|

市場調查報告書

商品編碼

1628721

美國溫度感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)US Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

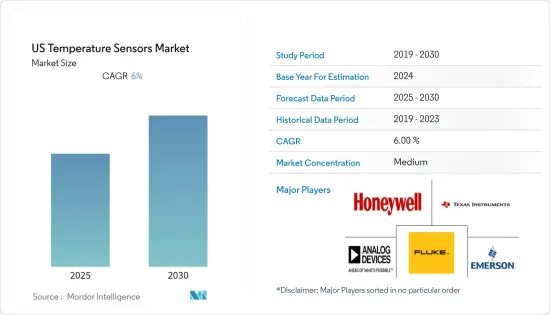

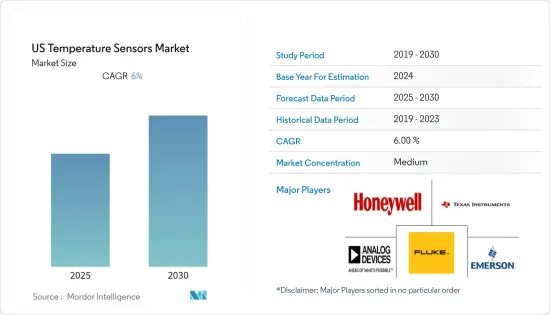

美國溫度感測器市場預計在預測期內複合年成長率為 6%

主要亮點

- 航太、石油天然氣和採礦等行業的特點是運行環境惡劣且複雜,需要合適的感測器能夠承受這些極端的外部環境,並以所需的準確度、可靠性、精度和可重複性運行,而採用這些感測器對於感測器的採用至關重要。

- 近年來,溫度監測技術的快速進步在無線溫度感測器的成長中發揮了關鍵作用。幾家大型製造商正專注於實施紅外線和熱感測器等先進概念。先進概念的使用預計將在未來幾年內打開巨大的市場成長潛力。

- 隨著國防費用的增加,無線型感測器已成為國防工業中具有多種應用的新興技術領域。國防和航太車輛的綜合車輛健康監測 (IVHM) 等應用主要需要確保機組人員安全和車輛安全。

- 感測器網路的本質是監測環境的物理特性並將這些物理測量結果轉換為電脈衝。感測器網路主要測量溫度等屬性。在許多情況下,網路被設計為感知環境並根據感知的資料對物理環境採取行動。

- 溫度感測器利用物聯網連接來加速 COVID-19篩檢。市場對篩檢製程設備的需求使得溫度感測器的需求大幅增加,各公司合作發明新的溫度感測器元件。例如,PolySense Technologies 和 Semtech 合作開發了一系列基於 Semtech遠距(LoRa)低功率廣域網路(LPWAN) 的人體溫度監測設備。該感測器為第一線醫護人員提供即時資料,以快速篩檢體溫過高的個人,這是 COVID-19 最常見的症狀之一。

美國溫度感測器市場趨勢

紅外線溫度感測器推動市場成長

- 紅外線溫度感測器廣泛應用於各種國防應用中,例如光學目標瞄準和可變發射率測量,並且通常可用於追蹤活動。然而,所有這些應用都非常複雜,並且由於全球軍事支出的增加而持續需求。

- 近年來,就連像百事可樂旗下受歡迎的菲多利公司這樣的頂級零食製造商也推出了烘焙點心而非油炸的新產品。這種趨勢,加上全球嚴格的食品安全法規,預計很快將為紅外線溫度感測器創造巨大的市場機會。

- FLIR(前視紅外線)是此類技術的著名供應商。 FLIR 技術已用於測試港口、邊境和機場的體溫升高。過去一個月,該公司的訂單大幅增加。

- 預測性維護是紅外線 (IR) 溫度感測器的功能應用之一,企業越來越關注預測性維護、自動化和物聯網。

汽車佔據最高的市場佔有率

- 由於該地區存在多家現有製造商,美國佔有很大的市場佔有率。根據美國汽車政策委員會的數據,汽車製造商及其供應商是美國最大的製造業,約占美國GDP的3%。

- 此外,僅在過去五年中,FCA US、福特和通用汽車就增加了美國組裝廠、引擎廠、變速箱廠、公司總部、研發實驗室、行政辦公室以及連接和支援它們的其他基礎設施的數量。宣布投資約350億美元。

- 通用汽車等汽車製造商計劃在 2023 年推出 20 款新型電動車。特斯拉也透過推出可靠、高效的電動車,改變了該國電動車細分市場的面貌。

- 美國汽車工業直接和間接僱用了數十萬美國,投資數十億美元。全球汽車產業每年在研發上花費近 1,050 億美元,其中美國估計花費 180 億美元將更新、更先進的感測器整合到汽車中。

美國溫度感測器產業概況

美國溫度感測器市場適度分散,參與者眾多,包括Honeywell、模擬設備、德克薩斯以及其他區域和本地製造商。持續的產品升級和產業融合正在推動市場朝向高度差異化的產品發展。此外,公司正在採取併購和夥伴關係等策略性舉措,以提高其在市場上的影響力。我們介紹一些最近的市場發展趨勢。

- 2020 年 7 月 - Maxim Integrated Products Inc. 和 Analog Devices Inc. 宣布雙方已簽署最終協議。 Analog Devices, Inc. 將透過全股票交易收購 Maxim, Inc.,企業總價值將超過 680 億美元。該交易預計將於 2021 年夏季完成。此交易增強了 Analog Devices, Inc. 的實力,並擴大了其在多個市場的影響力和規模。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 工業 4.0 和高速工廠自動化的發展

- 消費性電子產品對穿戴式裝置的需求不斷成長

- 市場限制因素

- 原物料價格波動

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 有線

- 無線的

- 依技術

- 紅外線的

- 熱電偶

- 電阻溫度檢測器

- 熱敏電阻器

- 溫度變送器

- 光纖

- 其他

- 按最終用戶產業

- 化學/石化

- 石油和天然氣

- 金屬/礦業

- 發電

- 飲食

- 車

- 醫療保健

- 航太/軍事

- 家電

- 其他最終用戶產業

第6章 競爭狀況

- 公司簡介

- Siemens AG

- Panasonic Corporation

- Texas Instruments Incorporated

- Honeywell International Inc.

- ABB Ltd

- Analog Devices Inc.

- Fluke Process Instruments

- Emerson Electric Company

- STMicroelectronics

- Microchip Technology Incorporated

- NXP Semiconductors NV

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Gunther GmbH Temperaturmesstechnik

- TE Connectivity Ltd

- Denso Corporation

- Omron Corporatio

- FLIR Systems

- Thermometris

- Maxim Integrated Products

- Kongsberg Gruppen

第7章 投資分析

第8章市場的未來

The US Temperature Sensors Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- Industries, such as aerospace, oil and gas, and mining, among others, are characterized by the harsh and complex operating environment and the adoption of a suitable sensor to withstand such external environment extremities and perform at the desired accuracy, reliability, precision, and repeatability are of crucial importance for these end-users.

- Rapid technological advancements in temperature monitoring have played a crucial role in the growth of wireless temperature sensors in the past few years. Multiple large-scale manufacturers have been focusing on implementing advanced concepts such as IR sensors and heat sensors. The usage of advanced concepts is further expected to open up significant potential for the market's growth in the coming years.

- With the increase in defense expenditure, wireless type sensors have been an emerging technology area with multiple applications within the defense industry. Applications such as integrated vehicle health monitoring (IVHM) of the defense and aerospace vehicles are primarily needed to ensure the crew's safety and the vehicle.

- At their essence, the sensor networks have been monitoring the physical characteristics of an environment and then translating those physical measurements to electrical impulses. The sensor networks primarily measure characteristics such as temperature, among others. In various cases, the network has been designed to sense the environment and act on the physical environment based on the sensed data.

- Temperature sensors are employing IoT connectivity to speed COVID-19 screening. The market demand for screening process equipment has enabled the demand for temperature sensors where various firms' collaboration to invent new temperature sensor devices has raised significantly. For instance, Polysense Technologies and Semtech have joined forces in developing a series of human body temperature monitoring devices based on Semtech's Long Range (LoRa) Low-Power Wide-Area Network (LPWAN). The sensors offer real-time data to frontline healthcare workers and quickly screen individuals with high temperatures, one of the most common symptoms of COVID-19.

US Temperature Sensors Market Trends

infrared Temperature Sensors to drive the market growth

- IR temperature sensor applications are found in various defense applications such as optical target sighting and variable emissivity measurements, often helpful in tracking activities. However, all these applications are very advanced and have a continuous demand due to the globally increasing military spending.

- In recent years, even the top snack manufacturers like Frito-Lay North America, Inc, a popular division of Pepsi Co, have started a new range of products rather baked than fried. Such trends, coupled with stringent food safety regulations worldwide, are expected soon to create substantial market opportunities for IR temperature sensors.

- Forward-Looking Infrared (FLIR) has been a prominent vendor for such technology. FLIR technology has been used in ports and borders and airports, and other places to look for elevated body temperatures. The company has witnessed a significant increase in those orders in the past month.

- Predictive maintenance is one of the functional uses of Infrared (IR) temperature sensors in the market; enterprises are increasingly focusing on predictive maintenance, automation, and IoT.

Automotive to Hold the Highest Market Share

- The United States holds a significant market share due to the presence of several established manufacturers in the region. According to the American Automotive Policy Council, automakers and their suppliers are the United States' largest manufacturing sector, responsible for approximately 3% of the US GDP.

- Moreover, over the last five years alone, FCA US, Ford, and General Motors announced investments of nearly USD 35 billion in their US assembly, engine, and transmission plants, headquarters, research and development labs, administrative offices, and other infrastructure that connects and supports them.

- Automakers, like General Motors, have planned to introduce 20 new all-electric vehicles by 2023. Tesla Company also changed the face of the electric vehicle market segment in the country by introducing reliable and efficient electric vehicles.

- The United States's automotive industry, directly and indirectly, employs hundreds of thousands of Americans and invest billions of dollars. It was estimated that the automotive industry annually spends nearly USD 105 billion on R&D worldwide, USD 18 billion of which is spent in the United States to incorporate newer and more advanced sensors into automobiles.

US Temperature Sensors Industry Overview

The United States temperature sensor market is moderately fragmented due to many players operating in the market, such as Honeywell, Analog Devices Inc, and Texas Instruments, among other regional and local manufacturers. Continuous product up-gradation and industry convergence are driving the market towards highly differentiated offerings. Further, players adopt strategic initiatives such as mergers and acquisitions, partnerships, etc., to strengthen their market presence. Some of the recent developments in the market are:

- July 2020 - Maxim Integrated Products Inc. and Analog Devices Inc. announced that they entered into a definitive agreement. Analog Devices Inc. will acquire Maxim in an all-stock transaction that values the combined enterprise at over USD 68 billion. The transaction is expected to close in the summer of 2021. This transaction would strengthen Analog Devices Inc. and increase its reach and scale across multiple markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growth in Industry 4.0 and Rapid Factory Automation

- 4.3.2 Increasing Demand for Wearable in Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Fluctuation in Raw Material Prices

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 By End-user Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Panasonic Corporation

- 6.1.3 Texas Instruments Incorporated

- 6.1.4 Honeywell International Inc.

- 6.1.5 ABB Ltd

- 6.1.6 Analog Devices Inc.

- 6.1.7 Fluke Process Instruments

- 6.1.8 Emerson Electric Company

- 6.1.9 STMicroelectronics

- 6.1.10 Microchip Technology Incorporated

- 6.1.11 NXP Semiconductors NV

- 6.1.12 GE Sensing & Inspection Technologies GmbH

- 6.1.13 Robert Bosch GmbH

- 6.1.14 Gunther GmbH Temperaturmesstechnik

- 6.1.15 TE Connectivity Ltd

- 6.1.16 Denso Corporation

- 6.1.17 Omron Corporatio

- 6.1.18 FLIR Systems

- 6.1.19 Thermometris

- 6.1.20 Maxim Integrated Products

- 6.1.21 Kongsberg Gruppen