being witnessed in Oman, which is expected to impact the market positively. For instance, BP and Eni signed an E&P agreement for Block 77. This is anticipated to result in an 8.0% increase in drilling activity. In December 2020, Oman created a new upstream oil and gas company known as Energy Development Oman (EDO), which will take a stake in the country's more established energy company, Petroleum Development Oman (PDO), and develop its projects.

MEA Temperature Sensors Industry Overview

The Middle East and Africa Temperature Sensor market is moderately competitive and consists of a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in the measurement and assessment of the electronic component, new players are increasing their market presence, thereby expanding their business footprint across the emerging economies.

- August 2021 - A Dubai school's five pupils have created a handy device and sterilization materials that can be used on an institution's door handles to prevent the spread of the raging Covid-19 outbreak and enhance their peers' public health safety further. The pupils relied on the fact that the door has equipment that produces kinetic energy. They also added Arduino-based temperature sensors and an LED screen in a bid to monitor the temperature of all those passing through the door.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 & Rapid Factory Automation

- 4.3.2 Increasing Demand for Wearable in Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Fluctuation in Raw Material Prices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 By End-user Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 By Country

- 5.4.1 UAE

- 5.4.2 Saudi Arabia

- 5.4.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Panasonic Corporation

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Honeywell International Inc.

- 6.1.5 ABB Ltd

- 6.1.6 Analog Devices Inc.

- 6.1.7 Fluke Process Instruments

- 6.1.8 Emerson Electric Company

- 6.1.9 STMicroelectronics

- 6.1.10 Microchip Technology Incorporated

- 6.1.11 NXP Semiconductors NV

- 6.1.12 GE Sensing & Inspection Technologies GmbH

- 6.1.13 Robert Bosch GmbH

- 6.1.14 Gunther GmbH Temperaturmesstechnik

- 6.1.15 TE Connectivity Ltd

- 6.1.16 Denso Corporation

- 6.1.17 Omron Corporatio

- 6.1.18 FLIR Systems

- 6.1.19 Thermometris

- 6.1.20 Maxim Integrated Products

- 6.1.21 Kongsberg Gruppen

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219