|

市場調查報告書

商品編碼

1639453

亞太慣性系統市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia-Pacific Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

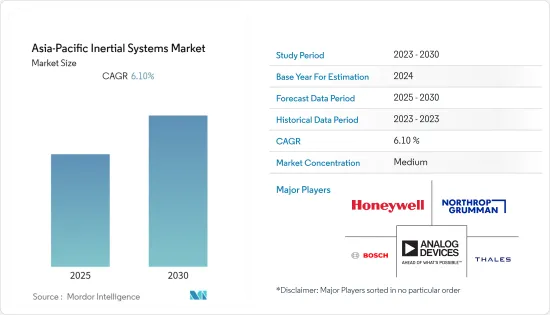

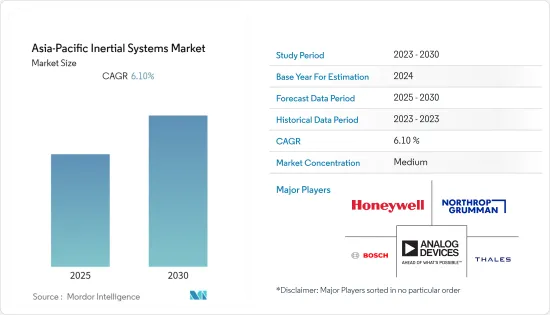

預計預測期內亞太慣性系統市場複合年成長率為 6.1%。

主要亮點

- 亞太地區是世界上最大的製造商和出口商的所在地。此外,印尼、中國、日本和印度等國家也是工業強國。國家公司和國際組織在這些國家設有大型工廠,用於出口和國內消費。隨著該地區經濟的成長,來自世界各地的新公司都希望在那裡投資。工廠在生產線上運作更多的機器以提高生產速度和效率。

- 全球生活方式的進步導致了對更舒適設備的需求,而運動感應技術以及慣性感測器的廣泛使用是這一市場的主要驅動力。

- 此外,預計這項技術將決定未來幾年的趨勢。無人駕駛汽車在各種民用和國防應用中的空前崛起,推動了對包括慣性感測器在內的複雜導航系統的需求。技術發展使得感測器變得更加普及且價格更加實惠。

- GPS/INS 和 GNSS/INS 等導航系統的日益整合,增加了比傳統導航系統更強大的功能,並推動了慣性系統市場的發展。近年來,國防和民用領域對無人機(UAV)、自主水下航行器(AUV)和遠程操作車輛(ROV)等無人駕駛車輛的需求大幅增加,刺激了亞太地區的成長。導航系統市場的成長。

- 由於政府關閉和多項規章制度,COVID-19 對全球各市場產生了重大影響。隨著該地區各政府放寬先前製定的規則和法規,市場已恢復穩定。終端用戶市場銷售額正在成長,預計在預測期內將繼續成長,從而推動市場發展。

亞太慣性系統市場趨勢

精密驅動市場需求不斷成長

- 高精度、高可靠性是此導航系統的主要特點。慣性導航系統相對於其他導航系統的優點在於,它們較少依賴外部輔助來選擇運動物體的旋轉和加速度。這些系統利用陀螺儀、加速計和磁力計的混合物來確定車輛或移動物體的向量變數。

- 導航系統天然適合於挑戰區域中車輛的綜合導航、控制和引導。與GPS和其他導航系統不同,慣性系統即使在惡劣的條件下也能保持其性能。慣性測量單元 (IMU) 非常適合估算導航系統的幾個指標。這些系統還能免受輻射和干擾問題的影響。與萬向節系統相比,捷聯慣性系統是慣性導航系統的較好選擇。由於它整合了 MEMS 技術,因此還具有成本效益。

- 隨著人工智慧和機器學習等先進技術被廣泛應用,透過感測器技術遠端控制的先進無人駕駛汽車變得越來越普遍。因此,戰術級裝備的高度和方向等正確的定位參數在當前情況下變得至關重要。

- 慣性導航系統廣泛應用於民航機、無人機、軍事和防禦單位,是導航和控制系統不可或缺的一部分。此外,隨著系統的處理能力逐漸提高,它們也能夠與其他導航系統互動。一些慣性系統,例如磁力儀,主要與其他慣性系統結合使用,以確定磁場的方向或存在。

- IMU 和 AHRS 等多軸系統用於確定移動車輛的高度、位置、加速度和速度。慣性系統利用加速計、陀螺儀和磁力計的組合,非常適合為導航系統提供高精度。

- 乘用車廣泛依賴導航系統,該地區對導航系統的需求一直很大。根據OICA(國際汽車製造商組織)預測,2021年包括中東在內的亞太地區乘用車銷量將在3,400萬輛左右,其中中國銷量將超過2,100萬輛。該地區的銷售額預計將增加並推動市場發展。

軍事應用的增加和 MEMS 的擴張可能會推動市場

- 印度陸軍最近獲得了自主研發的「丹努什」迫擊砲系統。武器配備慣性導航系統,可引導飛彈距離砲位最遠 36 公里。新技術還包括自動放置和基於 GPS 的槍支記錄。大砲利用其能力來計算彈道並測量其所裝備的彈的速度。熱成像、攝影機和雷射測距儀等技術對於改進慣性系統至關重要。

- IMU 在軍事行動中的使用,尤其是無人機(UAV),正在激勵各公司為這項技術創造先進的解決方案。因此,下一代 IMU 目前在市場上佔據主導地位。

- 慣性導引系統幾乎適用於所有軍用飛彈和精確導引炸彈,使這些武器能夠在飛行過程中準確瞄準目標並設定航向。慣性導引利用靈敏的測量感測器根據飛彈離開已知位置後的加速度來決定飛彈的位置。民航機使用環形雷射陀螺儀進行慣性導航。這比洲際彈道飛彈使用的機械系統精度較低,但仍能在一定程度上確定準確位置。

- 亞太地區軍事衝突頻繁。該地區領土爭端頻繁,促使各國購買最新的巡航飛彈以加強安全。新興國家不斷增加的軍事開支有助於現代巡航飛彈系統的開發和採購,推動該產業的發展。

- 印度和巴基斯坦繼續設計飛彈運載系統和核武。印度、巴基斯坦和中國之間日益激烈的競爭推動了三國採購和開發飛機、潛艇、火砲和飛彈系統等先進軍事戰術。

- 根據斯德哥爾摩國際和平研究所預測,2021年東亞地區軍費將達4,110億美元,僅次於北美。其中,南亞支出951億美元,東南亞支出431億美元,大洋洲支出353億美元,中亞支出18億美元。

亞太慣性系統產業概況

由於存在多種慣性系統解決方案提供商,亞太地區慣性系統市場相當分散。然而,供應商始終致力於擴大其產品範圍,以提高其知名度和存在感。此外,公司正在透過建立策略夥伴關係和進行收購來獲得市場吸引力並增加市場佔有率。

- 2022 年 7 月-Honeywell與韓華系統宣布,雙方已簽署合作備忘錄,合作擴大韓國的無人機系統 (UAS) 和城市空中交通 (UAM) 技術。韓華系統成立於韓國,在資訊基礎設施和國防電子領域提供卓越的智慧技術。Honeywell是領先的 UAS/UAM 技術供應商,提供一系列即用型技術,幫助客戶打造更永續的航空業未來。根據合作備忘錄的條款,兩家公司將探索各種混合動力推進解決方案,以應用Honeywell和韓華系統不斷擴大的、具有競爭力的 UAM 平台組合,這些平台旨在支持 UAS/UAM 市場。

- 2022 年 11 月 - GAMECO 與泰雷茲簽署了工業合作協議,以進一步開展 MRO 活動的合作。泰雷茲將繼續為 GAMECO 提供飛機維護、航空物資採購和銷售、技術文件和測試程序集 (TPS) 的支援。透過此協議,雙方將保持合作勢頭,以創新的產品、解決方案和優質的服務助力中國民航市場高品質發展。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章 市場動態

- 市場促進因素

- MEMS技術的出現

- 傾向國防和航太

- 導航系統的技術進步

- 市場限制

- 操作複雜,維護成本高

第6章 市場細分

- 按應用

- 民航

- 防禦

- 家用電子電器

- 車

- 能源和基礎設施

- 醫療

- 其他用途

- 按組件

- 加速計

- 陀螺儀

- IMU

- 磁力儀

- 姿態航向導航系統

- 其他組件

第7章 競爭格局

- 公司簡介

- Honeywell Aerospace Inc.

- Northrop Grumman Corporation

- Bosch Sensortec GmbH

- Analog Devices Inc.

- Thales Group

- Rockwell Collins Inc.

- Moog Inc.

- Fairchild Semiconductor(ON Semiconductors)

- VectorNav Technologies

- STMicroelectronics NV

- Safran Group(SAGEM)

- InvenSense Inc.

- Meggitt PLC

8.供應商市場佔有率分析

- 供應商地位分析(慣性系統)

- 供應商市場佔有率(高階慣性系統)

- 供應商市場佔有率(MEMS 產業)

第9章投資分析

第10章 市場潛力

簡介目錄

Product Code: 49995

The Asia-Pacific Inertial Systems Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- Asia-Pacific is home to the largest manufacturers and exporters of goods in the world. Also, countries like Indonesia, China, Japan, and India are the big powerhouses of industries. Domestic players and international organizations have large factories for exports and self-consumption in these countries. With the economy growing in this region, new companies from various parts of the world are looking to invest. Factories are operating more machines in the production lines to improve the speed and efficiency of production.

- The progress of the worldwide lifestyle has resulted in the requirement for equipment with greater comfort, allowing motion-sensing technology that broadly uses inertial sensors, which has become a key driving factor in this market.

- Further, it is anticipated to define the trend for the upcoming few years. The unprecedented increase in unmanned vehicles across different civilian and defense applications has raised the demand for complex navigational systems, including inertial sensors. Technological development has made sensors available and affordable, making their usage abundant in day-to-day devices.

- The growing integration of navigation systems such as GPS/INS and GNSS/INS added greater performance features than the traditional navigation system, thus, driving the inertial system market. In recent years, a substantial rise in demand for unmanned vehicles such as unmanned aerial vehicles (UAV), autonomous underwater vehicles (AUV), and remotely operated vehicles (ROV) across diverse applications in both defense and civilian applications fuelled the growth of the Asia-Pacific inertial navigation system market.

- COVID-19 significantly impacted various global markets due to lockdowns and multiple rules and regulations imposed by the government. The market returned to stability as the government in the regions eased the rules and regulations set earlier. The sales of the end-user market grew, which is anticipated to continue growing over the forecast period and drive the market.

APAC Inertial Systems Market Trends

Increasing Demand for Accuracy to Drive the Market

- High levels of precision and dependability are the major features of navigational systems. Inertial navigational systems have a different advantage over other navigation systems in terms of their shortage of reliance on exterior aids to choose the rotation and acceleration of a moving object. These systems utilize a mixture of gyroscopes, accelerometers, and magnetometers to specify the vector variables of a vehicle or a moving object.

- Navigational systems are naturally suited for integrated navigation, control, and guidance of vehicles in challenging areas. Unlike GPS and other navigation systems, inertial systems can maintain performance even under challenging conditions. Inertial measurement units (IMU) are well-fitted to estimate several metrics for navigational systems. These systems stay unchanged by radiation and jamming problems. Strapdown inertial systems find better usage in inertial navigation systems than gimbaled systems, as they are strapped to the moving object and offer more reliability and performance. They offer cost-effectiveness as they are integrated with MEMS techniques.

- As advanced technologies like AI and machine learning become more broadly adopted, advanced robotics cars remotely controlled through sensor technology are becoming more common. As a result, correct position parameters, such as height and orientation of tactical-grade equipment, are essential in the current scenario.

- Inertial navigation systems are available for commercial use in private aircraft, UAVs, and military and defense units and constitute an integral part of navigational control systems. They can also interact with other navigational systems due to gradual advancements in the system's processing power. Several inertial systems, like magnetometers, are primarily used to specify the orientation and existence of a magnetic field in conjunction with other inertial systems.

- Multi-axis systems such as IMUs and AHRS are operated to determine moving objects' altitude, position, acceleration, and velocity. Inertial systems are perfect for delivering high accuracy in navigational systems by utilizing a mixture of accelerometers, gyroscopes, and magnetometers.

- Passenger cars are widely dependent on navigation systems, which are in constant demand in the region. According to the OICA (Organisation Internationale des Constructeurs d'Automobiles), in 2021, the Asia-Pacific region sold approximately 34 million passenger cars, including in the Middle East, of which China sold more than 21 million. The numbers are anticipated to increase in the region and drive the market.

Rising Military Applications and Expansions of MEMS May Drive the Market

- An indigenous mortar system, Dhanush, is a recent addition to the Indian army. The weapons have an inertial navigation system that directs missiles nearly 36 km away from the guns' placements. The new technology also includes auto-laying and GPS-based gun recording. The cannon calculates ballistics and measures onboard velocity through its features. Technologies like thermal imaging, cameras, and a laser range finder are crucial to inertial systems' improvement.

- IMUs in military operations, especially in unmanned aerial vehicles (UAVs), have stimulated companies to create advanced solutions for this technology. As a result, next-generation IMUs are primarily available on the market today.

- Inertial guidance systems are operated in almost every missile and precision-guided bomb in the military, which enables these weapons to target and precisely set their course in flight. Inertial guidance utilizes sensitive measurement sensors to measure the missile's location based on the acceleration applied after it vacates a known site. Commercial aircraft employ inertial navigation with a ring laser gyroscope, which is less exact than the mechanical systems used in ICBMs but still delivers a precise, somewhat fix on location.

- Military clashes are frequent in the Asia-Pacific region. The region's rising frequency of territorial conflicts has encouraged countries to purchase modern cruise missiles to strengthen their security. The evolution of military expenditures in different countries in the region has assisted the development and procurement of modern cruise missile systems, driving the industry forward.

- India and Pakistan continue to design their missile delivery systems and nuclear arsenals. The growing obstruction relationship between India, Pakistan, and China boosts the procurement and development of advanced military strategies such as airplanes, submarines, artillery, and missile systems, among other things.

- According to the SIPRI (Stockholm International Peace Research Institute), in 2021, the military spending of East Asia amounted to USD 411 billion, second to North America. South Asia, Southeast Asia, Oceania, and Central Asia spent USD 95.10 billion, USD 43.10 billion, USD 35.30 billion, and USD 1.80 billion, respectively.

APAC Inertial Systems Industry Overview

The Asia-Pacific inertial systems market is moderately fragmented due to the presence of different inertial systems solution providers. However, the vendors consistently focus on product expansions to improve their visibility and presence. The companies are also adopting strategic partnerships and acquisitions to gain market traction and increase their market share.

- July 2022 - Honeywell and Hanwha Systems announced the signing of an MOU to partner on unmanned aerial systems (UAS) and urban air mobility (UAM) technology expansion in South Korea. Established in South Korea, Hanwha Systems delivers distinguished smart technologies in information infrastructure and defense electronics. Honeywell is a major provider of UAS/UAM technology, providing a wide variety of ready-now technologies and assisting customers in building a more sustainable future for aviation. Under the terms of the MOU, the companies will investigate different hybrid propulsion solutions for applying Honeywell and Hanwha Systems' UAM platform extended portfolio of competitive offerings developed to help the UAS/UAM market.

- November 2022 - GAMECO and Thales signed an industrial collaboration agreement for further cooperation in MRO activities. Thales will continue to assist GAMECO in aircraft maintenance, the procurement distribution of aviation supplies, and technical documentation and Test Program Sets (TPS). Both companies, with this agreement, will maintain the collaboration momentum in contributing to the high-quality development of the Chinese civil aviation market with innovative products, solutions, and quality services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Inclination Toward Defense and Aerospace

- 5.1.3 Technological Advancements in Navigation Systems

- 5.2 Market Restraints

- 5.2.1 Operational Complexity and High Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Civil Aviation

- 6.1.2 Defense

- 6.1.3 Consumer Electronics

- 6.1.4 Automotive

- 6.1.5 Energy and Infrastructure

- 6.1.6 Medical

- 6.1.7 Other Applications

- 6.2 By Component

- 6.2.1 Accelerometer

- 6.2.2 Gyroscope

- 6.2.3 IMU

- 6.2.4 Magnetometer

- 6.2.5 Attitude Heading and Navigation System

- 6.2.6 Other Components

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell Aerospace Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Analog Devices Inc.

- 7.1.5 Thales Group

- 7.1.6 Rockwell Collins Inc.

- 7.1.7 Moog Inc.

- 7.1.8 Fairchild Semiconductor (ON Semiconductors)

- 7.1.9 VectorNav Technologies

- 7.1.10 STMicroelectronics NV

- 7.1.11 Safran Group (SAGEM)

- 7.1.12 InvenSense Inc.

- 7.1.13 Meggitt PLC

8 Vendor Market Share Analysis

- 8.1 Vendor Positing Analysis (Inertial Systems)

- 8.2 Vendor Market Share (High-end Inertial Systems)

- 8.3 Vendor Market Share (MEMS Industry)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219