|

市場調查報告書

商品編碼

1630311

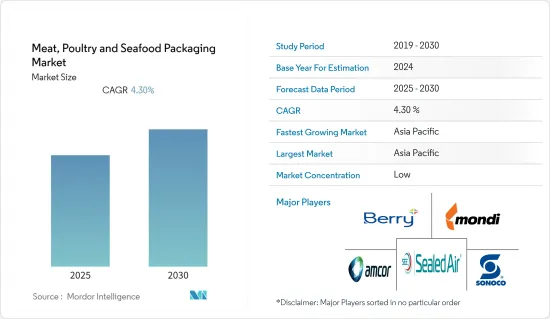

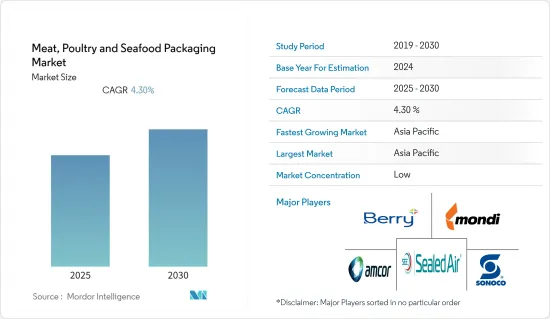

肉類、家禽和魚貝類包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)Meat, Poultry & Seafood Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

肉類、家禽和魚貝類包裝市場預計在預測期內複合年成長率為 4.3%

主要亮點

- 辦公室和零售環境對一次性包裝的需求不斷成長,以及製造商和零售商對包裝行業投資的增加,正在推動肉類、家禽和魚貝類包裝行業的發展。

- 隨著人們越來越關注永續性性和軟性包裝解決方案,消費者與肉類、家禽和魚貝類包裝的互動正在發生變化,而新的和創新的包裝解決方案每天都在改進這些解決方案。

- 對消費者友善包裝和加強產品保護的需求不斷成長,推動肉類、家禽和魚貝類包裝成為可行且經濟高效的替代品。

- GDP 和人口的成長可能會加速市場擴張。此外,消費者友善的儲存條件和可重新密封性也有助於全球市場的發展。

- 然而,包裝材料污染的風險可能會阻礙市場成長。基於苯乙烯和苯的有毒阻燃劑可能會因包裝不當或處理不當而污染食品材料。

- COVID-19 期間禽流感的威脅減少了全球肉類和家禽的消費。因此,肉類、家禽和魚貝類的包裝市場在疫情期間受到了負面影響。由於病毒和禽流感的威脅,許多人被迫重新考慮吃肉或去餐廳。

肉類、家禽和魚貝類包裝市場的趨勢

軟包裝檢查成長

- 由於動物產品消費增加等因素,軟包裝解決方案市場預計在整個預測期內將快速成長。

- 世界人口成長、收入增加和都市化等因素與動物性食品消費有強烈的正相關關係。世界衛生組織(WHO)估計,肉品消費量將從1997-1999年的2.18億噸增加到2030年的3.76億噸。

- 大型可靠的跨境零售連鎖店中牛肉和豬肉產品的供應量不斷增加,也正在增強市場。隨著消費者尋求更長保存期限的產品,對熱成型高阻隔薄膜和蒸餾包裝的需求不斷增加。

- 家常小菜越來越受到喜歡含有魚、肉和蔬菜的產品的消費者的歡迎,並且通常採用蒸餾包裝來延長保存期限。網路購物趨勢進一步增強了消費者的信心。

- 由於其吸引人的外觀、直立能力以及寬前面板等商品行銷優勢,立式袋將繼續取代冷凍應用中的袋子,但自立袋將繼續取代製冷應用中的袋子,但將繼續替代單劑量易腐爛、冷凍和加工應用中的袋子具有成長潛力。

- 然而,由於多種優點,軟袋的使用有所增加,包括改善現場屠宰、衛生、追蹤和召回以及延長保存期限。

亞太地區佔最大市場佔有率

- 亞太地區佔最大的市場佔有率,主要得益於印度和中國的新興人口。由於剛性和軟性包裝的使用不斷擴大,肉類、家禽和魚貝類包裝行業預計將出現市場成長。

- 該地區人均收入的提高、健康意識的增強和生活方式趨勢的改變是肉類、家禽和魚貝類包裝行業擴張的關鍵驅動力。該地區擁有豐富的用於製造熱成型、塑膠和鋁包裝的原料。

- 依國家(中國、印度)分類,新興經濟體對世界市場進出口的推動有顯著貢獻。一次性包裝的需求不斷增加,導致市場呈上升趨勢。預計亞太市場在預測期內將出現激增。

- 日益激烈的競爭和政府制定的表明品質、數量和價格的包裝標準,加上對簡單方便的包裝的需求,正在推動肉類、家禽和魚貝類包裝的採用。

肉類、家禽和魚貝類包裝產業概述

該市場由 Berry Global、Mondi Group、Amcor、Crown Holdings、DS Smith 和 Sonoco 等現有參與企業細分。該領域的幾家國內外供應商已經進行了大量的研發投資,以增強其食品包裝材料。因此,經常開發出成本更低且新穎的解決方案,從而在市場參與企業之間造成激烈的競爭。

- 2022 年 8 月 - Amcor 宣布收購捷克共和國的軟包裝工廠,這可能會增加和擴大 Amcor 的產品組合,以滿足整個歐洲軟包裝網路的強勁需求和客戶成長。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 人口成長導致需求增加

- 政府對改進和更好的包裝材料的法規

- 市場限制因素

- 由於包裝不良或處理不當而造成污染

第6章 市場細分

- 包裝類型

- 硬質包裝

- 軟包裝

- 產品類型

- 容器

- 鋁箔容器

- 塑膠容器

- 板貨櫃

- 成品袋

- 食品罐

- 塗膜

- 其他

- 容器

- 材料類型

- 聚丙烯(PP)

- 聚苯乙烯(PS)

- 聚酯纖維(PET)

- 熱成型

- 鋁

- 其他

- 目的

- 新鮮和冷凍產品

- 加工品

- 食用產品

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Berry Global

- Mondi Group

- Sealed Air

- Amcor

- Sonoco

- Smurfit Kappa Group

- DS Smith

- WestRock

- Stora Enso

- Crown Holdings

- Can-Pack SA

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 67310

The Meat, Poultry & Seafood Packaging Market is expected to register a CAGR of 4.3% during the forecast period.

Key Highlights

- The increased need for disposable packaging in the offices and retail sector and the rising investment in the packaging industry by manufacturers and retailers are boosting the meat, poultry & seafood packaging industry.

- Consumer interaction with meat, poultry, and seafood packaging is changing with an increasing focus on sustainability and rigid and flexible packaging solutions, which are being improved daily with new innovative packaging solutions.

- The increasing demand for consumer-friendly packages and enhanced product protection have propelled meat, poultry, and seafood packaging as a viable and cost-effective alternative.

- The rising GDP and population may accelerate market expansion. In addition, the consumer-friendly storage and resealability conditions are contributing to the market's development worldwide.

- However, the risk of contamination of the packaging material may hinder the market's growth. Sometimes, toxic flame retardants, which are made from styrene and benzene, contaminate the food material due to poor packaging or mishandling.

- The threat of bird flu during COVID-19 reduced meat and poultry consumption worldwide. Thus, the market for packaging meat, poultry, and seafood was negatively impacted during the pandemic. Many individuals were forced to reconsider eating meat and going to restaurants due to the threat of virus and bird flu.

Meat, Poultry & Seafood Packaging Market Trends

Flexible Packaging to Witness Growth

- Due to factors like the rising consumption of animal products, the market for flexible packaging solutions is predicted to have exponential growth throughout the forecast period.

- Factors such as the increasing world population, rising incomes, and urbanization are strongly and positively related to the consumption of animal products. The World Health Organization (WHO) estimates that meat consumption may increase to 376 million metric tons by 2030, from 218 million metric tons during 1997-1999.

- The growing availability of beef and pork products in large and reliable retail chains across international borders is also strengthening the market. The need for thermoformed high-barrier films and retort packaging is increasing as consumers seek products with longer shelf-lives.

- Ready-made meals have grown in popularity among consumers as they prefer products that include fish, meat, and vegetables and are typically retort-packed to make them shelf-stable. The rising trend of internet shopping has further boosted their confidence.

- While stand-up pouches will continue to displace bags in frozen applications due to their attractive looks, ability to stand upright, and wide front panels, all of which provide merchandising advantages, vacuum pouches in single-part fresh, frozen, and processed usage have potential for growth.

- However, the use of flexible packaging increased due to their several benefits, such as live on-site butchering, improved sanitation, tracking, and recall, as well as prolonged shelf life.

Asia-Pacific Holds the Largest Market Share

- The Asia-Pacific region holds the largest market share, primarily due to the emerging population of India and China. Due to the growing applications of rigid packaging and flexible packaging in the meat, poultry, and seafood packaging industries, the market is expected to grow.

- The region's rising per capita income, rising health consciousness, and shifting lifestyle trends are the main factors behind the expansion of the meat, poultry, and seafood packaging industry. The area boasts an abundance of raw materials for producing thermoforming, plastic, and aluminium packaging.

- Country-wise (China and India), emerging economies to promote import and export have been significant contributors to the global market. Increasing demand for disposable packaging has led to an upward trend in the market. The market in Asia-Pacific is expected to boost during the forecast period.

- The growing competition and packaging standards set by the government for labeling quality, quantity, and price, coupled with the demand for easy and convenient packaging, have been instrumental in driving the adoption of meat, poultry, and seafood packaging.

Meat, Poultry & Seafood Packaging Industry Overview

The market is fragmented due to existing players, including Berry Global, Mondi Group, Amcor, Crown Holdings, DS Smith, and Sonoco. Several local and international vendors in the area have already made significant R&D investments to enhance the food packaging materials. As a result, they frequently develop novel solutions at a lower cost, creating fierce competition among market participants.

- August 2022 - Amcor announced the acquisition of a flexible packaging plant in the Czech Republic, which may increase and expand Amcor's portfolio of ability to meet strong demand and customer growth across its flexible packaging network in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Population May Increase the Demand

- 5.1.2 Government Regulations for Improved and Better Packaging Materials

- 5.2 Market Restraints

- 5.2.1 Contamination Due to Poor Packaging or Mishandling

6 MARKET SEGMENTATION

- 6.1 Packaging Type

- 6.1.1 Rigid Packaging

- 6.1.2 Flexible Packaging

- 6.2 Product Type

- 6.2.1 Containers

- 6.2.1.1 Aluminium Foil Container

- 6.2.1.2 Plastic Container

- 6.2.1.3 Board Container

- 6.2.2 Pre-made Bags

- 6.2.3 Food Cans

- 6.2.4 Coated Films

- 6.2.5 Other Product Types

- 6.2.1 Containers

- 6.3 Material Type

- 6.3.1 Polypropylene (PP)

- 6.3.2 Polystrene (PS)

- 6.3.3 Polyester (PET)

- 6.3.4 Thermoform

- 6.3.5 Aluminium

- 6.3.6 Other Material Types

- 6.4 Application

- 6.4.1 Fresh and Frozen Products

- 6.4.2 Processed Products

- 6.4.3 Read-to-eat Products

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Global

- 7.1.2 Mondi Group

- 7.1.3 Sealed Air

- 7.1.4 Amcor

- 7.1.5 Sonoco

- 7.1.6 Smurfit Kappa Group

- 7.1.7 DS Smith

- 7.1.8 WestRock

- 7.1.9 Stora Enso

- 7.1.10 Crown Holdings

- 7.1.11 Can-Pack SA

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219