|

市場調查報告書

商品編碼

1627220

拉丁美洲LED構裝:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)LA LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

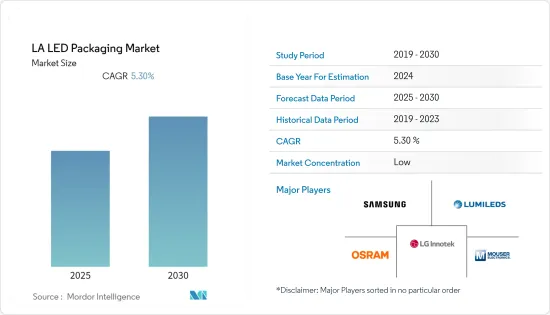

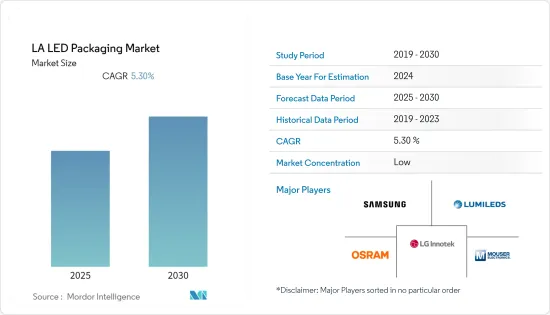

拉丁美洲LED構裝市場預計在預測期內複合年成長率為 5.3%

主要亮點

- LED構裝在拉丁美洲正在經歷顯著成長。包裝過程是勞力密集的,拉丁美洲由於人事費用結構降低的好處,已成為包裝的競爭市場。具體來說,由於規模經濟、現有基礎設施優勢、人事費用低以及許多大公司的存在,拉丁美洲已成為許多 LED 製造商的LED構裝流程的重要中心。

- 隨著住宅消費者繼續使用 LED 類型來提高能源效率,普通照明應用將推動LED構裝市場的成長。在拉丁美洲(例如巴西),各國政府正在重點開發和實施高效能能源技術,並為LED照明提供各種補貼,這可能會推動這些國家的LED構裝市場的擴張。

- 封裝技術的品質決定了封裝的可靠性和裝置的壽命。為了因應日益成長的照明需求,人們開發了多種技術來提高LED的輸出功率,LED封裝技術也從單晶片封裝發展到多晶片封裝。

- 隨著晶片設計、封裝以及大電流特性的發展,迫切需要LED的高功率封裝。高功率會影響裝置的散熱性能,進而影響LED的壽命和發光性能。因此, LED構裝的散熱性能是現在需要考慮的重要因素。此外,越來越多的計劃和法規將 LED 作為環境效益和節能解決方案來推廣,也正在推動市場成長。

- 板載晶片(COB) 和晶片級封裝 (CSP) 是多晶片封裝。 COB透過將晶片直接放置在基板上並塗上磷光黏合劑來實現更高的封裝密度。 COB和CSP是市面上比較常見的LED構裝。隨著裝置變得越來越小、越來越薄, LED構裝的散熱結構和技術也隨之發展。

- 製造業受到了 COVID-19 大流行的影響,製造和供應鏈業務受到干擾,客戶業務面臨類似的威脅。此外,COVID-19影響市場成長的主要原因是離散製造業的停工。封鎖限制和計劃建設活動的延誤對整個供應和分銷鏈產生了嚴重影響,導致製造企業延誤。

拉丁美洲LED構裝市場趨勢

晶片級封裝技術佔據主要市場佔有率

- 隨著拉丁美洲工業投資的增加,對智慧照明解決方案的需求不斷增加,推動了LED構裝市場的發展。隨著LED構裝變得更小、更薄,人們嘗試透過將現有晶圓級 (WL) 升級到晶片級 (CS) 來節省製程和投資成本。 CSP(晶片級封裝)是指使用晶圓級製程安裝在半導體發光裝置結構上的發光裝置封裝。

- CSP(晶片級封裝)技術透過整合先進的覆晶技術和磷光體塗覆技術,顯著縮小了傳統LED構裝的尺寸。這消除了金屬線和塑膠模具,從而實現更通用和緊湊的設計,同時也降低了成本。 CSP產品可靈活地改變發光面的尺寸和亮度水平,以滿足廣泛的照明應用的要求。

- 不同的封裝結構和材料可以提高LED的光提取效率和散熱性能,減少光衰減,提高壽命。換句話說, LED構裝的關鍵技術是在有限的成本範圍內從晶片中提取盡可能多的光,同時降低封裝的熱阻並提高可靠性。

- LED構裝技術是在半導體分立元件封裝的基礎上發展和演變的。封裝的作用是為晶片提供足夠的保護,防止其長期暴露在空氣中,造成機械損傷和失效,從而提高其穩定性。封裝材料和工藝佔LED燈總成本的30%~60%。

快速成長的住宅產業

- 隨著拉丁美洲工業化的快速發展,COB LED 在智慧照明中的採用不斷增加,正在推動市場成長。最值得注意的是,COB 技術顯著提高了 LED 陣列的封裝密度,即照明工程師所說的流明密度。此外,透過使用 COB LED 技術,可以顯著減少住宅領域 LED 陣列的佔地面積和消費量,同時保持光輸出恆定。

- 拉丁美洲國家對於LED構裝有一定的標準。在住宅領域,無論是燈 LED 或表面貼裝 LED (SMD-LED),都必須使用高精度結晶固體機械進行封裝。如果LED晶片封裝不準確,將直接影響整個封裝設備的發光效率。

- 各種場合使用的LED在尺寸、散熱方式、發光效率等方面都有所不同,因此LED構裝的類型也有所不同。製造商很快將集中精力開發高功率、高亮度的LED。封裝是LED產業鏈前後端的紐帶,必須重視。

- 在巴西和墨西哥等國家,住宅電力消耗不斷增加,LED 普及率不斷提高。 LED構裝提供機械支撐,實現良好的電氣連接(例如,借助貫穿封裝的「通孔」或接合線),有助於散熱,並允許 LED 晶片發光。 LED的封裝形式取決於應用場景、外觀、尺寸、散熱方案和發光效果。

拉丁美洲LED構裝產業概況

拉丁美洲LED構裝市場競爭激烈,由多家製造商組成,包括三星電子、Lumileds Holding BV、Osram GmbH、LG Innotek、Mouser Electronics, Inc、TT Electronics和Everlight Electronics。公司透過建立多個夥伴關係關係、投資計劃以及將新產品推向市場來增加市場佔有率。

- 2021年5月-億光正式成為ISELED聯盟成員。本公司採用ISELED,推出內建IC的EL SMART LED(EL3534-RGBISE0391L-AM)。新款EL3534智慧型LED採用了Innova Semiconductors的紅、藍、綠三色晶片以及驅動IC,採用全新設計的封裝結構。此驅動器 IC 會自動啟用 LED 的直接記憶體校準,以補償紅色熱降。它安裝在導線架的下側。將控制器 IC 和 LED 整合到一個封裝中可以節省空間並在緊湊的內部空間中進行互連。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 政府採用節能 LED 的措施和法規

- 對智慧照明解決方案的需求增加

- 市場挑戰

- LED價格高

第6章 市場細分

- 按包裝類型

- 板載晶片(COB)

- 表面黏著技術型(SMD)

- 晶片級封裝 (CSP)

- 按最終用戶

- 住宅

- 商業的

- 按國家/地區

- 巴西

- 墨西哥

- 其他拉丁美洲地區

第7章 競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- Lumileds Holding BV

- Osram GmbH

- LG Innotek

- Mouser Electronics, Inc.

- TT Electronics

- Everlight Electronics Co., Ltd

- Excelitas Technologies Corp.

- Arrow Electronics, Inc

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 51560

The LA LED Packaging Market is expected to register a CAGR of 5.3% during the forecast period.

Key Highlights

- LED packaging has witnessed significant growth in Latin America. The packaging process is more labor-intensive, and the benefits of reduced labor cost structures in Latin America have made it a competitive marketplace for packaging. Specifically, due to economies of scale, existing infrastructure benefits, low labor costs, and the presence of many major players, Latin America has become an important center of LED packaging processes for many LED manufacturers.

- General lighting applications will drive growth in the LED packaging market as residential consumers continue to use the LED types in energy efficiency initiatives. The major focus of governments in Latin America (e.g., In Brazil) for developing and implementing efficient energy technology and various subsidies given for LED lighting will boost the market for LED packaging in these countries.

- Packaging technology's quality determines the package's reliability and the device's service life. To meet the increasing demand for lighting, the technology of larger output LEDs has been extensively developed, and the packaging technology of LEDs has evolved from single-chip packaging to multi-chip packaging.

- With the development of chip design, packaging, and high current characteristics, high-power LED packaging has become an urgent need. The increase in the power of the package affects the heat dissipation performance of the device, which also influences the life of the LED and its luminous performance. Therefore, the heat dissipation of LED packaging is currently an important factor to be considered. Additionally, increasing initiatives and regulations to promote LEDs for environmental benefits and energy-efficient solutions fuels the market's growth.

- Chip-on-board (COB), and chip-scale package (CSP) are multi-chip packages. COB assigns chips directly to the board and coats them with a phosphorescent glue at a higher packing density. COB and CSP are more popular LED packages on the market. With the development of devices toward miniaturization and thinning, the heat dissipation structure and technology of LED packages have also been developed accordingly.

- The manufacturing companies were grappling with the effect of the COVID-19 pandemic, as the manufacturing and supply chain operations were disrupted, and their customer operations faced similar threats. Further, COVID-19 has impacted the market growth, mainly due to stoppage in discrete manufacturing industry operations. Due to restrictions in lockdowns, delays in project construction activities exponentially affected the whole supply and distribution network, hitting the manufacturing companies with a lag.

Latin America LED Packaging Market Trends

Chip Scale Packaging Technology to Hold Significant Market Share

- With the growing industrial investments in Latin America, the demand for smart lighting solutions is increasing, which in turn is propelling the LED packaging market. As LED packages are made smaller and slimmer, there is an endeavor to save costs of process and investment by upgrading existing WL (Wafer Level) to CS (Chip Scale). A chip-scale package (CSP) denotes a package for the light-emitting device mounted on the semiconductor light-emitting device structure in a wafer-scale process.

- CSP (Chip Scale Packaging) technology drastically scales down the size of a conventional LED package by integrating sophisticated flip-chip technology with phosphor coating technology. This removes metal wires and plastic molds for more versatile and compact designs and lowers costs. CSP products allow flexibility in changing the size of the light-emitting surface and luminance level to address a broader base of lighting application requirements.

- Different packaging structures and materials can improve LED's light extraction efficiency and heat dissipation performance, reduce light decay and improve its service life. In short, the key technology of LED packaging is to extract as much light as possible from the chip within a limited cost range while reducing the thermal resistance of packaging and improving reliability.

- LED packaging technology is developed and evolved based on semiconductor discrete device packaging. The function of packaging is to provide adequate protection for the chip, and prevent the chip from long-term exposure to the air or mechanical damage and failure, to improve the stability of the chip. Packaging materials and processes account for 30% to 60% of the total cost of LED lamps.

Residential Sector to Witness Significant Growth

- With the rapid industrialization in Latin America, the growing adoption of COB LED in smart lighting has been instrumental in driving the market's growth. Most notably, COB technology allows for a much higher packing density of the LED array, or what light engineers refer to as improved lumen density. Alternatively, using COB LED technology can greatly reduce the footprint and energy consumption of the LED array in the residential sector while keeping light output constant.

- Certain standards are followed by the countries in Latin America regarding LED Packaging. In the residential sector, it is essential to use high-precision crystal solid machines to package, no matter Lamp-LED or Surface Mount Device LED (SMD-LED). If LED chips are not placed into the package precisely, the luminescence efficiency of the overall packaging device will be influenced directly.

- LEDs applied on different occasions, with different sizes, heat-dissipation methods, and luminescence efficiency will have different types of LED packages. Soon, manufacturers should focus on developing high-power, high-brightness LED. As Packaging links the preceding and the following parts in the LED industry chain, attention should be paid to it.

- In countries like Brazil and Mexico, electricity consumption in the residential sector has been increasing, resulting in increased LED penetration. LED packages to provide mechanical support, allow good electrical connections (for example, with the aid of "vias" through the package or bonding wires), help with heat dissipation, and improve the light emission efficiency from the LED chip. The package form of the LED varies according to the application scenario, the appearance, the size, the heat dissipation solution, and the light-emitting effect.

Latin America LED Packaging Industry Overview

Latin America LED Packaging Market is competitive and consists of several partakers like Samsung Electronics Co.Ltd, Lumileds Holding B.V, Osram GmbH, LG Innotek, Mouser Electronics, Inc., TT Electronics, Everlight Electronics Co., Ltd, and many more. The companies are increasing their market share by forming multiple partnerships, investing in projects, and launching new products in the market.

- May 2021 - Everlight has officially become a member of the ISELED Alliance. The company employed ISELED to release EL SMART LED (EL3534-RGBISE0391L-AM) with an embedded IC. The new EL3534 smart LED has installed a driver IC from Inova Semiconductors in the newly designed package structure in addition to the three color chips (red, blue, and green). The driver IC automatically enables the direct calibration of LED in the memory and compensates the thermal drop for the red color. It is mounted on the bottom side of the lead frame. Integrating controller IC and LEDs in one package saves space and interconnections in compact interior space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Initiatives and Regulations to Adopt Energy-efficient LEDs

- 5.1.2 Increasing Demand for Smart Lighting Solutions

- 5.2 Market Challenges

- 5.2.1 High Prices of LED's

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Chip-on-board (COB)

- 6.1.2 Surface-mounted Device (SMD)

- 6.1.3 Chip Scale Packaging (CSP)

- 6.2 By End-User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.3 By Country

- 6.3.1 Brazil

- 6.3.2 Mexico

- 6.3.3 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Lumileds Holding B.V

- 7.1.3 Osram GmbH

- 7.1.4 LG Innotek

- 7.1.5 Mouser Electronics, Inc.

- 7.1.6 TT Electronics

- 7.1.7 Everlight Electronics Co., Ltd

- 7.1.8 Excelitas Technologies Corp.

- 7.1.9 Arrow Electronics, Inc

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219