|

市場調查報告書

商品編碼

1626897

拉丁美洲的活性和智慧包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)Latin America Active and Intelligent Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

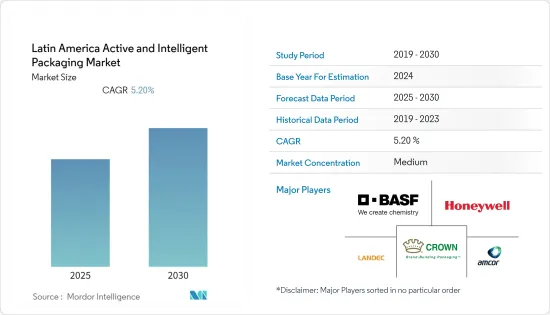

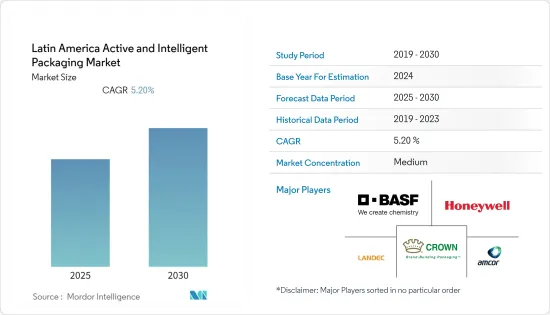

拉丁美洲活性包裝和智慧包裝市場預計在預測期內複合年成長率為5.2%

主要亮點

- 隨著世界城市人口的成長和生活方式趨勢的變化,對已調理食品、冷凍肉類和包裝食品的需求不斷增加。冷凍食品、肉品、蔬菜和水果的供應跨境,使當地市場走向全球。此外,隨著零售業的快速發展,對有吸引力的先進包裝的需求也在成長。

- 此外,仿冒品,特別是在新興國家的製藥和個人護理行業,迫使公司在包裝中使用 RFID 等技術。所有這些因素都解釋了對活性和智慧包裝的需求的顯著成長。然而,高昂的安裝和實施成本需要初始資金,並且與這些系統相關的安全問題對市場成長構成了挑戰。

- RFID 是眾多自動識別技術之一,可為肉類生產、分銷和零售鏈帶來多種潛在好處。這包括可追溯性、庫存管理、成本節約、安全性以及提高品質和安全性。防止產品召回也被認為是RFID技術的重要角色。因此,這是客戶對此類包裝產品需求不斷成長的主要動力。

- 雖然智慧包裝與活性包裝有明顯不同,但智慧包裝的功能允許使用者使用它來檢查活性包裝系統的有效性和完整性,帶來額外的功能,並且相輔相成。智慧包裝可以被認為是最終用戶行業可用的其他包裝功能的推動者,並在此過程中幫助客戶提供優質的產品。

- 此外,革命性工業4.0 的採用和疫情的蔓延增加了由Microsoft Azure 雲端服務等各種軟體支援的互聯包裝的使用,為該地區的零售商/電子零售商、品牌所有者、食品和飲料公司提供支持這對製造商有利。這正在推動市場研究。

拉丁美洲活性包裝與智慧包裝市場趨勢

更長的保存期限和消費者生活方式的變化預計將推動市場發展

- 消費者越來越需要保存期限長且易於使用的產品。這需要公司開發替代包裝解決方案。最佳食用日期是產品的一個重要方面。對於希望在不依賴先進冷藏鏈的情況下擴大產品供應的公司來說,提供更長保存期限的製造包裝已變得至關重要。

- 保護產品免受氧氣、水分和微生物等潛在劣化因素的影響,可延長保存期限。為了保護他們的產品,企業需要能夠實現相同目標且具有成本效益的包裝解決方案。減少整個食品供應鏈的浪費將是減少農業對環境影響和滿足不斷成長的糧食需求的關鍵活動。因此,投資高效、低成本、永續的加工和包裝解決方案,以延長產品(特別是乳製品、嬰兒食品和營養補充劑)的保存期限是一個可行的解決方案,對主動和增強型智慧包裝的需求將會增加; 。

- 生活方式的改變以及由此產生的消費者對加工、包裝和已調理食品的依賴正在增加對活性包裝和智慧包裝解決方案的需求。超級市場文化的出現也改變了購物格局,增加了對包裝的需求,特別是在食品和飲料領域。人們生活方式的變化導致從家庭烹飪轉向已烹調產品。除了易於使用之外,這些產品的包裝方式還必須確保它們新鮮且未受污染。

- 近幾個月來,我們看到消費者因 COVID-19 爆發而囤積不易腐爛的物品。活性、智慧包裝材料和生產流程等技術進步促使包裝設計師創造出延長產品保存期限的包裝產品和包裝方法。

- 此外,RFID 和 NFC 等智慧包裝解決方案可以整合到任何包裝材料中,包括塑膠、紡織品和原生纖維。這種靈活性正在提高所研究市場的採用率。

食品是市場成長的關鍵因素之一

- 根據巴西政府預測,2021年,巴西包裝食品零售額預計將達到1,166億美元,較2016年成長32.2%。本預測顯示高成長率的領域包括已調理食品、早餐用麥片穀類、嬰兒食品、調味醬料和調味料、加工肉品以及水產品和湯。這樣的成長率預計將增加對活性包裝和智慧包裝解決方案的需求。

- 依材料類型,阿根廷包裝市場分為四個部分:塑膠、紙張、鋁箔和纖維素包裝。因此,關注疫情的消費者可以使用 RFID 和 NFC 等智慧包裝來追蹤產品從運輸到儲存的整個過程。此外,Amcor 是阿根廷的主要參與企業之一。該公司透過 RFID 和 NFC 技術實現食品追蹤。這表明該地區對技術包裝的需求不斷成長。

- 從事食品加工和農產品企業(Tyson、Bachoco、Driscolls、Sunny Ridge 等)也需要比現有技術更好的環保包裝技術。烘焙點心和鹹味零食也呈現強勁成長,為墨西哥軟包裝製造商提供了廣泛的機會。鹹味零食產品系列包括洋芋片、玉米餅和玉米片,是最重要的產品領域。對已烹調營養食品的日益依賴也推動了墨西哥零食產品領域的包裝市場。

- 此外,巴西的食品配送應用正在興起,員工可以上門訂餐。這種成長是在大流行期間出現的,非接觸式送貨等各種措施促進了使用。因此,對智慧包裝的需求不斷成長,因為它可以讓客戶了解他們的包裝如何到達家門口,並知道該產品可以安全食用。

拉丁美洲活性包裝與智慧包裝產業概況

拉丁美洲活性和智慧包裝市場適度整合,主要參與者包括BASFSE、Amcor Ltd、霍尼韋爾國際公司、Landec Corporation、Bemis Company Inc.、Crown Holdings Inc.、Ball Corporation、Timestrip UK Ltd。 。公司不斷投資於策略聯盟和產品開發,以佔領更多的市場佔有率。近期市場趨勢如下。

- 2021 年 5 月 - 經過持續的市場篩檢過程,Four04 Packaging Ltd 被認定為 Coveris 策略成長計畫的理想合作夥伴。生鮮食品、水果和麵包包裝是該公司的特色業務。該公司提供的產品系列完美地補充了 Coveris 在這些市場中的現有產品線。

- 2021 年 5 月 - Sealed Air 開發了一種新的熱成型包裝解決方案。與常用的層壓材料相比,Sealed Air 聲稱其新型 CRYOVAC 品牌 LID830R 是一種更薄、更耐濫用的防霧覆蓋薄膜,可減少包裝重量高達 50%。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 更長的保存期限和消費者生活方式的改變

- 對新鮮、高品質食品的需求不斷成長

- 市場問題

- 包裝材料對人體影響的相關問題

- 智慧包裝的安全和隱私問題

第5章 COVID-19 對市場的影響

第6章 市場細分

- 按類型

- 活性包裝

- 氣體清除器/發送器

- 水分清除劑

- 微波基座

- 其他活性封裝技術

- 智慧包裝

- 編碼和標記

- 天線(RFID 和 NFC)

- 感測器和輸出設備

- 其他智慧包裝技術

- 活性包裝

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 個人護理

- 其他行業

- 按國家/地區

- 巴西

- 墨西哥

- 其他拉丁美洲

第7章 競爭格局

- 公司簡介

- BASF SE

- Amcor Ltd

- Honeywell International Inc.

- Landec Corporation

- Bemis Company Inc.

- Crown Holdings Inc.

- Ball Corporation

- Sonoco Products Company

- Graphic Packaging International LLC

- Timestrip UK Ltd

- Sealed Air Corporation

- Dessicare Inc.

- WestRock Company

第8章投資分析

第9章 市場未來展望

The Latin America Active and Intelligent Packaging Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- With the growing urban population and changing lifestyle trends worldwide, the demand for ready-to-eat, frozen meat, and packaged food is increasing. The supply of frozen foods, meat products, vegetables, and fruits surpass boundaries, giving regional markets global exposure. Moreover, with the retail industry propelling rapidly, the need for attractive and advanced packaging is also increasing.

- The increase in counterfeit products, especially in the pharmaceutical and personal care industries in emerging economies, also compelled companies to use technologies, such as RFID, during packaging. All these factors account for a substantial rise in the demand for active and intelligent packaging. However, the initial capital needed due to higher costs of installation and implementation and security issues regarding these systems is challenging the market's growth.

- RFID is one of many automatic identification technologies that offer some potential benefits to meat production, distribution, and retail chain. These include traceability, inventory management, labor-saving costs, security, and the promotion of quality and safety. The prevention of product recalls it is also considered a key role of RFID technology. Thus, it acts as a major driving factor for the increased demand from the customers for such products for packaging.

- Although intelligent packaging is distinctly different from active packaging, the features of intelligent packaging enable the user to use it to check the effectiveness and integrity of active packaging systems, bringing added features and complementing each other. Intelligent packaging can be considered the enabler of the other packaging features that end-user industries can utilize, and in the process, help their customers offer quality products.

- Furthermore, the introduction of revolutionary industry 4.0 and the spread of the pandemic has increased the use of connected packaging powered by various software such as Microsoft Azure cloud services to benefit the retailers/e-tailers, brand owners, and food manufacturers in the region. This is driving the market studied.

Latin America Active & Intelligent Packaging Market Trends

Longer Shelf Life and Changing Consumer Lifestyle is expected to drive the market

- Consumers have been demanding products with extended shelf life and easier usage. This has necessitated the companies to develop alternate packaging solutions. Shelf life has been an important aspect of the product. Companies looking to expand their product offerings with less dependency on sophisticated cold storage chains have become imperative to produce packages that provide longer shelf life.

- The shelf life can be increased by protecting the products from potential deteriorating agents, such as oxygen, moisture, and microbes. In order to protect their products, companies need a packaging solution that can achieve the same and is also cost-effective. Reducing wastage throughout the food supply chain is likely to become a crucial activity to reduce the environmental impact of agriculture and serve the increasing food demand. Therefore, investing in efficient, low-cost, and sustainable processing and packaging solutions to increase the shelf life of products (especially dairy, baby food, and nutraceuticals) is a viable solution, thus augmenting the requirement of active and intelligent packaging.

- Changing lifestyle and the consequent dependence of consumers on processed, packaged, and precooked food is increasing the demand for active and intelligent packaging solutions. The advent of the supermarket culture has also altered the landscape of shopping and has increased the need for packaging, especially in food and beverage products. The altering lifestyle of people has resulted in the shift from home-cooked to ready-to-eat products. In addition to this ease of use, these products should also be packaged in such a way to ensure they are fresh and uncontaminated.

- In the past few months, consumers have been witnessed stocking up on shelf-stable goods owing to the impact of the COVID-19 outbreak. Technological advancements such as active and intelligent packaging materials and production processes have led packaging designers to produce packaging products and methods that increase the shelf life of the products.

- Moreover, intelligent packaging solutions such as RFIDs and NFcs can be incorporated into any packaging material such as plastic, fiber, virgin fiber, among others. Such flexibility increases the adoption in the market studied.

Food is One of the Significant Factor for Market Growth

- According to the Brazilian government, by the year 2021, the retail sales in packaged food in Brazil are anticipated to reach USD 116.6 billion, a growth rate of 32.2% since 2016. High growth rates in the forecast include ready meals, breakfast cereals, baby food, sauces dressings and condiments, processed meat, and seafood and soup. Such growth rates are expected to increase the demand for active and intelligent packing solutions.

- Based on the material types, the packaging market in Argentina is categorized into four segments: plastic, paper, aluminum foil, and cellulose packaging materials. Thus intelligent packaging such as the RFIDs and NFCs can be included to track the products from transport to storage by consumers that are concerned amind the pandemic. Further, one of the major players in Argentina is Amcor. The company allows tracking of food products through RFID and NFC technology. This is indicative of the growing demand for technology-infused packaging in the region.

- The companies involved in food processing and agribusiness (Tyson, Bachoco, Driscolls, Sunny Ridge, etc.) also require better and greener packaging technologies than the available ones. Baked and salted snacks are also showing strong growth, providing extensive opportunities for flexible packaging manufacturers in Mexico. The salted snacks product group, including potato chips, tortillas, and corn chips, is the most significant product segment. Also, a greater reliance on ready-prepared nutritious foods drives the packaging market in the snack product segment in Mexico.

- Furthermore, Brazil is witnessing increased food delivery applications that allow personnel to order food at doorsteps. The increase was witnessed amid the pandemic, and various initiatives such as the non-contact deliveries are driving the use of applications. Thus the need for intelligent packaging increases as it allows customers and understand how the package arrived at their doorstep and enables them to know that the product is safe to consume.

Latin America Active & Intelligent Packaging Industry Overview

The Latin America Active and Intelligent Packaging market is moderately consolidated, with a few major companies like BASF SE, Amcor Ltd, Honeywell International Inc., Landec Corporation, Bemis Company Inc., Crown Holdings Inc.Ball Corporation, Timestrip UK Ltd are some players. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- May 2021 - Four04 Packaging Ltd was identified as an ideal partner for Coveris' strategic growth plans through a continuous market screening procedure. Packaging for fresh food and fruit, as well as bread, is a specialty of the company. It offers a product portfolio that ideally complements Coveris' existing product lines in these markets.

- May 2021 - A new thermoforming packaging solution has been developed by Sealed Air. When compared to commonly used laminates, Sealed Air claims that the new CRYOVAC brand LID830R is a thin, high abuse resistance, anti-fog top lid film that can reduce packing weight by up to 50%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Longer Shelf Life and Changing Consumer Lifestyle

- 4.4.2 Growing Demand for Fresh and Quality Food Products

- 4.5 Market Challenges

- 4.5.1 Issues with the Effects of Packaging Materials on the Human Body

- 4.5.2 Security and Privacy Issues in the Case of Intelligent Packaging

5 IMPACT OF COVID-19 ON THE MARKET

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Active Packaging

- 6.1.1.1 Gas Scavengers/Emitters

- 6.1.1.2 Moisture Scavenger

- 6.1.1.3 Microwave Susceptors

- 6.1.1.4 Other Active Packaging Technologies

- 6.1.2 Intelligent Packaging

- 6.1.2.1 Coding and Markings

- 6.1.2.2 Antenna (RFID and NFC)

- 6.1.2.3 Sensors and Output Devices

- 6.1.2.4 Other Intelligent Packaging Technologies

- 6.1.1 Active Packaging

- 6.2 By End-user Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BASF SE

- 7.1.2 Amcor Ltd

- 7.1.3 Honeywell International Inc.

- 7.1.4 Landec Corporation

- 7.1.5 Bemis Company Inc.

- 7.1.6 Crown Holdings Inc.

- 7.1.7 Ball Corporation

- 7.1.8 Sonoco Products Company

- 7.1.9 Graphic Packaging International LLC

- 7.1.10 Timestrip UK Ltd

- 7.1.11 Sealed Air Corporation

- 7.1.12 Dessicare Inc.

- 7.1.13 WestRock Company