|

市場調查報告書

商品編碼

1626888

北美冷凍食品包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

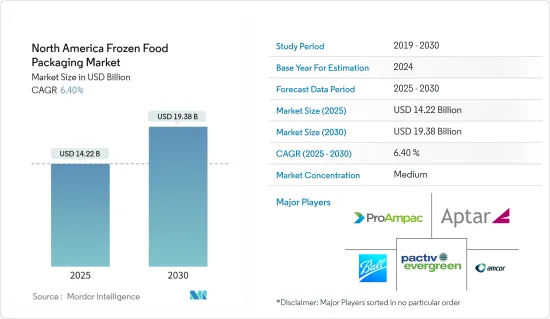

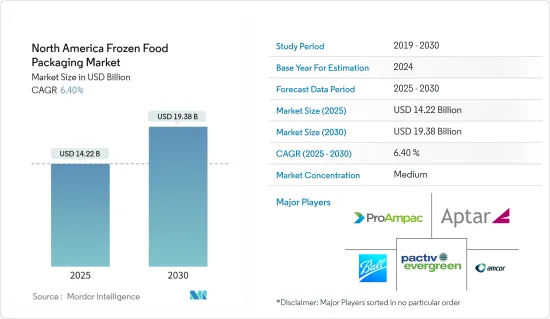

北美冷凍食品包裝市場規模預計到 2025 年為 142.2 億美元,預計到 2030 年將達到 193.8 億美元,預測期內(2025-2030 年)複合年成長率為 6.4%。

主要亮點

- 消費者對便利性的需求不斷成長,推動了冷凍食品銷售的成長,因為冷凍食品比傳統的家常飯菜需要更少的時間和精力。忙碌的生活方式正在促使消費者轉向加工食品,導致對冷凍食品的需求激增。包裝冷凍食品的主要類別包括烘焙產品和冷凍加工食品,其中冷凍已調理食品正在成為值得關注的類別。隨著消費者對食品品質的期望不斷提高,冷藏可以顯著延長保存期限。

- 隨著消費者對冷凍食品越來越感興趣,對永續包裝材料的需求也增加。許多製造商和零售商正在從傳統包裝過渡到可回收、可重複使用和可堆肥的替代品。對冷凍食品和獨立包裝物品的需求激增促使包裝產業競相適應。冷凍食品包裝的創新正在興起,其中顯著的進步包括適用於微波爐產品的蒸氣包裝。此外,低溫運輸技術和提醒用戶溫度變化的智慧包裝的發展預計將滿足這些不斷變化的需求。

- 雜貨購物習慣正在發生巨大變化。越來越多的消費者轉向線上平台購買食品,便利性和安全性成為首要考慮因素。為了應對這些不斷變化的偏好,零售商正在多樣化處理訂單的方式。有競爭力的價格、路邊取貨、宅配、宅配應用程式、遠端取貨等等。

- 零售商正在努力提高其召回價值和在農村、層級和層級地區的影響力,並加強使其促銷計劃更具吸引力。這種動態不僅凸顯了食品雜貨零售業不斷變化的格局,也凸顯了影響這些地區冷凍食品需求的新興機會。

北美冷凍食品包裝市場趨勢

透過零售通路對生鮮肉的需求不斷成長

- 隨著消費者對用於生肉包裝的生物基材料而不是有毒塑膠的需求日益增加,市場前景將在未來幾年發生變化。人們對環境問題的認知不斷提高,加上嚴格的政府監管,可能為市場相關人員創造新的商機。這種動態可能會推動這些參與企業在生鮮肉包裝領域尋求創新解決方案,從而推動整體市場的成長。

- 這種轉變是由於人們認知到富含肉類的蛋白質對健康的好處、生酮飲食等高蛋白飲食的興起以及對預包裝加工肉品的依賴增加而推動的,這對生鮮肉的需求產生了積極的影響。該地區的經濟成長預計也將促進肉類消費。

- 近年來,美國肉類產業表現出一致性。美國農業和經濟研究部的資料顯示,預計 2023 年該國牛肉產量將達到 269.6 億磅,低於 2022 年的 282.9 億磅。截至2021年,牛肉在美國生鮮肉零售額中排名第一,當年銷售額超過300億美元。 2022 年,100% 碎肉的零售價格達到每磅 4.8 美元,高於 2020 年的 3.95 美元。同時,主要雜貨零售商的牛胸肉平均價格約為每磅 8.84 美元。

- 根據食品工業協會統計,百貨公司的肉類銷售近年來最穩定,平均家庭滲透率超過98%,每年購買量接近50次。最暢銷的生鮮肉是牛肉和雞肉,最暢銷的加工肉品是培根和已烹調午餐肉。

- Progressive Grocer發布的一項研究顯示,美國生鮮肉零售額從過去幾年的648.8億美元增加至2022年的866.2億美元。在預測期內將觀察到這一積極趨勢,預計將增加該地區對肉類包裝的需求。

美國顯示出驚人的成長率

- 隨著冷凍食品包裝需求的飆升,產業參與者正在積極投資於產品創新,刺激了該國市場的成長。蓬勃發展的電子商務進一步增加了對包裝解決方案的需求。電子商務不僅增加了購物的便利性,也為各個細分市場的價格帶來了下行壓力。根據 Business Insider 報告,雖然電子商務正在推動零售成長,但對該地區軟包裝的影響也將擴大。

- 美國擁有競爭激烈的零售業,以沃爾瑪、克羅格和艾伯森等主要企業為主導。沃爾瑪來自美國,是全世界最大的零售商。特別是全球前10大零售企業中有5家總部位於美國,可見美國在全球零售業中扮演極為重要的角色。

- 在美國,千禧世代消費者強烈偏好單份、即食食品和飲料,這主要推動了對冷凍食品包裝產品的需求。冷凍食品包裝設計便攜、耐用、輕便,已成為此類產品的熱門選擇。此外,對加工食品和新鮮休閒食品日益成長的需求預計將進一步推動這一需求。

北美冷凍食品包裝產業概況

北美冷凍食品包裝市場是一個競爭激烈的市場,有許多強大的參與企業。其中一些主要參與企業目前在市場佔有率方面處於市場領先地位。這些擁有大量市場佔有率的領先參與企業正專注於擴大海外基本客群。市場上一些主要企業包括 Pactiv Evergreen Inc.、Amcor PLC、ProAmpac LLC、Aptar-Food Protection Inc.、AptarGroup Inc. 和 Ball Corporation Inc.。

- 2024 年 3 月,Amcor 集團與有機優格製造商 Stonyfield Organic 和領先的吸嘴袋包裝製造商 Cheer Pack North America 合作。兩家公司推出了 YoBaby 冷藏優格,這是業界首款全聚乙烯 (PE) 吸嘴袋,從傳統的多層結構轉向更負責任的設計。此次夥伴關係將三位永續性領導者聚集在一起,共同開創市場優先的解決方案,在保持最佳性能的同時支持永續性。

- 2023 年 10 月,冷凍有機和實踐水果市場的知名公司 Nature's Touch 宣布收購 SunOpta Inc. 的冷凍水果業務 Sunrise Growers 的部分資產。此次收購使 Nature's Touch 能夠加強其在北美地區以客戶為中心的做法,為供應商和零售商帶來許多好處,包括獲得採用環保且方便包裝的一流有機冷凍食品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業地緣政治情景分析

第5章市場動態

- 市場促進因素

- 簡便食品需求增加

- QSR(快速服務餐廳)越來越受歡迎

- 市場限制因素

- 人們越來越偏好天然食品

- 嚴格的政府法規

第6章 市場細分

- 按材質

- 玻璃

- 紙

- 金屬

- 塑膠

- 其他

- 透過食物

- 準備好的飯菜

- 水果和蔬菜

- 肉/雞肉

- 魚貝類

- 烘焙點心

- 其他

- 按包裝產品

- 包包

- 盒子

- 能

- 紙盒

- 托盤

- 饒舌歌手

- 其他

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Pactiv Evergreen Inc.

- Amcor PLC

- ProAmpac LLC

- Aptar-Food Protection(AptarGroup Inc.)

- Ball Corporation Inc.

- Sonoco Products Company

- Tetra Pak International

- Genpack LLC

- WestRock Company

- Sealed Air Corporation

- Universal Plastic Bag Manufacturing Co.

第8章投資分析

第9章市場的未來

The North America Frozen Food Packaging Market size is estimated at USD 14.22 billion in 2025, and is expected to reach USD 19.38 billion by 2030, at a CAGR of 6.4% during the forecast period (2025-2030).

Key Highlights

- With frozen items requiring less time and effort than traditional home-cooked meals, the rising consumer demand for convenience is fueling the growth of frozen product sales. Busy lifestyles are pushing consumers toward processed foods, leading to a surge in demand for frozen food. The primary categories of packaged frozen foods include bakery products and frozen processed foods, with frozen ready-to-eat items emerging as a notable category. Colder storage temperatures can significantly extend shelf life, all while consumer expectations for food quality continue to rise.

- As consumers increasingly turn to frozen foods, there is a growing demand for sustainable packaging materials. Numerous manufacturers and retailers are transitioning from traditional packaging to recyclable, reusable, and compostable alternatives. This surge in demand for frozen foods and individually wrapped items has the packaging industry racing to adapt. Innovations in frozen food packaging are on the rise, with notable advancements like steamable packaging for microwavable products. Furthermore, developments in cold-chain technology and smart packaging, like alerting users to temperature changes, are expected to address these evolving needs.

- Grocery shopping habits have undergone a seismic shift. A growing number of consumers are turning to online platforms for their food purchases, prioritizing convenience and safety. In response to these evolving preferences, retailers are diversifying their order fulfillment methods. These include competitive pricing, curbside pickups, home deliveries, food delivery apps, and pickups from remote locations.

- As retailers strive to enhance their recall value and presence in rural, tier I, and tier II regions, they are intensifying efforts to make their promotional programs more enticing. This dynamic not only underscores the evolving landscape of grocery retailing but also highlights the burgeoning opportunities that are shaping the demand for frozen foods in these regions.

North America Frozen Food Packaging Market Trends

Growing Demand for Fresh Meat Through Retail Channels

- As consumers increasingly demand bio-based materials over toxic plastics for fresh meat packaging, the market outlook is set to evolve in the coming years. Heightened environmental concerns, coupled with stringent government regulations, are poised to create fresh opportunities for market players. Such dynamics could propel these players toward innovative solutions in the fresh meat packaging arena, fueling overall market growth.

- This change has positively impacted the demand for fresh meat and poultry through online and offline retail channels owing to reasons, including the recognition of the health advantages of meat-rich protein, the rise of high-protein diets such as the keto diet, and the upswing in reliance on pre-packaged processed meat. Also, the region's economic growth is expected to boost meat consumption.

- The US meat industry has displayed consistency over recent years. Data from the US Department of Agriculture and Economic Research Service indicates that beef production in the country was projected to reach 26.96 billion pounds in 2023, a decrease from 28.29 billion pounds in 2022. As of 2021, beef led the pack in retail sales among fresh meats in the United States, with sales surpassing USD 30 billion that year. In 2022, the retail price for 100% ground beef reached USD 4.8 per pound, a rise from USD 3.95 in 2020. Meanwhile, beef brisket averaged around USD 8.84 per pound at major grocery retailers.

- According to the Food Industry Association, meat sales have been the most consistent in department retail stores during the last few years, with an average household penetration of more than 98% and nearly 50 shopping trips per year. The top sellers in fresh meat are beef and chicken, while bacon and pre-packed lunch meat are the top sellers in processed meats.

- As per the research published by Progressive Grocer, retail sales of fresh meat in the United States increased in the past few years from USD 64.88 billion to USD 86.62 billion in 2022. This positive trend is also anticipated to be witnessed during the forecast period, pushing the demand for meat packaging in the region.

United States to Witness Significant Growth Rate

- As demand for frozen food packaging surges, industry players are heavily investing in product innovation, fueling market growth in the country. The booming e-commerce landscape is further amplifying the need for packaging solutions. E-commerce not only enhances shopping convenience but also exerts downward pressure on prices across various sectors. According to Business Insider, while e-commerce is propelling retail growth, its impact on flexible packaging is poised to expand in the region.

- The United States boasts a fiercely competitive retail industry, largely propelled by dominant players like Walmart, Kroger, and Albertsons. Walmart, hailing from the United States, stands as the world's largest retailer. Notably, five out of the top ten global retail giants are US-based, underscoring the nation's pivotal role in the global retail landscape.

- In the country, millennial consumers, with their strong preference for single-serving and on-the-go food and beverage items, primarily drive the demand for frozen food packaging products. Designed to be portable, durable, and lightweight, frozen food packaging has emerged as a popular choice for such items. Additionally, the rising appetite for both processed and fresh snack foods is poised to further fuel this demand.

North America Frozen Food Packaging Industry Overview

The North American frozen food packaging market is competitive with several influential players. Some of these important players in terms of market share are currently leading the market. These influential players with significant market shares are focused on expanding their customer base abroad. Some of the key players in the market include Pactiv Evergreen Inc., Amcor PLC, ProAmpac LLC, Aptar-Food Protection Inc. (AptarGroup Inc.), and Ball Corporation Inc.

- March 2024: Amcor Group teamed up with Stonyfield Organic, an organic yogurt producer, and Cheer Pack North America, a premier manufacturer of spouted pouch packaging. Together, they unveiled the industry's inaugural all-polyethylene (PE) spouted pouch for YoBaby refrigerated yogurt, moving away from the previous multi-laminate structure to a more responsible design. This partnership united three sustainability leaders, pioneering a market-first solution that champions sustainability while maintaining top-notch performance.

- October 2023: Nature's Touch, a prominent player in the market of frozen organic and conventional fruits, announced the acquisition of specific assets of Sunrise Growers, the frozen fruit operations of SunOpta Inc. Through this acquisition, Nature's Touch will be able to enhance its customer-centric approach throughout North America, resulting in numerous advantages for suppliers and retailers, such as access to top-notch organic frozen food items in eco-friendly and convenient packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis of Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience Food

- 5.1.2 Increase in Popularity of QSRs (Quick-service Restaurants)

- 5.2 Market Restraints

- 5.2.1 Rising Preference for Natural Food Products

- 5.2.2 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Plastic

- 6.1.5 Other Materials

- 6.2 By Food Product

- 6.2.1 Readymade Meals

- 6.2.2 Fruits and Vegetables

- 6.2.3 Meat and Poultry

- 6.2.4 Seafood

- 6.2.5 Baked Goods

- 6.2.6 Other Food Products

- 6.3 By Packaging Product

- 6.3.1 Bags

- 6.3.2 Boxes

- 6.3.3 Cans

- 6.3.4 Cartons

- 6.3.5 Trays

- 6.3.6 Wrappers

- 6.3.7 Other Packaging Products

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv Evergreen Inc.

- 7.1.2 Amcor PLC

- 7.1.3 ProAmpac LLC

- 7.1.4 Aptar - Food Protection (AptarGroup Inc.)

- 7.1.5 Ball Corporation Inc.

- 7.1.6 Sonoco Products Company

- 7.1.7 Tetra Pak International

- 7.1.8 Genpack LLC

- 7.1.9 WestRock Company

- 7.1.10 Sealed Air Corporation

- 7.1.11 Universal Plastic Bag Manufacturing Co.