|

市場調查報告書

商品編碼

1627110

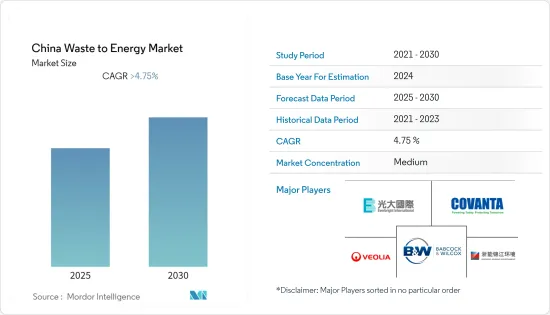

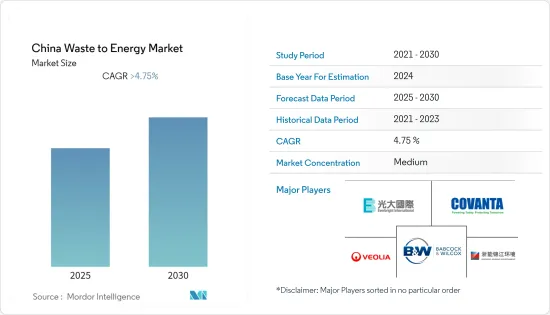

中國WtE(垃圾發電):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Waste to Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

中國WtE(垃圾發電)市場預計在預測期內複合年成長率將超過4.75%

主要亮點

- 從長遠來看,有利的政府措施和國內投資的增加預計將推動市場。

- 另一方面,市場成長是由垃圾焚化發電產生的有害氣體排放和這些發電廠產生的灰燼推動的,這些灰燼通常需要在垃圾掩埋場安全處置,這可能導致地下水污染。

- 然而,到 2050 年,該地區人均每日廢棄物產生量預計將增加近 40%。因此,該地區城市垃圾量的增加和能源需求的增加預計將為中國垃圾焚化發電市場提供未來的機會。

中國WtE(垃圾發電)市場趨勢

基於熱的廢棄物能源轉化主導市場

- 2019年,中國成為安裝全球最大焚化廠(深圳東廢棄物發電廠)的主要國家之一。該工廠每年將可處理270萬噸廢棄物,每年發電15億度。

- 對於除了發電之外還利用熱電汽電共生(供熱和製冷)的工廠,最佳效率預計可達 80%。

- 目前,焚燒是都市固態廢棄物(MSW)處理中最著名的垃圾焚化發電技術。

- 然而,垃圾焚化發電技術,尤其是焚燒,會產生污染並帶來潛在的健康和安全風險。

- 為了減少顆粒物和氣相排放,焚化廠業主採用了一系列製程裝置來清潔煙氣流,從而顯著改善環境永續性。

加大投資帶動市場

- 中國是世界第二大城市垃圾生產國。因此,我們在2017年啟動了廢棄物分類計劃,目標是到2025年建成100個零廢棄物城市。

- 全國廢棄物排放將從2010年的1.58億噸增加至2021年的2.487億噸,增加約57.4%。

- 根據中國國家主席習近平的反污染計劃,焚燒業預計將繼續擴大並取代惡臭、污染和土地密集的垃圾場。中國人口眾多,產生大量垃圾(每年成長 8-10%),因此正在尋找新的設施來燃燒固態廢棄物來發電。

- 到2025年,中國固態廢棄物產生量預計將加倍,達到每年5億噸以上。預計這一因素將在預測期內進一步推動該國對廢棄物處理設施的巨大需求。

- 預計這些因素將在預測期內推動中國WtE(垃圾發電)市場的發展。

中國廢棄物產業概況

中國廢棄物發電市場適度細分。主要參與企業包括(排名不分先後)中國光大國際有限公司、浙能錦江環境控股有限公司、Babcock & Wilcox Enterprises Inc.、Covanta Holding Corporation 和 Veolia Environnement SA。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章 按技術細分市場

- 身體的

- 熱的

- 生物

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- China Everbright International Limited

- Zheneng Jinjiang Environment Holding Co. Ltd

- Babcock & Wilcox Enterprises Inc.

- Covanta Holding Corporation

- Veolia Environnement SA

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 49282

The China Waste to Energy Market is expected to register a CAGR of greater than 4.75% during the forecast period.

Key Highlights

- Over the long term, favorable government policies and increasing investments in the country are expected to drive the market.

- On the other hand, the emission of harmful gases generated from waste-to-energy plants and the ash produced from these plants, which needs to be disposed of safely, usually in landfills, leading to groundwater contamination, may also hinder the growth of the market.

- However, the daily per capita waste generation in the region is expected to increase by nearly 40% by 2050. Thus, the increasing volume of municipal waste and rising demand for energy in the region are expected to create an opportunity for the waste-to-energy market in China in the future.

China Waste to Energy Market Trends

Thermal-based Waste-to-Energy Conversion to Dominate the Market

- In 2019, China became one of the prominent countries that installed the world's largest incineration plant (the Shenzhen East waste-to-energy plant). The plant can process 2.7 million ton of waste per year and generate 1.5 billion kilowatt-hours of power per year.

- Plants that utilize cogeneration of thermal power (heating and cooling), along with electricity generation, are estimated to reach optimum efficiencies of 80%.

- Presently, incineration is the most well-known waste-to-energy technology for municipal solid waste (MSW) processing.

- However, waste-to-energy technologies, particularly incineration, produce pollution and carry potential health safety risks.

- To reduce particulate and gas-phase emissions, incineration plant owners have adopted a series of process units for cleaning the flue gas stream, leading to a significant improvement in terms of environmental sustainability.

Increasing Investments to Drive the Market

- China is the second-largest producer of municipal waste in the world. Therefore, it initiated waste sorting plans in 2017 and aims to build 100 zero-waste cities by 2025.

- The country's disposed waste increased from 158 million ton in 2010 to 248.7 million ton in 2021, an increase of around 57.4%.

- Under Chinese President Xi Jinping's plan to tackle pollution, the incineration industry is expected to continue its expansion and replace stinky, polluting, land-intensive garbage dumps. With its massive population producing vast quantities of garbage (increasing by 8-10% annually), China is looking for new facilities that burn solid waste to produce electricity.

- By 2025, China's solid waste generation is expected to double to more than 500 million metric ton annually. This factor is further expected to create a huge demand for waste treatment facilities in the country during the forecast period.

- Such factors are expected to drive the market for waste to energy in China during the forecast period.

China Waste to Energy Industry Overview

China's waste-to-energy market is moderately fragmented. Some of the key players are (in no particular order) China Everbright International Limited, Zheneng Jinjiang Environment Holding Co. Ltd, Babcock & Wilcox Enterprises Inc., Covanta Holding Corporation, and Veolia Environnement SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION BY TECHNOLOGY

- 5.1 Physical

- 5.2 Thermal

- 5.3 Biological

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 China Everbright International Limited

- 6.3.2 Zheneng Jinjiang Environment Holding Co. Ltd

- 6.3.3 Babcock & Wilcox Enterprises Inc.

- 6.3.4 Covanta Holding Corporation

- 6.3.5 Veolia Environnement SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219