|

市場調查報告書

商品編碼

1640675

北美廢棄物能源 (WtE):市場佔有率分析、產業趨勢和成長預測(2025-2030 年)North America Waste to Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

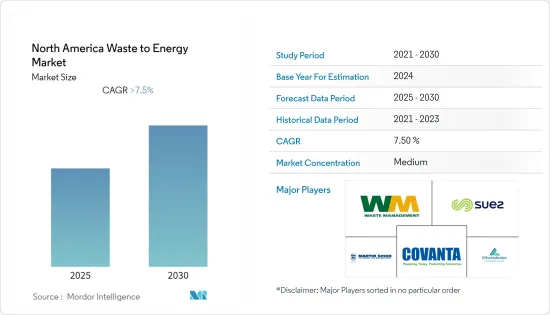

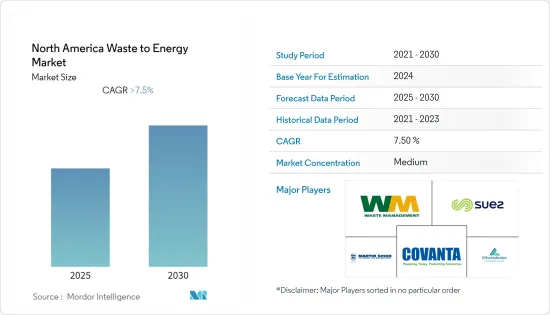

預測期內,北美 WtE(廢棄物轉化為能源)市場預計將以超過 7.5% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從長遠來看,廢棄物產生量的增加、對廢棄物管理的日益關注以滿足永續城市生活的需要以及對非石化燃料能源來源的日益關注預計將推動該地區的垃圾焚化發電市場的發展。需求。

- 另一方面,各國需要更好的垃圾焚化發電政策和法規,高資本投入和需要提高廢棄物回收率等因素正在限制垃圾焚化發電市場的成長。

- 預計垃圾焚化發電領域的技術進步將在不久的將來為工廠營運商創造巨大的商機。

- 由於對可再生能源發電的需求不斷增加,預計美國將在預測期內佔據市場主導地位。

北美 WtE(廢棄物轉化為能源)市場趨勢

基於熱能的廢棄物能源轉換將佔據市場主導地位

- 由於全球廢棄物焚化設施新興市場的不斷發展,預計預測期內熱能技術將佔據全球垃圾焚化發電 (WtE) 市場最大的市場佔有率。

- 據估計,使用熱電汽電共生(供熱和製冷)和發電的電廠可實現 80% 的最佳效率。

- 在當前情況下,焚燒是都市固態廢棄物(MSW)處理最為人所知的WtE(廢棄物轉化為能源)技術。然而,垃圾焚化發電技術,尤其是焚燒技術,會產生污染並帶來潛在的健康和安全風險。為了減少顆粒物和氣相排放,焚化廠業主採用了一系列製程裝置來清潔煙氣流。

- 2021年,美國消耗的廢棄物能源約為431兆英熱單位。為了減少顆粒物和氣相排放,焚化廠業主正在採用一系列製程設備來清潔廢氣流,從而顯著改善環境永續性。

- 2022 年 5 月,總部位於新澤西州的廢棄物管理公司 Covanta Holding Corporation 宣布,將利用基於熱能的技術,利用美國航空、Quest Diagnostics、Sunny Delight 和斯巴魯收集的廢棄物為 18,000 戶家庭提供足夠的電力。正在做。

- 考慮到上述情況和近期趨勢,預計在預測期內,以熱為基礎的垃圾焚化發電將主導美國垃圾焚化發電市場。

美國主導市場

- 近年來,由於人口成長和全國廢棄物產生量的增加,美國垃圾焚化發電市場持續成長。固態廢棄物通常在專門的垃圾焚化發電工廠中焚燒,燃燒產生的熱量用於產生蒸氣來發電或為建築物供暖。

- 2021年,美國64座發電廠燃燒了約2,800萬噸可燃都市固體廢棄物來發電,產生了約136億千瓦時的電力。生質能原料約佔可燃城市固體廢棄物重量的 61% 和發電量的 45%。

- 2021年,美國工業部門消耗了約160兆英熱單位的廢棄物能源。美國人扔掉了5,100萬噸包裝紙、瓶子和袋子,平均每人扔掉了約309磅塑膠。近 95% 最終進入垃圾掩埋場、海洋,或以有毒顆粒的形式散佈在空氣中。

- 政府採取的新措施旨在抑制二氧化碳的高排放。這阻礙了垃圾焚燒的發展。此外,到 2035 年城市固態廢棄物回收率預計將達到 60%,這也將對焚燒市場產生影響。

- 此外,2022 年 6 月,佛羅裡達州州長 Ron DeSantis 簽署了一項法案,為市政固態廢棄物燃燒設施的購電協議建立了一項財政援助計劃,並提供補助金以獎勵潛在的產能擴張。

- 考慮到以上所有因素,預計美國將在預測期內主導廢棄物能源 (WtE) 市場。

北美 WtE(廢棄物能源)產業概況

北美廢棄物能源(WtE)市場中等程度細分。主要參與企業(不分先後順序)包括 Covanta Holding Corp、Waste Management Inc.、Suez SA、Martin GmbH 和 Wheelabrator Technologies Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 科技

- 實體技術

- 熱技術

- 生物技術

- 地區

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Covanta Holding Corp

- Waste Management Inc.

- Suez SA

- Martin GmbH

- Wheelabrator Technologies Inc.

- Mitsubishi Heavy Industries Ltd

- Veolia Environnement SA

- Babcock & Wilcox Volund AS

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 56748

The North America Waste to Energy Market is expected to register a CAGR of greater than 7.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the increasing amount of waste generation, growing concern for waste management to meet the need for sustainable urban living, and increasing focus on non-fossil fuel sources of energy are driving the demand for the region's waste-to-energy market.

- On the other note, the countries still need more suitable policies and regulations concerning WTE, and factors such as high capital investment and increasing the recycling rate of waste have been restraining the growth in the WTE market.

- Nevertheless, technological advancements in the waste-to-energy sector are expected to create significant opportunities for plant operators in the near future.

- The United States is expected to dominate the market during the forecast period, with the growing demand for renewable-based electricity generation.

North America Waste to Energy Market Trends

Thermal Based Waste to Energy Conversion to Dominate the Market

- Thermal technology is expected to account for the highest market share in the global waste-to-energy market during the forecast period, owing to the increasing development of waste incineration facilities worldwide.

- It is estimated that plants, which utilize cogeneration of thermal power (heating and cooling), together with electricity generation, can reach optimum efficiencies of 80%.

- In the present scenario, incineration is the most well-known waste-to-energy technology for municipal solid waste (MSW) processing. However, waste-to-energy technologies, particularly incineration, produce pollution and carry potential health safety risks. In order to reduce particulate and gas-phase emissions, incineration plant owners have adopted a series of process units for cleaning the flue gas stream, which has, in turn, led to a significant improvement in environmental sustainability.

- In 2021, nearly 431 trillion British thermal units of energy derived from waste were consumed in the United States. In order to reduce particulate and gas-phase emissions, the owners of incineration plants have adopted a series of process units for cleaning the flue gas stream, which has, in turn, led to a significant improvement in terms of environmental sustainability.

- In May 2022, New Jersey-based waste management company Covanta Holding Corporation announced that it is making enough electricity to power 18,000 homes from the waste collected from American Airlines, Quest Diagnostics, Sunny Delight, and Subaru through thermal-based technology.

- Hence, owing to the above points and the recent developments, thermal-based waste-to-energy is expected to dominate the United States waste-to-energy market during the forecast period.

The United States to Dominate the Market

- The waste-to-energy market in the United States has been growing recently due to the increase in population and growing waste across the country. Solid waste is usually burned at special waste-to-energy plants that use the heat from the fire to make steam for generating electricity or to heat buildings.

- In 2021, 64 US power plants generated about 13.6 billion kilowatt-hours of electricity from burning about 28 million tonnes of combustible MSW for electricity generation. Biomass materials accounted for about 61% of the weight of the combustible MSW and about 45% of the electricity generated.

- In 2021, the US industrial sector consumed about 160 trillion British thermal units of energy derived from waste. The Americans discarded 51 million ton of wrappers, bottles, bags, and about 309 lb of plastic per person. Almost 95% ended up in landfills and oceans or scattered in the atmosphere in tiny toxic particles.

- The new government policies are aimed at restricting high carbon emissions. This factor is hindering the growth of the incineration process. In addition, the increase in municipal solid waste recycling to 60% by 2035 is expected to affect the incineration market.

- Also, in June 2022, Florida Gov. Ron DeSantis signed a law to establish a financial assistance program for power purchase agreements at municipally-owned solid waste combustion facilities and grants to incentivize capacity expansion potentially.

- Owing to the above points, the United States is expected to dominate the North American waste-to-energy market during the forecast period.

North America Waste to Energy Industry Overview

The North American waste to energy market is moderately fragmented. Some of the key players (in no particular order) include Covanta Holding Corp, Waste Management Inc., Suez SA, Martin GmbH, and Wheelabrator Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Physical Technology

- 5.1.2 Thermal Technology

- 5.1.3 Biological Technology

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Covanta Holding Corp

- 6.3.2 Waste Management Inc.

- 6.3.3 Suez SA

- 6.3.4 Martin GmbH

- 6.3.5 Wheelabrator Technologies Inc.

- 6.3.6 Mitsubishi Heavy Industries Ltd

- 6.3.7 Veolia Environnement SA

- 6.3.8 Babcock & Wilcox Volund AS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219