|

市場調查報告書

商品編碼

1626891

拉丁美洲慣性系統:市場佔有率分析、產業趨勢與成長預測(2025-2030)Latin America Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

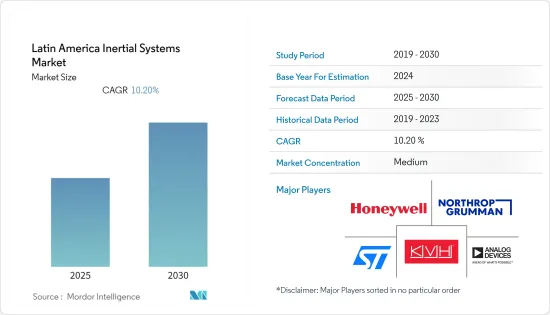

拉丁美洲慣性系統市場預計在預測期內複合年成長率為 10.2%

主要亮點

- 廉價航空公司的崛起預計將擴大市場機會。據波音公司稱,2017年航太業飛行營運服務的市場需求為18.7億美元,預計2035年將增至49.75億美元。

- 全球格局的權力下放和國防預算的增加預計將推動市場成長。慣性系統在國防部門中有許多應用,包括飛彈導引、精確導引彈藥、控制和瞄準、坦克砲塔穩定和魚雷導引。

- 此外,隨著微機電系統(MEMS)技術的加入,市場機會正在擴大。此技術廣泛應用於現場感測器和半導體。小口徑飛彈、水下導航儀、無人水下航行器等也不斷增加國防領域對高階MEMS感測器的需求。隨著智慧武器和先進坦克的出現,武器現代化程度的提升也是市場的關鍵驅動力。

- 技術的快速進步迫使市場公司創新具有先進功能的新產品。允許公司利用協同效應的策略聯盟和夥伴關係也在增加。例如,2021年10月,泰雷茲集團與CS Group合作開發了海軍水面艦艇的綜合網路安全導航系統。此次合作匯集了泰雷茲在慣性導航系統方面的專業知識和 CS Group 在智慧網路安全關鍵任務系統的經驗。

- 此外,慣性感測器因其多功能特性而廣泛應用於生物醫學設備。慣性系統擴大應用於醫療設備,如核磁共振造影系統、智慧病床、手術機器人和血管造影術機。阿根廷的 Nacer 計劃等政府舉措在該國取得了巨大成功並廣受歡迎。稅收資助的統一醫療保健系統改變了巴西的醫療保健系統。哥倫比亞將醫療保健權寫入其憲法,並在許多其他計劃中徹底改變了該地區的醫療保健系統。拉丁美洲醫療保健產業的擴張預計也將推動慣性系統市場。

拉丁美洲慣性系統市場趨勢

無人駕駛汽車需求的成長預計將推動市場發展

- 對無人水下航行器(UUV)的需求不斷成長是市場擴張的主要驅動力。 UUV廣泛應用於石油和天然氣探勘。拉丁美洲天然氣和石油生產以及探勘活動的增加可能會促進市場成長。例如,根據CIA(世界概況)的數據,2020年,巴西和墨西哥的原油出口量分別達到世界原油出口總量的3%和2.2%。

- UUV 在國防工業中用於惰性水雷、反擊、港口保全和船舶檢查。水下無人機支持科學研究中海底測繪的海洋調查。也用於要求高精度的科學研究和國防武器。

- 隨著全球石油和天然氣消耗的增加,UUV擴大用於石油鑽井平台建設、管道檢查和維護活動,刺激了對該產品的需求。例如,根據貝克休斯統計,截至2021年10月,拉丁美洲總合152個石油和天然氣鑽井平台,其中33個為海上鑽機。

- 此外,採用環形雷射陀螺儀(RLG)和光纖陀螺儀(FOG)的輕量級緊湊型導航系統的引入等技術進步也為市場的積極前景做出了貢獻。

- 由於COVID-19的嚴重影響,全球石油業各國需求急劇下降。例如,根據貿發會議的數據,由於 COVID-19 大流行造成的不可預見的干擾,2020 年全球海運量比與前一年同期比較下降了 4.1%。這次中斷主要擾亂了所研究市場的供應鏈、航運網路、貿易量和港口,暫時抑制了市場的成長。

汽車領域預計將佔據主要市場佔有率

- 世界生活方式的進步增加了對更易於使用的設備的需求,從而允許使用嚴重依賴慣性感測器的運動感測技術。這些感測器廣泛應用於汽車產業,以提高安全性、性能和成本效益。

- 由於 MEMS 技術的出現,汽車產量不斷增加,國防、軍用和海底車輛的高投資只是推動汽車慣性系統市場的部分因素。

- 對汽車安全的需求不斷成長正在推動市場成長。根據世界衛生組織 (WHO) 統計,全球每年約有 135 萬人死於交通事故。

- 此外,還有 2,000 萬至 5,000 萬人遭受非致命傷害,導致許多人身障者。 MEMS加速計在提高車輛安全性能方面發揮重要作用。

- 現代汽車嚴重依賴從安裝在車輛上的各種感測器收集的資料。陀螺儀和加速計提供重要的測量,以提高車輛的控制和穩定性。這些感測器在低頻下容易產生高噪聲,導致測量精度較差,尤其是在低動態條件下,加速了預測期內的市場需求。

拉丁美洲慣性系統產業概況

拉丁美洲慣性系統市場競爭適中,由多家大型企業組成。從市場佔有率來看,目前市場由Analog Devices Inc.、Honeywell International Inc.、ST MicroElectronics等幾家大公司主導。這些公司專注於擴大全球基本客群。

- 2021 年 10 月Honeywell推出精密視軸對準系統 (PBAS),旨在提高各種航太和非航太應用中的定位和定位精度。該系統由兩個小電氣箱組成。第一個連接到需要對齊的物體,例如導航系統,第二個連接到需要對齊的物體,即飛機。每個盒子包含三個陀螺儀,其功能與任何其他慣性導航設備一樣,用於確定定位資料。該盒子與中央電腦相連,並在技術人員發現差異時顯示資料。

- 2021 年 10 月-義法半導體宣布推出 Teseo 模組系列的最新成員 Teseo-VIC3DA。 Teseo-VIC3DA 導航模組將 ST 的高性能汽車 Teseo III GNSS1 IC 與汽車 6 軸 MEMS 慣性測量單元 (IMU) 和航位推算軟體相結合,並被認證為實用的汽車導航模組。 Teseo-VIC3DA 模組支援汽車導航、車隊管理和保險監控等應用。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- MEMS技術的出現

- 對導航精度的需求不斷增加

- 市場限制因素

- 導航系統中的綜合漂移誤差

- 成本和複雜性增加

第6章 市場細分

- 按設備

- 陀螺儀

- 加速計

- 慣性測量單元

- GPS/INS

- 多軸感測器

- 依技術

- MEMS

- 光纖陀螺儀

- 環形雷射陀螺儀

- 振動陀螺儀

- 半球諧振陀螺儀

- 機械慣性導航系統

- 按最終用戶產業

- 車

- 防禦

- 產業

- OEM

- 能源基礎設施

- 民航

- 按國家/地區

- 巴西

- 墨西哥

- 哥倫比亞

- 阿根廷

- 其他拉丁美洲

第7章 競爭格局

- 公司簡介

- Analog Devices Inc.

- Bosch Sensortec GmbH

- Safran Group

- Honeywell International Inc.

- Invensense Inc.

- Ixbluesas

- Kearfott Corporation

- KVH Industries Inc.

- Meggitt PLC

- Northrop Grumman Corporation

- ST Microelectronics

- Silicon Sensing Systems Ltd.

- Rockwell Collins

- UTC Aerospace Systems

- Vector NAV

第8章 未來展望

第9章投資分析

簡介目錄

Product Code: 48532

The Latin America Inertial Systems Market is expected to register a CAGR of 10.2% during the forecast period.

Key Highlights

- The rise of low-cost airlines is expected to boost market opportunities. According to Boeing, the market demand for flight operations services in the aerospace industry in 2017 was USD 1,870 million and is expected to rise to USD 4,975 million by 2035.

- Increased decentralization in global affairs and increased defense budgets are expected to drive market growth. The defense sector has numerous inertial systems applications like Missile Guidance, Precision Guided Munitions, Control and Targeting, Tank Turret Stabilization, and Torpedo Guidance.

- Further, the addition of microelectromechanical systems, or MEMS technology, has broadened market opportunities. The technology is widely used in field sensors and semiconductors. Small-diameter missiles, underwater navigators, and unmanned underwater vehicles also increase demand for high-end MEMS sensors in the defense sector. The growing modernization of weaponry with the advent of smart weapons and advanced tanks is also an essential driver for the market.

- The rapid advancement in technology and compels the market players to innovate new products with advanced features. Strategic collaborations and partnerships which enable companies to leverage their synergies are also on the rise. For instance, in October 2021, Thales Group partnered with CS Group to develop a comprehensive cyber-secure navigation system for use on naval surface ships. The collaboration brings together Thales' expertise in inertial navigation systems and CS Group's experience in smart cyber-protected mission-critical systems.

- Moreover, Inertial sensors are used in biomedical instruments extensively for their multi-function characteristics. The inertial systems are increasingly being used in medical equipment, including MRI devices, intelligent patient beds, surgical robots, and angiography equipment. Government initiatives like the Plan Nacer in Argentina have been immensely successful and popular in the country. The tax-funded Unified Health System has changed the healthcare system in Brazil. With Columbia establishing the right to healthcare in its constitution, among many other plans, overhauled the healthcare system in the region. As the healthcare sector widens in Latin America, it would also propel the inertial systems market.

Latin America Inertial Systems Market Trends

The Growing Demand for Unmanned Vehicles is Expected to Drive the Market

- The booming demand for Unmanned Underwater Vehicles (UUV) is the primary factor driving the market's expansion. UUVs are being widely used in oil and gas exploration. The increasing gas and oil production and exploration activities in Latin America would aid the market's growth. For instance, according to the CIA (The World Factbook), in 2020, Brazil and Mexico amounted to 3% and 2.2%, respectively, of the total worldwide crude oil export value.

- The UUVs are used in the defense industry for deactivating underwater mines, counterattacking, port security, and hull inspection. Underwater drones aid in oceanographic studies for mapping the ocean floor in scientific research. They are also employed in scientific research and defense weaponry, where high precision is required.

- With the rising consumption of oil and gas globally, the UUVs are increasingly being used for oil rig constructions, pipeline inspections, and maintenance activities, thereby fueling the demand for the product. For instance, according to Baker Hughes, Latin America has a total of 152 oil and gas rigs as of October 2021, of which 33 rigs are offshore.

- Moreover, technological advancements such as the introduction of light-powered and compact-sized navigation systems that use ring laser gyros (RLG) and fiber optic gyros (FOG) contribute to the market's positive outlook.

- The global oil industry encountered a sudden drop in demand across various countries due to the severe impact of COVID-19. For instance, according to UNCTAD, global maritime transport plummeted by 4.1% in 2020 compared to the previous year due to unexpected disruption caused by the COVID-19 pandemic. The disorder has principally hampered the supply chain, shipping network, trade volumes, and port in the studied market, temporarily restraining the market growth.

Automotive Segment is Expected to hold a Significant Market Share

- The advancement of the global lifestyle has resulted in a greater demand for equipment that is easier to use, which has enabled the use of motion-sensing technology that heavily relies on inertial sensors. These sensors are widely used in the automotive industry to improve safety, performance, and cost-effectiveness.

- The emergence of MEMS technology increased automotive production, and high investments in defense, military, and sub-sea vehicles are just a few factors driving the automotive inertial systems market, while high cost and complexity are stifling the market growth.

- The rising demand for automobile safety is boosting the market's growth. Every year, approximately 1.35 million people are killed in road accidents worldwide, according to the World Health Organization.

- Furthermore, between 20 and 50 million more people suffer non-fatal injuries, with many becoming disabled as a result. MEMS accelerometers play a critical role in improving vehicle safety features.

- The current generation of automobiles is heavily reliant on data collected from various sensors installed in the vehicle. Gyroscopes and accelerometers provide critical measurements for improving vehicle control and stability. These sensors are prone to producing significant noise at low frequencies, resulting in low measurement accuracy, particularly under low-dynamic conditions, thereby accelerating market demand during the forecast period.

Latin America Inertial Systems Industry Overview

The Latin America Inertial Systems Market is moderately competitive and consists of several major players. In terms of market share, a few of the major players like Analog Devices Inc., Honeywell International Inc., ST Microelectronics, etc., currently dominate the market. These players are focusing on expanding their customer base globally.

- October 2021 - Honeywell introduced the Precision Boresight Alignment System (PBAS), which is intended to improve positioning and location accuracy in various aerospace and non-aerospace applications. The system is made up of two small electrical boxes. The first attaches to the item that needs to be aligned, such as the navigation system, and the second attaches to whatever it should be aligned to, the aircraft. Each box contains three gyroscopes that function similarly to other inertial navigators to determine positioning data. The boxes are linked to a central computer, which displays the data from which the technician notices discrepancies.

- October 2021 - STMicroelectronics introduced the Teseo-VIC3DA, the latest member of the Teseo module family. The Teseo-VIC3DA navigation module combines ST's high-performance Automotive Teseo III GNSS1 IC with the automotive 6-axis MEMS inertial measurement unit (IMU) and dead reckoning software to form a convenient, automotive-qualified navigation module. The Teseo-VIC3DA module enables applications such as in-car navigation, fleet management, and insurance monitoring.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Increasing Demand for Accuracy in Navigation

- 5.2 Market Restraints

- 5.2.1 Integration Drift Error in Navigational Systems

- 5.2.2 Increasing Costs and Complexity

6 MARKET SEGMENTATION

- 6.1 By Equipment

- 6.1.1 Gyroscopes

- 6.1.2 Accelerometers

- 6.1.3 Inertial Measurement Units

- 6.1.4 GPS/INS

- 6.1.5 Multi-Axis Sensors

- 6.2 By Technology

- 6.2.1 MEMS

- 6.2.2 Optic Fibre Gyro

- 6.2.3 Ring Laser Gyro

- 6.2.4 Vibrating Gyro

- 6.2.5 Hemispherical Resonator Gyro

- 6.2.6 Mechanical Inertial Navigational Systems

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Defense

- 6.3.3 Industrial

- 6.3.4 OEM

- 6.3.5 Energy and Infrastructure

- 6.3.6 Civil Aviation

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Colombia

- 6.4.4 Argentina

- 6.4.5 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Bosch Sensortec GmbH

- 7.1.3 Safran Group

- 7.1.4 Honeywell International Inc.

- 7.1.5 Invensense Inc.

- 7.1.6 Ixbluesas

- 7.1.7 Kearfott Corporation

- 7.1.8 KVH Industries Inc.

- 7.1.9 Meggitt PLC

- 7.1.10 Northrop Grumman Corporation

- 7.1.11 ST Microelectronics

- 7.1.12 Silicon Sensing Systems Ltd.

- 7.1.13 Rockwell Collins

- 7.1.14 UTC Aerospace Systems

- 7.1.15 Vector NAV

8 FUTURE OUTLOOK

9 INVESTMENT ANALYSIS

02-2729-4219

+886-2-2729-4219