|

市場調查報告書

商品編碼

1627103

交通運輸中的慣性系統:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Inertial Systems in Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

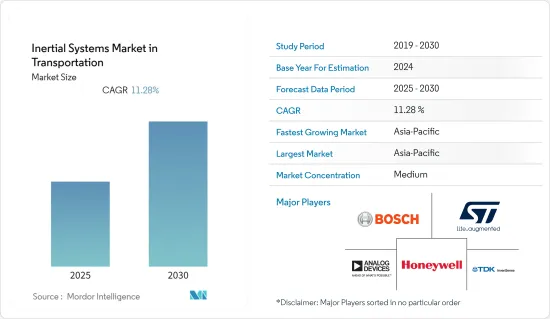

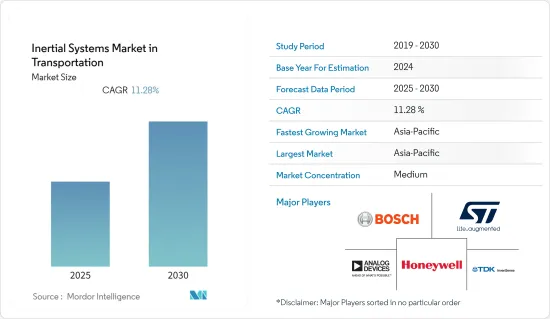

預計運輸慣性系統市場在預測期間的複合年成長率為 11.28%。

慣性系統由 IMU 和高性能感測器(陀螺儀、地磁計、加速計)組成,透過相對運動提供有關周圍環境的高精度資訊。 IMU 與其他車載感測器的強大組合可產生關鍵資料,從而提高車輛可靠性並在汽車應用中實現新的自動化突破。

主要亮點

- 慣性感測器擴大應用於交通運輸市場。汽車公司使用慣性感測器來增強安全功能、提高性能並降低車輛成本。用於ABS、安全氣囊展開、提升車輛穩定性、防盜等諸多功能。

- IMU 用於眾多汽車應用以及自動駕駛的現代化 ADAS 功能。當車輛駛向盲點或 LiDAR 功能在暴風雪中陷入困境時,IMU 有助於填補 GPS 的空白。

- 此外,由於 IMU 具有超過 25kHz 的高諧振頻率以及密封的驅動和評估單元,因此 IMU 提供了很高的機械干擾屏障。慣性測量單元 (IMU) 有助於主動和被動安全系統,例如 ESP(電子穩定控制程式)、安全氣囊控制單元以及主動式車距維持定速系統,其應用越來越受歡迎。這增強了整合微控制器的偏移性能。

- 相反,財務實力雄厚的公司也注重產品增強和策略收購,以增加市場佔有率並控制供應鏈。例如,Honeywell推出了HGuide i300,這是一款基於MEMS的高性能慣性測量單元(IMU),旨在滿足交通、無人機和UGV等各種市場的應用需求。憑藉行業標準的通訊介面和寬輸入電壓範圍,HGuide i300可以輕鬆整合到各種架構中。 HGuide i300 體積小、重量輕、功耗低,是許多應用的理想選擇。

交通運輸慣性系統的市場趨勢

市場對汽車MEMS的需求不斷增加

- 越來越多的車主需要增強車輛功能,以提高車內的安全性、舒適性和穩定性。這是MEMS市場的主要成長要素。此外,世界各國政府對車輛燃油效率和排放標準實施嚴格的規定。因此,汽車市場的領先公司越來越努力透過採用MEMS來滿足標準,從而增加了汽車MEMS的市場需求。

- MEMS 擴大應用於各種應用,包括停車煞車感測、防盜感測、高效引擎管理、輪胎壓力感測、側翻/打滑偵測和高效引擎管理。

- 隨著微機電系統(MEMS)技術的出現,感測器和半導體領域的機械和電子機械元件借助微加工和微加工技術實現了小型化。因此,MEMS現已成為1級、2級和3級自動駕駛汽車中多個自動化組件的重要組成部分,顯著拉動了汽車領域對慣性系統的需求。

- 根據世界衛生組織 (WHO) 統計,全球每年約有 135 萬人死於交通事故。此外,還有 2,000 萬至 5,000 萬人遭受非致命傷害,其中許多人因受傷而殘疾。 MEMS加速計在提高車輛安全性能方面發揮重要作用。

亞太地區成長強勁

- 在當前市場情況下,亞太地區是交通市場慣性系統的重要市場。中國、日本和印度等國家的大規模生產維持了該地區對慣性系統的持續需求。但最近,該地區部分地區的新車銷量大幅下滑。由於新冠肺炎 (COVID-19) 疫情的爆發,各個經濟體的汽車銷售量均出現下降。

- 例如,根據OICA的數據,2020年包括中東在內的亞太地區的乘用車銷量約為3,200萬輛,其中中國預計銷量為2,018萬輛。此外,預計2016年亞太地區乘用車銷量約3,536萬輛。

- 此外,預計今年電動車(EV)將在中國車主中越來越受歡迎。性能改進的新設計抵消了政府價格補貼的減少。羅蘭貝格表示,中國在該行業處於領先地位,並且生產最多的電動車和電池。純電動車(BEV)佔中國新能源乘用車銷量的大部分。中國政府將電動車視為中國參與競爭並成為主要汽車製造商的機會。

- 此外,在印度,由於政府雄心勃勃的計劃和舉措,電動車市場正在蓬勃發展。印度公共當局在過去幾年中宣布了多項與電動車相關的政策,展現了對該國推廣電動車的堅定承諾、具體行動和雄心壯志。

交通運輸慣性系統產業概述

運輸慣性系統市場競爭中等,由一些大型參與者組成。從市場佔有率來看,目前有少數幾家公司佔據市場主導地位。然而,隨著慣性系統感測器技術的進步,新參與企業正在增加其在市場中的存在,從而擴大企業發展。

- 2021年4月-自動駕駛車輛和設備慣性導引和導航系統開發商新納推出高精度定位硬體和軟體,提供高性能INS和RTK硬體與GNSS校正的系統整合,並宣布實現商業化。平台OpenARC。 OpenARC 由 Point One Navigation 為您提供,Point One Navigation 是下一代交通高精度定位提供者。

- 2020 年 3 月 - Teledyne Marine 是一家專門從事海底視覺化技術和無人海上車輛的公司,今天宣布推出一艘新型無人勘測船 TELEDYNE Z-BOATTM 1800-T。該研究船將配備 Trimble 的高精度 GNSS 航向接收器。它還與 Trimble Marine Construction (TMC) 軟體相容,允許在世界任何地方有效執行和即時監控海洋施工/疏浚計劃。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- MEMS技術的出現

- 用於國防和民用應用的無人駕駛車輛迅速增加

- 市場限制因素

- 綜合漂移誤差是導航系統中的一個主要問題

第6章 市場細分

- 按成分

- 加速計

- 陀螺儀

- 慣性測量系統(IMU)

- 慣性導航系統(INS)

- 其他組件

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭狀況

- 公司簡介

- Analog Devices Inc.

- Bosch Sensortec GmbH

- Safran Group

- Honeywell International Inc.

- Invensense Inc.

- Ixbluesas

- Kearfott Corporation

- KVH Industries Inc.

- Meggitt PLC

- Northrop Grumman Corporation

- ST Microelectronics

- Silicon Sensing Systems Ltd.

- UTC Aerospace Systems

- Rockwell Collins

- Vector NAV

- Thames Group

- Epson Europe Electronics

第8章投資分析

第9章 市場的未來

The Inertial Systems Market in Transportation Industry is expected to register a CAGR of 11.28% during the forecast period.

Inertial systems comprise IMUs in combination with high-performance sensors (gyroscopes, magnetometers, and accelerometers) to provide high-accuracy information about the surrounding environment through relative movement. The powerful combination of IMUs with other onboard sensors produces critical data increasing the reliability of the vehicles and leading to new automation breakthroughs in automotive applications.

Key Highlights

- Inertial sensors are being used increasingly in the transportation market. They are being used by automotive companies to increase safety features, improve performance, and reduce the cost of their vehicles. They are being used in ABS, airbag deployment, helping the stability of the vehicle, anti-theft, and many other features.

- The IMUs are used in a multitude of automotive applications as well as for the latest ADAS functioning for autonomous driving. It helps to fill the gap in GPS while the vehicle moves towards the blind spot and when LiDAR functionality struggles in a snowstorm.

- Moreover, owing to the high resonance frequency of over 25 kHz in IMU along with the closed driving and evaluation unit, it provides a high barrier to mechanical interference. The inertial measuring unit (IMU) has gained popularity for the application of contributing to active and passive safety systems such as ESP (Electronic Stability Control Program), airbag control unit, and driver assistance systems like the adaptive cruise control. This enhances the offset performance with an integrated microcontroller.

- On the contrary, companies with strong financials are also focusing on product enhancements and strategic acquisitions to gain more market share and significant control over the supply chain. For instance, Honeywell launched the HGuide i300, which is a high-performance MEMS-based Inertial Measurement Unit (IMU) designed to meet the needs of applications across various markets, including transportation, UAVs, and UGVs. With industry-standard communication interfaces and a wide-input voltage range, the HGuide i300 can be easily integrated into a variety of architectures. The small size, lightweight, and low power make the HGuide i300 ideal for many applications.

Transportation Inertial Systems Market Trends

Rise in Demand for Automotive MEMS in the Market

- A growing population of car owners is looking for enhanced vehicle features for better safety, comfort, and stability within cars. This is the major growth driver of the MEMS market. Moreover, the governments are imposing stringent regulations towards the standards for vehicle fuel efficiency and emission standards. As a result, major players in the automotive market are increasingly striving to meet the standards through the adoption of MEMS, thereby escalating the demand for automotive MEMS in the market.

- MEMS are increasingly being used in various applications, such as parking brakes sensing, anti-theft sensing, efficient engine management, tire pressure sensing, rollover & skidding detection, efficient engine management, and many more.

- The emergence of micro-electromechanical systems (MEMS) technology resulted in the miniaturization of mechanical and electro-mechanical elements in the field of sensors and semiconductors, with the help of micro-fabrication and micro-machining techniques. Hence, MEMS has now become an important part of several automation components in Level 1, 2, and 3 autonomous cars, boosting demand for inertial systems from the automotive sector significantly.

- According to the World Health Organization, globally, approximately 1.35 million people are killed in road accidents every year. Moreover, between 20 and 50 million more people suffer non-fatal injuries, with many incurring a disability as the result of their injury. MEMS accelerometers play an important role in improving the safety features of vehicles.

Asia Pacific to Register a Significant Growth

- The Asia Pacific region is a significant market for Inertial Systems Market in Transportation in the current market scenario. Huge volume production in countries such as China, Japan, and India keeps a constant demand for inertial systems in the region. However, in recent times, sales of the new vehicle in certain parts of the region have been sluggish. The witnessed a decrease in car sales across various economies due to COVID-19 Outbreak.

- For instance, according to the OICA, In 2020, it was estimated that about 32 million passenger cars were sold within the Asia Pacific region, including the Middle East, of which 20.18 million were sold in China. Comparatively, it was also estimated that approximately 35.36 million passenger cars were sold in the Asia Pacific region in 2016.

- Further, Electric vehicles (EVs) are projected to gain popularity with Chinese car owners this year, as new designs with improved performance offset a government cut in price subsidies. According to Roland Berger, China leads the way in terms of industry, producing the largest number of xEVs and battery cells. Battery Electric Vehicles (BEV) accounted for the vast majority of the new energy passenger vehicle sales in China. The Chinese government sees EVs as an opportunity for China to compete and become a major car manufacturer.

- Furthermore, the electric vehicle market is gaining momentum in India owing to the ambitious plans and initiatives of the government. Public authorities in India have made several electric vehicle-related policy announcements over the past few years, showing strong commitment, concrete action, and significant ambition for the deployment of electric vehicles in the country.

Transportation Inertial Systems Industry Overview

The Inertial Systems Market in Transportation is moderately competitive and consists of a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in sensor technology across the inertial systems, new players are increasing their market presence, thereby expanding their business footprint across the emerging economies.

- April 2021- ACEINNA, a developer of inertial-based guidance and navigation systems for autonomous vehicles and devices, announced the commercial availability of OpenARC, a precise positioning hardware and software platform that offers system integration of GNSS corrections with high-performance INS and RTK hardware. OpenARC is powered by Point One Navigation, a provider delivering precise positioning for the next generation of transportation.

- March 2020 - Teledyne Marine, which engages in subsea visualization technology and unmanned marine vehicles, announced today that it had released a new unmanned survey vessel, the TELEDYNE Z-BOATTM 1800-T. The survey vessel will be equipped with Trimble's high-precision GNSS heading receiver. It is compatible with Trimble Marine Construction (TMC) software, enabling marine construction/dredging projects to run efficiently and be monitored in real-time anywhere in the world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Rapid Rise of Unmanned Vehicles in Both Defense and Civilian Applications

- 5.2 Market Restraints

- 5.2.1 Integration Drift Error is a Major Concern in Navigation Systems

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Accelerometer

- 6.1.2 Gyroscope

- 6.1.3 Inertial Measurement Systems (IMU)

- 6.1.4 Inertial Navigation Systems (INS)

- 6.1.5 Other Components

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Bosch Sensortec GmbH

- 7.1.3 Safran Group

- 7.1.4 Honeywell International Inc.

- 7.1.5 Invensense Inc.

- 7.1.6 Ixbluesas

- 7.1.7 Kearfott Corporation

- 7.1.8 KVH Industries Inc.

- 7.1.9 Meggitt PLC

- 7.1.10 Northrop Grumman Corporation

- 7.1.11 ST Microelectronics

- 7.1.12 Silicon Sensing Systems Ltd.

- 7.1.13 UTC Aerospace Systems

- 7.1.14 Rockwell Collins

- 7.1.15 Vector NAV

- 7.1.16 Thames Group

- 7.1.17 Epson Europe Electronics