|

市場調查報告書

商品編碼

1630452

日本核子反應爐退役:市場佔有率分析、產業趨勢、成長預測(2025-2030)Japan Nuclear Power Reactor Decommissioning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

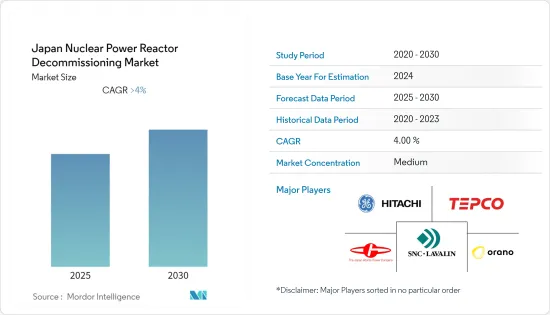

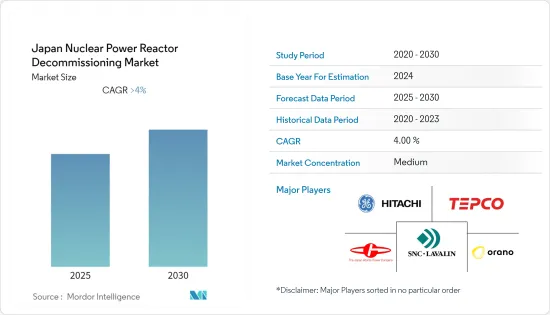

日本核子反應爐退役市場預計在預測期內複合年成長率將超過 4%。

COVID-19 對 2020 年市場產生了負面影響。目前,市場已達到疫情前水準。

從長遠來看,太陽能和風能等再生能源來源的滲透率不斷提高,產生更清潔、更經濟的能源,預計將在預測期內推動市場發展。

另一方面,電廠退役成本高和成熟電廠數量少預計將成為預測期內限制市場成長的關鍵因素。

此外,擴大使用機器人和人工智慧進行工廠退役,預計將為日本核能發電反應器退役市場創造重大機會。

日本核子反應爐退役市場趨勢

商業核子反應爐預計將主導市場

- 商業核核能發電廠是部署在社區內發電的發電廠,然後用於國家能源網,並輸送和分配到國內各部門。在日本,大多數核能發電廠被歸類為商業反應器。

- 根據世界核能協會統計,日本有33座商業核能發電廠運作中。此外,還有兩座商業發電廠正處於建設階段,一座正在規劃階段。

- 截至 2021 年,日本透過 33 個核子反應爐發電 61.2 TWh,總合容量為 31.68 GWe,而 2020 年為 43 GWe。截至2022年12月,日本有2座在建核子反應爐(總合2.75 GWe),1座在規劃反應核子反應爐(總合1.38 GWe),以及核子反應爐在建核反應堆,1座在規劃中,1座在規劃核反應器(總合8座)。

- 2021年日本核能發電總量為714.3兆瓦時(TWh),超過2020年同一地區的655太瓦時。該地區許多國家仍在發展核能發電發電,預計將阻礙該地區的市場成長。

- 截至2022年12月,日本已關閉27座核子反應爐,總合容量為17,128兆瓦。

- 例如,2021年,日本核能監管機構核准了東京電力公司(TEPCO)核能發電廠四座核子反應爐的除役計劃,該核電廠靠近受災的福島第一核電廠。除役工作預計需要44年時間。儲存在該裝置儲存池中的 10,000 個燃料組件將在 22 年內拆除和重新處理。

- 因此,鑑於上述幾點,商業電力部門很可能在預測期內主導日本核子反應爐退役市場。

可再生能源驅動市場成長

- 日本的可再生能源發電領域可能在不久的將來進一步成長。這主要歸功於旨在將能源轉向清潔發電的政府計劃以及可再生技術的持續改進。日本最近制定了多項氣候變遷目標以實現碳中和。

- 2020 年初,它宣布計劃到 2030 年將對可再生能源的依賴提高到 24%。隨著日本逐漸擺脫核能發電,轉向太陽能、風能和潮汐能等可再生能源,以減少對海外生產的依賴,並開始國內能源領域的創新。

- 2022年2月,經濟產業省在3次不同的競標中分配了2021年675MW的太陽能發電容量。平均得標價格為10.31日圓/kWh~10.82日圓/kWh,最低得標價格為10.23日圓/kWh。因此,政府鼓勵國內太陽能成長的計畫預計將在預測期內推動市場。

- 過去十年中,可再生能源發電量顯著增加。 2021年日本可再生為1.1186億千瓦,而2015年為6748萬千瓦。成長率約為65%。預計發電能力在預測期內將遵循類似的趨勢。

- 例如,Clean Energy Connect於2022年5月宣布將為日本NTT集團部署70MW太陽能發電容量。該計劃是根據與 NTT Anode Energy Corp 簽訂的電力採購協議開發的,該協議將主要透過異地電力購買協議 (PPA) 向通訊集團供應電力。計劃預計將於2023年完工。

- 鑑於上述情況,可再生能源的成長預計將在預測期內推動日本核子反應爐退役市場。

日本核子反應爐退役產業概況

日本核子反應爐退役市場適度細分。該市場的主要企業(排名不分先後)包括GE-Hitachi-Nuclear Energy, Ltd.、Japan Atomic Power Co.、Snc-Lavalin Group Inc (Atkins)、Tokyo Electric Power Company Holdings, Inc.、Korea Hydro & Nuclear力量包含。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 核子反應爐類型

- 壓水式反應爐

- 加壓重水反應器

- 沸水式反應爐

- 高溫反應爐

- 液態金屬快滋生反應器

- 其他核子反應爐

- 目的

- 商業動力反應爐

- 演示反應爐

- 研究反應器

- 核子反應爐容量

- 100MW以下

- 100~1,000MW

- 1,000MW以上

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- GE-Hitachi Nuclear Energy, Ltd.

- Japan Atomic Power Co.

- TUV Rheinland Group

- Snc-Lavalin Group Inc(Atkins)

- Tokyo Electric Power Company Holdings, Inc.

- Orano SA

- Toshiba Corp

第7章 市場機會及未來趨勢

The Japan Nuclear Power Reactor Decommissioning Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

In The long term, increasing penetration of renewable energy sources such as solar and wind, which produce cleaner and more economical energy, are expected to drive the market during the forecasted period.

On the other hand, the high cost of decommissioning plants and few numbers of mature power plants are major restraints expected to hinder the market's growth during the forecasted period.

Moreover, the increasing usage of robots and artificial intelligence for plant decommissioning is expected to create significant opportunities for the Japan Nuclear Power Reactor Decommissioning Market.

Japan Nuclear Power Reactor Decommissioning Market Trends

Commercial Power Reactor Expected to Dominate the Market

- Commercial nuclear power plants are the power plants deployed in the region to generate electricity and utilized in the national energy grid through which the generated electricity is transmitted and distributed to various sectors of the country. In Japan, the majority of nuclear power plants fall under the commercial reactor category.

- According to World Nuclear Association, 33 active commercial nuclear power plants exist in Japan. Moreover, two commercial power plants are in the construction stage, while one is in the planning stage.

- As of 2021, Japan has generated 61.2 TWh of electricity from its thirty-three nuclear reactors with a combined capacity of 31.68 GWe compared to 43 GWe in 2020. As of December 2022, the country has two nuclear reactors under construction with a combined total of 2.75 GWe, one reactor is under planning stages with a total of 1.38 GWe, and eight reactors with a combined capacity of 11.56 GWe under construction, planned, and proposed stages, respectively.

- The total power produced by nuclear energy in Japan in 2021 was 714.3 terawatt-hours (TWh), which was higher than the region produced in 2020, which was 655 TWh. Many countries in the region are still developing nuclear power for electricity, which is anticipated to hinder regional market growth.

- As of December 2022, Japan has shut down 27 nuclear reactors with a total capacity of 17128 MWe.

- For instance, in 2021, Japan's nuclear regulator approved Tokyo Electric Power Company's (Tepco's) decommissioning plan for the four reactors at its Fukushima Daini nuclear power plant, close to the damaged Fukushima Daiichi plant. The decommissioning process is expected to take 44 years. The 10,000 fuel assemblies held in the units' storage pools will be removed over 22 years and will be reprocessed.

- Hence, owing to the above points, the commercial power rector segment is likely to dominate the Japan nuclear power reactor decommissioning market during the forecast period.

Increasing Renewable Energy Expected to Drive the Market

- Japan renewable power sector is likely to thrive more in the near future, mainly due to the government programs for an energy transition to cleaner power generation sources and the continuous improvement in renewable technology. The country has set many climate goals in the recent picture to achieve carbon neutrality.

- In early 2020, the country announced its plans to increase its reliance on renewable power to 24% of its energy mix by 2030. As Japan is moving away from nuclear power generation, it is turning to renewable energy sources, such as solar, wind, and tidal power, to reduce its dependence on overseas production and kickstart innovation in its domestic energy sector.

- In February 2022, the Ministry of Economy, Trade, and Industry (METI) allocated 675 MW of PV capacity across three different auctions in 2021. The average bid price ranged from JPY 10.31/kWh to JPY 10.82/kWh, with the lowest bid price at JPY 10.23/kWh. Thus, such government programs to encourage solar energy growth in the country are likely to drive the market during the forecast period.

- Electricity generation through renewable energy has increased significantly in the last decade. In 2021, Japan had renewable energy installed capacity of 111.86 GW compared to 67.48 GW in 2015. The growth was recorded at around 65%. The generation capacity is expected to follow a similar trend during the forecasted period.

- For instance, In May 2022, Clean Energy Connect Co Ltd announced that it would deploy 70 MW of solar power generating capacity for the benefit of the NTT Group in Japan. The project will be developed under an electricity procurement contract with NTT Anode Energy Corp, which will supply the output mainly to the telecommunications group through an offsite power purchase agreement (PPA). The project is expected to be finalized by 2023.

- Hence, owing to the above points, increasing renewable energy is expected to drive the Japan Nuclear Power Reactor Decommissioning Market during the forecast period.

Japan Nuclear Power Reactor Decommissioning Industry Overview

The Japan Nuclear Power Reactor Decommissioning Market is moderately fragmented. Some of the key players in this market (not in a particular order) include GE-Hitachi-Nuclear Energy, Ltd., Japan Atomic Power Co., Snc-Lavalin Group Inc (Atkins), Tokyo Electric Power Company Holdings, Inc., and Korea Hydro & Nuclear Power Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Reactor Type

- 5.1.1 Pressurized Water Reactor

- 5.1.2 Pressurized Heavy Water Reactor

- 5.1.3 Boiling Water Reactor

- 5.1.4 High-temperature Gas-cooled Reactor

- 5.1.5 Liquid Metal Fast Breeder Reactor

- 5.1.6 Other Reactor Types

- 5.2 Application

- 5.2.1 Commercial Power Reactor

- 5.2.2 Prototype Power Reactor

- 5.2.3 Research Reactor

- 5.3 Capacity

- 5.3.1 Below 100 MW

- 5.3.2 100-1000 MW

- 5.3.3 Above 1000 MW

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 GE-Hitachi Nuclear Energy, Ltd.

- 6.3.2 Japan Atomic Power Co.

- 6.3.3 TUV Rheinland Group

- 6.3.4 Snc-Lavalin Group Inc (Atkins)

- 6.3.5 Tokyo Electric Power Company Holdings, Inc.

- 6.3.6 Orano SA

- 6.3.7 Toshiba Corp