|

市場調查報告書

商品編碼

1628807

歐洲LED構裝:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Europe LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

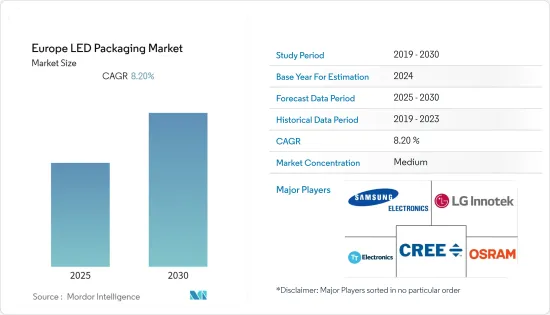

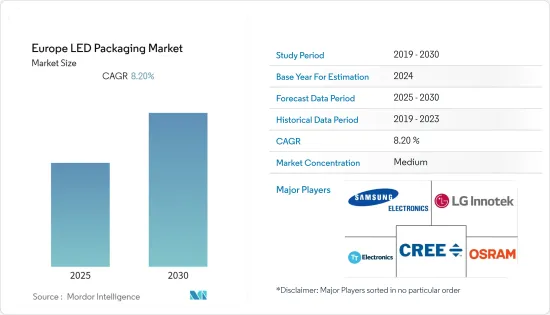

歐洲LED構裝市場預計在預測期間內複合年成長率為8.2%

主要亮點

- LED構裝市場成長的推動因素是滅菌系統流行期間對高效UV LED構裝的需求激增。 UV LED 也用於紫外線固化和生物醫學研究。紫外線分為UV-A、UV-B、UV-C。這次疫情增加了對 UV-C LED 的需求,這種 LED 可以作為消毒劑,破壞細菌和病毒的核酸和 DNA。目前,UV-C LED 用於空氣、水和表面消毒系統,具有長壽命和可靠性。

- 由於 LED 的節能、效率和環境效益,最近的政府措施和法規正在推廣 LED 的使用。因此,SMD LED 的市場正在擴大,因為它們具有高度通用性,並且可以容納具有複雜設計的晶片。與其他傳統光源相比,由於其能源效率,照明燈具中使用的 SMD LED構裝不斷成長。這種成長也是由於 SMD LED 價格暴跌,使消費者更能負擔得起。

- LED構裝市場也正在推動汽車內外照明的需求。 LED構裝技術的最新趨勢是CSP技術。 CSP 技術近年來在汽車產業發展勢頭強勁,因為與傳統LED構裝相比,它具有更高的光密度、更好的流明維持率、色彩穩定性、更低的電流消耗和可靠性等特點。

- 此外,預計該地區的汽車顯示器市場在未來幾年將出現顯著的市場發展。例如,隨著支援擴增實境的OLED 引入汽車顯示器市場,一些主要的歐洲汽車製造商正計劃安裝儀表板和其他螢幕。

- 由於價格競爭的加劇以及提供LED構裝的製造商數量的增加,市場競爭日益激烈。全球電視消費群已達到飽和狀態,對新科技產品的需求有限,因為只要滿足期望,消費者就會繼續使用舊產品。此外, LED構裝市場日益激烈的價格競爭迫使 LED 製造商開發創新的照明解決方案。

- 由於COVID-19大流行,歐洲市場的LED構裝業務出現下滑。由於COVID-19的傳播,歐洲許多國家實施了更嚴格的感染控制措施。一些市場主要參與者的LED構裝業務出現了前所未有的低迷。持續的貿易爭端、地緣政治的不確定性以及汽車製造業的持續下滑是歐洲LED構裝市場面臨的其他主要挑戰。

歐洲LED構裝市場趨勢

住宅產業需求的增加推動市場

- 消費者需求轉向 LED 等節能照明,推動了住宅領域的發展。此外,最近的政府舉措和消費者意識的提高預計將對該行業產生重大影響。

- 歐盟(EU)住宅照明的總消費量正在增加,特別是由於一些國家福利的改善以及每個住宅單元的燈具數量的快速增加。 LED燈泡的效率和發光特性正在迅速提高。預計 LED 照明在未來將節省大量能源。 LED照明的壽命比傳統照明長5至25倍。

- 在各類照明中,LED照明佔有很大的佔有率。由於人們認知的提高和政府政策的加強,LED 的採用率在全球範圍內不斷增加。 LED全球滲透率較去年同期持續上升。

- 根據國際能源總署預測,2019 年 LED 銷售量將達到創紀錄的超過 100 億顆,包括光源(燈泡、燈管、模組)和燈具。 LED 在住宅和商業用途的引入正在取得進展,並且 LED 燈的銷售數量已超過螢光。法國國際能源總署認為,商業建築應符合清潔能源轉型,以最大限度地減少碳足跡。

- LED 的日益普及也使得業界能夠實施智慧照明系統(連網型照明)。由於 LED 在顏色變化和亮度方面更加靈活,因此與傳統光源相比,網路系統可能會從使用 LED 中受益。

該地區政府的舉措是市場成長的主要推動力

- 2019年12月,歐盟委員會通過了有關能源效率和能源標籤的新法規。歐盟成員國已決定在 2021 年逐步淘汰低效鹵素燈和緊湊型螢光,同時引入LED燈和燈具的最低性能和品質標準。該法規適用於住宅、商業、工業和街道照明應用。新規則將於2021年9月1日生效。

- 基於組件的 SSL(固體照明)以 LED、OLED 和 LD 為基礎,對傳統技術提出了挑戰。因此,短期內,所有電氣化照明預計都將基於SSL,並且SSL市場預計將大幅擴大。

- 在英國,英國政府的能源效率計畫正在推動LED照明進入市場。各國政府正在透過提供各種回扣和收費計劃來獎勵用LED燈取代現有的傳統光源。政府正在與多家電力供應商合作實施該計劃。

- 由於政府鼓勵安裝和使用智慧照明控制解決方案的支援和補貼,公路和街道照明應用佔據了戶外智慧照明應用的最大市場佔有率。能源標籤調整的設計更加嚴格,只有少數產品最初獲得“A”或“B”評級,為更有效率的產品逐步進入市場留下了空間。該規定規定了18個月的期限,在此期間,舊標籤的產品可以繼續在實體店銷售,以銷售現有庫存。

歐洲LED構裝產業概況

市場正在見證供應商的併購,為公司提供了有利可圖的機會,以促進技術進步和市場成長。市場上的一些主要企業正在投資標籤產業的新技術和解決方案,預計這將進一步推動市場投資。

- 2021 年 1 月 - 歐司朗集團推出晶片級封裝 LED Osconiq C 2424。業界領先的效率可以使您的戶外照明設備更加高效且更具成本效益。此外,它的使用壽命很長。

- 2020 年 10 月 - Cree, Inc. 宣布已與 SMART Global Holdings 達成協議,以高達 3 億美元的價格出售其 LED 產品業務部門(「Cree LED」)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 政府採用節能 LED 的措施和法規

- 對智慧照明解決方案的需求增加

- 市場限制因素

- 市場競爭加劇

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場區隔

- 按類型

- 板載晶片(COB)

- 表面貼裝元件 (SMD)

- 晶片級封裝 (CSP)

- 按行業分類

- 住宅

- 商業的

- 其他行業

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

第6章 競爭狀況

- 公司簡介

- Cree Inc.

- OSRAM Licht AG

- Samsung Electronics Co. Ltd

- LG Innotek

- TT Electronics

- Nichia Corporation

- Seoul Semiconductor Co. Ltd

- Stanley Electric Co. Ltd

- Lumileds Holding BV

- Everlight Electronics Co. Ltd

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 54861

The Europe LED Packaging Market is expected to register a CAGR of 8.2% during the forecast period.

Key Highlights

- The LED packaging market's growth is driven by the surge of demand for efficient UV LED packages amid the pandemic of disinfection systems. UV LEDs are also used in UV curing and biomedical research. UV radiation can be classified into UV-A, UV-B, and UV-C. The pandemic has boosted the demand for UV-C LEDs, with the light having germicidal properties by killing the bacteria and viruses by destroying their nucleic acids and disrupting the DNAs. Currently, UV-C LEDs are used in air, water, and surface disinfection systems while offering longer lifetimes and reliability.

- The recent government initiatives and regulations are promoting the use of LEDs for energy conservation, efficiency, and environmental benefits. This has driven the market for SMD LEDs that are versatile and can accommodate chips with complex designs. SMD LED packages used in luminaires are growing continuously due to the superior energy efficiency of these LEDs compared to other conventional light sources. This growth can also be attributed to the steep fall in the price of SMD LEDs, thereby making them affordable for consumers.

- LED packages market is also driven by the automotive interior and exterior lighting due to the high demand for central stack displays and instrument cluster displays. The latest trend in LED packaging technology is CSP technology, which has gained momentum in recent years in the automotive vertical owing to its features such as high optical density, good lumen maintenance, color stability, reduced current consumption, and reliability over conventional LED packages.

- Additionally, the automotive display market in the region is expected to experience substantial developments in the coming years. For instance, the introduction of augmented reality-enabled OLED in the automotive display market and some of the major automotive manufacturers in Europe have started to integrate OLED displays in dashboards and other screens from 2020 in most of their vehicles due to the high demand for central stack displays and instrument cluster displays.

- The market is witnessing intense competition owing to the surged price pressure and increased number of manufacturers offering these LED packages. The global consumer base for TVs has reached saturation as consumers keep using old products as long as they serve their expectations, resulting in limited demand for new technology-based products. Additionally, the increased pricing competition in the LED packaging market has pressured LED manufacturers to develop innovative lighting solutions.

- The LED packaging business saw a decline in the European Market market due to the COVID-19 pandemic. Many countries in Europe implemented more stringent infection control measures because of the spread of COVID-19. Some of the primary critical players in the market saw an unprecedented slump in the LED packaging business. The ongoing trade disputes, geopolitical uncertainties, and the continued decline in automotive manufacturing are the other crucial challenges in the European LED packaging market.

Europe LED Packaging Market Trends

Increasing Demand from Residential Segment to Drive the Market

- The residential sector is being driven by a shift in consumer demand toward energy-effective lightings, such as LEDs. Moreover, recent government initiatives and growing awareness among consumers expect to impact the industry significantly.

- Total residential lighting consumption in the European Union is increasing, owing to rising welfare, particularly in some countries, and a fast increasing number of lamps per home. The efficacy and luminous properties of LED bulbs are rapidly improving. LED lights are predicted to save a significant amount of energy in the future. LED lamps have a lifespan of 5 to 25 times that of traditional lights.

- Out of all the lighting sources, LED lights hold a significant share. The growing awareness and increasing policies of the various governments have globally increased the penetration rate of LEDs. The global LED penetration is on the continuous surge YoY.

- According to International Energy Agency, the sales of LEDs are reaching at a record number of sales of more than 10 billion units in 2019, including both light sources (bulbs, tubes, modules) and luminaires. Both residential and commercial LED deployment is advancing and LED sales are now exceeding that of fluorescent lamps. According to IEA France, commercial buildings should be in line with the clean energy transition, thereby minimizing the carbon footprint.

- The increasing prominence of LEDs can also lead to intelligent lighting systems (connected lighting) in industries. Because LEDs are more flexible in terms of color change and brightness, networked systems are more likely to profit from the usage of LEDs over traditional lighting sources.

Government Initiatives in the Region is Significantly Driving the Market Growth

- The European Commission adopted new regulations on energy efficiency and energy-labeling in December 2019. EU member states voted to phase out inefficient halogen lamps and compact fluorescent lamps in 2021 while introducing minimum performance and quality standards for LED lamps and luminaires. This regulation applies to applications including household, commercial, industrial and street lighting. The new rules will come into force on September 1, 2021.

- The SSLs (Solid-State Lighting) based on components is based on LEDs, OLEDs, and LDs challenges conventional technologies. It is thereby anticipated that in the short term, all-electric lighting will be based on SSLs, and the market for SSLs will increase on a massive scale.

- The UK Government Energy Efficiency program has increased the adoption of the LED lighting market in the UK. The government incentivizes by offering various rebate and tariff programs to replace existing traditional light sources with the LED lamps; the government has collaborated with multiple electricity providers for the program's implementation.

- One of the most significant market shares is held by the highways & roadways lighting application segment of the outdoor smart lighting application owing to government support and subsidies encouraging the installation and use of smart lighting control solutions. The rescaling of energy labels is stricter and designed, so that very few products are initially able to achieve the "A" and "B" ratings, leaving space for more efficient products to gradually enter the market with the most energy-efficient products currently on the market will typically now be labeled as "C" or "D." The rules provide for an 18-month period where the products bearing the old label can continue to be sold on the market in physical retail outlets to sell the existing stock.

Europe LED Packaging Industry Overview

The market is witnessing mergers and acquisitions by vendors, thereby, offering lucrative opportunities to the companies that enable them to boost technological advancements and market growth. Some of the prominent players in the market are investing in new technologies and solutions for the labeling industry, which is expected to drive the investment in the market further.

- January 2021 - Osram group has launched Osconiq C 2424, a chip scale package LED. Outdoor luminaires may be made more efficient and cost-effective with their industry-leading efficiency. Furthermore, it has a long lifespan.

- October 2020 - Cree, Inc. announced that it had reached a deal with SMART Global Holdings, Inc. to sell its LED Products business unit ('Cree LED') for up to USD 300 million, comprising fixed upfront and deferred payments, as well as contingent consideration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Initiatives and Regulations to Adopt Energy-efficient LEDs

- 4.2.2 Increasing Demand for Smart Lighting Solutions

- 4.3 Market Restraints

- 4.3.1 High Level of Competition into the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chip-on-board (COB)

- 5.1.2 Surface-mount Device (SMD)

- 5.1.3 Chip Scale Package (CSP)

- 5.2 By End-user Vertical

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Other End-user Verticals

- 5.3 Country

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cree Inc.

- 6.1.2 OSRAM Licht AG

- 6.1.3 Samsung Electronics Co. Ltd

- 6.1.4 LG Innotek

- 6.1.5 TT Electronics

- 6.1.6 Nichia Corporation

- 6.1.7 Seoul Semiconductor Co. Ltd

- 6.1.8 Stanley Electric Co. Ltd

- 6.1.9 Lumileds Holding BV

- 6.1.10 Everlight Electronics Co. Ltd

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219