|

市場調查報告書

商品編碼

1640532

亞太冷凍食品包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)APAC Frozen Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

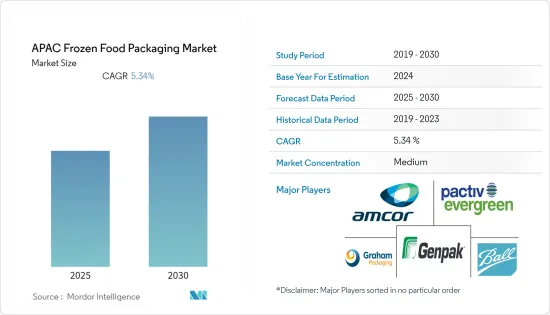

預測期內亞太冷凍食品包裝市場預期複合年成長率為 5.34%

關鍵亮點

- 亞太地區人口不斷成長,推動了對食品和冷凍食品的需求。快速的都市化以及對食品相關疾病、食品浪費、變質、優質產品和快節奏生活方式的日益關注,正在推動消費者對冷凍食品的偏好,因為與傳統的家常菜相比,冷凍食品的準備時間更短。

- 隨著中國和印度等新興市場的成長,不斷成長的「忙碌」客戶群和購買力進一步推動了市場的發展。由於對有吸引力、有創意且易於攜帶的包裝的需求不斷成長,以使產品在競爭中脫穎而出,對冷凍食品包裝的需求預計也將成長。

- 中國佔亞太冷凍食品包裝市場的最大佔有率。根據中國國家統計局的數據,2021年有64.72%的人口居住在都市區,這推動了對冷凍食品的需求增加。中國消費者現在想要方便食用、高品質的食品。該地區冷凍肉和其他經常消費的產品的供應保持了固定食品市場需求的穩定。

- 該地區的私人公司已與一家私募股權公司合作,擴大其在該地區的業務範圍。預計這將刺激對冷凍食品包裝的需求。例如,2022 年 5 月,知名快餐冰淇淋和速食店公司 Dairy Queen 宣布已與私人公司的FountainVest Partners 簽署協議,到 2030 年進軍分店國冷凍食品市場。 。

- 新冠肺炎疫情的爆發,為冷凍食品包裝製造商帶來許多問題。但這只是短暫的。封鎖的影響包括供應鏈中斷、製造過程中使用的原料短缺、勞動力短缺、價格波動可能導致最終產品的生產過剩和預算超出以及運輸問題。

- 然而,企業為了保持冷凍食品的新鮮度而使用澱粉,增加了糖尿病、心臟病等疾病的風險,阻礙了市場的成長。

亞太冷凍食品包裝市場趨勢

可支配所得增加與消費行為改變

- 市場需求受到多種因素的影響,例如生活方式的改變,可支配收入的提高,市場發展中國家的快速都市化,尤其是中等收入階層的崛起,推動了對冷凍食品袋的需求。人口密度推動了對包裝食品的需求,而千禧世代也對這一成長做出了貢獻。

- 包裝食品需要時間才能到達世界各地的消費者手中。包裝食品可能不新鮮,在到達消費者手中之前可能會失去其香氣和味道。這帶來了越來越大的威脅,因為食品在到達消費者手中之前就已經變質,這意味著在包裝上投入的資金就損失了。為了克服這個問題,食品加工產業正在投資智慧包裝和工程科學等有助於延長產品保存期限的技術以及各種新包裝技術。這就是工業對冷凍食品的需求不斷增加的原因。除了收益之外,組織也關心消費者滿意度,這會影響他們在市場上的形象和價值。

- 在印度和中國等新興市場,人均收入和支出的增加正在推動對包裝和冷凍食品的需求。冷凍食品的需求也受到顧客行為和生活方式改變的影響。

- 當地零售店的便利性不斷提高,促進了冷凍食品的需求。近年來,特許經營商的需求呈指數級成長。例如,線上生鮮食品店MissFresh最近於2021年9月在中國東部城市寧波分店,並將在未來五年內擴展到30至35個城市。該公司的策略是維持和擴大其分散式迷你倉庫模式(DMW)網路,目前該網路已覆蓋中國17個一線和二線城市,包括北京、上海、廣州、深圳和杭州。提供的產品包括水果、蔬菜和魚等生鮮食品、乳製品、飲料、冷凍食品、包裝食品和快速消費品。

- 此外,根據中國國家統計局的數據,中國冰淇淋和冷凍甜點的銷售額預計將從 2020 年的 89.5 億美元增加到 2025 年的 107.6 億美元。預計金額的成長將增加對冷凍食品的需求,並最終促進所研究市場的發展。

預測期內印度將實現顯著成長

- 過去十年,印度面向最終消費者的食品出口大幅成長,包括即食產品(RTE)、即煮產品(RTC)和即食產品(RTS)。過去十年,即食食品的複合年成長率為 12%。由於工商部重視出口產品的增值,同期 RTE 在農業和加工食品出口(APEDA)的佔有率從 2.1% 增加到 5%。 (資料來源:印度商務和工業部)

- 憑藉著誘人的財政激勵措施、支持性經濟措施以及食品零售業令人鼓舞的成長,印度的食品生態系統提供了巨大的投資潛力。印度政府透過食品加工工業部(MoFPI)正在採取一切必要措施增加對印度食品加工產業的投資。印度政府已為 PMKSY 計畫撥款 460 億印度盧比(557.1 億美元),有效期至 2026 年 3 月。預計這筆配額將刺激冷凍食品包裝的需求。

- 根據印度食品加工工業部(MoFPI)的數據,到 2025 年印度食品加工市場規模將達到 4,700 億美元。未來幾年,二線和三線城市可能會延續大都會圈的趨勢,消費更多加工食品和冷凍食品,推動冷凍,促進食品包裝的成長。

- 印度生產了世界上7.96%的魚類,是世界第三大生產國。

- 印度是世界第三大魚類生產國,佔全球產量的7.96%。 2020-2021 財政年度魚類總產量預計為 1,369 萬噸。儘管 2021-22 年該產業面臨重大挑戰,印度仍出口了價值 5,758.648 億印度盧比(77.6 億美元)的水產品。與2020-2021年相比,成長了30%。印度最希望出口水產品的前三大國家是美國、中國和日本。根據印度投資局統計,63%的出口銷往這三個國家。這些因素對預測期內的市場成長率貢獻巨大。

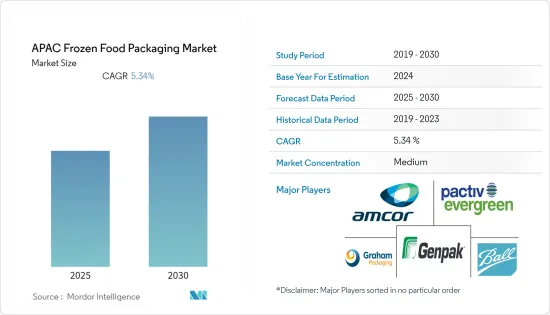

亞太冷凍食品包裝產業概況

亞太地區冷凍食品包裝市場適度細分,由幾家領先的公司組成。擁有突出市場佔有率的大公司正致力於擴大在國外的基本客群。

2022 年 3 月 - 香港 3D 食品列印公司 Alt Farm 將中國和澳洲作為其首批主要目標市場,並希望在未來 12 到 18 個月內推出其植物來源A5 和牛產品的原型。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 技術概述

- 技術簡介

- 冷凍食品包裝產品類型

- 冷凍食品包裝所使用的主要材料

- 持續發展

第5章 市場動態

- 市場促進因素

- 消費者對便利性的需求日益增加

- 可支配所得增加與消費行為改變

- 市場限制

- 政府監管與干預

- 全球冷凍食品包裝概覽

第6章 市場細分

- 主要材料

- 玻璃

- 紙

- 金屬

- 塑膠

- 包裝類型

- 包包

- 盒子

- 能

- 紙盒

- 托盤

- 饒舌歌手

- 其他

- 產品類型

- 即食食品

- 水果和蔬菜

- 肉

- 海鮮

- 烘焙點心

- 其他

- 地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Amcor Ltd

- Genpak LLC

- Graham Packaging Company, Inc.

- Ball Corporation Inc

- Crown Holdings

- Tetra Pak International

- Placon Corporation

- Toyo Seikan Group Holdings, Ltd.

- WestRock Company

- Rexam Company

第8章投資分析

第9章:市場的未來

The APAC Frozen Food Packaging Market is expected to register a CAGR of 5.34% during the forecast period.

Key Highlights

- The growing population in the Asia Pacific region is propelling the demand for food and frozen food products. Surging urbanization and expanding awareness about foodborne illnesses, food wastage, spoilage, quality products, and fast-paced lifestyle have shifted the preferences of consumers towards frozen food products, which requires less time for cooking than the traditional home-cooked meal.

- "On-the-go" customer base and rising purchasing power have further fueled the market through the growth in developing nations like China and India. The demand for frozen food packaging is also predicted to grow as there is a rising need for appealing, inventive, and easy-to-carry packaging to set the product apart from the competition.

- China has the largest share of the Asia-Pacific frozen food packaging market. According to the National Bureau of Statistics of China, 64.72% of the population resided in cities in 2021, contributing to the increased demand for frozen food products. Chinese consumers are now looking for easy-to-use and quality food products. The need for frozen meat and other regularly consumed products in the fixed food market has been constant in the region because of their availability.

- Players in the region are teaming up with private equity companies to expand their footprint in one of the nations with the highest rate of QSR development due to the rising ice cream consumption. It will spur demand for frozen food packaging. For instance, in May 2022, Dairy Queen, the prominent quick-service ice cream and fast food restaurant company, aimed to open 600 new restaurants in China by 2030, following an agreement with private equity firm FountainVest Partners to penetrate the country's frozen-treat market further.

- With the outbreak of COVID-19, frozen food packaging manufacturers got flooded with a pool of issues. However, they were only for the short -term. Some of the effects of the lockdown include supply chain disruptions, lack of availability of raw materials used in the manufacturing process, labor shortages, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, shipping problems, etc.

- However, owing to the increased risk of diabetes as companies use starch to keep frozen food items fresh, the risk of heart disease and other diseases will hinder the market growth.

APAC Frozen Food Packaging Market Trends

Increase in Disposable Income and Changing Consumer Behaviour

- The demand for the market gets influenced by numerous factors, such as changing lifestyles, increasing disposable income, and rapid urbanization in developing countries, especially the growing middle-income population, which are increasing the demand for bags for frozen food. Population density has increased demand for packaged food, with Millenials contributing to the growth.

- After packaging, it takes time for packaged food to reach consumers across various parts of the world. The packaged food may not be fresh and might lose its aroma and taste before reaching the consumer. The threat of food getting spoilt before going to the consumer is increasing, as it would result in a loss of the capital invested in the packaging. To overcome this, food processing industries are investing in technologies and various new packaging techniques, such as intelligent packaging and engineering science, which help to increase the product's shelf life. It is the reason for the industry's increased demand for frozen food. Organizations are focusing on consumer satisfaction, apart from revenues, as it impacts the image and value in the market.

- Developing markets in India and China are experiencing high demand for packaged and frozen food due to increased per capita income and spending. The need for frozen food is also influenced by changing behavior and lifestyle of the customers.

- The convenience of local retail establishments has expanded, contributing to the demand for frozen food. In recent years, the demand from merchants has grown dramatically. For instance, the online fresh grocery store MissFresh expanded into 30 to 35 cities during the next five years, following its most recent opening in the eastern Chinese city of Ningbo, in September 2021. The company's strategy is to maintain and expand its distributed mini-warehouse model (DMW) network, which is now accessible in 17 first- and second-tier Chinese cities, including Beijing, Shanghai, Guangzhou, Shenzhen, and Hangzhou. The products provided are fresh produce such as fruits, vegetables, fish, dairy, drinks, frozen and packaged meals, and FMCG items.

- Also, according to the National Bureau of Statistics China, the sales value of ice cream and frozen desserts in China is projected to increase from USD 8.95 billion in 2020 to USD 10.76 billion in 2025. The growth in the value state that the demand for frozen food is projected to increase, eventually fueling the development of the studied market.

India to Grow at Significant Rate during Forecast Period

- In the past ten years, the export of final consumer food items from India, such as Ready to Eat (RTE), Ready to Cook (RTC), and Ready to Serve (RTS) products, has increased significantly. Food products falling under the RTE category have seen a Compound Annual Growth Rate (CAGR) of 12% over the past ten years. The share of RTE in Agricultural and Processed Food Products Export (APEDA) exports has increased from 2.1% to 5% over the same period, thanks to the Ministry of Commerce & Industry's emphasis on the value addition of products for export. (Source: Ministry of Commerce & Industry, India)

- Owing to the enticing fiscal incentives, supportive economic policies, and encouraging growth in the food retail sector, India's food ecosystem presents enormous investment prospects. The Government of India (GoI) is taking all necessary measures to increase investments in the food processing sector in India through the Ministry of Food Processing Industries (MoFPI). The government of India has allocated INR 4600 crores (USD 55.71 Billion) to the umbrella PMKSY plan through March 2026. The allotment will boost the demand for frozen food packaging.

- According to the Ministry of Food Processing Industries (MoFPI), the Indian food processing market will reach USD 470 billion by 2025. In the upcoming years, Tier-II and Tier-III cities may adopt the trend already seen in metropolitan areas by consuming more processed and frozen food, Thus, fueling the growth of frozen food packaging .

- India produces 7.96% of the world's fish, making it the third-largest producing country in the world with the total fish production for FY 20-21 at 14.73 MMT, compared to

- India is the third-largest fish-producing country in the world and accounts for 7.96 percent of global production. The total fish production during the financial year 2020-2021 was estimated at 13.69 million metric tons (MMT). Despite the industry's significant challenges in 2021-22, India still exported seafood worth Rs 57,586.48 crore (USD 7.76 billion). Compared to 2020-21, it saw a growth increase of 30%. The top 3 countries India prefers to export its marine products to are the USA, China, and Japan. 63% of exports were sent to these three nations, according to Invest India. These factors significantly contribute to the market growth rate during the forecast period.

APAC Frozen Food Packaging Industry Overview

The Asia Pacific Frozen Food packaging market is moderately fragmented and consists of several major players. The major players with a prominent market share are focusing on expanding their customer base across foreign countries.

March 2022 - Hong Kong 3D food printing firm Alt Farm is eyeing China and Australia as its first key target markets, revealing it hopes to launch a prototype plant-based A5 Wagyu Beef product in the next 12 to 18 months.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Technology Overview

- 4.5.1 Technology Snapshot

- 4.5.2 Type of frozen food packaging products

- 4.5.3 Primary materials used for frozen food packaging

- 4.5.4 Ongoing developments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience by Consumers

- 5.1.2 Increase in Disposable Income and Changing Consumer Behaviour

- 5.2 Market Restraints

- 5.2.1 Government Regulations and Interventions

- 5.3 Global Frozen Food Packaging Overview

6 MARKET SEGMENTATION

- 6.1 Primary Material

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Plastic

- 6.2 Type of Packaging

- 6.2.1 Bags

- 6.2.2 Boxes

- 6.2.3 Cans

- 6.2.4 Cartons

- 6.2.5 Trays

- 6.2.6 Wrappers

- 6.2.7 Other Packaging

- 6.3 Type of Food Product

- 6.3.1 Readymade Meals

- 6.3.2 Fruits and Vegetables

- 6.3.3 Meat

- 6.3.4 Sea Food

- 6.3.5 Baked Goods

- 6.3.6 Other Food Product

- 6.4 Geogrphy

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.4.6 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Ltd

- 7.1.2 Genpak LLC

- 7.1.3 Graham Packaging Company, Inc.

- 7.1.4 Ball Corporation Inc

- 7.1.5 Crown Holdings

- 7.1.6 Tetra Pak International

- 7.1.7 Placon Corporation

- 7.1.8 Toyo Seikan Group Holdings, Ltd.

- 7.1.9 WestRock Company

- 7.1.10 Rexam Company