|

市場調查報告書

商品編碼

1628729

北美核子反應爐退役:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Nuclear Power Reactor Decommissioning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

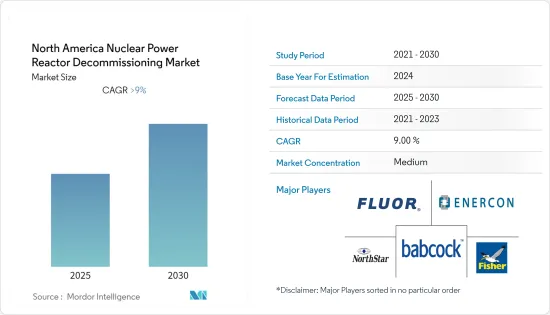

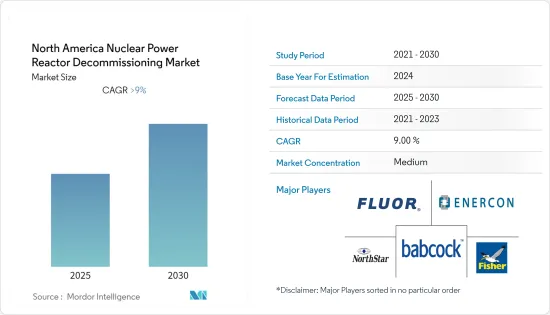

預計北美核子反應爐退役市場在預測期內將以超過 9% 的複合年成長率成長。

2020 年,市場受到 COVID-19 大流行的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,退役核子反應爐數量的增加預計將推動北美核子反應爐退役市場的成長。

- 另一方面,組串式逆變器的技術缺陷預計將阻礙預測期內的市場成長。

- 美國和加拿大等國家的核能淘汰措施可能會在預測期內為北美核子反應爐退役市場提供利潤豐厚的成長機會。

- 美國在市場上佔據主導地位,並且可能在預測期內實現最高的複合年成長率。這一成長是由於越來越多的舊核能發電廠除役所致。

北美核子反應爐退役市場趨勢

商業動力反應爐預計將主導市場

- 商業動力反應爐是主要用於發電的核子反應爐。這些核子反應爐大部分位於核能發電廠。來自太陽能和風能的可再生能源更便宜和清潔,增加了安裝這些核子反應爐的需求。

- 美國和加拿大等該地區國家正在退役老舊過時的核能發電廠,這可能會在預測期內推動北美核子反應爐除役市場的發展。

- 2021年北美核能發電總量為923.0兆瓦時(TWh),與2020年大致持平,即940.1 TWh。該地區核能曲線停滯或平坦表明該地區核子反應爐除役超過了新核能發電廠安裝速度。

- 2022 年 5 月,Entergy 公司關閉了密西根湖的帕利塞茲核電廠。核電廠發電能力為80萬千瓦。燃料從核子反應爐容器中取出並放入乏燃料池中進行冷卻。冷卻後,燃料被運送到發電廠現場安全、獨立的乏燃料倉儲設施。該公司還計劃在 2041 年完成除役的退役。

- 因此,這些因素可能導致商業動力反應器產業在預測期內主導北美核子反應爐退役市場。

預計美國將主導市場

- 美國是全球最大的核能發電國之一,2021年約佔全球核能發電量的30%。 2021年該國核子反應爐發電量為778.15兆瓦時(TWh),與前一年同期比較去年同期小幅成長0.35%。老化核能發電廠退役的準備工作預計將推動核子反應爐除役市場的發展。

- 2021年,美國核能發電廠發電量約為778.15兆瓦時,為十年來最低水準。自 1990 年達到高峰 112 座以來,核子反應爐數量一直在減少。

- 過去十年,低成本頁岩氣發電的激烈競爭導致國內核能發電產業競爭力下降。創紀錄的低批發電價和高成本延長(PLEX)升級也導致核電廠提前退役。

- 隨著美國核能發電時代的結束,核能發電廠除役正成為一個重要的產業。私人公司收購了這些工廠並接管了它們的許可證、責任、除役資金和廢棄物合約。大約 41 座核子反應爐已關閉,總合容量為 19.97 GWe,最新的是密西根州帕利塞茲核電廠,該核電廠於 2022 年 5 月關閉。 2021年12月,Holtec International收購了密西根州科維特市的Palisades核電廠,並獲得美國核能管理委員會批准除役和拆除。預計到 2030 年還將關閉另外 198 座核子反應爐。

- 美國的核子反應爐正在老化。美國美國核能管理委員會(NRC) 正在考慮透過後續許可證更新 (SLR) 計劃將運行許可證延長 60 至 80 年的申請。然而,一些核電廠業主最近選擇在 45 至 50 年內提前退休。

- 由於這些因素,預計美國將在預測期內主導北美核子反應爐退役市場。

北美核子反應爐退役產業概況

北美核子反應爐退役市場適度分散。市場主要企業包括(排名不分先後)Babcock International Group PLC、NorthStar Group Services Inc.、James Fisher & Sons PLC、Fluor Corporation 和 Enercon Services Inc.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:百萬美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 核子反應爐類型

- 壓水式反應爐

- 加壓重水反應器

- 沸水式反應爐

- 高溫反應爐

- 液態金屬快滋生反應器

- 其他核子反應爐

- 目的

- 商業動力反應爐

- 演示反應爐

- 研究反應器

- 核子反應爐容量

- 100MW以下

- 100~1,000MW

- 1,000MW以上

- 地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- Babcock International Group PLC

- James Fisher & Sons PLC

- NorthStar Group Services Inc.

- Fluor Corporation

- Enercon Services Inc.

- Bechtel Group Inc.

- Orano Group

- Manafort Brothers Incorporated

- Cutting Technologies Inc.

第7章 市場機會及未來趨勢

The North America Nuclear Power Reactor Decommissioning Market is expected to register a CAGR of greater than 9% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, an increasing number of nuclear reactors reaching operational retirement is expected to drive the growth of the nuclear power reactor decommissioning market in North America.

- On the other hand, technical drawbacks of string inverters are expected to hamper the growth of the market during the forecast period.

- Nuclear phase-out policies in countries such as the United States and Canada will likely create lucrative growth opportunities for the North American nuclear power reactor decommissioning market during the forecast period.

- The United States dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing decommissioning of its old nuclear plants.

North America Nuclear Power Reactor Decommissioning Market Trends

Commercial Power Reactor Expected to Dominate the Market

- Commercial power reactors are nuclear reactors mainly used for generating electricity. Most of these reactors are being installed in nuclear power plants. Renewable energy from solar and wind is much cheaper and cleaner, thus increasing the demand for installing these reactors.

- The countries in the region, such as the United States and Canada, are decommissioning their old and outdated nuclear power plants, which may drive the North American nuclear power reactor decommissioning market during the forecast period.

- In 2021, North America's total electricity produced by nuclear energy was 923.0 terawatt-hours (TWh), almost the same as in 2020, i.e., 940.1 TWh. The slow-growing or flatness of the nuclear energy curve in the region shows that the nuclear power reactors' decommissioning will surpass the installation of new nuclear plants in the region.

- In May 2022, Entergy Corporation shut down its Palisades nuclear plant on Lake Michigan. The nuclear power plant had an 800 MW power generation capacity. The fuel was removed from the reactor's vessel and placed in the spent fuel pool to cool. After the cooling process, the fuel will be transported to the secured Independent Spent Fuel Storage Facility on the station property. The company also aims to complete the decommissioning of the nuclear plant by 2041.

- Hence, due to such factors, the commercial power reactor sector may dominate the North American nuclear power reactor decommissioning market during the forecast period.

United States Expected to Dominate the Market

- The United States is one of the largest nuclear power producers globally, accounting for almost 30% of the global nuclear power generated in 2021. The country's nuclear reactors produced 778.15 terawatt hours (TWh) of electricity in 2021, representing a slight increase of 0.35% over the previous year's value. The ready-to-retire old nuclear plants are likely to drive the nuclear power reactor decommissioning market.

- In 2021, nuclear power plants in the United States generated around 778.15 terawatt hours of electricity, the lowest output recorded in one decade. The number of nuclear power reactors has been decreasing since 1990, when it peaked at 112 units.

- Over the past decade, intense competition from electricity generation using low-cost shale gas has hurt the competitiveness of the country's nuclear power industry. Record low wholesale electricity prices and the high cost of life extension (PLEX) upgrades have also led to early nuclear plant retirements.

- As the era of nuclear power in the United States comes to an end, the decommissioning of nuclear power plants is becoming a significant industry. Private companies are acquiring these plants, taking over their licenses, liability, decommissioning funds, and waste contracts. Around 41 reactors with a combined capacity of 19.97 GWe were shut down, with the latest being the Palisades nuclear plant in Michigan, which shut down in May 2022. In December 2021, HoltecInternational received approval from the Nuclear Regulatory Commission to acquire the Palisades plant in Covert, Michigan, to decommission and dismantle the plant. An additional 198 reactors are expected to shut down by 2030.

- The nuclear reactor fleet of the United States is now aging. The US Nuclear Regulatory Commission (NRC) is considering applications for extending operating licenses beyond 60-80 years with its subsequent license renewal (SLR) program. However, some plant owners recently opted for early retirements of their nuclear units at 45-50 years.

- Hence, due to such factors, the United States is expected to dominate the North American nuclear power reactor decommissioning market during the forecast period.

North America Nuclear Power Reactor Decommissioning Industry Overview

The North American nuclear power reactor decommissioning market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Babcock International Group PLC, NorthStar Group Services Inc., James Fisher & Sons PLC, Fluor Corporation, and Enercon Services Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Reactor Type

- 5.1.1 Pressurized Water Reactor

- 5.1.2 Pressurized Heavy Water Reactor

- 5.1.3 Boiling Water Reactor

- 5.1.4 High-temperature Gas-cooled Reactor

- 5.1.5 Liquid Metal Fast Breeder Reactor

- 5.1.6 Other Reactor Types

- 5.2 Applications

- 5.2.1 Commercial Power Reactor

- 5.2.2 Prototype Power Reactor

- 5.2.3 Research Reactor

- 5.3 Capacity

- 5.3.1 Below 100 MW

- 5.3.2 100-1000 MW

- 5.3.3 Above 1000 MW

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaborations, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Babcock International Group PLC

- 6.3.2 James Fisher & Sons PLC

- 6.3.3 NorthStar Group Services Inc.

- 6.3.4 Fluor Corporation

- 6.3.5 Enercon Services Inc.

- 6.3.6 Bechtel Group Inc.

- 6.3.7 Orano Group

- 6.3.8 Manafort Brothers Incorporated

- 6.3.9 Cutting Technologies Inc.