|

市場調查報告書

商品編碼

1629788

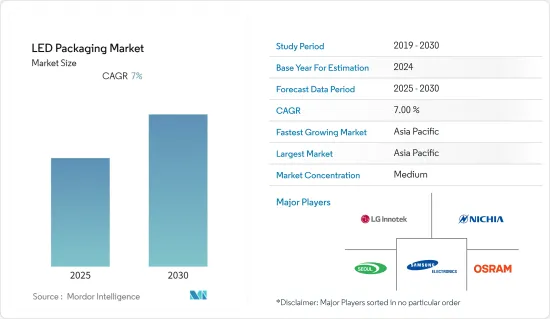

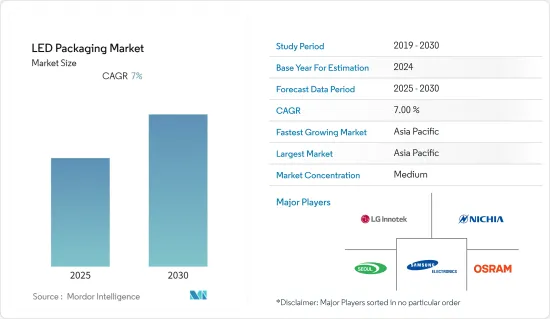

LED構裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

LED構裝市場預計在預測期間內複合年成長率為7%

主要亮點

- LED 技術透過為廣大消費者提供緊湊、高效的照明解決方案並提高效率,正在激發照明產業的想像力。產業創新飽和狀態,同時市場產能過剩。對於電視顯示器應用,業界正在從 OLED 轉向 QLED(量子點發光二極體),這是最新的創新。預計這將進一步滲透市場。

- 封裝設計過程直接影響溫度、發光效率、波長和壽命等因素,進而降低整體營運成本。因此,功率 LED 晶片封裝技術的改進正在增加 LED 解決方案的採用。

- LED構裝要求非常嚴格。如果LED晶片在封裝內放置不準確,會直接影響整個封裝設備的發光效率。任何稍微偏離固定位置都會導致LED光線無法從反光杯完全反射,進而影響LED的亮度。

- LED構裝應用的快速進步預計將推動創新和消費,從而推動未來幾年LED構裝市場的發展。另一方面,高飽和度可能會限制產品的可接受性,從而限制市場成長。

- 未來幾年,對能夠改善夜間能見度和方面能見度的新型 LED 的需求預計將超過現有 LED。 CSP LED 常用於汽車應用,如車頭燈、車內照明、環境照明、指示器、車頭燈叢集、駕駛員監控系統和停車輔助系統攝影機燈。 LED構裝的需求也受到中央堆疊顯示器、儀錶群顯示器和汽車顯示器市場採用擴增實境OLED 的高需求推動。

- 自COVID-19爆發以來,各家公司的供應鏈都面臨挑戰。 LED產業也不例外,由於用於製造LED和驅動器的原料大部分來自亞洲國家,因此該地區在3月和4月受到疫情的嚴重影響,因此該行業受到了顯著影響。此外,疫情導致汽車和家用電子電器產業顯示面板需求下降。消費者減少了高階智慧型手機和 OLED 電視等昂貴產品的支出,對市場產生了負面影響。

- LED構裝應用的快速增強預計將在未來幾年推動技術創新和消費成長,從而帶動LED構裝市場。另一方面,高飽和度可能會限制產品的採用並影響市場成長。

- 由於參與企業尋求獲得市場佔有率,激烈的市場競爭繼續壓低價格,從而限制了利潤。

LED構裝市場趨勢

政府採用節能 LED 的措施和法規將推動市場發展

- 由於消費者需求轉向 LED 等節能照明,住宅領域的前景基本上樂觀。此外,最近的政府舉措和消費者意識的提高預計將對該行業產生重大影響。

- 例如,印度政府於 2015 年啟動的一項旨在提高該國能源效率的舉措UJALA 截至 2021 年 8 月已分發了超過 36 兆個 LED 燈泡。這些舉措預計將對LED構裝市場產生重大影響。

- 在所有照明光源中,LED照明佔有很大的佔有率。由於意識的提高和政府措施的加強,LED 的滲透率正在提高。根據國際能源總署(IEA)預測,2025年LED在照明市場的滲透率預計將達到75.8%。

- LED 的日益普及也可能導致智慧照明系統(連網照明)在工業中的採用增加。與傳統照明相比,互聯系統可能更能從 LED 的使用中受益,因為 LED 在顏色變化和亮度方面非常靈活。

- 2021 年 10 月,美國能源局(DOE) 宣布將投資 6,100 萬美元用於 10 個先導計畫,這些項目將利用新技術將數千個家庭和企業改造為最先進的節能結構。這包括從白熾燈和鹵素燈泡切換到更節能的 LED 照明。因此,由於LED市場的成長,預計美國LED構裝市場在預測期內將出現成長。

亞太地區將成長最快

- 亞太地區的照明系統目前正在發生重大變化。由於效率提高,該地區的公司正在其行業中採用 LED 照明系統。

- 過去五年來,中國一直在逐步減少白熾燈泡產品的銷售量。這意味著過時的技術很快就會被更先進、更盈利的技術所取代。

- 印度政府向最終用戶推廣具有成本效益的 LED 的計劃已獲得一些關注。該國正在將所有路燈更換為 LED,並採用智慧 LED 來製作交通號誌。此舉可能會增加當地LED製造商的需求,並帶動LED構裝市場的成長。

- 多項政府和私人舉措正在推動全部區域基礎設施現代化和智慧城市等發展對智慧高效照明系統的需求,這將直接推動該地區的LED構裝市場。

- 亞太地區政府的能源效率舉措對LED構裝市場的成長做出了重大貢獻。印度和中國等國家目前正在實施多項旨在提高能源效率的政府計畫和計畫。 Unnat Jyoti by Affordable LEDs for All (UJALA) 是印度政府於 2015 年發起的舉措,旨在鼓勵該國提高能源效率,截至 2021 年 8 月已分發超過 36 兆個 LED 燈泡。

LED構裝產業概況

LED構裝市場因其性質而適度細分,因為有多家參與企業提供LED構裝。

- 2021 年 9 月 - Lumileds 推出採用導線架和塑膠封裝的全新 Luxeon 7070 (7.7mm) LED,面向街道照明和體育場館照明等應用的高性能陶瓷高功率LED。此外,彩色固體照明 (SSL) 系統的開發商現在擁有更多選擇,包括 Lumileds 的磷光體轉換 PC 紅橙色 LED。

- 2021 年 8 月 - 西鐵城電子宣布開發出「向上照明多色 LED」。在小型高亮度LED構裝中改進了混色特性。它適用於遊戲設備、電腦鍵盤、家用電子電器產品、業餘嗜好用品、顯示器、汽車環境照明、彩色照明等的照明和指示器。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 政府採用節能 LED 的措施和法規

- 對智慧照明解決方案的需求增加

- 市場限制因素

- 市場競爭加劇

第6章 市場細分

- 按類型

- 板載晶片(COB)

- 表面黏著型元件(SMD)

- 晶片級封裝 (CSP)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- OSRAM Opto Semiconductors GmbH

- Nichia Corporation

- LG Innotek

- Seoul Semiconductor Co. Ltd

- Stanley Electric Co. Ltd

- Lumileds Holding BV

- Everlight Electronics Co. Ltd

- Toyoda Gosei Co.

- Dow Corning

- Citizen Electronics Co. Ltd

- TT Electronics PLC

第8章投資分析

第9章 未來趨勢

簡介目錄

Product Code: 56708

The LED Packaging Market is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- LED technology has been capturing the imagination of the lighting industry by offering small and efficient lighting solutions to a diverse set of consumers with enhanced efficiency. Innovations in the industry are saturated, and at the same time, the market has overcapacity. For TV display applications, the industry is moving from OLED to QLED (Quantum dot Light-emitting diode), the latest innovation. This is expected to penetrate more into the market.

- The design process of packaging has directly influenced factors such as temperature, luminescence efficiency, wavelength, life span, and others and has reduced the overall operational costs. Hence, owing to the improvements in the packaging technology of power LED chips, there is increased adoption of LED solutions.

- The requirements for LED packaging are very stringent. If LED chips are not placed into the package precisely, the luminescence efficiency of the overall packaging device might be affected directly. Any variation from the established position will prevent LED light from being entirely reflected from the reflective cup, affecting LED's brightness.

- Rapid advancements in LED package applications are projected to boost innovation and consumption in the coming years, propelling the LED packaging market. On the other hand, high saturation may limit product acceptance, which, in turn, limits market growth.

- The demand for new LEDs that provide improved night vision and enhanced side visibility is anticipated to outpace existing LEDs in the coming years. CSP LEDs are commonly used in automotive applications such as headlights, cabin illumination, ambient lighting, indicator lights, headlight clusters, driver monitoring systems, and parking-assistance system camera lights. LED package's demand is also driven by high demand for central stack displays, instrument cluster displays, and the introduction of augmented reality-enabled OLED in the automotive display market.

- Since the outbreak of COVID-19, various businesses have faced challenges in the supply chain. The LED industry is no exception; as a significant share of the raw materials for producing LEDs and Drivers originated from Asian countries, the industry was significantly influenced during March and April as the region was under severe clutches of the pandemic. Further, the pandemic led to a decline in demand for display panels from the automotive and consumer electronics industries. Consumers have reduced spending on expensive products, such as high-end smartphones and OLED TVs, negatively impacting the market.

- The rapid enhancement in the applications of LED packaging is expected to increase innovation and consumption in the upcoming years, driving the LED packaging market. On the other hand, high saturation may restrict product adoption, which may affect the market's growth.

- The high competition in the market is restricting the margin, as there is a continuous decline in prices by players to gain market share.

LED Packaging Market Trends

Government Initiatives and Regulations to Adopt Energy-efficient LEDs will Drive the Market

- The residential sector outlook has largely been optimistic, driven by a shift in consumer demand toward energy-effective lighting, such as LEDs. Moreover, recent government initiatives and growing awareness among consumers are expected to have a significant impact on the industry.

- For instance, UJALA, a Government of India initiative launched in 2015 to promote energy efficiency in the country, has already distributed over 36 crores of LED light bulbs as of August 2021. such initiatives will show a substantial effect on the LED Packaging Market.

- Out of all the lighting sources, LED lights hold a major share. The growing awareness and increasing government policies have increased LEDs' penetration rate. According to the International Energy Agency (IEA), the penetration rate of LEDs into the lighting market is expected to reach 75.8% in 2025.

- The increasing prominence of LEDs can also lead to the adoption of smart lighting systems (connected lighting) in industries. Owing to the flexibility of LEDs in terms of color variation and brightness, connected systems are more likely to benefit from the use of LEDs over traditional lighting sources.

- In October 2021, the US Department of Energy (DOE) announced that it would invest USD 61 million in ten pilot projects that will use new technologies to turn thousands of homes and businesses into cutting-edge, energy-efficient structures. This involves switching out incandescent and halogen bulbs for more energy-efficient LED lighting. As a result, with the increase in the LED market, the LED Packaging Market in the United States will grow in the forecasted time period.

Asia-Pacific to Witness the Fastest Growth

- Currently, Asia-Pacific is experiencing a tremendous shift in lighting systems, as companies in this region are adopting LED lighting systems in the industries, owing to their improved efficiency.

- China has gradually reduced the sale of incandescent light bulb products during the last five years. This ensures that outdated technology is soon to be replaced by more advanced and profitable technology.

- The Indian government's plan of deploying cost-effective LED's across the end users received a decent response. The country is on the verge of replacing all street lamps with LED and adopting smart LEDs for traffic signals. This move is likely to increase the demand for local LED manufacturers, leading to the growth of the LED packaging market.

- Multiple governmental and private initiatives have been driving the need for smart and efficient lighting systems in the modernization and development of infrastructure, such as smart cities across the region, which directly boosts the market for LED packages in the region.

- Government energy efficiency initiatives in the Asia Pacific region have made a significant contribution to the growth of the LED packaging market. Several government schemes and plans to promote energy efficiency are currently in the works in countries such as India and China. Unnat Jyoti by Affordable LEDs for All (UJALA), an initiative launched by the Government of India in 2015 to encourage energy efficiency in the country, has already distributed over 36 crores of LED light bulbs as of August 2021.

LED Packaging Industry Overview

The LED packaging market is moderately fragmented in nature due to the presence of several players offering LED packaging.

- September 2021 - Lumileds launched the new Luxeon 7070 (7.7-mm) LED with a lead frame and plastic package aimed at high-performing, ceramic, high-power LEDs in applications such as street lights and sports-venue lighting. Furthermore, developers working on color solid-state lighting (SSL) systems continue to get more options in their tool chest, including a Lumileds phosphor-converted, PC Red-Orange LED.

- August 2021 - Citizen Electronics Co. Ltd announced the development of 'Upward-lighting Multicolor LEDs.' Small, high-brightness LED packages that feature an improved color mixing property. They are intended for illumination and indicators for game devices, keyboards for personal computers, home appliances, hobby goods, displays, ambient lighting for automobiles, colored lighting, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Initiatives and Regulations to Adopt Energy-efficient LEDs

- 5.1.2 Increasing Demand for Smart Lighting Solutions

- 5.2 Market Restraints

- 5.2.1 High Level of Competition in the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Chip-on-Board (COB)

- 6.1.2 Surface-mount Device (SMD)

- 6.1.3 Chip Scale Package (CSP)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 OSRAM Opto Semiconductors GmbH

- 7.1.3 Nichia Corporation

- 7.1.4 LG Innotek

- 7.1.5 Seoul Semiconductor Co. Ltd

- 7.1.6 Stanley Electric Co. Ltd

- 7.1.7 Lumileds Holding BV

- 7.1.8 Everlight Electronics Co. Ltd

- 7.1.9 Toyoda Gosei Co.

- 7.1.10 Dow Corning

- 7.1.11 Citizen Electronics Co. Ltd

- 7.1.12 TT Electronics PLC

8 INVESTMENT ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219