|

市場調查報告書

商品編碼

1628713

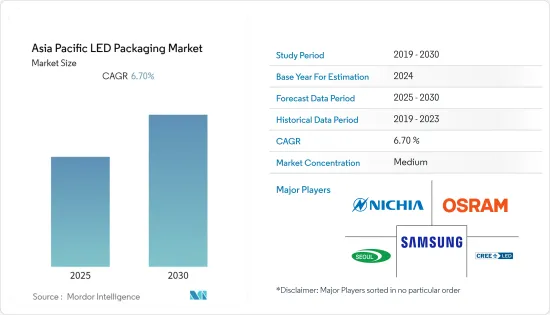

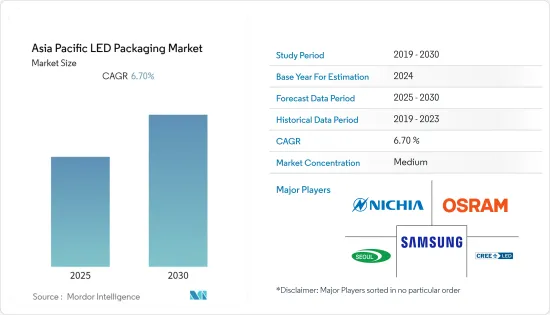

亞太地區LED構裝:市場佔有率分析、產業趨勢、成長預測(2025-2030 年)Asia Pacific LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

亞太LED構裝市場預計在預測期內複合年成長率為 6.7%

主要亮點

- LED 技術透過為廣大消費者提供緊湊、高效的照明解決方案並提高效率,正在激發照明產業的想像力。本產業創新飽和狀態,同時市場產能過剩。對於電視顯示器應用,業界正在從 OLED 轉向 QLED(量子點發光二極體),這是最新的創新。預計這將進一步滲透市場。

- QLED顯示器的生產成本相對較低,因為固定成本(設備)較低,而變動成本也較低,因為可以在給定時間內生產許多單位。公司專注於透過規模經濟進行營運。因此, LED構裝公司和製造商之間正在經歷行業整合。

- 未來幾年, LED構裝應用的快速發展預計將推動創新和消費,進而推動LED構裝市場的發展。另一方面,高飽和狀態可能會限制產品的接受度,進而限制市場的成長。

- 該市場與三星電子、歐司朗和工業等公司競爭激烈,隨著價格不斷下降以獲取市場佔有率,利潤率有限。

- 此外,政府措施預計也將推動市場成長。例如,印度政府計劃在多個行業引入具有成本效益的LED。該國正在用 LED 取代所有路燈,交通號誌也採用智慧 LED。此舉預計將增加當地LED製造商的需求並擴大LED構裝市場。

亞太LED構裝市場趨勢

對能源效率的需求不斷成長正在顯著推動市場發展

- 隨著 LED 照明系統效率的顯著提高,亞太地區的照明系統部署正在發生根本性轉變,該地區的公司在各個領域都採用了 LED。

- 多項政府和私人舉措正在推動該地區基礎設施現代化和智慧城市等市場發展對智慧高效照明系統的需求,這將直接推動該地區的LED構裝市場。

- 亞太地區政府的能源效率措施對LED構裝市場的發展做出了重大貢獻。印度和中國等國家正在實施多項旨在提高能源效率的政府計畫和計畫。印度政府於 2015 年啟動的 Unnat Jyoti by Affordable LEDs for All (UJALA)舉措旨在提高該國的能源效率,截至 2021 年 8 月已生產了超過 36 兆個 LED 燈泡。

- 此外,穿戴式裝置和智慧型手機等高階家電在中國、日本和印度等國家越來越受歡迎,對Micro LED和閃光燈LED構裝的需求預計將顯著高於上一代顯示器的效率,也在顯著增加。

晶片級封裝(CSP)預計在預測期內顯著成長

- 晶片級封裝(CSP) LED構裝LED晶片的體積與LED構裝總體積的比例接近。基本上,磷光體層塗在裸露 LED晶粒的頂部,晶粒的下側透過 P 和 N 觸點進行金屬化,以形成電連接和熱路徑。

- 由於最新的覆晶LED 的出現,對 CSP LED 架構的需求不斷增加,該技術透過在 P 型 GaN 層頂部實施電極墊片來提高傳熱效率和封裝可靠性,同時增加光發射,以防止損耗。

- 市場上的供應商正在推出新產品以保持競爭優勢。例如,三星推出了CSP LED“LM101B”,該產品在轉換層中使用薄膜磷光體,以減少表面粗糙度並實現均勻的薄膜厚度控制,同時減少顏色變化。此外,FEC(圓角增強型 CSP)技術在晶片表面周圍形成 TiO2(二氧化鈦)牆,並將光輸出向上反射,使這款中功率CSP 的光通量高達 205 lm/W(65 mA,業界領先)效率(CRI 80+,5000K)。

- 此外,一些供應商也為特定應用提供晶片級封裝 (CSP) LED。例如,歐司朗為品牌時尚精品店和珠寶店的高階零售照明設計 CSP LED。客製化CoB和小型燈具的專門設計是CSP支援的主要應用。

亞太地區LED構裝產業概況

亞太LED構裝市場競爭激烈,多家主要廠商進入該市場。從市場佔有率來看,目前幾家大公司佔據市場主導地位。這些市場佔有率突出的龍頭企業正致力於透過策略合作措施擴大海外客戶群,以提高市場佔有率和盈利。

- 2021 年 7 月 歐司朗使用歐司朗的 Ostar Projection Power LED 作為 ViewSonic LS600W 的光源,可提供高達 3,000 ANSI 流明的亮度,在各種使用案例中展示出卓越的性能,並促進 LED 投影機的開發。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

- 市場促進因素

- 對智慧照明解決方案的需求增加

- 對能源效率的需求不斷增加

- 市場限制因素

- 缺乏意識和增加資本投入

第5章市場區隔

- 按類型

- 板載晶片(COB)

- 表面黏著型元件(SMD)

- 晶片級封裝 (CSP)

- 按行業分類

- 住宅

- 商業的

- 其他行業

- 按國家/地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

第6章 競爭狀況

- 公司簡介

- Samsung Electronics Co. Ltd

- OSRAM Litch AG

- Cree, Inc.

- Nichia Corporation

- Seoul Semiconductor Co. Ltd

- Stanley Electric Co. Ltd

- Everlight Electronics Co. Ltd

- Toyoda Gosei Co.

- Citizen Electronics Co. Ltd

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 51751

The Asia Pacific LED Packaging Market is expected to register a CAGR of 6.7% during the forecast period.

Key Highlights

- The LED technology has been capturing the imagination of the lighting industry by offering small and efficient lighting solutions to a diverse set of consumers with enhanced efficiency. Innovations in the industry are saturated, and at the same time, the market has overcapacity. For TV display applications, the industry is moving from OLED to QLED (Quantum dot Light-emitting diode), which is the latest innovation. This is expected to penetrate more into the market.

- The production costs of QLED displays will be decreased since fixed costs (equipment) are less, and variable costs are relatively less as more units can be produced within a given time. Companies are focusing on operating through economies of scale. As such, the industry is witnessing the consolidation of players/manufacturers of LED packaging.

- In the coming years, rapid advancements in LED package applications are projected to boost innovation and consumption, propelling the LED packaging market. On the other hand, high saturation may limit product acceptance, which, in turn, limits market growth.

- The high competition in the market with players such as Samsung Electronics, Osram, and Nichia is restricting the margin, as there is a continuous decline in prices by players to gain market share.

- Moreover, governmental initiatives are also anticipated to drive the market's growth. For instance, the Indian government's planned to deploy cost-effective LEDs across multiple sectors. The country is on the verge of replacing all its street lamps with LEDs and adopting smart LEDs for traffic signals as well. This move is likely to increase the demand for local LED manufacturers, resulting in the growth of the LED packaging market.

APAC LED Packaging Market Trends

Increasing Demand for Energy-efficiency Significantly Drives the Market

- Owing to the sheer increasing efficiency of LED lighting systems, the Asia-Pacific region has been experiencing a fundamental transition in its deployed lighting systems, with firms in the regions embracing LEDs in multiple sectors.

- Multiple governmental and private initiatives have been driving the need for smart and efficient lighting systems in the modernization and development of infrastructure such as smart cities across the region, which directly boosts the market for LED packages in the region.

- Government initiatives for energy efficiency in the Asia Pacific region immensely contribute to the development of the LED packaging market. Several Government schemes and plans are in progress in countries such as India and China to promote energy efficiency. Unnat Jyoti by Affordable LEDs for All (UJALA) initiative by the Indian Government to encourage energy efficiency in the country launched in 2015 has already distributed more than 36 crores LED light bulbs as of August 2021.

- The increase in the adoption of high-end consumer electronics, like wearable and smartphones in China, Japan, Inda, among others, also significantly increases the demand for micro-LED and flash LED packages, which tend to be significantly efficient as compared to previous generation displays.

Chip Scale Package (CSP) is Expected to Grow Significantly Over the Forecast Period

- A chip scale package (CSP) LED package has a close-ratio between the volume of the LED chip and the total volume of the LED package. It is essentially a bare LED die on which a phosphor layer is coated, with the underside of the die metalized with the P and N contacts to form the electrical connection and thermal path.

- The growing demand for CSP LED architecture is the latest incarnation of flip-chip LEDs and prevents light loss due to the mounting of electrode pad on the upside of the P-type GaN layer while improving heat transfer efficiency and package reliability.

- Vendors in the market are introducing new products to maintain their competitive advantage. For instance, Samsung introduced LM101B CSP LEDs that use a film phosphor in the conversion layer to reduce surface roughness and enable uniform control of thickness with small color dispersion. The fillet-enhanced CSP (FEC) technology forms TiO2 (Titanium dioxide) walls around the chip surface to reflect its light output toward the top, enabling the mid-power CSP to deliver an industry-leading efficacy of up to 205 lm/W (65mA, CRI 80+, 5000K).

- Moreover, some of the vendors offer Chip Scale Package (CSP) LEDs to a specific application. For instance, OSRAM designs CSP LEDs for high-class retail lighting in brand fashion boutiques and jewelry stores. Professional designs for customized CoB and small luminaires are the main applications being supported by CSP.

APAC LED Packaging Industry Overview

The Asia Pacific LED packaging market is competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries as well by leveraging strategic collaborative initiatives to increase their market share and profitability.

- July 2021: OSRAM partnered with ViewSonic for more possibilities in developing LED projectors by using OSRAM's Ostar Projection Power LED as a light source for ViewSonic LS600W and achieving a brightness of up to 3,000 ANSI lumens, providing exceptional performance in different use cases.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Market Drivers

- 4.5.1 Increasing Demand for Smart Lighting Solutions

- 4.5.2 Increasing Demand for Energy-efficiency

- 4.6 Market Restraints

- 4.6.1 Lack of Awareness and Higher Capital Investment

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chip-on-board (COB)

- 5.1.2 Surface-mount Device (SMD)

- 5.1.3 Chip Scale Package (CSP)

- 5.2 By End-user Vertical

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Other End-user Verticals

- 5.3 By Country

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 India

- 5.3.4 Australia

- 5.3.5 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Samsung Electronics Co. Ltd

- 6.1.2 OSRAM Litch AG

- 6.1.3 Cree, Inc.

- 6.1.4 Nichia Corporation

- 6.1.5 Seoul Semiconductor Co. Ltd

- 6.1.6 Stanley Electric Co. Ltd

- 6.1.7 Everlight Electronics Co. Ltd

- 6.1.8 Toyoda Gosei Co.

- 6.1.9 Citizen Electronics Co. Ltd

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219