|

市場調查報告書

商品編碼

1628762

中東和非洲軟性飲料包裝:市場佔有率分析、產業趨勢、成長預測(2025-2030)MEA Soft Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

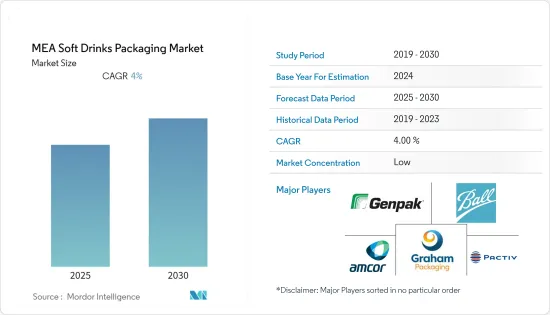

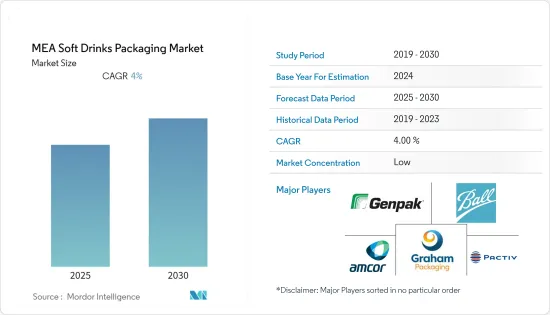

中東和非洲軟性飲料包裝市場預計在預測期內複合年成長率為 4%

主要亮點

- 根據利樂包裝公司的研究,2018年海灣合作理事會消費量了37.33億公升乳製品,26.46億公升果汁、花蜜和非碳酸飲料,69.09億公升咖啡和茶,69億公升包裝水,佔113.1億公升。其中,碳酸飲料29.81億公升,總合278.57億公升。

- 飲料業在該地區發揮重要作用。根據第八屆阿拉伯飲料會議的數據,飲料業為該地區約 3 億消費者提供服務,每年產量約 100 億公升。飲料產業繼續在塑造當地經濟中發揮重要作用。

- 受該地區衛生署主導的宣傳活動的影響,對健康飲料的需求預計將增加。由於該地區許多國家都禁止飲酒,因此人們正在考慮將能量飲料和健康飲料等軟性飲料作為替代品。據加拿大農業和食品部稱,2020年阿拉伯聯合大公國強化和功能性能量飲料的零售額預計將達到3.448億美元。

- 該地區對瓶裝水的需求顯著增加。消費者也越來越意識到對健康飲食的需求。瓶裝水需求的增加預計將促進中東和非洲地區瓶裝水包裝市場的成長。

- 此外,包裝水和其他軟性飲料的寶特瓶也有大量需求。例如,Almarai 透過策略投資發展業務。中東最大的軟性飲料製造和銷售公司。作為果汁市場的領導者,Almarai 在其 Al Kharj 中央加工廠 (CPP) 安裝了兩條全新的完整西得樂 PET 生產線,產能為每小時 54,000 瓶。

- 最近的 COVID-19 爆發導致許多軟性飲料包裝和解決方案製造商的產量減少(由於該地區的封鎖情況和供應鏈中斷)。這一因素影響了各企業包裝產品的生產。例如,2020年3月27日,阿拉伯聯合大公國政府關閉生鮮食品市場兩週。該地區其他國家也採取了類似措施,包括沙烏地阿拉伯和卡達。鑑於疫情大流行,阿西爾市政府下令對食品和飲料進行安全可靠的包裝。

- 受疫情影響,非洲地區國內生產毛額(GDP)下降。由於我們嚴重依賴原料和產品進口,我們預計供應鏈將受到影響。預計這將對該地區的包裝產品製造產生影響。

中東和非洲軟性飲料包裝市場趨勢

沙烏地阿拉伯佔最高市場

- 沙烏地阿拉伯擁有中東地區最大的軟性飲料包裝產業之一。該國擁有龐大的消費群,該國對軟性飲料包裝的需求每年都在快速成長。

- 高可支配收入、交通便利、生活水準提高、多樣性、遊客數量增加、國內市場以及國際參與者等因素正在推動該國飲料行業的成長。

- 沙烏地阿拉伯也是海灣合作理事會地區最大的塑膠製品消費國之一。根據GPCA最近估計,該國人均塑膠消費量量約95公斤,是全部區域最大的塑膠製品消費國。

- 儘管需求和消費量很大,塑膠包裝也有相當大的缺點。由於石油價格波動和安全事件,從該國採購聚合物和其他塑膠原料的當地製造商經常面臨不確定性,從而影響聚合物和樹脂的成本。

- 目前,沙烏地阿拉伯約有 10% 的 PET(聚對苯二甲酸乙二醇酯)瓶被回收。隨著政府更加重視回收,回收率預計將會上升。因此,該國的 PET 需求預計將增加。

- 公司越來越關注將 PET 回收到飲料容器等食品級產品的緊迫性。例如,可口可樂計劃在 2030 年之前在其容器中使用 50% 的回收 PET。

- 總部位於沙烏地阿拉伯的 SABIC 開發了一種新型 Flowpact PP 抗衝共聚物,以支援透過射出成型生產硬質包裝。 Flowpact PP 設計用於生產容量從 200ml 到 10L 的硬質包裝。新型 Flowpact PP 提供剛性包裝,具有增強的堆疊能力,使運輸和儲存更加經濟。

- 日本對塑膠的使用有嚴格的規定。這迫使製造商選擇新的包裝替代品,例如可分解塑膠。沙烏地阿拉伯瑞士中東商業中心的拉爾比·埃爾-阿塔里 (Larbi El-Attari) 表示,這些規定同樣適用於沙烏地阿拉伯生產和進口的塑膠。由於這項發展,不合規的產品將無法再透過進口管道進口。

埃及玻璃瓶預計將大幅成長

- 玻璃瓶因其保存期限長且避免污染而成為軟性飲料最優選的包裝材料。玻璃瓶保留飲料香氣和風味的能力正在推動需求。

- 這就是為什麼大多數餐廳都使用梅森玻璃罐,這種玻璃罐有吸引力、易於清潔且可重複使用。客戶環保意識的提高也迫使製造商重新考慮包裝。

- 市場上的許多供應商正在透過改用先進的工具和生產基礎設施來實現製造工廠的現代化,以滿足注重品質的客戶的需求。

- 例如,阿拉伯藥用玻璃公司對其製造工廠進行了升級,改用了電控玻璃熔爐、6條自動化生產線以及最先進的電控成型和檢測設備。我們向 Gsk、Aventis Pharma、MEPACO 和 Novartis Pharmaceuticals 等製藥公司供應玻璃瓶。

中東和非洲軟性飲料包裝產業概況

中東和非洲軟性飲料包裝市場擁有全面的國內和國際供應商組合。這一因素導致了供應商之間的激烈競爭。在缺乏多種分銷管道的情況下,供應商通常直接與最終用戶合作銷售他們的產品。這種情況會導致與最終用戶的長期交易。因此,供應商通常依靠有競爭力的定價策略來留住客戶或創造新客戶。

此外,大部分包裝材料均來自進口,因此供應商之間為了佔領有限的市場而展開激烈的競爭。這一因素加劇了國內外製造商之間的競爭。以下是一些最近的趨勢:

- 2020 年 7 月 - Futamaki 今天推出了一系列高品質且價格實惠的可重複使用口罩。 Huhta 口罩適合日常使用,可減少飛沫向周圍區域的傳播。這款舒適的面罩採用優質布料製成,透氣、耐洗、抗菌、防液。

- 2020 年 6 月 - 利樂推出世界上第一條新型低能耗果汁、花蜜和非碳酸飲料加工線 (JNSD),將飲料加工提升到新的效率水平。該生產線結合了巴氏殺菌、過濾和紫外線技術,以兩個單獨的流處理飲料,並將它們無菌混合到最終飲料中。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 軟性飲料消費量增加

- 消費者對便利包裝的需求增加

- 市場限制因素

- 與塑膠使用相關的環境問題

- 嚴格的政府法規

- 當前中東和非洲軟性飲料包裝市場的機遇

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業政策

第5章技術概況

第6章 市場細分

- 按主要材質分

- 塑膠

- 紙板

- 玻璃

- 金屬

- 其他

- 按類型

- 瓶裝水

- 汁

- 即飲飲料

- 運動飲料

- 其他

- 按地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他

第7章 競爭格局

- 公司簡介

- Pactiv, LLC

- Amcor, Ltd.

- Genpak

- Graham Packaging Company

- Ball Corporation

- SIG Combibloc Company Ltd.

- Tetra Pak International

- Placon

- Toyo Seikan Group Holdings Ltd.

- Rock Tenn Company

- Nuconic Packaging

- The Scoular Company

- Owens-Illinois Inc

- Crown Holdings Incorporated

- Rexam inc

- Alcoa Inc

第8章投資分析

- 最近的併購

- 投資者展望

第9章中東和非洲軟性飲料包裝市場的未來

The MEA Soft Drinks Packaging Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- According to a study by Tetra Pack, the GCC consumed 3,733 million liters of dairy, 2,646 million liters of juice, nectars, and still drinks, 6,909 million liters of coffee and tea, 11,310 million liters of packaged water, and 2,981 million liters of carbonated soft drinks in 2018 for a total of 27,857 million liters.

- The beverage industry plays an essential role in the region. According to the Eighth Arab Beverages Conference, the beverage industry caters to about 300 million consumers in the region, with a production volume of about 10 billion liters per year. The beverage industry continues to play a significant role in shaping the region's economy.

- The demand for health drinks is expected to increase, influenced by the campaigns led by the ministries of health in various countries in the region. Due to the ban on alcohol in many countries in the region, soft drinks, such as energy and health drinks, are considered substitutes. According to Agriculture and Agri-Food Canada, the retail sales of fortified and functional energy drinks in the United Arab Emirates are expected to account for USD 344.8 million in 2020.

- The demand for bottled water increased significantly in the region. In addition, consumers are more conscious of the need for healthier diets. The increased demand for bottled water, in turn, is expected to augment the growth of the bottled water packaging market in the MEA region.

- Moreover, there is a significant demand for PET bottles for water and other soft drinks packaging. For instance, Almarai developed its business through strategic investments. It is the largest producer and distributor of soft drinks in the Middle East. As the leader in the juice market, Almarai installed two new Sidel PET complete lines, each one handling 54,000 bottles/hr, in its Al Kharj central processing plant (CPP).

- With the recent outbreak of COVID -19, the production of many manufacturers of soft drink packaging solutions decreased (due to lockdown situations in the region and the disruption in the supply chain). This factor impacted the manufacturing of packaging products among various companies. For example, on March 27, 2020, the UAE government closed the fresh food market for two weeks. The other countries in the region, such as Saudi Arabia and Qatar, also implemented the same. The Asir municipality ordered safe and secure packaging for food and beverage light of the pandemic situation.

- The African region is facing a decline in GDP due to the pandemic. This is expected to impact its supply chain, as it is heavily dependent on importing raw materials and goods. This, in turn, is expected to affect the manufacturing of packaging products in the region.

Middle East and Africa Soft Drinks Packaging Market Trends

Saudi Arabia to hold the highest market

- Saudi Arabia is one of the most extensive soft drinks packaging industries in the Middle Eastern region. The country has a vast consumer base, adding to the rapid growth in the demand for soft drinks packaging from the country every year.

- The factors, such as high disposable income, ease of availability, improvement in living standards wide variety, increasing tourism, presence of domestic, and the presence of the international players in the market, are fueling the growth of the beverages industry in the country.

- In addition, Saudi Arabia is one of the largest consumers of plastic products in the GCC region. According to the recent estimates of the GPCA, the country has about 95 kg per capita consumption of plastics, making it the largest consumer of plastic products in the entire GCC region.

- Despite the high demand and consumption, plastic packaging also has considerable drawbacks. The local manufacturers who source polymer or other plastic raw material from the country are often exposed to uncertainty caused by fluctuating crude oil prices and security incidents, affecting the cost of polymers and resins.

- Currently, Saudi Arabia recycles about 10% of its PET (polyethylene terephthalate) bottles. The recycling rate is expected to increase, with the increasing focus of the government on recycling. This, in turn, is expected to drive the demand for PET in the country.

- Companies are increasingly focusing on the urgency of recycling PET into food-grade products, such as beverage containers. For instance, The Coca-Cola Company intends to use 50% recycled PET in its containers by 2030.

- The Saudi Arabian-based SABIC developed new Flowpact PP impact copolymers to assist in manufacturing injection-molded rigid packaging. Flowpact PP was designed to produce rigid packaging, with volumes ranging between 200 ml and around 10 L. It can be used to manufacture closures and caps used for packaging soft drinks. The new Flowpact PP offers rigid packaging with enhanced stacking capabilities and makes transport and storage more economical.

- Stringent regulations for the use of plastic are imposed in the country. This is forcing the manufacturers to opt for new packaging alternatives, such as oxo-degradable plastics. According to the Larbi El-Attari of the Swiss Business Hub Middle East in Saudi Arabia, these regulations are equally applicable to the plastic produced in Saudi Arabia or imported to the country. As a result of this development, non-compliant products can no longer be brought through import channels.

Glass Jars in Egypt are expected to Register a Significant Growth

- Glass Jar is among the most preferred packaging material for soft drinks as it preserves for the long term and avoids contamination. The ability of glass jars to preserve the aroma and flavor of the drink is driving the demand.

- Therefore, most restaurants use mason glass jars to serve as they are attractive, easy to wash, and reusable. The rise in environmental awareness among customers is also forcing manufactures to reconsider their packaging.

- Many vendors in the market are modernizing their manufacturing plants by switching to advanced tools and production infrastructure to meet the needs of their quality-conscious customers.

- For instance, Arab Pharmaceutical Glass Co. has upgraded its manufacturing plants by switching to electronically controlled glass melting furnaces, six automated production lines, electronically controlled state-of-the-art forming machines, and inspection machines. It offers glass jars to pharmaceutical companies such as Gsk, Aventis Pharma, MEPACO, Novartis Pharmaceuticals, etc.

Middle East and Africa Soft Drinks Packaging Industry Overview

The Middle East and Africa packaging market have a comprehensive portfolio of suppliers from the local and international markets. This factor leads to high competition among the vendors. In many cases, due to the absence of multiple distribution channels, the vendors directly interact with the end-users to sell their products. This scenario leads to long-term deals with end-users. Hence, the vendors often choose to retain their clients or make new clients by competitive pricing strategies.

Additionally, as most of the packaging material is sourced from imports, there is high competition among the suppliers to capture a limited number of players in the market. This factor intensifies the competitive rivalry among the local and foreign manufacturers. Some of the recent developments are:

- Jul 2020 - Huhtamaki launched a range of high-quality affordable and reusable face masks today. The Huhta Masks are suitable for everyday use and help reduce the spread of droplets into the environment. The comfortable masks are designed to be breathable and washable and are made of high-quality fabric with anti-microbial and fluid repellent properties.

- June 2020 - Tetra Pak launched a new, first-of-its-kind low-energy processing line for juice, nectar, and still drinks (JNSD) to take beverage processing to a new efficiency level. It uses a combination of Pasteurization, Filtration, and UV Light technology to treat beverages in two separate streams, aseptically blended into the final beverage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Soft Drink Consumption

- 4.2.2 Increased demand for convenience packaging from consumers

- 4.3 Market Restraints

- 4.3.1 Environmental concerns regarding usage of plastic

- 4.3.2 Stringent Government Regulations

- 4.4 Current Opportunities in the Middle East and Africa Soft Drinks Packaging Market

- 4.5 Industry Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of substitute products and services

- 4.6.5 Competitive Rivalry within the Industry

- 4.7 Industry Policies

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 By Primary Material Used

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Metal

- 6.1.5 Others

- 6.2 By Type

- 6.2.1 Bottles Water

- 6.2.2 Juices

- 6.2.3 RTD Beverages

- 6.2.4 Sport Drinks

- 6.2.5 Others

- 6.3 By Region

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 South Africa

- 6.3.4 Egypt

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv, LLC

- 7.1.2 Amcor, Ltd.

- 7.1.3 Genpak

- 7.1.4 Graham Packaging Company

- 7.1.5 Ball Corporation

- 7.1.6 SIG Combibloc Company Ltd.

- 7.1.7 Tetra Pak International

- 7.1.8 Placon

- 7.1.9 Toyo Seikan Group Holdings Ltd.

- 7.1.10 Rock Tenn Company

- 7.1.11 Nuconic Packaging

- 7.1.12 The Scoular Company

- 7.1.13 Owens-Illinois Inc

- 7.1.14 Crown Holdings Incorporated

- 7.1.15 Rexam inc

- 7.1.16 Alcoa Inc

8 INVESTMENT ANALYSIS

- 8.1 Recent Mergers and Acquisitions

- 8.2 Investor Outlook