|

市場調查報告書

商品編碼

1627095

北美主動和智慧包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Active and Intelligent Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

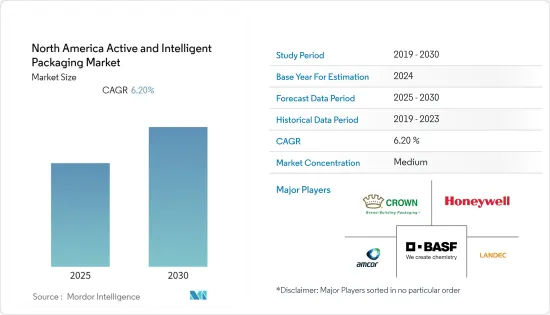

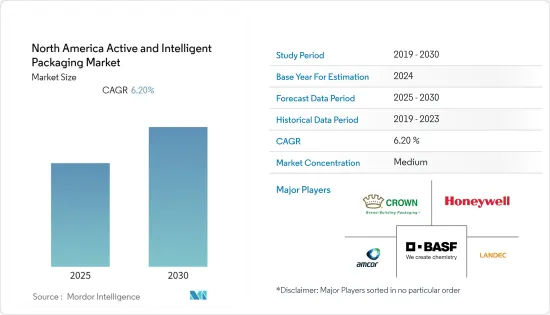

北美活性包裝和智慧包裝市場預計在預測期內複合年成長率為6.2%

主要亮點

- 食品加工公司正在推動主動包裝的需求,以在供應鏈中更長時間地保持食品新鮮度,減少食品廢棄物,並為消費者提供更方便的包裝。去氧劑與包裝中的氧氣反應,以保護產品劣化氧化反應並保持新鮮度。

- 智慧包裝使其能夠感知和測量所包裝食品及其儲存環境的多個變數。此功能可讓相關人員(製造商、零售商和消費者)透過測量的屬性來了解其食品的健康狀況。

- 該地區的消費者傾向於購買含有魚、肉和蔬菜的產品,這些產品主要經過蒸餾包裝以延長保存期限,導致家常小菜越來越受歡迎。線上購買趨勢也推動了其受歡迎程度。

- 根據美國疾病管制與預防中心的研究,美國每年約有4,800萬起食物中毒病例,這意味著每年有六分之一的美國會食物中毒。這些疾病已導致估計 128,000 人住院治療和 3,000 人死亡。人們對食物中毒的認知不斷提高,消費者對新鮮和高品質包裝食品的需求不斷成長,以及食品製造商對延長食品保存期限的關注正在推動主動包裝和智慧包裝市場的發展。

- 仿冒品的增加,特別是在製藥和個人護理行業,迫使公司在包裝中使用 RFID 等技術。所有這些因素都顯著增加了對主動和智慧包裝的需求。然而,由於安裝和實施成本高昂,以及與這些系統相關的安全問題,所需的初始資金為市場成長帶來了挑戰。

北美活性包裝與智慧包裝市場趨勢

活性包裝大幅增加

- 活性包裝的概念與包裝內容物的品質完全相關。活性包裝與被包裝產品直接接觸,並與被包裝產品產生化學或生物交互作用。

- 為了延長產品的保存期限,將某些成分摻入包裝中並從包裝材料中吸收或吸收到包裝材料中,以延長保存期限並保持產品的品質。這個過程稱為活性包裝。為此目的使用了各種技術,包括去氧劑、微波基座、氣味吸收劑/釋放劑、吸濕劑/濕度吸收劑和抗菌包裝。

- 美國零售商嚴重依賴使用當地加工商進行的店後鮮切業務。例如,Church Brothers Farms 就是這樣一家公司,主要向餐飲業供應產品,約 15% 的產品銷往零售店。

- 包裝食品的需求不斷成長正在推動活性包裝市場的發展。客戶對包裝食品和即食食品的偏好不斷增加,正在推動活性包裝市場的發展,預計這一趨勢將在預測期內持續下去。切碎和包裝的水果和蔬菜主要使用活性包裝,這種包裝會釋放包裝內的氣體。

飲料業是市場成長的關鍵因素之一。

- 消費者正在轉向更健康、更衛生的產品,對健康飲料和果汁飲料的需求越來越大。除了瓶裝水外,還有適合旅行和運輸的小型果汁飲料。隨著對健康飲料的需求增加,消費者被紙盒包裝所吸引,因為紙盒包裝具有環境永續性和可回收性。這導致牛奶和飲料製造商採用液體紙盒包裝。

- 由於健康意識不斷增強,冷壓果汁在美國越來越受歡迎,消費者正在尋找有機、天然成分和最低限度加工的產品。品牌擁有者設計的果汁紙盒具有高度保護性、在常溫下持久且環保。

- 此外,採用環保包裝和含有受控成分的調味水正在增加紙箱水的使用。根據國際瓶裝水協會的數據,瓶裝水是美國最常用的飲料產品(以體積計算),從 2019 年的 144 億加侖增加到 2020 年的 152 億加侖。用紙盒代替寶特瓶將對市場產生重大影響。

- 2020 年 5 月,Sustana Fiber 位於魁北克的工廠宣布了回收多層果汁和牛奶紙盒的新製程。因此,我們現在每年能夠加工 3,000 至 4,000 噸多層紙箱。回收的多層紙盒提供了繼續生產廁所用衛生紙和餐巾紙等必需品所需的原料,從而改善了回收和回收工作。增加紙箱回收有助於保護自然資源、實現關鍵的轉移和回收目標、創造就業機會,並且在 COVID-19 的情況下,避免生產必需品所需的紙漿短缺。

北美活性包裝與智慧包裝產業概況

北美活性和智慧包裝市場適度整合,該地區有幾家主要參與者,包括BASF股份公司、Amcor Ltd、霍尼韋爾國際公司、Landec Corporation、Bemis Company Inc、Crown Holdings Inc 和 Ball Corporation。公司不斷投資於策略聯盟和產品開發,以佔領更多的市場佔有率。近期市場發展趨勢如下。

- 2020 年 8 月 -美國跨國包裝公司 Sonoco 以 4,900 萬美元完成對法國永續紙包裝及相關製造設備製造商 Can Packaging 的收購。透過此次策略性收購,該公司取得了多項突破,包括生產可回收、高性能全紙包裝的專利技術,這些包裝可以有各種形狀和尺寸,包括圓形、方形、矩形、橢圓形和三角形. 獲得技術技能。

- 2021 年 8 月 - Amcor 是全球開發和製造可靠且多功能包裝解決方案的先驅之一,該解決方案用於含有兩種或多種受控成分(器械、藥物、生技藥品)的組合產品,宣布推出其獨特的醫用蓋技術。 Amcor 的最新發明是基於取得專利的惰性薄膜開發和層壓板設計。耐熱滅菌封蓋解決方案可對產品進行保存和滅菌,同時防止藥物滯留在包裝中。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 更長的保存期限和消費者生活方式的改變

- 對新鮮、高品質食品的需求不斷成長

- 市場問題

- 包裝材料對人體影響的相關問題

第5章 COVID-19 對市場的影響

第6章 市場細分

- 按類型

- 活性包裝

- 氣體清除器/發送器

- 水分清除劑

- 微波基座

- 其他活性封裝技術

- 智慧包裝

- 編碼和標記

- 天線(RFID 和 NFC)

- 感測器和輸出設備

- 其他智慧包裝技術

- 活性包裝

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 個人護理

- 其他行業

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- BASF SE

- Amcor Ltd

- Honeywell International Inc.

- Landec Corporation

- Crown Holdings Inc.

- Ball Corporation

- Sonoco Products Company

- Graphic Packaging International LLC

- Coveris Holdings SA

- Sealed Air Corporation

- Dessicare Inc.

- WestRock Company

第8章投資分析

第9章 市場未來展望

The North America Active and Intelligent Packaging Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- Food processing companies drive active packaging demand to keep food fresh for a more extended period and during its duration in the supply chain, reduce food waste, and promote more convenient packaging for consumers. This rise in the demand for fresh food is significantly contributing to the need for oxygen scavengers, as they react with the oxygen in the package and protect the product from degradative oxidation reactions, keeping them fresh.

- Intelligent packaging is enabled to sense and measure some variables of the food that it encloses or the environment in which it is kept. This feature enables it to inform the stakeholders (manufacturer, retailer, and consumer) of the state of the food through measured properties.

- As consumers in the region are inclined towards products containing fish, meat, and vegetables, which are mainly retort-packed to keep them shelf-stable, readymade meals gained increased popularity. The increasing trend of online purchasing further buoyed their popularity.

- According to the Center for Disease Control and Prevention findings, in the United States, there are about 48 million cases of foodborne illness annually, which is equivalent to one in six Americans each year. These illnesses resulted in an estimated 128,000 hospitalizations and 3,000 deaths. The increasing awareness about foodborne diseases, the growth in the demand for fresh and quality packaged food by consumers, and manufacturers' concern for longer shelf-life for food products are driving the market for active and intelligent packaging.

- The increase in counterfeit products, especially in the pharmaceutical and personal care industries, has been compelling companies to use technologies, such as RFID, during packaging. All these factors account for a substantial rise in the demand for active and intelligent packaging. However, the initial capital needed due to higher costs of installation and implementation and security issues regarding these systems is challenging the growth of the market.

North American Active & Intelligent Packaging Market Trends

Active Packaging is Observing a Significant Increase

- The concept of active packaging is completely associated with the quality of the packaged content. Active packaging interacts directly with the packaged product, as it is in direct contact with the product and can interact chemically or biologically with the packaged product.

- To improve the product's shelf life, certain components are incorporated into packaging that releases or absorb from or into the packed substance to prolong its shelf life and sustain the quality of the product. This process is termed active packaging. For this purpose, various technologies are used, which include oxygen scavengers, microwave susceptors, odor absorbers/emitters, moisture/ humidity absorbers, and anti-microbial packaging.

- The retailers in the United States are heavily reliant upon fresh-cut operations at the back of stores using regional processors. For instance, Church Brothers Farms is one such company that predominantly caters to the foodservice, with around 15% of its product going to retail, which indicates that a major portion of the country has yet to switch to MAP.

- The rising demand for packaged food is boosting the active packaging market. The growing inclination of customers toward packaged and ready-to-eat foodstuffs is propelling the active packaging market, and this trend is expected to continue within the forecast period. Chopped and packaged fruits and vegetables employ active packaging to a large extent, releasing gases within the packaging.

Beverage Industry is One of the Significant Factor for Market Growth

- Consumers have been shifting towards healthier and hygienic products, and they have been demanding healthy beverages, fruit drinks, etc. Along with bottled water, some fruit drinks are also being made in smaller sizes for travel and mobility purposes. Simultaneously with the increasing demand for healthier beverages, consumers are fascinated by carton packaging, providing environmental sustainability and recyclability. This has been attracting milk and beverage producers to adopt carton packaging for liquids.

- Cold-pressed juices are gaining popularity in the United States due to the growing health-consciousness and demanding organic and natural ingredients and minimally processed products. Brand owners have been designing cartons for juices as it offers high protection and excellent long-term shelf life at room temperature and is eco-friendly.

- Also, the introduction of eco-friendly packaging and flavored water with regulated ingredients has escalated the growth in carton water usage. According to International Bottled Water Association, bottled water is the widely used beverage product in the United States (by volume), which grew to 15.2 billion gallons in 2020 from 14.4 billion gallons in 2019. Substituting plastic bottles with cartons has a major impact on the market.

- In May 2020, Sustana Fiber's mill in Quebec announced new processes to recycle multilayer juice and milk cartons. It can now annually process 3,000 to 4,000 tons of these cartons collected from across the country. Each recycled multilayer carton provides the raw material needed to continue producing essential items like toilet paper and paper napkins, thus improving recycling and recovery efforts. Increased carton recycling helps preserve natural resources, meet important diversion and recycling goals, create jobs, and, in the case of COVID-19, helps avoid shortages of the pulp needed to manufacture essential items.

North American Active & Intelligent Packaging Industry Overview

The North America Active and Intelligent Packaging market are moderately consolidated, with a few major companies like BASF SE, Amcor Ltd, Honeywell International Inc., Landec Corporation, Bemis Company Inc., Crown Holdings Inc., Ball Corporation operating in the region. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- August 2020 - Sonoco, a multinational packaging company based in the United States, completed the USD 49 million acquisition of Can Packaging, a French manufacturer of sustainable paper packaging and related manufacturing equipment. This strategic acquisition provides the company with several breakthroughs, including patented technology for creating a recyclable, high-performance all-paper package that can be made in various shapes and sizes, including round, square, rectangular, oval, elliptical, and triangular.

- August 2021 - Amcor, one of the global pioneers in developing and producing a diverse range of reliable packaging solutions, announced the debut of a proprietary healthcare lidding technology that will be used for combination products containing two or more regulated components (device, drug, or biologic). Amcor's recent invention is based on patented inert film development and laminate design. It offers a lidding solution that can endure heat sterilization, which conserves and sterilizes products while preventing drug uptake into the package.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Longer Shelf Life and Changing Consumer Lifestyle

- 4.4.2 Growing Demand for Fresh and Quality Food Products

- 4.5 Market Challenges

- 4.5.1 Issues with the Effects of Packaging Materials on the Human Body

5 IMPACT OF COVID-19 ON THE MARKET

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Active Packaging

- 6.1.1.1 Gas Scavengers/Emitters

- 6.1.1.2 Moisture Scavenger

- 6.1.1.3 Microwave Susceptors

- 6.1.1.4 Other Active Packaging Technologies

- 6.1.2 Intelligent Packaging

- 6.1.2.1 Coding and Markings

- 6.1.2.2 Antenna (RFID and NFC)

- 6.1.2.3 Sensors and Output Devices

- 6.1.2.4 Other Intelligent Packaging Technologies

- 6.1.1 Active Packaging

- 6.2 By End-user Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BASF SE

- 7.1.2 Amcor Ltd

- 7.1.3 Honeywell International Inc.

- 7.1.4 Landec Corporation

- 7.1.5 Crown Holdings Inc.

- 7.1.6 Ball Corporation

- 7.1.7 Sonoco Products Company

- 7.1.8 Graphic Packaging International LLC

- 7.1.9 Coveris Holdings SA

- 7.1.10 Sealed Air Corporation

- 7.1.11 Dessicare Inc.

- 7.1.12 WestRock Company