|

市場調查報告書

商品編碼

1629763

歐洲冷凍食品包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)Europe Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

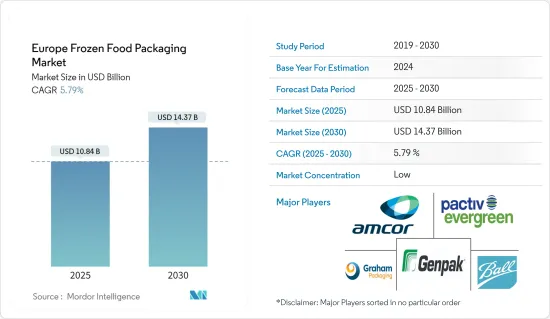

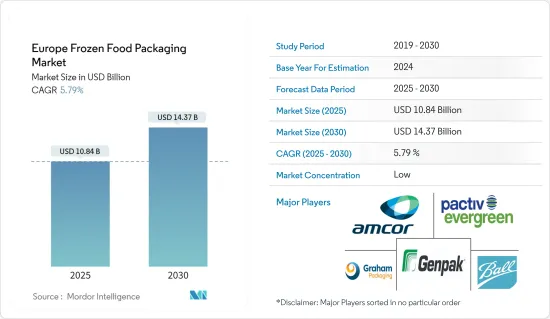

歐洲冷凍食品包裝市場規模預計到2025年為108.4億美元,預計2030年將達到143.7億美元,預測期內(2025-2030年)複合年成長率為5.79%。

快速的都市化和快節奏的生活方式正在將消費者的偏好轉向冷凍食品,冷凍食品的準備時間比傳統的家常飯菜要少。

主要亮點

- 消費者對食品品質的期望不斷提高,推動了對冷凍食品包裝的需求。消費者對產品品質的評價也是推動市場成長的因素。此外,由於經濟和生活方式的變化,歐洲對冷凍食品包裝的需求正在增加。預計市場在預測期內將出現高速成長。

- 最近也開發了新的包裝技術,使冷凍食品包裝更加實用和安全。這些技術包括智慧包裝、活性包裝和工程科學。為了減少環境污染並遵守政府法規,企業正在關注環保包裝,採用可回收、回收和再利用的可生物分解性包裝材料。

- 此外,便利性是推動全球冷凍食品消費成長的主要因素之一。因此,領先的公司正在推出新的類型和成分,以滿足消費者的區域偏好。消費者對便利產品日益成長的偏好推動了對冷凍產品的需求增加,因為與從頭開始烹飪相比,冷凍產品更容易準備並節省時間。

- 此外,由於工作人群日益忙碌的生活方式,冷凍休閒食品市場正在迅速擴大,這推動了冷凍零食市場的發展,並帶動了對冷凍食品包裝市場的需求。

- 然而,由於歐盟委員會等機構對食品包裝類型和接觸材料的嚴格規定,預計歐洲市場仍將受到嚴格監管。冷凍食品包裝需要強大的解決方案來防止污染、水分進入和溫度波動,以維持整個供應鏈的食品品質和安全。

歐洲冷凍食品包裝市場趨勢

塑膠佔據很大的市場佔有率

- 在便利性、保存期限和成本效益的推動下,歐洲冷凍食品產業對塑膠包裝的需求急劇增加。隨著消費者傾向於即食食品和冷凍零食,塑膠包裝脫穎而出。其氣密性顯著延長了冷凍食品必需品的保存期限。防止潮濕、冷凍和氧化對於保持風味、質地和營養價值至關重要。軟性塑膠薄膜、袋子和小袋在歐洲越來越受歡迎,因為它們重量輕、易於使用並有助於保持食品品質。

- 消費者生活方式的改變進一步推動了歐洲冷凍食品市場的成長。隨著現代生活的喧囂,許多歐洲人為了方便和延長保存期限而傾向於冷凍食品。單份塑膠包裝的興起,支持份量控制並最大限度地減少食物浪費,這與歐洲消費者日益增強的環保意識一致。此外,電子商務和線上雜貨購物場景在歐洲蓬勃發展,增加了對堅固耐用包裝的需求,以確保冷凍產品在運輸過程中的完整性。

- 然而,隨著塑膠的好處變得更加明顯,環境問題日益影響歐洲的需求模式。作為回應,許多歐洲國家正在訂定法規來遏制塑膠廢棄物並支持永續包裝。歐盟的永續性承諾不僅僅是一個承諾,它也是刺激包裝領域創新的催化劑。其結果是可回收塑膠、生物分解性塑膠,甚至植物來源塑膠等進步。隨著消費者環保意識的增強,製造商正在探索替代材料。它的目的是什麼?滿足監管義務和消費者需求,同時保持塑膠在冷凍食品包裝中提供的基本功能和品質。

- 歐洲千禧世代正在推動冷凍食品包裝的需求,他們更喜歡單份和外帶的選擇。千禧世代重視便利、份量控制和快餐,因此塑膠包裝至關重要。一次性容器和軟包裝袋滿足了這些需求,同時保持了食品的新鮮度和安全性,從而推動了冷凍食品包裝中對塑膠的需求。

- 德國冷凍食品研究所稱,德國冷凍食品消費量呈上升趨勢,零售額預計將從 2020 年的 101.7 億美元增至 2023 年的 125.9 億美元。這一趨勢反映了整個歐洲的轉變,冷凍食品成為忙碌消費者的主食。銷售量的增加直接推動了對塑膠包裝的需求,這對於保持品質和延長保存期限至關重要。

- 隨著冷凍食品需求的成長,製造商開始轉向塑膠解決方案,例如多層薄膜、托盤和袋子,因為它們具有多功能性和成本效益。為了響應歐洲對環境責任的關注,可回收和永續包裝的創新也在不斷湧現。

袋包裝類型推動市場成長

- 對氣密密封需求不斷成長的背後是對具有阻隔性的袋子的需求,以長期保持含香氣產品的品質。此外,由於對可重新密封和可重新閉合包裝的需求,自封袋在所研究的市場中變得越來越普遍。該公司選擇袋子是因為其節省空間的包裝形式,推動了該細分市場在研究市場中的成長。此外,塑膠袋提供的柔韌性、抗撕裂性、透明度和防潮性等特性預計將進一步加速市場成長。

- 此外,我們的行業同行也致力於推出由 50% 再生塑膠製成的新型優質零嘴零食包裝。例如,2024 年 3 月,百事公司為其英國和愛爾蘭的 Sunbites 零食品牌推出由 50% 再生塑膠製成的新型優質零食包裝,英力士在其中發揮了關鍵作用。該包裝採用先進的回收工藝製造,符合歐盟食品接觸包裝的嚴格監管標準。

- 為了實現這一里程碑,整個軟性食品包裝供應鏈的各個合作夥伴共同努力。 GreenDot 提供消費性塑膠包裝廢棄物,透過 Plastic Energy 的技術將其轉化為 TACOIL。英力士公司使用這種熱解油生產再生丙烯和原生品質的再生聚丙烯樹脂。 IRPAST 使用這種樹脂生產由 50% 回收材料製成的包裝薄膜,Amcor 為百事可樂公司印刷這些薄膜。此次夥伴關係符合百事公司到 2030 年在包裝中消除化石塑膠的承諾。

- 此外,線上雜貨購物的增加正在推動對包裝解決方案的需求,例如袋子,以在運輸過程中保持冷凍產品的新鮮度。消費者對方便餐點準備的偏好推動了對冷凍食品的需求增加,包括家常小菜、蔬菜、水果和甜點。

- 袋裝形式可以精確控制冷凍零食的份量,促進消費管理並最大限度地減少食物浪費。根據加拿大農業和食品部統計,2023年英國零嘴零食零售額最高,為143.729億美元,其次是法國、義大利和其他歐洲國家國家。

歐洲冷凍食品包裝產業概況

由於冷凍食品的便利性和多功能性,越來越多的消費者喜歡冷凍食品,這推動了該地區的市場成長。創新的包裝形式和包裝材料還可以改善消費者體驗並有助於最大限度地減少廢棄物。

歐洲冷凍食品包裝市場較為分散,由幾家大型企業組成,包括 Genpack LLC、Graham Packaging Company、Ball Corporation、Pactiv LLC 和 Amcor Group。該地區的公司也致力於推出用於冷凍食品的永續包裝材料。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 全球冷凍食品包裝市場概況

第5章市場動態

- 市場促進因素

- 消費者對便利包裝的需求不斷成長

- 歐洲可支配所得的增加與消費行為的變化

- 市場限制因素

- 透過政府監管和干涉來限制市場

第6章 市場細分

- 依材料類型

- 玻璃

- 紙

- 金屬

- 塑膠

- 其他

- 依產品類型

- 包包

- 盒子

- 標籤和杯子

- 托盤

- 小袋

- 其他產品類型

- 依食物類型

- 準備好的飯菜

- 蔬菜和水果

- 肉

- 海鮮

- 烘焙點心

- 其他食品

- 按國家/地區

- 英國

- 德國

- 法國

- 西班牙

- 義大利

第7章 競爭格局

- 公司簡介

- Pactiv LLC

- Amcor Group

- Genpak LLC

- Graham Packaging Company, Inc.

- Ball Corporation Inc

- Crown Holdings

- Tetra Pak International

- Placon Corporation

- Toyo Seikan Group Holdings, Ltd.

- WestRock Company

- Sealed Air Corporation

- Berry Global Inc.

第8章投資分析

第9章市場的未來

The Europe Frozen Food Packaging Market size is estimated at USD 10.84 billion in 2025, and is expected to reach USD 14.37 billion by 2030, at a CAGR of 5.79% during the forecast period (2025-2030).

The rapid growth of urbanization and fast-paced lifestyles have shifted consumers' preferences toward frozen food products, which require less time for cooking than traditional home-cooked meals.

Key Highlights

- The rise in consumer expectations related to food quality has propelled the demand for frozen food packaging. Also, consumer appreciation of the product quality is another factor driving the market growth. Additionally, with changes in the economy and lifestyles, there is an increased demand for frozen food packaging in Europe. The market is expected to grow lucratively during the forecast period.

- New packaging technologies have also developed recently, making packaging for frozen food products more practical and secure. These technologies include intelligent packaging, active packaging, and engineering science. To reduce environmental pollution and comply with government regulations, companies focus on eco-friendly packaging by employing biodegradable packaging materials that can be recycled, regenerated, and reused.

- Furthermore, convenience is one of the primary factors driving the global increase in frozen food consumption. As a result, leading players are introducing new types and ingredients to cater to consumers' regional tastes. The growing consumer preference for convenience products fuels the increasing demand for frozen products due to their ease of preparation and time savings compared to cooking from scratch.

- Moreover, the frozen snacks food market is expanding rapidly due to the increasing volume of the hectic lifestyle of the working population, which is boosting the frozen snacks market and propelling the demand for the frozen food packaging market.

- However, the European market is anticipated to remain highly regulated, owing to stringent regulations regarding food packaging types and contact materials by agencies such as the European Commission. Frozen food packaging requires robust solutions to maintain food quality and safety across the supply chain by preventing contamination, moisture intrusion, and temperature fluctuations.

Europe Frozen Food Packaging Market Trends

Plastic to Hold Significant Market Share

- In Europe, a surge in demand for plastic packaging in the frozen food sector is evident, spurred by convenience, preservation, and cost-effectiveness. Plastic packaging stands out as consumers gravitate towards ready-to-eat meals and frozen snacks. Its airtight seal capability significantly extends product shelf life, a vital feature in frozen food. Safeguarding against moisture, freezer burn, and oxidation is paramount to preserving taste, texture, and nutritional value. In Europe, flexible plastic films, bags, and pouches have gained traction, offering food quality preservation while being lightweight and user-friendly.

- Changing consumer lifestyles have further propelled the growth of Europe's frozen food market. With the hustle and bustle of modern life, many Europeans are gravitating towards frozen foods for convenience and extended shelf life. The rise of single-serve plastic packaging caters to portion control and minimizes food waste, aligning with the heightened environmental awareness among European consumers. Moreover, the burgeoning e-commerce and online grocery shopping scene in Europe amplifies the demand for robust, durable packaging, ensuring the integrity of frozen products during transit.

- Yet, as the advantages of plastic become more pronounced, environmental concerns increasingly shape Europe's demand landscape. In response, numerous European nations are rolling out regulations to curb plastic waste and champion sustainable packaging. The EU's sustainability pledge is not just a commitment but a catalyst, spurring innovations in the packaging domain. This has birthed advancements like recyclable, biodegradable, and even plant-based plastics. With a growing environmental consciousness among consumers, manufacturers are searching for alternative materials. Their goal? To align with regulatory mandates and consumer desires, all while preserving the essential functionality and quality plastic offers in frozen food packaging.

- Europe's Millennials drive demand for frozen food packaging, favoring single-serving and on-the-go options. They value convenience, portion control, and quick meals, making plastic packaging essential. Single-serve containers and flexible pouches meet these needs while keeping food fresh and secure, fueling demand for plastic in frozen food packaging.

- According to the German Frozen Food Institute, Germany's frozen food consumption is rising, with retail revenue growing from USD 10.17 billion in 2020 to USD 12.59 billion in 2023. This trend reflects a broader European shift, where frozen foods are staples for busy consumers. Increased sales directly boost demand for plastic packaging, which is crucial for preserving quality and extending shelf life.

- As frozen food demand grows, manufacturers rely on plastic solutions like multi-layer films, trays, and pouches for their versatility and cost-effectiveness. Innovations in recyclable and sustainable packaging are also emerging to address Europe's focus on environmental responsibility.

Bags Packaging Type to Drive the Market Growth

- The rising demand for airtight sealing is driven by the need for bags with high barrier properties, which retain product quality, including aroma, for a prolonged period. Furthermore, zippered bags are becoming more and more common in the market under study, driven by the demand for packaging that can be resealed and reclosed. Due to space-saving packaging formats, businesses choose bags, boosting the segment's growth in the market under study. Moreover, properties such as flexibility, tear-resistance, transparency, and moisture protection offered by plastic bags are expected to accelerate the market's growth further.

- Additionally, in line with the same players are focusing on launching new, premium-quality snack packaging containing 50% recycled plastic. For instance, in March 2024, INEOS played a pivotal role in launching new, premium quality snack packaging containing 50% recycled plastic, which PepsiCo introduced for their Sunbites snack brand in the UK and Ireland. This packaging, made through advanced recycling processes, meets strict EU regulatory standards for food contact packaging.

- Various partners collaborated across the flexible food packaging supply chain to achieve this milestone. GreenDot provided post-consumer plastic packaging waste, which was converted into TACOIL by Plastic Energy's technology. INEOS utilized this pyrolysis oil to produce recycled propylene and virgin-quality recycled polypropylene resin. IRPLAST used this resin to create packaging films with 50% recycled materials, while Amcor printed these films for PepsiCo. This partnership aligns with PepsiCo's commitment to eliminating fossil-based plastic in its packaging by 2030.

- Moreover, the growth in online grocery shopping has increased demand for packaging solutions such as bags that maintain frozen product freshness during transportation. Consumer preference for convenient meal preparation has driven increased demand for frozen foods, including ready meals, vegetables, fruits, and desserts.

- The bag format enables precise portion control for frozen snacks, facilitating consumption management and minimizing food waste. According to Agriculture and Agri-Food Canada, the retail sales of snacks in the United Kingdom in 2023 took first position with USD 14,372.9 million sales, followed by France, Italy, and many other countries across Europe.

Europe Frozen Food Packaging Industry Overview

Rising consumer preference for frozen foods due to their convenience and versatility is driving the market growth in the region. Innovative packaging formats and materials are also helping to improve consumer experience and minimize waste.

The European frozen Food packaging market is fragmented and consists of several major players, such as Genpack LLC, Graham Packaging Company, Ball Corporation, Pactiv LLC, and Amcor Group. Players in the region are also focusing on launching sustainable packaging materials for frozen food.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Overview of the Global Frozen Food Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience Packaging by Consumers

- 5.1.2 Increase in Disposable Income and Changing Consumer Behavior in Europe

- 5.2 Market Restraint

- 5.2.1 Government Regulations and Interventions limit the Market

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Plastic

- 6.1.5 Others Material Type

- 6.2 By Product Type

- 6.2.1 Bags

- 6.2.2 Boxes

- 6.2.3 Tubs and Cups

- 6.2.4 Trays

- 6.2.5 Pouches

- 6.2.6 Other Product Types

- 6.3 By Type of Food

- 6.3.1 Readymade Meals

- 6.3.2 Fruits and Vegetables

- 6.3.3 Meat

- 6.3.4 Sea Food

- 6.3.5 Baked Goods

- 6.3.6 Others Food Types

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Spain

- 6.4.5 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv LLC

- 7.1.2 Amcor Group

- 7.1.3 Genpak LLC

- 7.1.4 Graham Packaging Company, Inc.

- 7.1.5 Ball Corporation Inc

- 7.1.6 Crown Holdings

- 7.1.7 Tetra Pak International

- 7.1.8 Placon Corporation

- 7.1.9 Toyo Seikan Group Holdings, Ltd.

- 7.1.10 WestRock Company

- 7.1.11 Sealed Air Corporation

- 7.1.12 Berry Global Inc.