|

市場調查報告書

商品編碼

1627126

拉丁美洲過程自動化:市場佔有率分析、行業趨勢和成長預測(2025-2030)Latin America Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

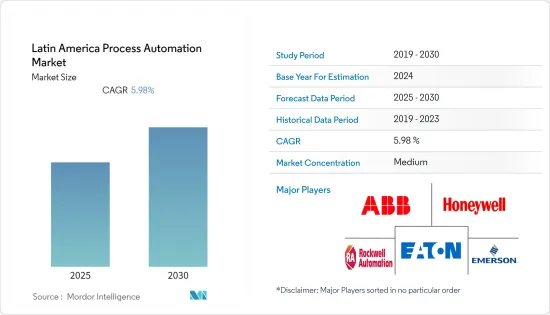

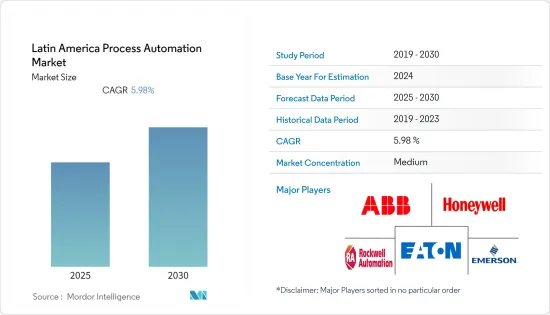

拉丁美洲過程自動化市場預計在預測期內複合年成長率為 5.98%

主要亮點

- 自動化已成為現代製造和工業流程的重要組成部分。它幫助企業實現上述優先事項。世界各地的公司借助 SCADA、DCS、MES 和 PLC 等各種技術實現業務自動化。對這些技術的需求正在迅速增加,許多供應商正在生產解決方案來幫助公司簡化其製造流程。

- 物聯網需求趨勢預計在不久的將來將從消費者需求轉向工業領域,主要由各種工業4.0應用推動。墨西哥和巴西等國家正處於工業革命的邊緣,資料正在生產中大規模使用,並與整個供應鏈中的各種製造系統整合。

- 此外,巨量資料分析允許公司利用工廠自動化從反應性實踐轉向預測性實踐。這項變更旨在提高流程效率和產品效能。

- 製造過程的自動化提供了許多好處,包括更容易監控、減少浪費和提高生產速度。該技術透過標準化和準時、低成本的可靠產品為客戶提供了更高的品質。

- 此外,連接工業機械和設備並獲取即時資料在 SCADA、HMI、PLC 系統和提供可視化的軟體的採用中發揮關鍵作用。

拉丁美洲過程自動化市場趨勢

醫藥產業預計將佔據主要市場佔有率

- 由於重視公共衛生安全,製藥業受到嚴格監管。準確性、可重複性和控制是自動化系統的主要優勢,有助於提高製藥生產設施的生產力、安全性和清潔度。對流程最佳化、法規遵循和供應鏈增強的需求正在推動整個製藥行業對自動化技術的投資。

- 自動化正在融入活性藥物成分 (API) 等主要方面以及包裝和分銷等其他次要方面。數位轉型為該地區的製藥公司創造了新的業務效率、品質、流程自動化和員工生產力。

- 此外,製造、測試、藥物開發、包裝和分銷等各種流程對流程自動化解決方案的需求不斷成長,也是推動製藥業在流程自動化和儀器市場成長的因素之一。

- 自動化描述了對流程的更好控制以及從遠端位置監控流程的能力。它還可以幫助您自動建立報告、輸入所需資料並即時共用資訊。自動化正在改變製藥業的產品開發、商業生產和即時監控。採用感測器和系統可以推動卓越製造,並幫助公司以最低成本實現合規性。

- 此外,拉丁美洲的許多製藥公司正在動員員工遠距工作。在這種情況下,自動化可以幫助基本流程不受阻礙地繼續進行。藥物發現的自動化可最大限度地減少人為錯誤,提高通量並提高再現性,使整個過程更加可靠。

墨西哥佔最大市場佔有率

- 拉丁美洲(尤其是墨西哥)的物聯網解決方案正在從服務供應鏈流程發展到提高醫療保健、政府和酒店業的可見度。 Wi-Fi、RFID、藍牙和感測器的快速普及帶來了物聯網革命。

- 對連網型設備和穿戴式裝置的需求不斷成長也推動了國內市場的成長。隨著連網型設備和感測器的高採用率以及 M2M通訊的可用性,製造中產生的資料點正在迅速增加。

- 物聯網需求趨勢預計在不久的將來將從消費者需求轉向工業領域,主要由各種工業4.0應用推動。此外,化學品和石化、造紙和紙漿、水和污水處理、能源和公共產業、石油和天然氣、製藥以及食品和飲料等加工行業預計將推動成長。拉丁美洲市場也出現了類似的趨勢。

- 墨西哥智慧工廠的網路攻擊呈上升趨勢,引發了人們對工業控制系統使用的擔憂。政府已計劃遏制此類犯罪的增加。這符合智慧工廠國產工業控制系統以避免網路安全漏洞風險的成長趨勢。

- 此外,流程發現、流程最佳化、流程智慧和流程協作等技術和術語正在成為機器人流程自動化 (RPA) 的重要組成部分。未來,業務流程管理 (BPM) 和 RPA 之間的關係將持續發展。

拉丁美洲流程自動化產業概況

拉丁美洲過程自動化市場適度細分,新參與企業和主導參與企業都很少。公司不斷創新並結成策略夥伴關係以維持市場佔有率。近期市場發展趨勢如下。

- 2021 年 7 月 - 羅克韋爾自動化公司宣布與雲端基礎的產品數位化和可追溯性平台 Kezzler AS 建立合作夥伴關係。

- 2020年5月-無線工業自動化與物聯網解決方案供應商OleumTech宣布推出新型智慧壓力感測器(HGPT智慧表壓力感測器)。這些傳送器是該公司快速成長的 H 系列硬連線製程儀器產品線的補充,使其成為石化、化學、電力、上游石油和天然氣污水等製程工業的理想選擇。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章 研究方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 市場促進因素(日益關注能源效率和降低成本|安全自動化系統的需求|工業物聯網的出現)

- 市場挑戰(成本和實施挑戰)

- 行業標準和法規

- 對墨西哥、巴西和阿根廷主要工業自動化地點的分析 - 根據過去三年的投資和擴張活動來確定。

第 5 章:評估 COVID-19 對拉丁美洲流程自動化產業的影響

- 根據疫情中短期影響所確定的關鍵主題分析-V型復甦、中期復甦、低迷復甦

- 墨西哥流程自動化市場 - 具有最終用戶效能的基礎變數分析

- 巴西製程自動化市場 - 具有最終用戶效能的基礎變數分析

- 阿根廷過程自動化市場 - 具有最終用戶性能的基礎變數分析

- 供應相關挑戰的影響以及市場監管在市場振興中的作用

第6章 市場細分

- 按通訊協定

- 有線

- 無線的

- 依系統類型

- 按系統硬體

- 監控與資料採集系統(SCADA)

- 集散控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 製造執行系統(MES)

- 閥門和致動器

- 馬達

- 人機介面 (HMI)

- 製程安全系統

- 感測器和發射器

- 依軟體類型

- APC(獨立和客製化解決方案)

- 先進的監理控制

- 多變量模型

- 推理與連續式

- 資料分析和基於報告的軟體

- 其他軟體和服務

- 按系統硬體

- 按最終用戶產業

- 石油和天然氣

- 化學/石化

- 電力/公共產業

- 用水和污水

- 飲食

- 紙/紙漿

- 製藥

- 其他

- 按國家/地區

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲國家

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Honeywell International Inc.

- Rockwell Automation

- Emerson Electric Co.

- Eaton Corporation

- Siemens AG

- Schneider Electric

- General Electric Co.

- Mitsubishi Electric

- Fuji Electric

- Delta Electronics Limited

- Yokogawa Electric

第8章過程自動化產業關鍵創新者與挑戰分析

第9章投資分析及市場展望

簡介目錄

Product Code: 49570

The Latin America Process Automation Market is expected to register a CAGR of 5.98% during the forecast period.

Key Highlights

- Automation has become an essential part of modern manufacturing and industrial processes. It helps enterprises to realize the priorities above. Companies worldwide are automating their operations with the help of different technologies like SCADA, DCS, MES, and PLC. The demand for these technologies is escalating, and many vendors are manufacturing solutions to help enterprises achieve higher efficiency in their manufacturing processes.

- The IoT demand trend is expected to shift toward industrial space from consumer demand over the near future, primarily driven by various Industry 4.0 applications. Countries like Mexico and Brazil are on the verge of the industrial revolution, as data is being used on a large scale for production while integrating it with various manufacturing systems throughout the supply chain.

- Moreover, big data analytics allows an enterprise to use factory automation to shift from reactionary practices to predictive ones. This change targets to improve the efficiency of the process and performance of the product.

- Automation of manufacturing processes has offered various benefits, such as effortless monitoring, reduction of waste, and production speed. This technology offers customers an improved quality with standardization and dependable products within time and at a much lower cost.

- Further, connecting the industrial machinery and equipment and obtaining real-time data have played a vital role in the adoption of SCADA, HMI, PLC systems, and software that offer visualization; thus enables reducing the faults in the product, reducing downtime, scheduling maintenance, and switching from being in the reactive state to predictive and prescriptive stages for decision-making.

Latin America Process Automation Market Trends

Pharmaceutical Industry is Expected to Hold Significant Market Share

- The pharmaceutical industry is highly regulated due to the importance placed on public health safety. Accuracy, repeatability, and control are the key benefits of an automated system, helping to enhance productivity, safety, and cleanliness in pharmaceutical manufacturing facilities. The need for process optimization, regulatory compliance, and enhancements in the supply chain are driving investment in automation technologies across the pharmaceutical industry.

- Automation is embedded in primary aspects such as Active Pharma Ingredients (API) and other secondary aspects, including packaging and distribution. Digital transformation provides new operational efficiency, quality, process automation, and employee productivity to pharmaceutical companies in the region.

- Moreover, an increase in the need for process automation solutions to various processes such as manufacturing, testing, drug development, packaging, and distribution are among the factors that are likely to propel the growth in the pharmaceutical industry in the process automation and instrumentation market.

- Automation offers better control of processes and the ability to monitor processes from remote locations. It assists in automatically creating reports, entering essential data, and sharing real-time information. Automation is transforming pharma concerning product development, commercial production, and real-time monitoring. It can foster manufacturing excellence by adopting sensors and systems to help companies achieve compliance at the lowest costs.

- Further, many pharma companies in Latin America have mobilized their employees to remote working conditions. In such a scenario, automation helps them continue the essential processes unobstructed. Automation in drug discovery enhances the reliability of the entire process by minimizing manual errors, augments the throughput, and improves the ability to reproduce.

Mexico Accounts for the Largest Market Share

- IoT solutions in Latin America, specifically Mexico, have grown from servicing the supply chain process to adding visibility to healthcare, government offices, and hospitality industries. The rapidly growing implementation of Wi-Fi, RFID, Bluetooth, and sensors have brought on the IoT revolution, which is believed to be the most transformative technology for the next decade by 99% of respondents.

- The increasing demand for connected and wearables devices is also aiding the growth of the market in the country. With the high rate of adoption of connected devices and sensors and the enabling of M2M communication, there has been a surge in the data points generated in the manufacturing industry.

- The IoT demand trend is expected to shift toward industrial space from consumer demand over the near future, primarily driven by various Industry 4.0 applications. Furthermore, process industries, such as chemical and petrochemical, paper and pulp, water and wastewater treatment, energy and utilities, oil and gas, pharmaceutical, food, and beverages, are expected to fuel growth. Similar trends were observed in the Latin American market as well.

- With cyber-attacks increasing in smart factories in Mexico, there is growing concern about using Industrial Control Systems. The government has plans to curb the rise of such crimes. This aligns with the growing trend of industrial control systems manufactured in the country for smart factories to avoid the risk of cybersecurity breaches.

- Further, technologies and terminologies such as process discovery, process optimization, process intelligence, and process orchestration are becoming a more significant part of Robotic Process Automation (RPA). There is an ongoing trend of increasing a closer relationship between business process management (BPM) and RPA in the future.

Latin America Process Automation Industry Overview

The Latin American Process Automation Market is moderately fragmented, with few new entrants and few dominant players. The companies keep on innovating and entering into strategic partnerships to retain their market share. Some of the recent developments in the market are:

- July 2021 - Rockwell Automation, Inc announced a partnership with Kezzler AS, cloud-based product digitization and traceability platform, to help manufacturers capture the journey of their products from raw material sources to point-of-sale or beyond using cloud-based supply chain solutions that focus on product traceability.

- May 2020 - OleumTech, wireless industrial automation and IoT solutions provider announced the launch of new intelligent pressure transmitters (HGPT Smart Gauge Pressure Transmitters). These transmitters are an addition to its fast-growing H Series line of hardwired process instrumentation and claimed to deliver remarkable performance, accuracy, and reliability ideal for process industries, such as petrochemical, chemical, power, upstream oil, and gas wastewater.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHADOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers (Growing emphasis on energy efficiency & cost reduction| Demand for Safety Automation Systems| Emergence of IIoT)

- 4.5 Market Challenges (Cost & Implementation Challenges)

- 4.6 Industry Standards & Regulations

- 4.7 Analysis of the major Industrial Automation hubs in the Mexico, Brazil, and Argentina - To be identified based on the investor activity & expansion activities undertaken over the last 3 years

5 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE PROCESS AUTOMATION INDUSTRY IN LATIN AMERICA

- 5.1 Analysis of the key themes identified based on the near & medium-term effects of the pandemic - V-shaped recovery, Mid-range recovery & Slump recovery

- 5.2 Mexico Process Automation Market - Base variable analysis based on end-user performance

- 5.3 Brazil Process Automation Market - Base variable analysis based on end-user performance

- 5.4 Argentina Process Automation Market - Base variable analysis based on end-user performance

- 5.5 Impact of Supply-related challenges & the role of market regulations in spurring activity

6 MARKET SEGMENTATION

- 6.1 By Communication Protocol

- 6.1.1 Wired

- 6.1.2 Wireless

- 6.2 By System Type

- 6.2.1 By System Hardware

- 6.2.1.1 Supervisory Control and Data Acquisition System (SCADA)

- 6.2.1.2 Distributed Control System (DCS)

- 6.2.1.3 Programmable Logic Controller (PLC)

- 6.2.1.4 Manufacturing Execution System (MES)

- 6.2.1.5 Valves & Actuators

- 6.2.1.6 Electric Motors

- 6.2.1.7 Human Machine Interface (HMI)

- 6.2.1.8 Process Safety Systems

- 6.2.1.9 Sensors and Transmitters

- 6.2.2 By Software Type

- 6.2.2.1 APC (Standalone & Customized Solutions)

- 6.2.2.1.1 Advanced Regulatory Control

- 6.2.2.1.2 Multivariable Model

- 6.2.2.1.3 Inferential & Sequential

- 6.2.2.2 Data Analytics and Reporting-based Software

- 6.2.2.3 Other Software and Services

- 6.2.1 By System Hardware

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power and Utilities

- 6.3.4 Water and Wastewater

- 6.3.5 Food and Beverage

- 6.3.6 Paper and Pulp

- 6.3.7 Pharmaceutical

- 6.3.8 Other End-user Industries

- 6.4 By Country

- 6.4.1 Mexico

- 6.4.2 Brazil

- 6.4.3 Argentina

- 6.4.4 Rest of the Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Rockwell Automation

- 7.1.4 Emerson Electric Co.

- 7.1.5 Eaton Corporation

- 7.1.6 Siemens AG

- 7.1.7 Schneider Electric

- 7.1.8 General Electric Co.

- 7.1.9 Mitsubishi Electric

- 7.1.10 Fuji Electric

- 7.1.11 Delta Electronics Limited

- 7.1.12 Yokogawa Electric

8 ANALYSIS OF MAJOR INNOVATORS & CHALLENGERS IN THE PROCESS AUTOMATION INDUSTRY

9 INVESTMENT ANALYSIS & MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219