|

市場調查報告書

商品編碼

1628732

亞太地區溫度感測器 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)APAC Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

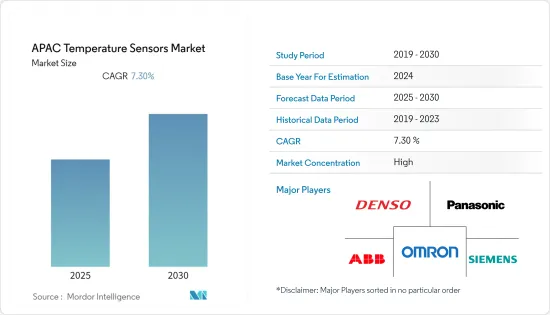

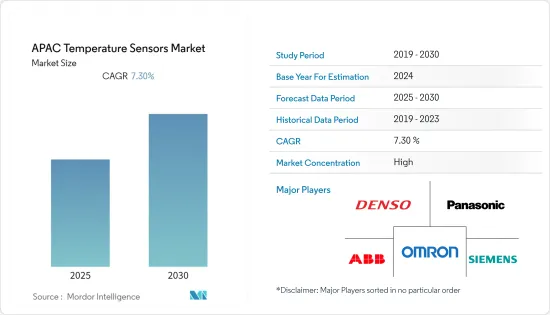

亞太地區溫度感測器市場預計在預測期內複合年成長率為 7.3%

主要亮點

- 石油和天然氣以及化學和石化產業是該地區溫度感測器最主要的消費者。作為煉油廠、化學和石化加工廠、金屬、採礦和製造業的主要樞紐之一,該地區對溫度感測器的需求正在增加。石油和天然氣領域使用的氣動和液壓是溫度感測器的主要應用。近年來,隨著油田基礎設施的進步,溫度感測器的需求也隨之增加。

- 印度汽車工業在經濟和人口方面都處於有利的成長位置,有助於提高國內利益和出口潛力。作為「印度製造」計畫的一部分,印度政府的目標是讓汽車製造業成為該計畫的關鍵驅動力。正如《2016-2026 年汽車使命計畫》(AMP) 中所強調的那樣,該計畫預計到 2026 年乘用車市場將成長兩倍,達到 940 萬輛。預計這將增加該地區汽車行業溫度感測器的採用。

- 據自然資源部稱,自2020年5月1日起,在中國註冊且淨資產不低於3億元人民幣(4,300萬美元)的外國公司將可參與油氣探勘和生產。此舉是北京推動擴大石油和天然氣開發並將民間資本引入上游能源項目的一部分。 2019年,中國生產天然氣1,730億立方米,生產石油1.91億噸。上游探勘和生產年度投資為3,320億元人民幣(478億美元)。該地區的工業發展正在推動溫度感測器的成長,並擴大在石油和天然氣行業的應用。

- 該地區的醫療領域也大量使用溫度感測器。例如,2020 年 1 月下旬,上海公共衛生臨床中心 (SPHCC) 利用美國連線健診新興企業VivaLNK 的連續溫度感測器來監測 COVID-19 患者,防止醫護人員接觸病毒,從而顯著降低了風險。 2020 年 4 月,SPHCC 宣布利用藍牙物聯網產品和解決方案供應商 Cassia Network 的閘道結合 VivaLNK 的醫用溫度感測器來監測 COVID-19 患者。

亞太溫度感測器市場趨勢

消費性電子產品大幅成長

- 根據印度品牌資產基金會(IBEF)預測,印度家用電子電器及家用電子電器(ACE)市場複合年成長率將達9%,預計到2022年將達到3.15兆印度盧比(483.7億美元)。預計這將在預測期內推動溫度感測器市場的成長。該地區已經推出了多種採用溫度感測器的家用電子電器產品。

- 日本正在努力透過引入戰略空間來提高其國家石油儲備的靈活性,使精製業能夠有效地採購所需的輕質原油。該地區也是家用電子電器市場的主要零件製造商,也是該地區溫度感測器的主要用戶之一。

- 幾家當地公司推出了包含溫度感測器的產品。例如,2020年6月,DetelPro宣布推出“Make in Bharat”,據稱這是全球價格最低的紅外線測溫儀。該產品享有 2 年保修,售價為 INR 999+GST。

- 2020 年 10 月,電子公司 Hammer 推出了 Pulse智慧型手錶,擴大了在印度的產品系列。該公司的新款智慧型手錶配備了溫度感測器,聲稱電池續航時間為一周,售價為 2,799 印度盧比。此次產品發布顯示印度對具有溫度感測器的智慧型手錶有著巨大的需求。

市場佔有率最高的車

- 韓國政府正積極推廣自動駕駛汽車。韓國作為全球主要汽車製造國之一,對引領新興產業的ADAS發展需求龐大。因此,預計在預測期內溫度感測器將廣泛採用。

- 中國政府也將汽車工業(包括汽車零件產業)視為主導產業之一。中國中央政府預計,2020年中國汽車產量將達3,000萬輛,到2025年將達到3,500萬輛。因此,汽車產業有望成為中國溫度感測器的突出應用領域之一。然而,中國工業協會修改了2020年的預測,根據COVID-19疫情的影響,預計上半年銷量將下降近10%,全年銷量將下降5%。

- 2020年8月,韓國安裝了配備溫度感測器和紫外線燈的防毒公車候車亭,只有在溫度低於攝氏37.5度時門才會滑開。首爾東北部設立了 10 個先進的公車候車亭設施,以抵禦季風降雨、夏季炎熱和 COVID-19。

亞太地區溫度感測器產業概況

亞太溫度感測器市場競爭激烈,由多家大型企業組成。從市場佔有率來看,目前有幾家大型參與企業佔據市場主導地位。然而,憑藉創新和永續的包裝,許多公司正在透過贏得新契約和開拓新市場來擴大其市場佔有率。

- 2020年12月-台灣Thinking Electronic Industrial生產NTC和PTC熱敏電阻器以及溫度感測器等零件,預計隨著全球汽車銷售的復甦,2021年汽車出貨量將大幅成長。據該公司介紹,其馬達和PTC熱敏電阻器和溫度感測器主要應用於LED汽車燈、車輛控制單元、車上娛樂系統系統、電力傳輸系統、充電樁、車載充電器、電池組和車載設備。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 工業 4.0 和高速工廠自動化的發展

- 消費性電子產品對穿戴式裝置的需求不斷成長

- 市場限制因素

- 原物料價格波動

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 有線

- 無線的

- 科技

- 紅外線的

- 熱電偶

- 電阻溫度檢測器

- 熱敏電阻器

- 溫度變送器

- 光纖

- 其他

- 最終用戶產業

- 化學/石化

- 石油和天然氣

- 金屬/礦業

- 發電

- 飲食

- 車

- 醫療保健

- 航太/軍事

- 家用電子電器

- 其他

- 國家名稱

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- Siemens AG

- Panasonic Corporation

- Texas Instruments Incorporated

- Honeywell International Inc.

- ABB Ltd

- Analog Devices Inc.

- Fluke Process Instruments

- Emerson Electric Company

- STMicroelectronics

- Microchip Technology Incorporated

- NXP Semiconductors NV

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Gunther GmbH Temperaturmesstechnik

- TE Connectivity Ltd

- Denso Corporation

- Omron Corporatio

- FLIR Systems

- Thermometris

- Maxim Integrated Products

- Kongsberg Gruppen

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 52418

The APAC Temperature Sensors Market is expected to register a CAGR of 7.3% during the forecast period.

Key Highlights

- The oil and gas and chemical/petrochemical industries are some of the most prominent consumers of temperature sensors in the region. Being one of the major hubs for refineries, chemical and petrochemical processing plants, and metals, mining, and manufacturing, the region has been experiencing an increase in the demand for temperature sensors. The pneumatics and hydraulics used in the oil and gas sector are the major applications for temperature sensors. The infrastructure build-out in the oil patches has increased in recent years, thereby translating the demand for temperature sensors.

- The Indian automotive industry is well-positioned for growth, economically and demographically, serving both domestic interest and export possibilities, which are set to rise in the near future. As a part of the "Make In India" scheme, the Government of India aims to make automobile manufacturing the main driver for the initiative. The scheme expects the passenger vehicles market to triple to 9.4 Million units by 2026, as highlighted in the Auto Mission Plan (AMP) 2016-2026. This factor is expected to rise the adoption of temperature sensors in the automotive sector of the region.

- According to the Ministry of Natural Resources, from May 1, 2020, foreign firms registered in China with net assets no lower than CNY 300 Million (USD 43 Million) would be allowed to participate in oil and gas exploration and production. This move comes as part of Beijing's push to increase oil and gas development and bring private capital into the upstream energy business. In 2019, China produced 173 billion cubic meters of natural gas and 191 Million metric tons of oil. Annual investment in upstream exploration and production was CNY 332 billion (USD 47.8 billion). The development of industries in the region has been driving the growth of temperature sensors, owing to their growing applications in the oil and gas industry.

- The medical sector of the region has also been significantly utilizing a temperature sensor. For instance, at the end of January 2020, Shanghai Public Health Clinical Center (SPHCC) utilized US-based connected health startup VivaLNK's continuous temperature sensor to monitor COVID-19 patients, which has been considerably reducing the risks of healthcare workers being exposed to the virus. In April 2020, SPHCC announced that they are utilizing Bluetooth IoT products and solutions provider Cassia Network's gateways, coupled with VivaLNK's medical temperature sensors to monitor COVID-19 patients.

Asia-Pacific Temperature Sensor Market Trends

Consumer Electronics to Show Significant Growth

- According to the India Brand Equity Foundation (IBEF), the Indian appliances and consumer electronics (ACE) market are expected to register a CAGR of 9% to reach INR 3.15 trillion (USD 48.37 billion) in 2022. This is expected to boost the temperature sensors market growth over the forecast period. Multiple consumer electronic products have been launching in the region that incorporates temperature sensors.

- Japan has been making efforts toward boosting its flexibility with the national petroleum reserves by introducing strategic space that will allow the country to efficiently procure crude oil that is in line with the refining sector's requirement for lighter grades. The region is also a major manufacturer of components to the consumer electronics market, which is one of the significant users of temperature sensors in the area.

- Several local companies have been launching products incorporating temperature sensors. For instance, in June 2020, DetelPro announced the launch of its 'Make in Bharat,' reportedly the world's most low-cost infrared thermometer. The launched product comes with two years of warranty and is priced at INR 999 + GST.

- In October 2020, an electronics company, Hammer, expanded its product portfolio in India with the launch of its Pulse smartwatch. The new smartwatch from the company comes with a temperature sensor and claims to offer a one-week battery life and a price of INR 2,799. The product launches show that there is a significant demand for smartwatches incorporating temperature sensors in India.

Automotive to Hold the Highest Market Share

- The South Korean government has been actively promoting autonomous vehicles. As South Korea is one of the major car manufacturing countries globally, there is a massive demand for developing ADAS to lead the new industry. This is expected to lead to the broad adoption of temperature sensors over the forecast period.

- The Chinese government also views its automotive industry, including the auto parts sector, as one of the prominent industries. The country's Central Government expects China's automobile output to reach 30 Million units by 2020 and 35 Million units by 2025. This is posed to make the automotive sector one of the prominent uses of temperature sensors in China. However, the China Association of Automobile Manufacturers revised the predictions for 2020, forecasting an almost 10% drop in sales for the first half of the year and 5% for the full year, based on the COVID-19 outbreak.

- In August 2020, South Korea installed anti-virus bus shelters with temperature sensors and UV lamps, where the door will slide open only if their temperature is below 37.5C. Ten advanced bus shelter facilities have been installed in a north-eastern district of Seoul, offering protection from monsoon rains and summer heat and COVID-19.

Asia-Pacific Temperature Sensor Industry Overview

The Asia Pacific Temperature Sensor Market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with innovative and sustainable packaging, many of the companies are increasing their market presence by securing new contracts and by tapping new markets.

- December 2020 - Taiwan-based Thinking Electronic Industrial engaged in the production of components, such as NTC and PTC thermistors and temperature sensors, expects its shipments for the automotive landscape to increase significantly in 2021, coupled with the recovery of global vehicle sales. According to the company, its NTC and PTC thermistors and temperature sensors have been significantly applied to LED auto lights, vehicle control units, in-car entertainment systems, power transmission systems, charging piles, in-vehicle chargers, battery packs, and automotive motors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 & Rapid Factory Automation

- 4.3.2 Increasing Demand for Wearable in Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Fluctuation in Raw Material Prices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 End-user Industry

- 5.3.1 Chemical & Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Panasonic Corporation

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Honeywell International Inc.

- 6.1.5 ABB Ltd

- 6.1.6 Analog Devices Inc.

- 6.1.7 Fluke Process Instruments

- 6.1.8 Emerson Electric Company

- 6.1.9 STMicroelectronics

- 6.1.10 Microchip Technology Incorporated

- 6.1.11 NXP Semiconductors NV

- 6.1.12 GE Sensing & Inspection Technologies GmbH

- 6.1.13 Robert Bosch GmbH

- 6.1.14 Gunther GmbH Temperaturmesstechnik

- 6.1.15 TE Connectivity Ltd

- 6.1.16 Denso Corporation

- 6.1.17 Omron Corporatio

- 6.1.18 FLIR Systems

- 6.1.19 Thermometris

- 6.1.20 Maxim Integrated Products

- 6.1.21 Kongsberg Gruppen

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219